1.Introduction

Louis Vuitton Mot Hennessy, or LVMH for short, was created in 1987 by Bernard Arnault when he merged Louis Vuitton with Mot Hennessy. In 2020, LVMH's CEO Bernard Arnault was one of the world's richest men. One of the important factors of the LVMH group's success was that it could capture young customers' mentality very well.

In recent years, with the impact of COVID-19, most companies in the luxury industry have been greatly affected as tourists have been unable to travel and many have seen a huge drop in sales. LVMH is not an exception. The CEO of LVMH also stated that, after taking into account currency fluctuations and portfolio adjustments, revenues grew by 8% during the course of three months leading up to December of 2019. In 2020, LVMH's owners reported their worst in three years, quarterly revenues have increased. Since the end of 2016, LVMH's quarterly growth rate has been the slowest [1]. The luxury sector is more likely to be disappointing in the long run due to its high valuation.

Based on the above discussion, this written paper aims to provide a fundamental financial analysis for LVMH. It will investigate LVMH's financial performance during 2018 to 2022, analyze LVMH stock’s past performance, value the stock with valuation model and predict the stock price of LVMH in the future 5 years.

This written essaywill firstly provide a company overview in section 2, and then look at section 3 will provide qualitative and quantitative analysis about LVMH stock. Section 4 will price LVMH's stock with valuation models. Section 5 will make further analysis of LVMH. Finally, a conclusion on the research question will be offered in section 6.

2.Company Overview

The luxury goods include cars, airplanes, beverages, watches, and jewelries, etc. Luxury goods aim to meet customer desires by turning everyday objects into status symbols while focusing on branding, aesthetics, premium materials, skilled workmanship, and cost. The gross domestic product (GDP) of economies fluctuates along with the luxury market. The desire for luxury items increases significantly during periods of economic stability and growth, while it declines during challenging economic times. Globally, the most valuable luxury brand is Louis Vuitton, with a 2019 brand value of more than $47.2 billion [2].

In this written essay two other peer firms, Kering and Richemont, also in the luxury industry will be incorporated to make comparisons with LVMH. The reason is that there are three well-known groups in the luxury industry: LVMH, Kering and Richemont. The first one, LVMH is the main firm this written paper will focus on. LVMH, that has been introduced in Section 1, is the world’s leading supplier of luxury goods, offering products such as fragrances and designer handbags. Kering is the second group. Kering, a global high-end boutique company that was established in 1963, brings together an array of prestigious garments, jewelry, and leather goods. According to the official website of Kering edited by Disko, it contains various brands such as Gucci, Saint Laurent, etc. The third group is Hermes, a French luxury brand. According to Richemont’s website. The goal of Richemont as a family-oriented Group is to shape the future by fostering the distinctive craftsmanship, creative inspiration, and inventive spirit of our workforce. By doing this, Richemont hope to produce long-term value for all of stakeholders, including customers, employees, partners, investors, and the general public.

3.Stock Analysis

3.1.Qualitative Analysis: How Does LVMH Stock Perform?

The stock trends of LVMH (MC.PA), Kering (PPRUY), and Richemont (CFR.SW) are compared in Figure 1. As figure 1 shwon, from 2018 until Jan 2020, Richemont's stock price was the highest of the three. From Jan 2018 to Jan 2019, Kering and LVMH's stock prices were comparable, but by January 2019, PPRUY's stock price had fully surpassed LVMH's. PPRUY's saw a significant fall in April 2020. The share prices of all three businesses have increased dramatically since the outbreak of the 2020 COVID-19, especially PPRUY and Richemont. LVMH had always had the lowest stock price of the three.

Figure 1: Stock comparsion of LVMH (Green) , PPRUY (Red) and Richemont (Blue) from 2018-2021. Sorce: Yahoo finance.

