1. Introduction

The words ‘digital economy’ firstly occurred in ‘The Digital Economy: Hope and Risks in the Age of Intelligent Interconnection’ which written by Don Tapscott in 1996. He had given various research about digit and informational technology before that, in the 1984 and 1992, respectively [1]. Then he suggested in his paper in 2000 that some successful companies are famous for their ability to identify and accumulate digital capital. In that paper, he said that businessman could reinvent their companies by jettisoning the business models which behind the times and getting success in digital capital. In the other word, he thought that the digital economy can be beneficial to individual company development, which could be considered that even is helpful to regional and social promotion of economy. In contrast to China, having a relatively backward beginning of development and awareness of digital finance. It seems that China has experienced different whole stage of internet technology development. What does it mean? From the reports written by CAICT. China focused on the Internet technology from 2007 to 2014 and then started researched the Internet of things as well as 5G technology from 2015 to 2017. In the middle year 2017, CAICT suggested how essential to develop digital economy in China. In fact, there are many new digital financial products appearing in Chinese market, like WeChat payment, Alipay and so on. In these few years, the concept and news about digital finance and economy appearing in people’s horizon more frequently and more Chinese people pay attention on that side. This essay will start by introducing the recent brief history of digital economy in China.

2. The Status of Digital Finance in the Chinese Economy

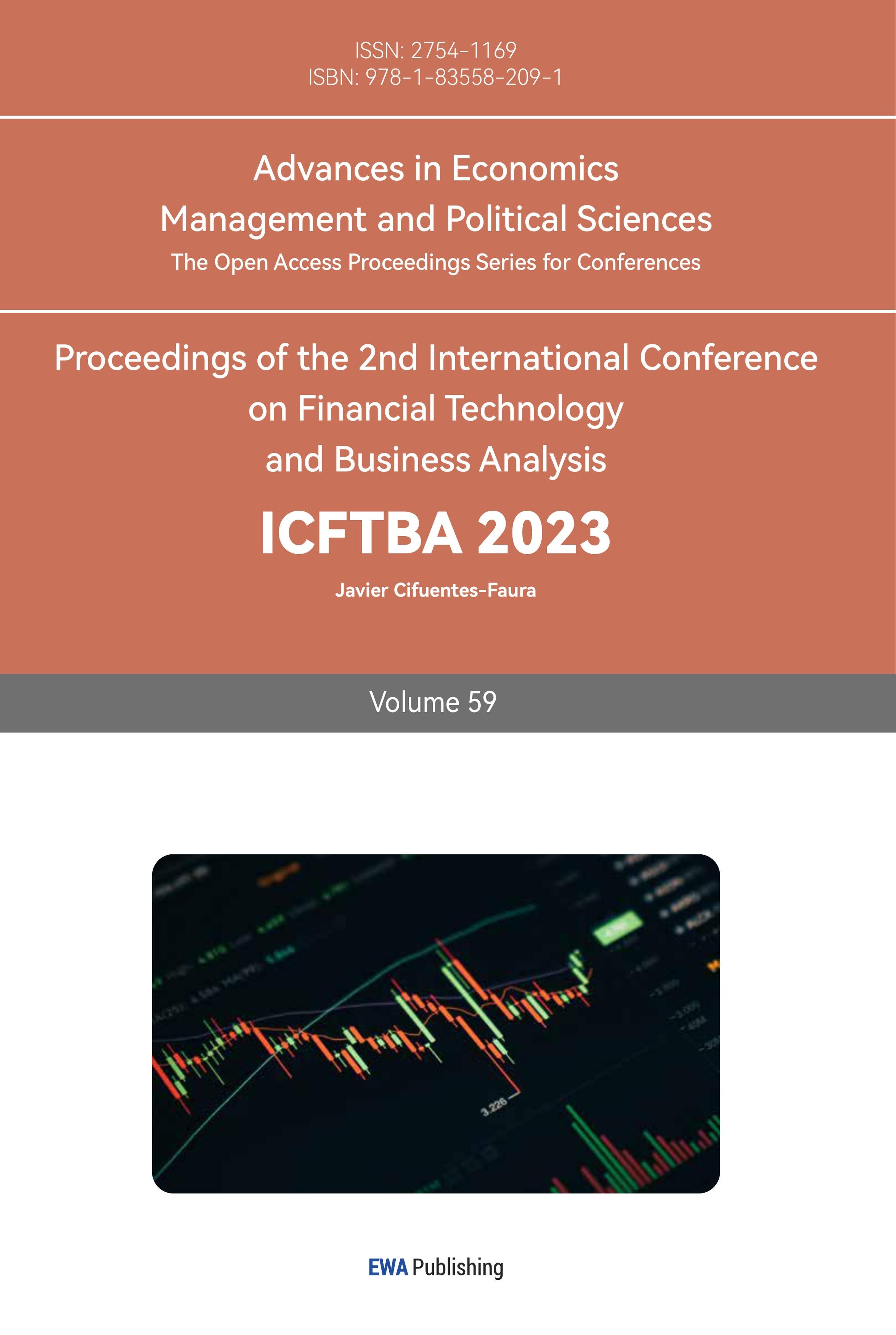

In the year 2017, according to CAICT, China government emphasis the importance of digital economy. It mentioned that the year 2016 had witnessed that 22.6 trillion yuan were the 30.3% of Chinese GDP. The digital economy infrastructure achieved leapfrog development, with stable growth and structural optimization in the digital economy infrastructure. It also gave the domestic structure of digital economy that the average proportion of digital economy was 29.6% in the service industry, the percentage of that in the industry was 17.0%, and the data was 6.2% in the agriculture industry (in Figure 1).

Figure 1: Total size of digital economy [2]

