1.Introduction

Investment management has long been regarded as a cornerstone of prudent financial stewardship. The quest for optimal investment strategy remains an ongoing and complex endeavour characterised by multifaceted challenges. In 1952, the pioneering work of Markowitz invented the Portfolio Theory, a seminal contribution that garnered recognition for its effectiveness over the following decades. However, in the rapidly evolving financial landscape, the contemporary applicability of this theory warrants rigorous investigation. This research seeks to elucidate the nuanced interplay between risk and return within investment portfolios, offering insights to enhance investors' financial well-being across five critical dimensions. This paper has conducted a systematic literature review of 15 pertinent research papers to address these facets. This research encapsulates the current state of portfolio theory research and charts a course for future exploration. This study endeavours to enrich our comprehension of portfolio theory and equip decision-makers with valuable insights into many investment choices.

The subsequent sections of this paper are organised as follows: Section 2 outlines the research methodology employed, Section 3 presents the results and their subsequent analysis, and Section 4 offers concluding remarks while delineating avenues for future research and development.

2.Methodology

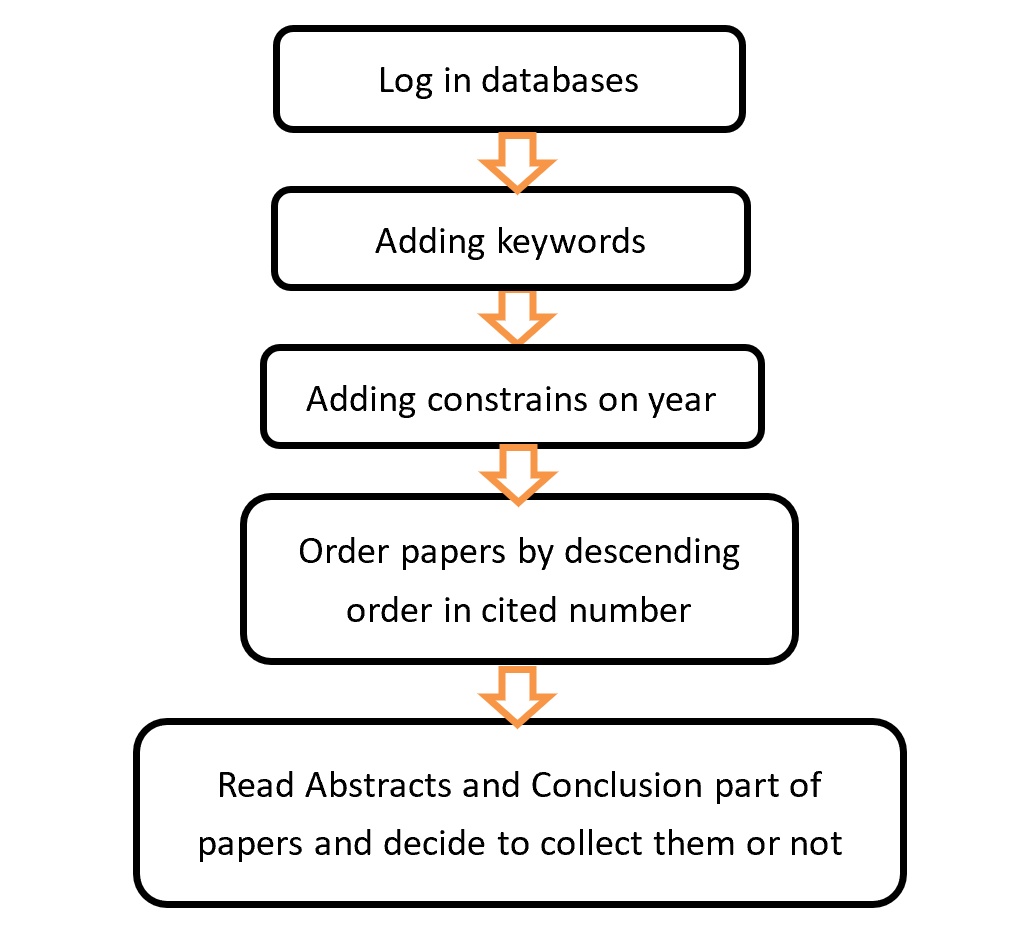

To gain insights into the current state of research, search engines have proven invaluable tools, facilitating rapid access to relevant scholarly materials. The papers included in this study were systematically sourced from reputable databases, including Scopus and CNKI (National Knowledge Infrastructure). The search process involved filtering results based on the keywords 'portfolio' and 'optimal' and then sorting them chronologically, encompassing the timeframe from 2020 to the present day. This flow chart in Figure 1 shows the process of how papers are selected.

Figure 1: The process of selecting candidate papers.

A discernible pattern emerged through meticulous examination of these papers and subsequent citation analysis, illuminating five primary dimensions through which individuals seek to enhance their investment strategies. Those five dimensions are:

1)The implementation of portfolio theory in the Chinese market. As Portfolio Theory was first invented by Markowitz [1], which is not applied in China, it is worthy for Chinese investors to research whether it is applicable.

2)The effect of investors' mentality on the risk and return of a portfolio. Not all investors hold the same risk attitude. Therefore, their portfolio choice would differ.

3)The method to improve the portfolio theory. The traditional model of Portfolio Theory is likely to be outmoded. Some further constraints or variables can be considered for improvement.