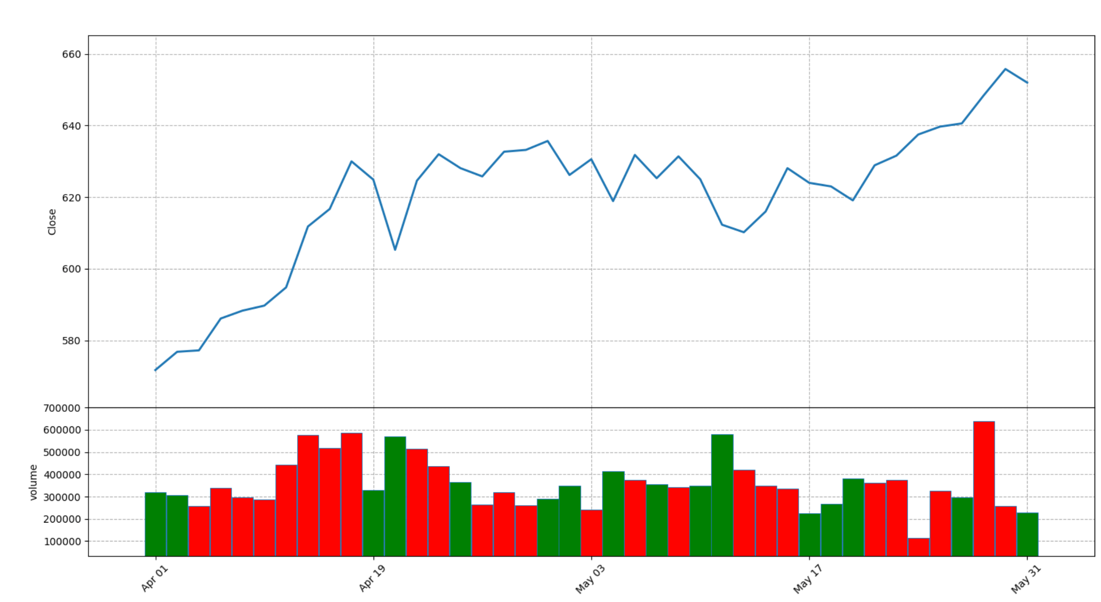

LVMH CEO Bernard Arnault will be wealthier than Jeff Bezos and Elon Musk on the morning of May 24, 2021, having a projected net worth of $186.3 billion. And Arnault's wealth has increased dramatically by more than $110 billion over the past 14 months, which caused LVMH's shares to rise by 0.4% in the opening hour of trading on May 24th, 2021 [3][3]. And as a result, LVMH's market value increased to $320 billion. Figure 2 illustrates this by displaying the significant increase in LVMH's stock price in May 2021. According to the official website of LVMH (2021), it began a fresh round of share buyback program in November 2021, following which the share price increased.

Figure 2: Stock price of LVMH from 2021.4 to 2021.6 Source: Yahoo finance.

