1. Introduction

Consumer behavior research has an extensive and longstanding tradition that has contributed significantly to our understanding of how individuals make purchasing decisions and interact with products and services. Researchers have utilized various theoretical frameworks, methodologies and models for studying consumer behavior more in-depth over time; more recently big data analytics have further revolutionized this field by helping researchers unlock valuable insights from large datasets. Sagiroglu and Sinanc present an in-depth review of Big Data analytics, its applications, challenges associated with processing large volumes of information and the promise it holds for various fields - consumer behavior research being an example [1]. Fitriani, Hadita and Faeni make significant strides toward understanding consumer behavior through their research on viral marketing's effect on purchase intentions mediated by consumer behavior. Their investigation investigates social media platforms - specifically TikTok - on consumer behaviors to illuminate an evolving consumer interactions landscape as well as highlight digital marketing strategies as key to its effectiveness [2]. Sheth explores the future directions of consumer behavior research, marketing strategy and analytics [3]. He touches upon topics like artificial intelligence, machine learning and data-driven decision-making as areas of particular interest; further stressing that researchers must adapt to an ever-evolving landscape while taking advantage of advanced analytical techniques to gain greater insights into consumer behavior. These references offer a glimpse of the wide array of topics and approaches within consumer behavior research, while emphasizing how big data analytics, social media platforms, and technological advances have played a part in shaping its current trajectory.

Recently, consumer behavior research has increased its scope across many application scenarios by taking advantage of cutting-edge technologies and data-driven approaches. These advancements have allowed researchers to gain deeper insights into consumer preferences, decision-making processes, and factors affecting consumer behavior. Sheth explores innovative areas of research in marketing strategy, consumer behavior and analytics [4]. The author highlights the increasing significance of artificial intelligence, machine learning and data-driven decision-making technologies in comprehending consumer behavior and developing marketing strategies. Furthermore, this reference offers insight into current trends and possible future directions of consumer behavior research. Recent advances have advanced consumer behavior studies rapidly, yet it remains essential to recognize earlier contributions which laid the foundation. Bernoulli's theory on measuring risk has had an immense effect on understanding consumer decision-making processes [5]. Furthermore, Bernoulli and Blower's study of smallpox mortality and inoculation benefits reveal historical developments of risk perception as they impact consumer behavior [6].

Consumer behavior research has made significant strides over time, driven by advances in technology and data analytics. Key application scenarios, including big data use, viral marketing influence, and emerging technology integration have broadened our understanding of consumer behavior. Businesses can leverage these insights to develop more effective marketing strategies, enhance customer experiences and achieve business success more easily - these references show progress made within consumer behavior research in these areas and highlight their contributions.

This essay will investigate various methods and models of big data analysis used in understanding consumer behavior across industries. The following sections provide a structured exploration of this topic, beginning with an introduction to big data analysis as it applies to consumer research before exploring its applications within retail, healthcare and financial services industries.

The Sec. 2 will analyze three industries and their use of big data analysis in understanding consumer behavior. First up is retail, this study will explore articles published from 2015 onwards within this industry. Following that will be healthcare; visual aids will be included to outline application scenarios, models employed, insights gained through big data analysis; then financial services where articles published from 2015 forward will be examined with similar visual aids to outline application scenarios, models employed and significant findings obtained through big data analysis. After exploring these application scenarios, the essay will go on to examine the limitations of big data analysis. Issues such as privacy concerns, data quality concerns and need for robust analytical models will all be explored to give a comprehensive picture of all challenges associated with using big data analytics in consumer behavior research. Finally, this study will present a forward-looking perspective on the future of big data analysis. It will look into advancements and emerging technologies that may further our understanding of consumer behavior across retail, healthcare and financial services industries - as well as discussing any implication or possibilities for further consumer behavior research in consumer analysis.