It obviously showed that digital economy made up the highest percentage of whole domestic industry. The online shopping platform like Mei tuan, Tmall, Taobao, JD.com started to be popular in Chinese consumer market and each of them uses the similar payment method like WeChat or Alipay. In addition, the report in 2017 also created a new term called Digital Economy Index (DEI). This DEI index showed that the raising rate of digital economy in China was obviously higher than that of China's macroeconomic prosperity index, and it had become an essential engine which promotes Chinese economy. In the same year, Group of 20 reported that the American digital economy led the world in scale. The money they had were 10.8 trillion US dollars, which accounted for 58.3% of their total GDP. The digital economy in other countries (besides China) ranked from high to low, including Japan, Germany, the United Kingdom, France, South Korea, India, Brazil, Italy, Canada, Mexico, Russia, Australia, Indonesia, and South Africa. Digital economy has been considered as the key factor for stimulating GDP growth in the 20 countries. It means that the trend of developing digital economy and globalization of that are necessary and inevitable [3]. In the other word, digital economy had been really essential part of economic development in China since 2017.

In 2018, there were $30.2 trillion driving in America. It had made up two fifth parts of the national GDP, with a nominal growth of 9.2%. Digital economy in this year in China was 31.3 trillion yuan, which made up 34.8% of GDP and it had accounted for 20.9% of the nominal growth. This report shows that in the early years of digital economic development, China shows a rapid and highly potential development. In addition, the leaders of China had repeatedly mentioned the importance and necessity of digital economy in China in the meetings from 2016 to 2019.

They had encouraged many regions and zones developing the economy with digital aspect and release policies to stimulate the its growth. The some provinces and cities digital economy related policies are show in Table 1.

Table 1: The some provinces and cities digital economy related policies (CAICT, 2018)

Zhejiang province | August 2016 | “Digital Zhejiang 2.0” development plan |

Guizhou province | February 2017 | Guizhou Digital Economy Development Plan (2017-2020) |

Fujian province | April 2018 | Key Points of Work in Digital Fujian 2018 |

Guangdong province | April 2018 | Guangdong Digital Economy Development Plan 2018-2025 |

Shanxi Province | May 2018 | Key points of Shanxi Province’s Digital Economy Work in 2018 |

Anhui Province | June 2018 | Guideline on accelerating the construction of a “digital Jianghuai” |

“Guizhou Province | June 2018 | Opinions on promoting big data could computing artificial intelligence, innovation and development to accelerate the construction of digital Guizhou |

In the recent years, CAICT gave the latest policies, the related contents are show in table 2.