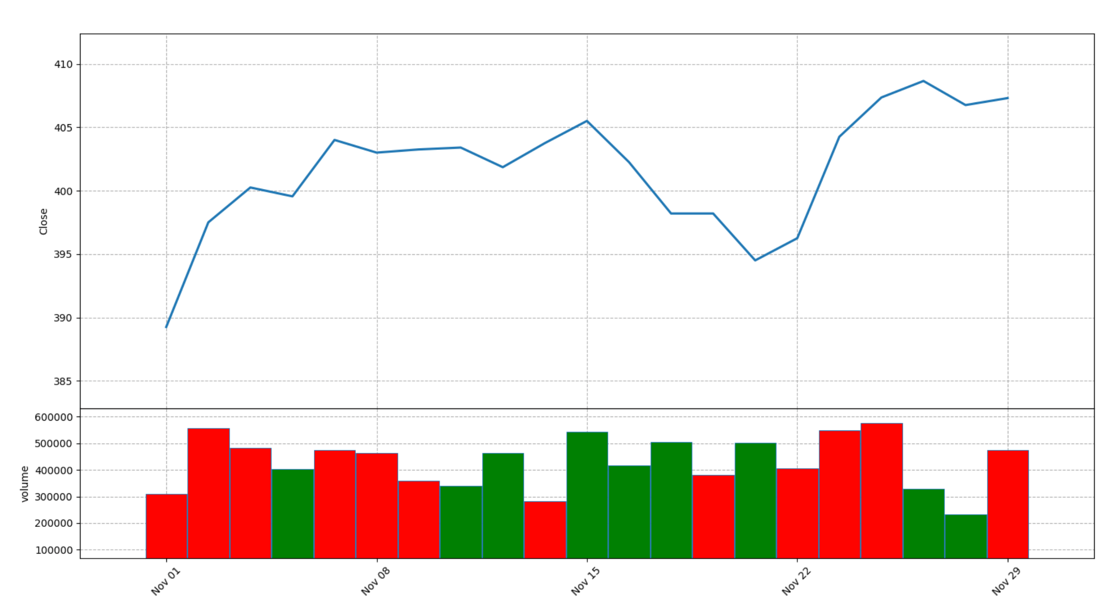

In an agreement made on November 25, 2019, LVMH and Tiffany agreed that LVMH would purchase Tiffany & Co. for $135 in cash per share ($16.2 billion in total). After the announcement, the LVMH stock rose 1.4% on Monday morning [4]. Figure 3 shows the sharp increase in LVMH's stock price that occurred from November to December 2019 because of the announcement. On September 29, 2020, LVMH sued Tiffany, claiming that Tiffany was not able to be acquired due to COVID-19 and political factors [5]. Following that, the price of LVMH's stock increased briefly before dropping to $423.1. On January 7, 2021, LVMH announced its purchase of Tiffany after several rounds of discussions, and its stock price immediately increased.

Figure 3: Stock price of LVMH from 2019.11 to 2019.12 Source: Yahoo finance.

3.2.Quantitative Analysis

3.2.1.How To Analyze A Stock?

The standard deviation is the square root of the variance, which is the predicted squared variation from the mean [6]. Variance is the anticipated squared deviation from the mean, a method for estimating the risk associated with a probability distribution [6]. In the world of finance, a return's volatility is defined by its standard deviation, and it is equal to\( √Variance \)[6]. The difference between a stock's opening and closing prices during a trading day is used to calculate daily return, which represents the return a stock produces during its trading time [7].

The anticipated percentage shift for a 1% change in the market portfolio, in a security's excess return is known as beta (β) [6]. The CAPM is:\( E{R_{i}}-{R_{0}}={β_{i}}(E({R_{M}})-{R_{0}}) \)[8].\( E{R_{i}} \)is the expected return of the security i ,\( {R_{0}} \)is the risk-free rate,\( {β_{i}} \)represents the sensitivity of security i’s return to the market portfolio, and (\( E{R_{m}}-{R_{0}} \)) is the market risk premium [8]. Risk premium,\( E{R_{i}}-{R_{0}} \)is the additional return that investors expect to receive in order to compensate for the risk associated with security i based on the risk-free investment [6]. The excess return reflects the average risk premium investors received in exchange for taking on investment risk. It is calculated as the difference between the average return on the investment and the average return on Treasury notes, a risk-free investment [6].

Sharpe ratio measures the reward per unit of risk and is the ratio of excess return of security i to the standard deviation (SD) of the security’s excess return [6]. Hence, it is written as\( \frac{Risk premium}{SD of excess return} \).

3.2.2.Data Analysis: How Does LVMH Stock Perform?

This section will examine the annualized return and volatility, Sharpe ratio, and beta of LVMH's stock. The risk-free rate is obtained from the website macrotrends, the data for the LVMH stock and the S&P 500 are obtained from yahoo finance, and Excel is used for all calculations.