2. Basic Definitions of Bigdata Analysis

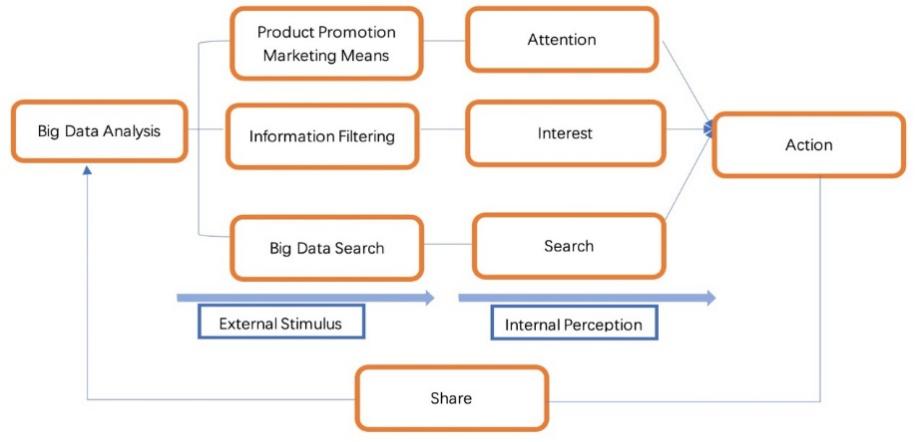

Big data analysis refers to the practice of studying and extracting insights from large, complex datasets to reveal patterns, trends, and correlations [7]. It employs various methodologies and models in order to sift through vast amounts of information in order to uncover meaningful details that help understand consumer behavior - for instance providing businesses with more effective product promotions and marketing strategies as a result. Information filtering is one of the cornerstones of big data analysis for consumer behavior research, gathering and processing large amounts of data from various sources such as social media platforms and customer databases before using advanced algorithms to filter out relevant details that will provide businesses with a deeper insight into their target audiences.

Big data analysis in consumer behavior research requires big data search (seen from Fig. 1). Businesses can take advantage of advanced search algorithms and techniques to navigate large datasets by conducting exhaustive searches across numerous data sources; doing this enables them to detect patterns that will assist their marketing strategies and decision-making processes. External stimuli play an essential part in consumer behavior, and big data analysis provides businesses with an effective tool to capture and understand these stimuli [8]. By examining advertising campaigns, social media trends, market conditions, or any other external factor such as weather conditions that influence consumer's attention spans or search behavior, they can better understand how such stimuli influence consumers and create targeted marketing and promotional activities to reach target markets more effectively.

Figure 1: The mechanism by which big data analysis affects customer behavior.

Internal perception and action are also integral parts of consumer behavior, and big data analysis provides valuable insights in these areas [9]. By analyzing customer interactions, purchase history, feedback and post-purchase activities businesses can gain insights into customers' preferences, decision-making processes and post-purchase actions which they can then use to personalize marketing efforts and boost customer satisfaction and loyalty. Big data analysis also allows businesses to monitor the impact of their marketing efforts by measuring metrics like shares and engagement rates [10]. By keeping tabs on such measures, businesses can assess the success of their marketing campaigns while making data-driven adjustments that optimize strategies. Big data analysis offers businesses powerful techniques and models for understanding consumer behavior. By employing techniques such as information filtering, big data search, external stimuli analysis, internal perception analysis and action research they can gain invaluable insight into consumer preferences, decision-making processes and post-purchase behavior that they can then utilize to enhance product promotion efforts, tailor marketing methods and create overall improvements to marketing strategies.