4)The financial assets could be selected to improve the portfolio performance. Portfolio Theory only concludes the way of allocating each asset's proportion. The selection of assets is also essential for maximizing investors' utility.

5)The Influence of government's policies and regulations on portfolio theory. What effect could governments impose on investors, and what policy suggestion could improve investors' portfolios?

3.Result and Analysis

3.1.Year of Publication

Table 1: Year of publication and the corresponding number of papers collected.

|

Year |

Number of papers collected |

|

2011 |

2 |

|

2012 |

1 |

|

2014 |

1 |

|

2018 |

1 |

|

2019 |

1 |

|

2020 (start of pandemic COVID-19) |

3 |

|

2021 |

2 |

|

2022 |

2 |

|

2023 |

2 |

|

Total |

15 |

Among the corpus of papers analysed (listed in Table 1), it is noteworthy that the majority, precisely nine out of all, were published after 2020. This temporal distribution indicates a heightened interest in asset management coinciding with the onset of the COVID-19 pandemic. This observation underscores the dynamic nature of financial markets and investment strategies, which responded to the unique challenges posed by the pandemic.

Furthermore, it is significant that three papers within this selection explicitly incorporated discussions on environmental factors, a subject that had yet to be as prominent in pre-2020 literature. This discernible shift suggests that the pandemic played a role in elevating awareness regarding environmental issues within the context of investment and portfolio management. This attests to the broader societal impact of the COVID-19 crisis, which extended beyond public health concerns to influence various facets of economic and financial decision-making.

3.2.Journal Analysis

Among the sources utilised in this study, it is pertinent to note that six selected papers originated from Elsevier, renowned for its high-quality academic publications. Additionally, four papers were procured from the China Academic Journal Electronic Publishing House, a reputable source of scholarly content.

3.3.Keyword Analysis

Table 2: Keywords appear in papers and their occurrence.

|

Keyword |

Occurrence |

|

Portfolio choice |

6 |

|

Optimal portfolio |

6 |

|

COVID-19 |

3 |

|

Portfolio theory |

3 |

|

Governance |

1 |

|

Skewness |

1 |

Indeed, it is evident that the prevalent occurrence of keywords such as "Portfolio choice," "Optimal portfolio," and "Portfolio theory" reflects the primary focus on portfolio-related topics within the selected papers. (Table 2) These keywords serve as pivotal touchstones for examining and enhancing portfolio management strategies. Furthermore, while keywords like "COVID-19", "governance", and "skewness" may not be directly linked to portfolio decision-making, their presence in the literature underscores their potential relevance in influencing and shaping investment strategies. These seemingly tangential keywords can provide valuable insights and avenues for improvement in portfolio decision-making by addressing broader contextual factors and statistical considerations.