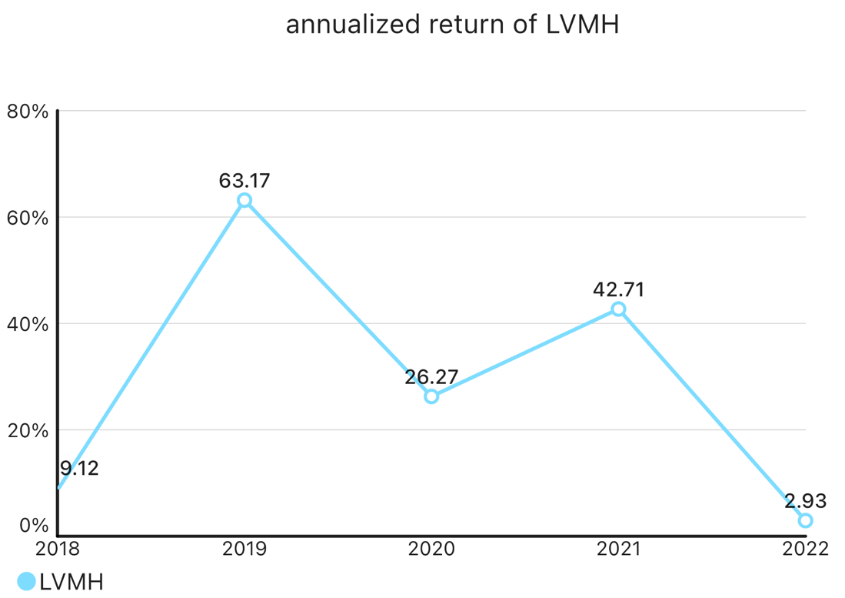

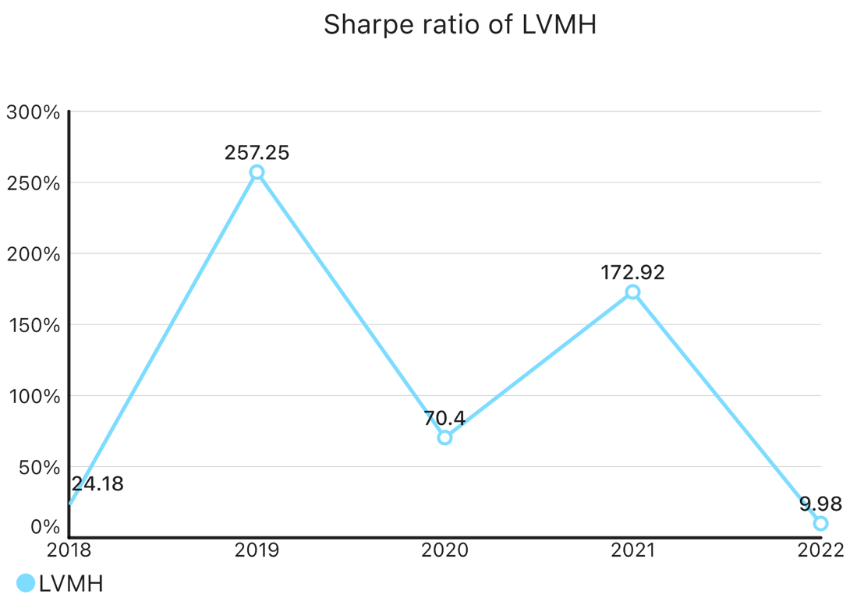

First, figure 4 shows that during the four years from 2018 to 2022, the annualized return for LVMH varies greatly. The annualized return significantly increases between 2018 and 2019, from 9.12% to 63.17%, but noticeably decreases between 2019 and 2020, from 63.17 to 26.27 percent, perhaps as a result of COVID-19. When comparing figures 4 and 6 it is clear that the annualized return and Sharpe ratio have trajectories that are very similar, first rising, then declining, and then eventually rising again. It should be noted that the Sharpe ratio is equal to\( \frac{Risk Premiumm}{SD of excess return}=\frac{{R_{p}}-{R_{f}}}{SD of excess return} \)therefore it makes sense that the annualized return can influence the Sharpe ratio's size in part. As a result, they exhibit the same patterns in this instance.

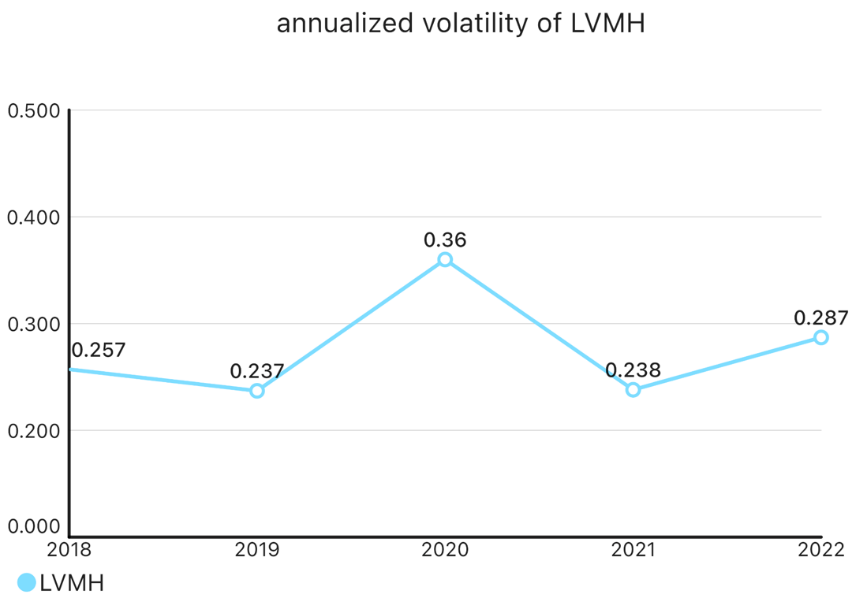

It is used to calculate an investment's risk to quantify annualized volatility. A larger annualized return necessitates a higher level of risk on the part of the investor, who will naturally be rewarded with a higher return.