3. Retail

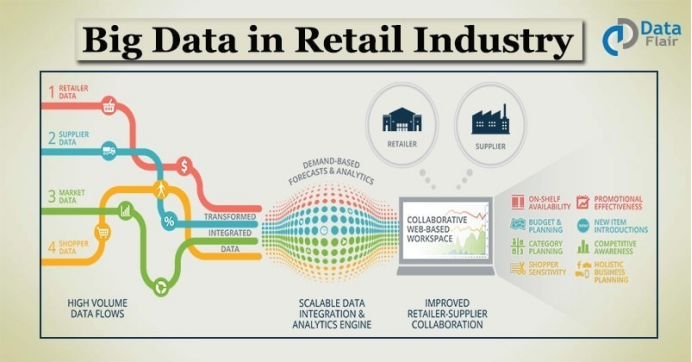

Retail has seen significant transformations due to big data analytics. Leveraging large and complex datasets, retailers can gain invaluable insights into consumer behavior that enable informed decisions and strengthen marketing strategies. Here, this study will present a case study showing how big data analytics has been applied in retail environments using the AISAS model as an example (seen from Fig. 2). Peighambari et al. present the AISAS model, an analysis framework designed to comprehend consumer engagement through stages such as Action, Interest, Search Action Share [11]. Retailers can utilize this framework to analyze customer interactions and behaviors at each step and leverage them effectively so as to optimize marketing efforts and enhance customer satisfaction. As part of the case study, a retail company collected and analyzed vast amounts of customer data in order to better comprehend and engage their target audience. Through the AISAS model, they gained insights into different stages of consumer behavior and adjusted their marketing strategies accordingly.

Figure 2: Big Data in Retail Industry.

At this stage, a retail company tracked customer purchase patterns and identified initial actions taken by customers, gathering insights into factors affecting customers' buying decisions. At the Interest stage, the retail company employed big data analysis to identify customer interests and preferences. By studying browsing behavior, wish lists, product views and customer browsing preferences they gained an in-depth knowledge of customers' specific passions while customizing marketing campaigns accordingly. At the Search Stage, the company employed big data analytics to understand customer search patterns and preferences. By studying search queries, click-through rates, and search histories they gained insights into customers' information-seeking behavior while improving the user experience of their search functionality on their website. In the second Action stage, retail companies focused on customer retention and repeat purchases by analyzing loyalty programs, purchase histories and customer feedback to identify strategies to increase customer retention and encourage repeat purchases - such as offering tailored offers based on past actions and preferences of existing customers. As part of its Share stage, the retail company monitored and analyzed customer reviews, social media posts, and word-of-mouth recommendations from customers to understand customer sentiment and brand perceptions. This allowed the retail company to build brand advocacy by capitalizing on positive customer experiences for promotional purposes. Utilizing big data analytics using the AISAS model led to considerable progress for a retail company. By taking advantage of insights gained at each step, they were able to optimize marketing strategies, enhance customer engagement and enhance overall customer satisfaction. The research findings of Hofacker et al corroborate with this case study by emphasizing the opportunities afforded by big data in terms of understanding consumer behavior and improving marketing efforts in various industries, including retail [12].

4. Healthcare

Healthcare institutions have increasingly turned to big data analytics in an attempt to enhance patient care, optimize operations and enhance decision-making processes. This study presents here a case study which illustrates this use case of big data analytics within healthcare utilizing the Plan-Do-Check-Act model as our focal point. Sheth details the PDCA model as a systematic method for continuous improvement and problem-solving, providing healthcare organizations with a way to plan, execute, evaluate, and adjust strategies based on insights gleaned from big data analysis [13]. This enables healthcare organizations to effectively plan, execute, evaluate, and adapt strategies based on insights gained through big data analytics. In this case study, a healthcare organization sought to enhance patient outcomes and maximize resource allocation using big data analytics. They utilized the PDCA model as their guide. The Plan stage involved setting objectives and identifying KPIs related to patient care and operational efficiency. A healthcare organization collected and analyzed various forms of data such as electronic health records, medical imaging studies, wearable devices and social determinants of health to identify areas for improvement and form action plans accordingly. Stepping up to the Do stage, healthcare organizations implemented action plans derived from the Plan stage. Big data analytics was utilized to monitor patient progress and track outcomes as well as optimize resource allocation. Real-time data from wearable devices and remote patient monitoring systems was integrated into analysis for timely intervention and adjustments for improved care delivery. At the Check stage, the organization evaluated outcomes and performance against KPIs they had set forth. Utilizing big data analysis techniques, they were able to assess patient outcomes, measure adherence to clinical guidelines, identify variations in care delivery models and detect potential issues. Comparing actual results against desired targets gave insight into any areas requiring further improvement.