The comprehensive examination of papers containing these diverse keywords offers a holistic perspective on portfolio management, allowing for a more nuanced and informed approach to investment decisions. By considering a range of factors and influences, investors and researchers can better navigate the intricate landscape of portfolio optimisation and risk management, ultimately contributing to more robust and adaptive investment strategies.

3.3.1.Analysis of Keyword: COVID-19

The COVID-19 pandemic has been shown influential in many faces by various authors. Naoyuki Yoshino et al. [2] stated that COVID-19 has shrunk the global energy demand, leading to renewable energy projects losing competitiveness. This will have an impact on allocating assets. Similarly, Aviral Kumar Tiwari et al. [3] claimed that analysing the connectedness between green bonds and renewable energy stocks is useful for identifying the direction of shock transmission. This is helpful for policymakers to formulate recovery policies, especially in times of crises like the COVID-19 pandemic.

Jie YIN and Hoi Ying Wong [4] found that the trading volume has dropped sharply since the second quarter of 2020, which is the pandemic's start. This leads to investors focusing more on corporate bonds under non-financial shocks. They conclude that the pandemic could lower the credit of corporate bonds' long-range dependent level, which could be influential in investigating how the demands of corporate bonds vary before and during particular crises.

3.4.Content Analysis

This section will provide an overview of the results obtained through the analysis conducted within the framework of the five dimensions outlined in Section 2. The analysis aims to shed light on various aspects of portfolio management and its optimisation, as explored in the selected papers.

3.4.1.The Implementation of Portfolio Theory in the Chinese Market

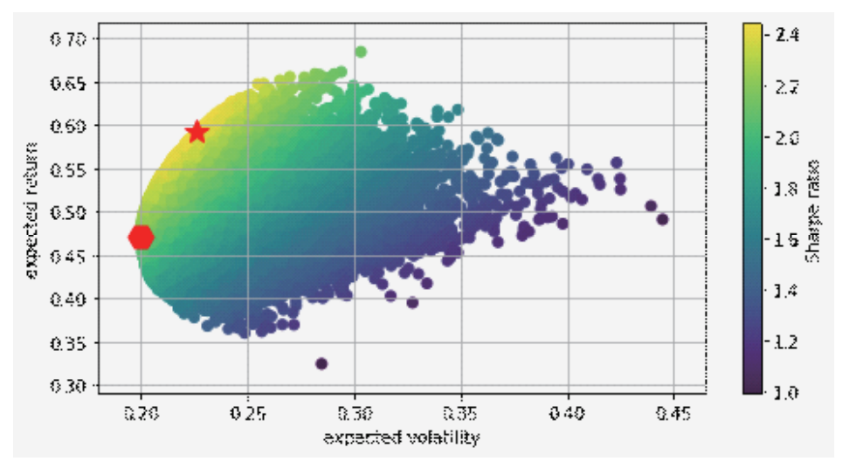

The application of Portfolio Theory, initially introduced in 1952, has been demonstrated to be a valuable tool in enhancing investment safety through the diversification of assets. Libo Sun [5] conducted a noteworthy application of Portfolio Theory within the context of the Chinese Stock Market. Her study involved the selection of 20 Chinese stocks representing diverse business sectors and the computation of their annualised returns. By assessing and contrasting these stocks' correlation and return rates, the analysis narrowed the selection to five specific stocks, accompanied by their respective covariance and correlation matrices.