Figures 4, 5, and 6 summarize the information about LVMH’s annualized return and volatility, and Sharpe ratio during 2018 to 2022. The annualized volatility from 2018 to 2022 is similar, fluctuating around 0.24 except in 2020 which reaches 0.36. The Sharpe ratio has gone up a lot since annualized return has increased sharply. The annualized return has fallen dramatically from 2019 to 2020, and even with a small increase in annualized volatility, the Sharpe ratio still shows a decline. Between 2020 and 2021, the annualized return has recovered, although the annualized volatility has decreased a little, and the Sharpe ratio has also recovered by 0.09. Finally, from 2020 to 2021, the annualized return and sharpe ratio both decreased, but the annualized volatility increased by about 0.06.

Figure 4: annualized return of LVMH from 2018 to 2022.

Figure 5: annualized volatility of LVMH from 2018 to 2022.

Figure 6: Sharpe ratio of LVMH from 2018 to 2022.

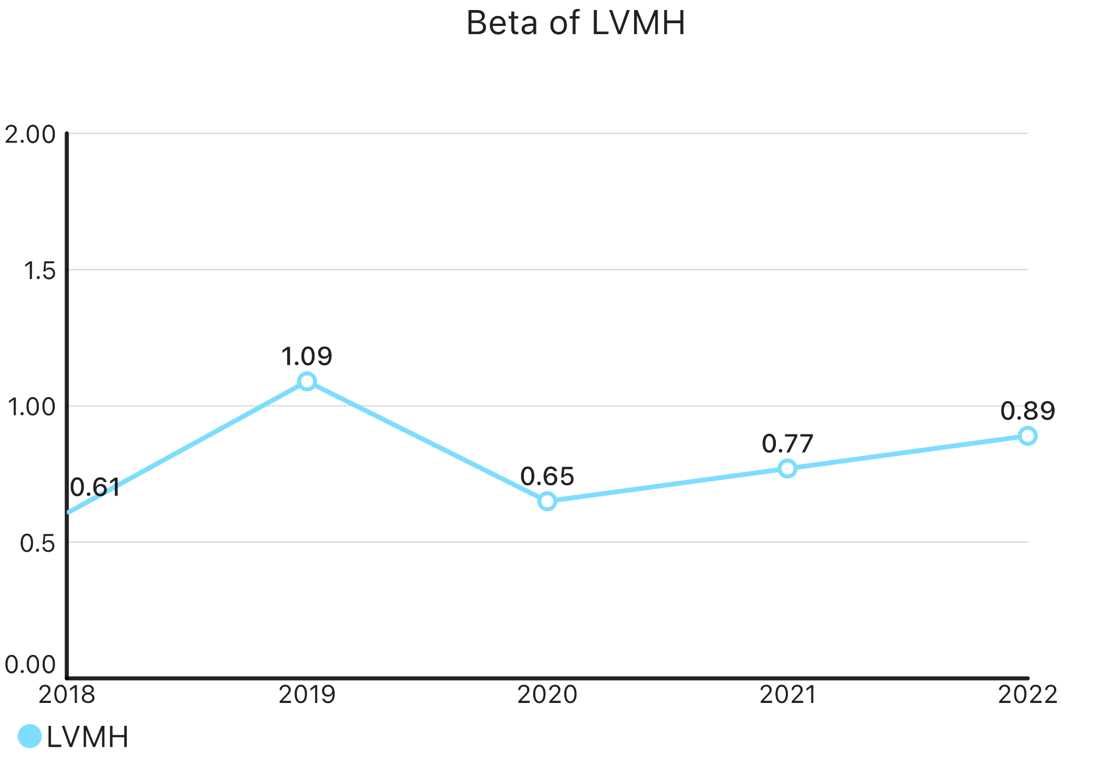

Finally, betas of LVMH stock from 2018 to 2022 are calculated respectively using daily data in the corresponding year. Larger beta suggests that the firm’s stock is more sensitive or responsive to the market (a proxy for systematic risk). In figure 7, LVMH has a positive rising beta from approximately 0.62 in 2018 to 1.10 in 2019, and it implies that the stock of LVMH is becoming more sensitive to performance benchmarks, the market portfolio which measures the systematic risk. During 2019 to 2020, because of the influence of COVID-19, beta of LVMH declines by about 40%. From 2020 to 2022, LVMH’s beta rises to 0.89 after the shock of COVID-19.

Figure 7: Beta of LVMH from 2018 to 2022.