Based on their findings from the Check stage, a healthcare organization took swift action at the Act stage, where necessary adjustments and interventions were implemented. Big data analytics helped identify areas for optimization, resource reallocation, quality improvement initiatives as well as predictive analytics tools for anticipating patient needs and allocating resources proactively resulting in enhanced patient care while increasing operational efficiency. Big data analytics using the PDCA model proved highly successful for healthcare organizations. By continually analyzing and revising strategies based on real-time data, they achieved improved patient outcomes, lower costs, and enhanced operational effectiveness. This case study aligns with the findings of Tang and Wu [14], who underlined how big data influences consumer behavior by emphasizing its mechanisms of influence as well as the necessity for data analysis in healthcare settings.

5. Financial Services

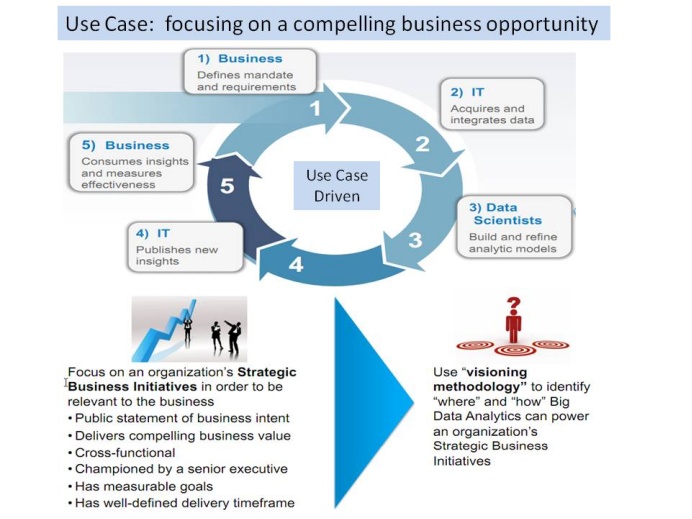

The finance industry has recognized the immense power of big data analytics for driving financial decision-making, risk evaluation, and customer segmentation. Here, this study will present a detailed case study demonstrating its successful application within financial services in particular focusing on its successful deployment to create customer segmentation models. Customer segmentation plays an essential role in finance as it allows financial institutions to gain a better understanding of their customer base on an intimate level, enabling them to tailor products and services more closely towards certain customer groups and enhance customer satisfaction, marketing strategies, business growth and profitability. This research will use customer segmentation model as an example of how big data analytics can be effectively employed within finance [15]. A sketch of the case is shown in Fig. 3. As part of this case study, a well-known financial institution sought to gain a comprehensive understanding of their diverse customer base and create tailored marketing campaigns that resonated with specific customer segments. They turned to Big Data analytics as an efficient method for collecting and analyzing massive amounts of customer data such as transaction history, online interactions, social media activity and demographic details.

Leveraging their customer segmentation model, this financial institution employed advanced analytics techniques to divide their customer base into distinct groups based on shared characteristics, behaviors and preferences. Clustering algorithms and other data analysis methodologies helped identify patterns among customers allowing for meaningful yet actionable segments to be created. Once customer segments were established, the financial institution customized its marketing strategies accordingly. They offered personalized product recommendations, promotional offers, and communication channels tailored specifically for each segment based on its individual needs and preferences. Big data analytics allowed for such personalized approaches through providing comprehensive insights into customer behaviors enabling targeted marketing efforts.

Figure 3: Use Case.