Libo Sun [5] employed Monte Carlo Simulation, generating 50,000 random combinations of these selected stocks. This simulation yielded a thermodynamic diagram (Figure 2), where the x-axis depicted expected volatility, and the y-axis represented expected return. Intriguingly, this diagram is closely aligned with the principles of Portfolio Theory, as elucidated by Markowitz, which espouses a mean-variance model and delineates the concept of an efficient frontier. Within this graph, two red points emerged as the most compelling portfolios. The hexagon point signified the portfolio with the lowest level of risk, while the star point represented an optimal choice for investors seeking to maximise additional returns while accepting an incrementally higher level of risk. Consequently, Libo Sun [5] concluded that Portfolio Theory remains a pertinent and practical framework for constructing investment portfolios in the dynamic and evolving landscape of the Chinese Stock Market. This empirical demonstration reinforces the enduring relevance and applicability of Portfolio Theory as a valuable asset management strategy.

Figure 2: Visualisation of optimal portfolio.

In alignment with Libo Sun's viewpoint, Jianxiang Zhao [6] acknowledges the merits of portfolio diversification in mitigating non-systematic risk. However, Zhao highlights the predominance of systematic risk in the Chinese stock market's overall risk profile. Consequently, Zhao suggests that Chinese investors should cultivate a keen awareness of risk and tailor their asset allocation strategies in alignment with their individual risk preferences to optimise utility.

On the other hand, LI Jin-xin et al. [7] conducted an empirical study involving ten portfolio construction strategies, which cast doubt on the utility of the mean-variance model. Their findings suggest that this model's performance could be improved by its inability to account for parameter uncertainty. Importantly, they noted that, from a statistical perspective, none of the tested strategies outperformed a straightforward diversification approach. Consequently, they propose adopting simple diversification as a benchmark for evaluating the effectiveness of new asset allocation models.

The divergence in conclusions among these authors may be attributed, in part, to differences in data sources and timeframes under consideration. Nevertheless, a noteworthy observation is the apparent improvement in the efficiency of Markowitz's mean-variance model over time, which indirectly indicates a convergence between the Chinese stock market and the market conditions analysed by Markowitz. This evolution underscores the dynamic nature of financial markets and the ongoing quest for effective investment strategies tailored to specific contexts.

3.4.2.The Effect of Investors' Mentality on the Risk and Return of a Portfolio

Guowei Jiang [8] recognised that traditional Portfolio Theory only considers risk from the financial market. However, investors also have to face risk from what he called background. He states that although variance of returns is a standardised method to measure risk, this could not be intuitive for investors because the return is unknown. When the return is higher than his expected or the benchmark return, a higher variance may be tolerable and vice versa. Huang [9] defined the risk index to measure average loss to let investors realise more clearly. Guowei Jiang let the letter 'C' represent investors' tolerance level when the return is below the benchmark. So, he only considered portfolios that satisfied risk index lower than 'C'.

To test the Influence of risk preference on portfolio choice decisions, Guowei Jiang chose ten securities to simulate, and the results listed in Table 3 were obtained by changing the tolerance level to 'C'. Figure 3 shows the trend of expected return changed with tolerance level. The curve before reaching the climax illustrates a result identical to the viewpoint: the more risk is taken, the more return gains. When the tolerance level exceeds a specific region, the return on the portfolio will not vary and will not gain more than the return on given securities.

So, Guowei Jiang concludes that investors' tolerance level for risk and the returns of the bonds chosen affect the portfolio's best-expected return.

Table 3: Optimal portfolio under different tolerance levels.

|

C |

Expected return |

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

β1 |

|

1.5 |

4.35 |

0 |

92.71 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

7.29 |

30.64 |

|

2 |

4.54 |

0 |

65.64 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

34.36 |

32.99 |

|

2.5 |

4.73 |

0 |

39.04 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

60.96 |

34.65 |

|

3 |

4.91 |

0 |

12.74 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

87.26 |

35.90 |

|

3.5 |

5 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

100 |

36.40 |

|

4 |

5 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

100 |

36.40 |

Figure 3: Visualisation of Optimal expected return under different tolerance levels.

Zhao Jianxiang [6] cite a utility function (\( U = E(r) – \frac{1}{2} × A × {σ^{2}} \)) commonly used in finance to show how attractive the portfolio is for investors.