4.Valuation

4.1.Method of Value A Stock

Firms are viewed as investments when using the DCF approach, and their value is calculated as the discounted total of the anticipated cash flows. The formula is:\( EV=\sum _{t=1}^{∞}\frac{{FCFF_{t}}}{{(1+r)^{t}}} \)=\( {FCFF_{0}}\sum _{t=1}^{∞}\frac{\prod _{i=1}^{t}(1+{g_{i}})}{{(1+r)^{t}}} \)[9]. The weighted average cost of capital, or WACC, often known as the discount rate (r). The formula of\( WACC=\frac{({E_{t-1}}*{Ke_{t}}+{D_{t-1}}*K{d_{t}}*(1-T))}{({E_{t-1}}+{D_{t-1}})} \)is the stock market value of the business [10]. T in the calculation stands for the effective tax rate applied to interest [10].\( {E_{t-1}} \)and\( {D_{t-1}} \)values received when doing the valuation using formulas\( {E_{0}}=P{V_{0}} \),\( {D_{0}}=P{V_{0}} \)or\( {E_{0}}+{D_{0}}=P{V_{0}} \)[10]. The value of the project's remaining free cash flow that surpasses the forecasted range is its terminal value. The enterprise value of a firm is the overall market value of its shares and liabilities less the value of its liquid assets and convertible securities [6]. It determines the value of the company's current business.

In relative valuation, the worth of an asset is contrasted with the prices placed on identical or comparable assets by the market [11]. The market value per share is often divided by earnings per share to determine the price-earnings ratio. P/E ratios may be calculated in a number of ways [12]. Enterprise value, or EV, is the market capitalisation of a company less cash and cash equivalents and debt. Earnings before interest, taxes, depreciation, and amortization, or EBITDA [13].

The DCF technique relies on forward-looking data, necessitating a sizable number of forecasts for the company's and the economy's future business conditions [14]. However, the DCF technique is particularly susceptible to changes in the underlying assumptions, according to the sensitivity analysis[14]. However, relative valuation can be easier to calculate. Relative valuation could overlook variables like risk and cash flow. Hence, it is easier for a beginner to value a firm via relative valuation method.

4.2.Data Analysis: Is LVMH Stock Overvalued or Undervalued?

In this section, the relative valuation method will be used to examine the stock valuation of LVMH. The LVMH stock data and financial data were obtained from several databases and websites, and all the calculations were carried out in Excel.

The multiples that are chosen throughout the theoretical framework of relative valuation are EV/Sales, EV/EBIDTA, and P/E. Additionally, this section has added a few additional comparable companies to evaluate LVMH in Excel in order to make fair comparisons. According to peer group data, the average EV/Sales ratio is 5.96, the EV/EBIDTA ratio is 15.65, and the P/E ratio is 32.35. EV/Sales and EV/EBIDTA produce an implied LVMH enterprise value based on these multiples. The implied enterprise value of LVMH is 472134.6 in EV/Sales and 427986.31 in EV/EBIDTA. LVMH's implied share price is 184.8 and 167.18 at that point. Using these numbers, the P/E ratio first calculates the implied share price, which comes out to be 181.88, the implied equity value, which comes out to be 4555618, and the enterprise value, which comes out to be 464818.

As table 1 shown, the actual share price (713.86$) is higher than the implied share price (184.8$ and 167.18$) based on EV/Sales and EV/EBIDTA multiple, indicating that the share price of LVMH has been overpriced.

Table 1: Relative valuation of LVMH.

|

Company |

LVMH (money is in million EUR) |

||

|

Share price |

713.86 |

||

|

Shares outstanding |

2505 |

||

|

Revenue |

79184 |

||

|

EBITDA |

27343 |

||

|

Net income |

14084 |

||

|

Net debt |

9201 |

||

|

Peer groups |

EV/Sales |

EV/EBITDA |

P/E |

|

Kering |

2.86 |

8.01 |

16.2 |

|

Hermes |

13 |

28.5 |

45 |

|

Richemont |

3.51 |

13.6 |

31.9 |

|

Prada |

4.48 |

12.5 |

36.3 |

|

Mean |

5.96 |

15.65 |

32.35 |

|

Implied LVMH Enterprise Value |

472134.60 |

427986.31 |

464818.40 |

|

Net Debt |

9201 |

9201 |

9201 |

|

Implied LVMH Equity Value |

462933.60 |

418785.31 |

455617.40 |

|

Implied LVMH Share Price |

184.8 |

167.18 |

181.88 |

According to the P/E multiple, the actual share price of LVMH (713.86 dollars) is still greater than the implied share price of the company (181.88 dollars), indicating that the company's stock is overvalued.