Table 2: Cloud computing related policies of some provinces and cities in China in 2022-2023 [6]

Sichuan | 2022.10 | On accelerating the promotion of sports in the new era implementation opinions of construction | Use IT like the Internet, big data to promote the integration of sports resources, data sharing and connectivity |

2023.4 | 2023 Chengdu High-tech Zone to support enterprises digital intelligent technology transformation application object. | Encourage enterprises to "use data to empower the cloud", rated as five stars, four stars, three stars yuan, 100,000yuan, 50,000yuan in Sichuan Province. | |

Guangdong (Shenzhen) | 2023.5 | Shenzhen special economic zone quality regulations | It will develop the combination of big data and mobile internet, to foster new industrial forms and innovate new business models. |

2023.4 | 2023 Shenzhen Baoan district on the cloud platform enterprises | For enterprises on the cloud platform, the maximum consumption voucher subsidy of 50,000 yuan will be given according to the platform. Industrial software charges 30% of fees for the year |

Tables 1-2 illustrate the policy that has been released in China, which revealing the Chinese government's high emphasis on the digital economy.

3. Possible Risk Analysis

In the history of digital financial development, which risks may happen and how can these risks be avoided? First of all, the individual private information will be easy to obtain because of the usage of internet or digital products usually required personal fundamental information. People’s information may be used on some crime of fraud or other illegal crimes. In addition, digital financial products facing to the technical attacks by hackers. Once the criminal gang obtain people’s basic information, they could break safety barrier and stole people’s possession. They could even stole the digital money from the banks through their methods.

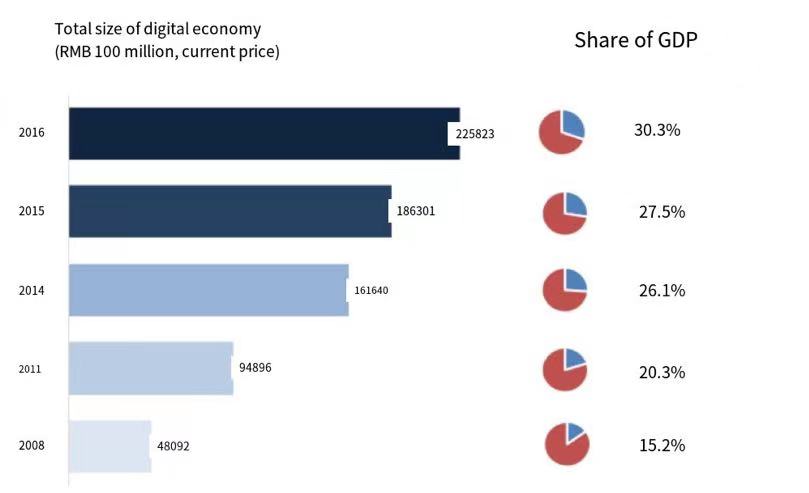

Figure 2: Vulnerabilities of financial industry apps at all levels [4]

The Figure 2 gives an example in 2019. It illustrates that there are more than 70% of leaks happening in all the levels of financial industries which are really significant proportion and data.

Moreover, the application of new digital technology may lead to technical unemployment risk. The appearing of new digital technology in manufacturing process may cause unemployment because of the lower cost of these technology compared with low-skilled workforce in the short term. The most important aspect which involving national security is that there are some essential data may be disclosed. With the growth of data value, it has become a regulatory problem to protect the security of important national data resources, balance the data localization policy and the development needs of enterprises, and protect government departments, enterprises and personal data from theft and abuse. In March 2019, it was revealed that there are minimized 200 million and maximized 600 million users' passwords of Facebook were stored in database. These data information, were viewed by the engineers or workers of Facebook for million times [4].