U is utility. E(r) is the portfolio's return rate.\( \frac{1}{2} \)is usage establish a coefficient. A is the risk-averse coefficient.\( {σ^{2}} \)is portfolio's variance.

From this function, we could know that the larger the risk-averse coefficient or the portfolio's variance is, the less utility is. Generally, investors are considered risk-averse people. So, for them, the risk-averse coefficient 'A' has a positive sign, and the higher its value, the more risk-free asset investors will choose in their portfolio. By fixing risk-averse coefficients 2, 3 and utility 0.05, 0.10, the expected return can be obtained by varying the standard deviation from 0 to 0.6. Table 8 is the graph drawn based on the assumption and value given before.

Figure 4: The indifference curves of different investors at different levels of utility.

It is clear that indifference curves (in Figure 4) have the same shape when investors have the same risk-averse level, and the higher the risk-averse level is, the steeper slope the indifference curves have. So, for a turbulent market (high variance of portfolio return), the more risk-averse investors are, the more expected return they expect to gain to obtain the same utility.

Maarten van Rooij et al. [10] use the DNB (De Nederlandsche Bank) Household Survey to measure locals' financial literacy and find its relationship with participation in the stock market. They conclude that lack of financial knowledge leads to fear of taking part in investments. In addition, unsophisticated investors are more likely to make unwise investments. Therefore, popularising financial knowledge is an efficient solution to remove the fear of investors participating in investments or making unsensible portfolios.

3.4.3.The Method to Improve the Portfolio Theory

Lasse Heje Pedersen et al. [11] propose an ESG (environmental, social, and governance) score for each stock to evaluate their firms' fundamentals and Influence on investors' preferences. They calculate the carbon intensity, defined as the ratio of carbon emissions in thousands of tons over sales in millions of dollars, of the company to measure the Environmental part; use a non-sin stock indicator to measure the social part; and look at each firm's accruals over assets to measure Governance part. By considering ESG scores, they found how to quantify the ESG preferences of investors. The more investors value ESG characteristics, the less return they could gain from the portfolio. Although the level of reduction is not that significant, this still suggests how to balance a high ESG score stock and a high Sharpe ratio portfolio.

Zhou Xiaoyu [12] proposed a novel way to improve portfolio, which is to add skewness into consideration to make portfolio. He found that the return rate of the Chinese securities market has negative skewness instead of being evenly distributed. In addition, investors' attitudes toward huge losses and gains differ. So, Zhou Xiaoyu structured a mean-variance-skewness model to make a portfolio and concluded that including skewness is necessary for investors to measure extreme risk better. He also suggested that the government strengthen daily supervision and institutional development as the Chinese stock market could hardly reach the efficiency the model requested.

3.4.4.The Financial Assets Could Be Selected to Improve the Portfolio Performance

Adding some special assets into the portfolio could get improvement either by lower risk or by higher return rate. Guowei Jiang [8] chose to add risk-free assets into the portfolio to adjust the risky assets' proportion to lower the total risk taken. When discussing whether green bonds should be added to the portfolio to reduce risk or not, Aviral Kumar et al. [3], in their research, found this is not that significant. However, when creating bilateral portfolios, green bonds significantly reduce the investment risk of other assets.

Alex Edmans [13] found a contradiction between people's predictions about whether employee satisfaction could benefit the valuation of corporations or not. As an intangible asset, he discovered satisfaction is hard to value due to its invisibility and is seldom used in previous studies. Therefore, after investigation, he concluded that companies are more likely to produce extraordinary returns when their staff feel satisfied.

The new type of currency, such as bitcoin, is also worth discussion for its inclusion in the portfolio. Akhtaruzzaman Md; Sensoy, Ahmet; Corbet, Shaen [14] discovered that bitcoin is relatively less correlated with other bonds. This enables Bitcoin to hedge the portfolio's risk. So, by adding Bitcoin to the global industry portfolio and PIMCO to test the portfolio's performance, they verify that Bitcoin investments efficiently hedge a wide range of industrial sectors and bonds.