Financial institution used big data analytics to keep an eye on customer interactions and sentiment in real time, including analyzing feedback, social media mentions and service interactions to gain invaluable insight into customer satisfaction levels and identify any potential issues; using this knowledge they were able to implement timely interventions to enhance overall customer experience.

Applying big data analytics using a customer segmentation model was instrumental to the financial institution. By aligning their marketing strategies with certain customer segments, they were able to increase customer engagement levels, retain more customers, and boost overall profitability. Leveraging big data insights allowed the financial institution to make data-driven decisions that resulted in more efficient marketing campaigns and enhanced customer satisfaction. Yu and Yang support this case study by emphasizing the crucial role that big data analysis plays in new product development, as well as its significance for driving innovation and growth within finance industry [16]. By using big data analytics to gain a deeper understanding of customer behavior and preferences, financial institutions can identify emerging trends, recognize new opportunities and develop products and services tailored towards meeting evolving customer demands.

6. Limitations and Prospects

While big data analytics has great promise in revolutionizing the finance industry, it is also essential to acknowledge its limitations. One major impediment to progress lies within data quality and accuracy concerns: financial data may come from multiple sources and systems and ensure consistency, completeness, and reliability is often an uphill battle; without effective governance and quality assurance processes in place to safeguard big data analytics insights may become compromised, leading to inaccurate decisions being drawn and ineffective decision-making being implemented. Though limited, big data analytics in finance holds immense promise for its future. Advancements in technology and data management techniques will play a key role in meeting current challenges; such as improvements to data quality control mechanisms like cleaning algorithms or validation processes which will enhance data accuracy and reliability; while advancements in integration/consolidation techniques allow financial institutions to harness multiple sources of structured and unstructured data to enhance insights gleaned from big data analytics.

Privacy and security technologies of tomorrow offer great potential in terms of privacy and security. Advancements such as differential privacy and homomorphic encryption could help financial institutions extract insights from customer data while respecting individual rights to privacy. Likewise, decentralized technologies like blockchain hold great promise as transparent data-sharing frameworks allowing efficient collaboration among financial institutions while guaranteeing data integrity and confidentiality.

7. Conclusion

To sum up, big data analytics has become an indispensable asset to financial institutions, providing them with insight into customer behaviour, tailor offerings to individual customer preferences and optimize marketing strategies. Though big data analytics in finance may present certain limitations due to data quality, privacy, and its reliance on historical information, its future outlook remains positive with advancements in technology and data management techniques expected to help address such challenges. This study's significance lies in its demonstration that using big data analytics, particularly customer segmentation models, to enhance customer engagement, retention rates and business performance for financial institutions is the key to competitiveness and growth within an industry.

References

[1]. Sagiroglu, S. and Sinanc, D. (2013). Big data: A review. In 2013 international conference on collaboration technologies and systems (CTS) (pp. 42-47).

[2]. Fitriani, I., Hadita, H. and Faeni, D.P. (2022). The impact of Viral Marketing on Purchase Intention mediated by Consumer Behavior (Study on Tiktok User of Management Students at Bhayangkara Jakarta Raya University). Journal of Sustainable Community Development (JSCD), 4(2), 84-91.

[3]. Sheth, J. (2021). New areas of research in marketing strategy, consumer behavior, and marketing analytics: the future is bright. Journal of Marketing Theory and Practice, 29(1), 3-12.

[4]. Bernoulli, D. (2011). Exposition of a new theory on the measurement of risk. In The Kelly capital growth investment criterion: Theory and practice (pp. 11-24).

[5]. Bernoulli, D. and Blower, S. (2004). An attempt at a new analysis of the mortality caused by smallpox and of the advantages of inoculation to prevent it. Reviews in medical virology, 14(5), 275.

[6]. Peighambari, K., Sattari, S., Kordestani, A. and Oghazi, P. (2016). Consumer behavior research: A synthesis of the recent literature. Sage Open, 6(2), 2158244016645638.

[7]. Copeland, A.H. (1945). John von Neumann and Oskar Morgenstern, theory of games and economic behavior.