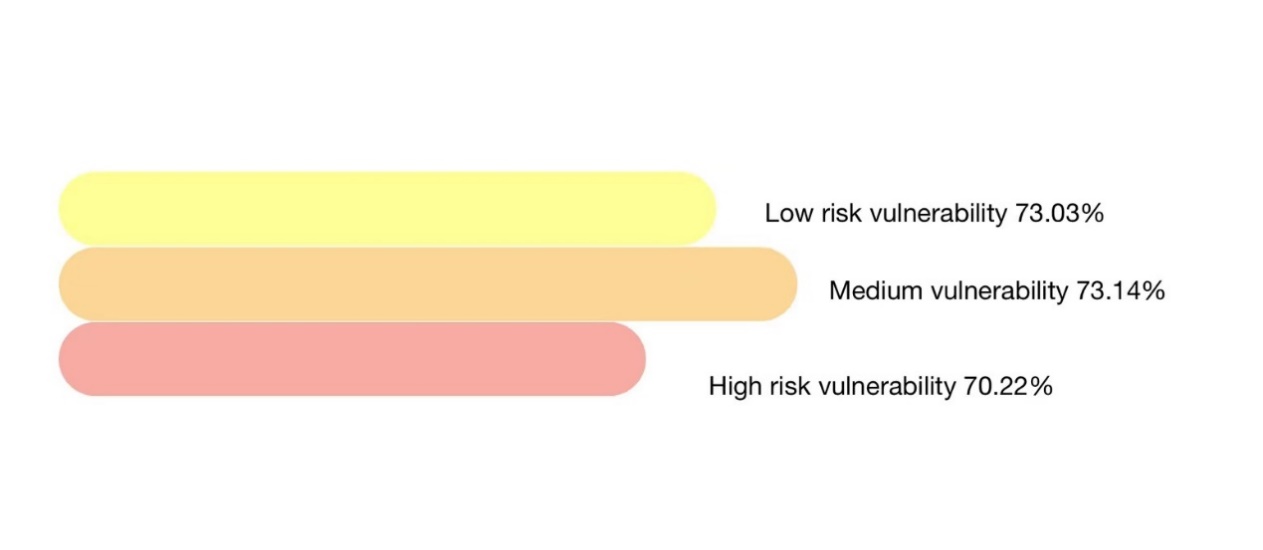

Figure 3: The market capitalization ratio [5]

Additionally, there are high possibility of marketing monopoly in digital financial market. As of December 20, 2019, eight of the top ten enterprises in the world by market value were digital platform enterprises, accounting for 88.4% of the market value, and the market value reached 6.23 trillion US dollars. With the influence of network effect, the power and influence of this career giants will be amplified which may cause monopoly (in Figure 3).

In conclusion, digital economy not only in China, but also in the whole world economic system, is still facing to big challenges, including personal information leakage, financial fraud, technical unemployment risk, national essential data leakage and market monopoly. To face and deal with these risks, China still has a long day and way to give research and do need the help and employment of high-skilled talents.

4. Suggestion

There are some other suggestion and future of the digital finance coming from other researches. In the long term future, economy o digital form could also be used as an essential part in the financial inclusion. The digital financial inclusion could be seem as a promotion policy having increasing effect on the international development [7]. In addition, innovation of technology brings to us a huge challenge which is different from the past. It means that not only China but other countries around the world need the development of multi-countries cooperation [8]. Moreover, to stimulate the digital economy and commerce, leadership, accountability, first-mover effects and some department including logistics, warehousing, transport and internet connectively are really critical factors [9]. Finally, some theoretical reports illustrate that the lack of policy about monetary will cause the barriers of digital finance on economic raise, so it is essential for monetary policy including the digital finance into its quantitative framework [10].

5. Conclusion

Affected by the epidemic, the world economy has been greatly impacted, every country tries to recover and develop their economy. This time, the digital economy will be the most helpful hand to achieve the goal. It ignores the distance, time, location, which ignoring the physical factors and having high spreading speed. From the reports and researches of CAICT, it is obvious that digital economy has been the biggest expectation of Chinese future economy development and also has played an essential role in Chinese economic structure. To build up a better digital environment, there many problems should be solved by China in the short-term future, including the protection of individual and national data, lack of high skill talents and the possible monopoly in the digital financial career.

This article also has certain shortcomings. About this research methods, theoretical analysis is dominated, while quantitative analysis is lacking. Although there are some simple data analysis, empirical research is not combined with historical data. In the future, quantitative research can be conducted when data is available.

References

[1]. Tapscott, D., Ticoll, D., & Lowy, A. (2000). Digital capital: harnessing the power of business Webs. Ubiquity, 2000, 9.