3.4.5.The Influence of Government's Policies and Regulations on Portfolio Theory

The contributions of Aviral Kumar Tiwari, Emmanuel Joel Aikins Abakah et al. [3] and Naoyuki Yoshino et al. [2] offer valuable insights into the role of government policies in promoting sustainability and addressing environmental concerns, particularly in the context of financial markets.

Aviral Kumar Tiwari and colleagues [3] emphasise the importance of government policies in supporting renewable energy sources, such as providing subsidies. They highlight the direct impact of these policies on the pricing of green bonds, which the performance of renewable energy stocks can significantly influence. Their research underscores the need for policymakers to consider the interconnectedness of these elements when crafting policy frameworks. By encouraging the growth of renewable energy and sustainable investments, governments can play a pivotal role in fostering environmentally responsible financial markets.

In contrast, Naoyuki Yoshino, Farhad Taghizadeh-Hesary, and Miyu Otsuka [2] address the evolving dynamics of public interest in sustainable projects in the wake of the COVID-19 pandemic. Their theoretical illustration suggests that people's focus on sustainability may have diminished in the post-pandemic era. To counter this trend and incentivise sustainable practices, they propose a policy approach that involves taxing pollution and providing subsidies to green companies. This approach aims to align economic incentives with environmental goals, fostering a more sustainable and resilient economy.

4.Conclusion

This paper explores the current state of research and future trends in portfolio theory through a systematic literature review. Upon reviewing the selected papers, it becomes evident that the importance of money management and portfolios surged with the onset of the COVID-19 pandemic, leading to shifts in investor preferences and behaviour. While researchers have found portfolio theory increasingly applicable to the Chinese stock market over time, several areas for enhancement persist. These include considerations of investors' risk attitudes, ESG preferences, skewness, specialised asset selection, and the Influence of government policies. Notably, the Chinese stock market is perceived as immature and incomplete, characterised by asymmetries that reduce the efficiency of portfolio theory. One proposed remedy involves government mandates that companies maintain transparency regarding their cash flows and decision-making processes.

References

[1]. Markowitz H (1952). Portfolio Selection[J] . The Journal of Finance

[2]. Yoshino, N., Taghizadeh-Hesary, F., & Otsuka, M. (2021). Covid-19 and optimal portfolio selection for investment in sustainable development goals. Finance research letters, 38, 101695.

[3]. Tiwari, A. K., Abakah, E. J. A., Gabauer, D., & Dwumfour, R. A. (2022). Dynamic spillover effects among green bond, renewable energy stocks and carbon markets during COVID-19 pandemic: Implications for hedging and investments strategies. Global Finance Journal, 51, 100692.

[4]. Yin, J., & Wong, H. Y. (2023). Bond portfolio optimisation with long-range dependent credits. Journal of Industrial and Management Optimization, 19(10), 7090-7104.

[5]. Libo, S. (2020). An Empirical Study of Markowitz's Portfolio Theory Based on Python [J]. Times Finance, 25(3).

[6]. Jianxiang Zhao (2018). Research on Portfolio Optimization and Application based on risk attitude https://kns.cnki.net/KCMS/detail/detail.aspx?dbname=CMFD202102&filename=1019812692.nh

[7]. Jinxin Li, Wei Tu, Zhiguo Wang, Hengfu Zou (2014). Is the Optimal asset Allocation Model Applicable to the Chinese Stock Market. Modern Economic Science (02),52-61+126.

[8]. Guowei Jiang (2022). Portfolio selection model and decision making under background risk based on uncertainty theory . https://kns.cnki.net/KCMS/detail/detail.aspx?dbname=CDFDLAST2022&filename=1022015117.nh

[9]. Huang, X. (2012). A risk index model for portfolio selection with returns subject to experts' estimations. Fuzzy Optimisation and Decision Making, 11, 451-463.