[8]. Hofacker, C.F., Malthouse, E.C. and Sultan, F. (2016). Big data and consumer behavior: Imminent opportunities. Journal of consumer marketing, 33(2), 89-97.

[9]. Fang, Z. and Li, P. (2014). The mechanism of “Big Data” impact on consumer behavior. American Journal of Industrial and Business Management, 2014.

[10]. Tang, M. and Wu, Z. (2015). Research on the mechanisms of big data on consumer behavior using the models of C2C e-commerce and countermeasures. African journal of business management, 9(1), 18-34.

[11]. Matz, S.C. and Netzer, O. (2017). Using big data as a window into consumers’ psychology. Current opinion in behavioral sciences, 18, 7-12.

[12]. Ma, D., Hu, J. and Yao, F. (2021). Big data empowering low-carbon smart tourism study on low-carbon tourism O2O supply chain considering consumer behaviors and corporate altruistic preferences. Computers & Industrial Engineering, 153, 107061.

[13]. Yu, S. and Yang, D. (2016, April). The role of big data analysis in new product development. In 2016 International Conference on Network and Information Systems for Computers (ICNISC) (pp. 279-283).

Cite this article

Wang,Y. (2024). Big Data Analysis in Consumer Behavior: Evidence from the Retail, Healthcare, and Financial Services Industries. Advances in Economics, Management and Political Sciences,59,231-237.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Sagiroglu, S. and Sinanc, D. (2013). Big data: A review. In 2013 international conference on collaboration technologies and systems (CTS) (pp. 42-47).

[2]. Fitriani, I., Hadita, H. and Faeni, D.P. (2022). The impact of Viral Marketing on Purchase Intention mediated by Consumer Behavior (Study on Tiktok User of Management Students at Bhayangkara Jakarta Raya University). Journal of Sustainable Community Development (JSCD), 4(2), 84-91.

[3]. Sheth, J. (2021). New areas of research in marketing strategy, consumer behavior, and marketing analytics: the future is bright. Journal of Marketing Theory and Practice, 29(1), 3-12.

[4]. Bernoulli, D. (2011). Exposition of a new theory on the measurement of risk. In The Kelly capital growth investment criterion: Theory and practice (pp. 11-24).

[5]. Bernoulli, D. and Blower, S. (2004). An attempt at a new analysis of the mortality caused by smallpox and of the advantages of inoculation to prevent it. Reviews in medical virology, 14(5), 275.

[6]. Peighambari, K., Sattari, S., Kordestani, A. and Oghazi, P. (2016). Consumer behavior research: A synthesis of the recent literature. Sage Open, 6(2), 2158244016645638.

[7]. Copeland, A.H. (1945). John von Neumann and Oskar Morgenstern, theory of games and economic behavior.

[8]. Hofacker, C.F., Malthouse, E.C. and Sultan, F. (2016). Big data and consumer behavior: Imminent opportunities. Journal of consumer marketing, 33(2), 89-97.

[9]. Fang, Z. and Li, P. (2014). The mechanism of “Big Data” impact on consumer behavior. American Journal of Industrial and Business Management, 2014.

[10]. Tang, M. and Wu, Z. (2015). Research on the mechanisms of big data on consumer behavior using the models of C2C e-commerce and countermeasures. African journal of business management, 9(1), 18-34.

[11]. Matz, S.C. and Netzer, O. (2017). Using big data as a window into consumers’ psychology. Current opinion in behavioral sciences, 18, 7-12.

[12]. Ma, D., Hu, J. and Yao, F. (2021). Big data empowering low-carbon smart tourism study on low-carbon tourism O2O supply chain considering consumer behaviors and corporate altruistic preferences. Computers & Industrial Engineering, 153, 107061.

[13]. Yu, S. and Yang, D. (2016, April). The role of big data analysis in new product development. In 2016 International Conference on Network and Information Systems for Computers (ICNISC) (pp. 279-283).