These three techniques reveal that the suggested share prices for LVMH are relatively comparable when utilizing the three multiples, EV/Sales, EV/EBITDA, and P/E. LVMH has been overvalued because the results range from 160 to 180 dollars per share, while the real share price is 713,86 dollars. However, as was already said, relative valuation is unable to account for firm-specific information, unlike the DCF model.

5.Discussion and Further Study

This section will examine the LVMH group from three perspectives: Environment, social and governance.

Regarding the environment, LVMH has made a commitment to putting into practice sustainable growth techniques, such as lowering carbon emissions, utilizing eco-friendly products, and fostering a circular economy. These actions help to safeguard the environment while also gaining the business widespread social recognition.

Second, LVMH has also made commensurate efforts in terms of social responsibility. For instance, the business has always placed a priority on diversity and employee welfare, and it actively encourages professional growth and job happiness by offering a great workplace and treating everyone fairly. Additionally, LVMH is actively involved in initiatives that promote public welfare, and its contributions to the neighborhood have received high appreciation.

Furthermore, LVMH does quite well in terms of corporate governance. Its good governance is evident in its open decision-making process, robust internal audit procedures, and regard for shareholders' interests.

6.Conclusion

Finally, the purpose of this paper is to assess LVMH stock using comparative valuation techniques. The CEO becoming president, the Tiffany scandal, and COVID-19, with the pandemic having the biggest influence, are the events that had the biggest impact on the share price of LVMH, according to the qualitative stock analysis portion. In the quantitative analysis section, the annualized return for LVMH varies considerably during the four-year period between 2018 and 2021. The trends of the annualized return and Sharpe ratio are also similar, rising first, dropping briefly, and then rising again. Apart from 2019, when it is slightly bigger than 1, LVMH's beta is reasonably low (less than 1) throughout the sample period. Finally, relative valuation is employed, and it is discovered that while the actual share price is approximately $700, the implied share prices based on EV/Sales, EV/EBITDA, and P/E are all around 160 to 180 dollars. This indicates that LVMH has been significantly overvalued.

This project has its limits. First off, the sample period is brief, and the number of peer groups chosen is rather limited, consisting just of Kering and Richemont, so there may not be enough comparison to ensure accuracy. Second, the valuation methods utilized in this research are quite basic and straightforward, and they may have missed factors like cash flows and capital expenses, which can be incorporated in the DCF model. As DCF models could reflect more specific information about the company and the market, and special cases like COVID-19 might be more appropriately incorporated in DCF models, while relative valuation models fail to do that, more reliable data and realistic assumptions could be obtained. In addition, the paper only utilizes three multiples to value LVMH, and this may not be enough multiples, which could result in erroneous data.

The study was still important, though. In particular for non-specialists, this essay’s share price research and valuation help readers gain a better grasp of LVMH and the luxury market.

Future research related to financial valuation could combine DCF valuation, relative valuation, and more valuation models together to determine the firm value more accurately, if data is available. Moreover, the sample period of the research analysis could be longer, and the number of comparable firms would be larger to make better comparison and get a more accurate conclusion.

References

[1]. Ryan, C. (2020). Louis Vuitton's dip doesn't herald end of luxury boom. The Wall Street Journal. Retrieved March 9, 2023, from https://www.wsj.com/articles/louis-vuittons-dip-doesnt-herald-end-of-luxury-boom-11580248058

[2]. Sabanoglu, T. (2023). Value of various global luxury markets, by market type 2022. Statista. Retrieved March 9, 2023, from https://www.statista.com/statistics/246115/value-of-various-global-luxury-markets-by-market-type/

[3]. Dawkins, D. (2021). Bernard Arnault becomes world's richest person as LVMH stock rises. Forbes. Retrieved March 10, 2023, from https://www.forbes.com/sites/daviddawkins/2021/05/24/bernard-arnault-becomes-worlds-richest-person-as-lvmh-stock-rises/?sh=1bf986d82ad9

[4]. Ellyatt, H. (2019). LVMH confirms deal to acquire Tiffany for $16.2 billion. CNBC. Retrieved March 10, 2023, from https://www.cnbc.com/2019/11/25/lvmh-confirms-deal-to-acquire-tiffany-for-16-billion.html

[5]. LVMH files countersuit against Tiffany. the conditions to close the acquisition are not met. LVMH. (n.d.). https://www.lvmh.com/news-documents/press-releases/lvmh-files-countersuit-against-tiffany-the-conditions-to-close-the-acquisition-are-not-met/

[6]. Berk, J. B., & DeMarzo, P. M. (2014). In Corporate finance. essay.