[10]. Van Rooij, M., Lusardi, A., & Alessie, R. (2011). Financial literacy and stock market participation. Journal of Financial economics, 101(2), 449-472.

[11]. Pedersen, L. H., Fitzgibbons, S., & Pomorski, L. (2021). Responsible investing: The ESG-efficient frontier. Journal of Financial Economics, 142(2), 572-597.

[12]. Xiaoyu Zhou.(2022). Research on effectiveness of Portfolio Theory under skewness constraints in securities markets. https://kns.cnki.net/KCMS/detail/detail.aspx?dbname=CMFDTEMP&filename=1022800616.nh

[13]. Edmans, A. (2011). Does the stock market fully value intangibles? Employee satisfaction and equity prices. Journal of Financial economics, 101(3), 621-640.

[14]. Akhtaruzzaman, M., Sensoy, A., & Corbet, S. (2020). The Influence of Bitcoin on portfolio diversification and design. Finance Research Letters, 37, 101344.

Cite this article

Wang,X. (2024). Portfolio Theory Application and Enhancement in the Chinese Stock Market. Advances in Economics, Management and Political Sciences,60,37-45.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Markowitz H (1952). Portfolio Selection[J] . The Journal of Finance

[2]. Yoshino, N., Taghizadeh-Hesary, F., & Otsuka, M. (2021). Covid-19 and optimal portfolio selection for investment in sustainable development goals. Finance research letters, 38, 101695.

[3]. Tiwari, A. K., Abakah, E. J. A., Gabauer, D., & Dwumfour, R. A. (2022). Dynamic spillover effects among green bond, renewable energy stocks and carbon markets during COVID-19 pandemic: Implications for hedging and investments strategies. Global Finance Journal, 51, 100692.

[4]. Yin, J., & Wong, H. Y. (2023). Bond portfolio optimisation with long-range dependent credits. Journal of Industrial and Management Optimization, 19(10), 7090-7104.

[5]. Libo, S. (2020). An Empirical Study of Markowitz's Portfolio Theory Based on Python [J]. Times Finance, 25(3).

[6]. Jianxiang Zhao (2018). Research on Portfolio Optimization and Application based on risk attitude https://kns.cnki.net/KCMS/detail/detail.aspx?dbname=CMFD202102&filename=1019812692.nh

[7]. Jinxin Li, Wei Tu, Zhiguo Wang, Hengfu Zou (2014). Is the Optimal asset Allocation Model Applicable to the Chinese Stock Market. Modern Economic Science (02),52-61+126.

[8]. Guowei Jiang (2022). Portfolio selection model and decision making under background risk based on uncertainty theory . https://kns.cnki.net/KCMS/detail/detail.aspx?dbname=CDFDLAST2022&filename=1022015117.nh

[9]. Huang, X. (2012). A risk index model for portfolio selection with returns subject to experts' estimations. Fuzzy Optimisation and Decision Making, 11, 451-463.

[10]. Van Rooij, M., Lusardi, A., & Alessie, R. (2011). Financial literacy and stock market participation. Journal of Financial economics, 101(2), 449-472.

[11]. Pedersen, L. H., Fitzgibbons, S., & Pomorski, L. (2021). Responsible investing: The ESG-efficient frontier. Journal of Financial Economics, 142(2), 572-597.

[12]. Xiaoyu Zhou.(2022). Research on effectiveness of Portfolio Theory under skewness constraints in securities markets. https://kns.cnki.net/KCMS/detail/detail.aspx?dbname=CMFDTEMP&filename=1022800616.nh

[13]. Edmans, A. (2011). Does the stock market fully value intangibles? Employee satisfaction and equity prices. Journal of Financial economics, 101(3), 621-640.

[14]. Akhtaruzzaman, M., Sensoy, A., & Corbet, S. (2020). The Influence of Bitcoin on portfolio diversification and design. Finance Research Letters, 37, 101344.