[2]. China Academy of Information and Communications Technology, 2017, White Paper on the Development of China's Digital Economy, Retrieved from http://www.caict.ac.cn/kxyj/qwfb/bps/201804/P020170713408029202449.pdf

[3]. China Academy of Information and Communications Technology, 2017, Research Report on the Development of Digital Economy in G20 Countries (2017), Retrieved from http://www.caict.ac.cn/kxyj/qwfb/bps/201804/P020171213443445335367.pdf

[4]. China Academy of Information and Communications Technology, 2019, Mobile Finance Application Security White Paper (2019), Retrieved from http://www.caict.ac.cn/kxyj/qwfb/bps/201911/P020191106355706395096.pdf

[5]. China Academy of Information and Communications Technology, 2019, White Paper on Digital Economy Governance (2019), Retrieved from http://www.caict.ac.cn/kxyj/qwfb/bps/201912/P020191226515354707683.pdf

[6]. China Academy of Information and Communications Technology, 2023, Cloud Computing White Paper (2023), Retrieved from http://www.caict.ac.cn/kxyj/qwfb/bps/202307/P020230725521473129120.pdf

[7]. Natile, S. (2020). Digital Finance Inclusion and the Mobile Money “Social” Enterprise: A Socio-Legal Critique of M-Pesa in Kenya. Historical Social Research / Historische Sozialforschung, 45(3), 74–94.

[8]. Bilotta, N., & Botti, F. (2018). Libra and the Others: The Future of Digital Money. Istituto Affari Internazionali (IAI).

[9]. Kong, S. T. (2019). E-commerce development in rural China. In L. SONG, Y. ZHOU, & L. HURST (Eds.), The Chinese Economic Transformation: Views from Young Economists:129–142.

[10]. Jiang, S., Qiu, S. & Zhou, H. (2022) Will digital financial development affect the effectiveness of monetary policy in emerging market countries? Economic Research-Ekonomska Istraživanja, 35:1, 3437-3472.

Cite this article

Cao,C. (2024). Analysis of the Status of Digital Economy in China's Economy. Advances in Economics, Management and Political Sciences,59,42-47.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Tapscott, D., Ticoll, D., & Lowy, A. (2000). Digital capital: harnessing the power of business Webs. Ubiquity, 2000, 9.

[2]. China Academy of Information and Communications Technology, 2017, White Paper on the Development of China's Digital Economy, Retrieved from http://www.caict.ac.cn/kxyj/qwfb/bps/201804/P020170713408029202449.pdf

[3]. China Academy of Information and Communications Technology, 2017, Research Report on the Development of Digital Economy in G20 Countries (2017), Retrieved from http://www.caict.ac.cn/kxyj/qwfb/bps/201804/P020171213443445335367.pdf

[4]. China Academy of Information and Communications Technology, 2019, Mobile Finance Application Security White Paper (2019), Retrieved from http://www.caict.ac.cn/kxyj/qwfb/bps/201911/P020191106355706395096.pdf

[5]. China Academy of Information and Communications Technology, 2019, White Paper on Digital Economy Governance (2019), Retrieved from http://www.caict.ac.cn/kxyj/qwfb/bps/201912/P020191226515354707683.pdf

[6]. China Academy of Information and Communications Technology, 2023, Cloud Computing White Paper (2023), Retrieved from http://www.caict.ac.cn/kxyj/qwfb/bps/202307/P020230725521473129120.pdf

[7]. Natile, S. (2020). Digital Finance Inclusion and the Mobile Money “Social” Enterprise: A Socio-Legal Critique of M-Pesa in Kenya. Historical Social Research / Historische Sozialforschung, 45(3), 74–94.

[8]. Bilotta, N., & Botti, F. (2018). Libra and the Others: The Future of Digital Money. Istituto Affari Internazionali (IAI).

[9]. Kong, S. T. (2019). E-commerce development in rural China. In L. SONG, Y. ZHOU, & L. HURST (Eds.), The Chinese Economic Transformation: Views from Young Economists:129–142.

[10]. Jiang, S., Qiu, S. & Zhou, H. (2022) Will digital financial development affect the effectiveness of monetary policy in emerging market countries? Economic Research-Ekonomska Istraživanja, 35:1, 3437-3472.