[7]. Kenton, W. (2022). What is intraday return? Investopedia. Retrieved March 11, 2023, from https://www.investopedia.com/terms/i/intraday-return.asp

[8]. Abad, P. (2021). Which Assets Can Be Priced by the CAPM Formula?. Available at SSRN 3872771.

[9]. Steiger, F. (2010). The validity of company valuation using Discounted Cash Flow methods. arXiv preprint arXiv:1003.4881.

[10]. Fernandez, P. (2010). WACC: definition, misconceptions, and errors. Business Valuation Review, 29(4), 138-144.

[11]. Damodaran, A. (2002). Relative valuation. Investment Valuation.

[12]. Ghaeli, M. R. (2016). Price-to-earnings ratio: A state-of-art review. Accounting, 3(2), 131-136.

[13]. Gaining insight with the EV - chartwell capital - Chartwell Capital. Available at: http://www.chartwell-capital.hk/wp-content/uploads/2011/08/GainingInsightWithTheEV.pdf (Accessed: 27 September 2023).

[14]. Steiger, F. (2010) The validity of company valuation using discounted cash flow, Papers. Available at: https://ideas.repec.org/p/arx/papers/1003.4881.html (Accessed: 29 September 2023).

Cite this article

Zhang,X. (2024). How Has LVMH Performed Financially from 2018 to 2022: A Fundamental Financial Analysis of LVMH. Advances in Economics, Management and Political Sciences,59,306-314.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Ryan, C. (2020). Louis Vuitton's dip doesn't herald end of luxury boom. The Wall Street Journal. Retrieved March 9, 2023, from https://www.wsj.com/articles/louis-vuittons-dip-doesnt-herald-end-of-luxury-boom-11580248058

[2]. Sabanoglu, T. (2023). Value of various global luxury markets, by market type 2022. Statista. Retrieved March 9, 2023, from https://www.statista.com/statistics/246115/value-of-various-global-luxury-markets-by-market-type/

[3]. Dawkins, D. (2021). Bernard Arnault becomes world's richest person as LVMH stock rises. Forbes. Retrieved March 10, 2023, from https://www.forbes.com/sites/daviddawkins/2021/05/24/bernard-arnault-becomes-worlds-richest-person-as-lvmh-stock-rises/?sh=1bf986d82ad9

[4]. Ellyatt, H. (2019). LVMH confirms deal to acquire Tiffany for $16.2 billion. CNBC. Retrieved March 10, 2023, from https://www.cnbc.com/2019/11/25/lvmh-confirms-deal-to-acquire-tiffany-for-16-billion.html

[5]. LVMH files countersuit against Tiffany. the conditions to close the acquisition are not met. LVMH. (n.d.). https://www.lvmh.com/news-documents/press-releases/lvmh-files-countersuit-against-tiffany-the-conditions-to-close-the-acquisition-are-not-met/

[6]. Berk, J. B., & DeMarzo, P. M. (2014). In Corporate finance. essay.

[7]. Kenton, W. (2022). What is intraday return? Investopedia. Retrieved March 11, 2023, from https://www.investopedia.com/terms/i/intraday-return.asp

[8]. Abad, P. (2021). Which Assets Can Be Priced by the CAPM Formula?. Available at SSRN 3872771.

[9]. Steiger, F. (2010). The validity of company valuation using Discounted Cash Flow methods. arXiv preprint arXiv:1003.4881.

[10]. Fernandez, P. (2010). WACC: definition, misconceptions, and errors. Business Valuation Review, 29(4), 138-144.

[11]. Damodaran, A. (2002). Relative valuation. Investment Valuation.

[12]. Ghaeli, M. R. (2016). Price-to-earnings ratio: A state-of-art review. Accounting, 3(2), 131-136.

[13]. Gaining insight with the EV - chartwell capital - Chartwell Capital. Available at: http://www.chartwell-capital.hk/wp-content/uploads/2011/08/GainingInsightWithTheEV.pdf (Accessed: 27 September 2023).

[14]. Steiger, F. (2010) The validity of company valuation using discounted cash flow, Papers. Available at: https://ideas.repec.org/p/arx/papers/1003.4881.html (Accessed: 29 September 2023).