1. Introduction

Nowadays, global environmental protection and new energy development are becoming increasingly important, so many companies are trying to use new energy to make human life better. For example, Tesla, the largest electric vehicle manufacturing company today.

Tesla Corporation, established in 2003 by Elon Musk, JB Straubel, and Martin Eberhard, is a trailblazer in the field of electric vehicles and sustainable energy solutions. The company is committed to expediting the global shift towards sustainable energy sources. Tesla is renowned for its innovative electric cars, energy storage solutions, and solar energy products. It serves as a prominent symbol of the rapid expansion of the electric vehicle industry. Remarkably, Tesla achieved a milestone in 2022 with global vehicle deliveries reaching an impressive 1.31 million units, highlighting robust growth despite challenges posed by the global automotive semiconductor shortage.

In this research, use the SWOT method to analyze Tesla Company. Identifying Tesla's strengths, weaknesses, opportunities, and threats. Assessing its competitive advantages and areas for improvement. This research aims to help people better understand the importance of sustainable resource development and objectively analyze Tesla's existing strengths and challenges.

2. Strengths

Strengths within a company encompass its core competencies, expertise, and the inherent advantages that set the organization apart. Firstly, Tesla has a strong brand awareness and a leading position in the field of electric vehicle (EV) technology. In 2022, Tesla delivered over 1,313,581 electric vehicles, solidifying its position as a dominant player in the EV market [1]. By doing so, Tesla's market capitalization surpassed that of traditional automakers, making it one of the most valuable automotive companies globally. This was indicative of investor confidence in Tesla's EV leadership. Tesla differentiated themselves from their competitors. Secondly, Tesla's competitors are traditional gasoline car companies, their consumers often must accept the disadvantages of expensive gasoline and environmental protection in exchange for comfort. However, Tesla cars not only surpass gasoline cars in terms of comfort, but also achieve lower use costs and environmental protection, so they are widely loved by consumers. In another hand, Tesla's sales method has certain advantages, because Tesla does not use dealer sales methods like traditional gasoline vehicles but uses a direct-operated store method like Apple Company for sales, although direct-operated stores are more efficient than using direct-operated stores. Dealers incur higher costs, but direct-operated stores allow the company to communicate directly with consumers efficiently, gain a more direct understanding of front-line sales, and make it easier to collect consumer information. This is Tesla's huge advantage in marketing. According to Tesla's 2022 impact report, their customers avoided releasing about 13.4 million metric tons of CO2e into our atmosphere. A single Tesla vehicle avoids 55 tons of CO2e over its life. This aspect fully reflects the outstanding contribution and advantages of Tesla electric vehicles in environmental protection [1]. Tesla is currently the world's best electric car. Tesla has a commanding lead in the hottest electric car statistics. Tesla is a huge innovative company Tesla has a very high innovation rate. For example, Tesla’s new product cybertrack. According to an analysis by Sandy Munro in a YouTube video, “Tesla's Cybertruck has a huge advantage over Ford and GM as it weighs less, has faster charging, costs less to make, and with the potential to sell in large numbers, it could steal hundreds of thousands of sales away from its competitors.” In addition, he also predicted that in the future In four years, the Cybertruck could become the top-selling pickup truck in the US, leaving Ford and GM in shock [2]. Additionally,V. J. Thomas also stated in his academic journal:“esla Motors' successful entry into the notoriously entrenched automotive industry, repeated successful product launches, growth to a market capitalization of over US$50 billion, and redefinition of the electric vehicle market is inspiring to many.”[3]

3. Weakness

Weaknesses are the weakest points of an enterprise. These weaknesses often lead to a decline in the influence of the enterprise. Therefore, the company should adjust the weak points in a timely manner to make the enterprise more successful. Tesla, like any company, has its weaknesses and challenges. Here are some of the weaknesses associated with Tesla. The first factor is production challenges, and Tesla has had trouble hitting production targets in the past. Scaling production to meet high demand can be a challenge, leading to delays in vehicle deliveries, especially in the North American market where this problem is particularly acute, leading to some delays in Model Y deliveries. In addition, the most important one for Tesla is the supply chain. For example, humanity is experiencing the COVID-19 pandemic, which has caused disruptions to the global supply chain and led to the paralysis of the semiconductor supply chain. These supply chain-related factors will seriously affect the specific Tesla’s production capacity. Reliance on global supply chains can leave companies vulnerable to disruptions. According to Insider, Musk said new gigafactories in Austin and Berlin are “losing billions of dollars” as operating expenses accrue and production stalls due to EV battery parts stuck at a port in China. Tesla is not the only electric vehicle company affected by the epidemic, it, like other electric vehicle companies, is deeply affected by the supply chain. For example, EV company Rivian and Ford have also expressed supply chain pain [4]. The problems caused by COVID-19 port closures are only temporary, but battery raw material shortages will continue to plague the industry. The average cost of key minerals used in batteries, such as cobalt, nickel and lithium, is about $8,255 per vehicle, a 140% increase from the cost of $3,381 in March 2020, according to Insider [5]. The cost of these raw materials is now 125% higher than that of gasoline vehicles. For this problem, business analyst Jacob Bourne gave effective solutions. Firstly, the raw material problem is not inevitable, but given the limited supply of minerals and geopolitical challenges, if no action is taken, the situation may get worse. Secondly, he suggested that doubling down on battery recycling would reduce the need for mineral exploration and mining. Developing new battery technologies that don't use the most expensive minerals will help make electric vehicles more affordable.

4. Opportunities

Opportunities are crucial to any enterprise, and they are an important factor in the development and expansion of enterprises. Autonomous driving technology is a huge breakthrough opportunity for Tesla and a core component of the company's strategy. Autopilot and Autopilot: Tesla has developed two autopilot features, namely "Autopilot" and "Full Self-Driving (FSD)". Autopilot is an advanced driving assistance system. It can achieve automatic driving under certain conditions, but it requires driver supervision. In emergencies, the driver needs to control the road surface and accelerator and brake. FSD is Tesla's higher-level automatic driving system, designed to achieve fully automatic driving, including Autonomous driving in cities and highways. Tesla has a differentiated competitive advantage in autonomous driving because Tesla has made significant progress in autonomous driving technology in recent years, which makes them a leading player in the electric vehicle market. It has differentiated competitive advantages and is far ahead of other electric vehicle companies. Tesla's vehicles are equipped with sensors, cameras and powerful chip computing capabilities to realize autonomous driving functions. Tesla can maintain its advantage in the future by continuing to upgrade software and fix bugs, which means Tesla owners can get more advanced self-driving features over time without having to buy a new car. Beyond that, Tesla has a huge sales opportunity. For example, in North America, almost every city has government subsidies for the purchase of Tesla electric cars. For example, in Canada Vancouver you could get 7500$ tax back. Today, as gasoline prices get higher and higher, this will make more people interested in Tesla, attracting more sales and profits. Tesla still has big opportunities on the product front, according to Mark Matousek research, almost every single one of the 5,000 Tesla Model 3 owners surveyed by Bloomberg said they would buy the car again [5]. More evidence, according to an update from Tesla, about 373,000 people want to buy the Model 3” [6]

5. Threats

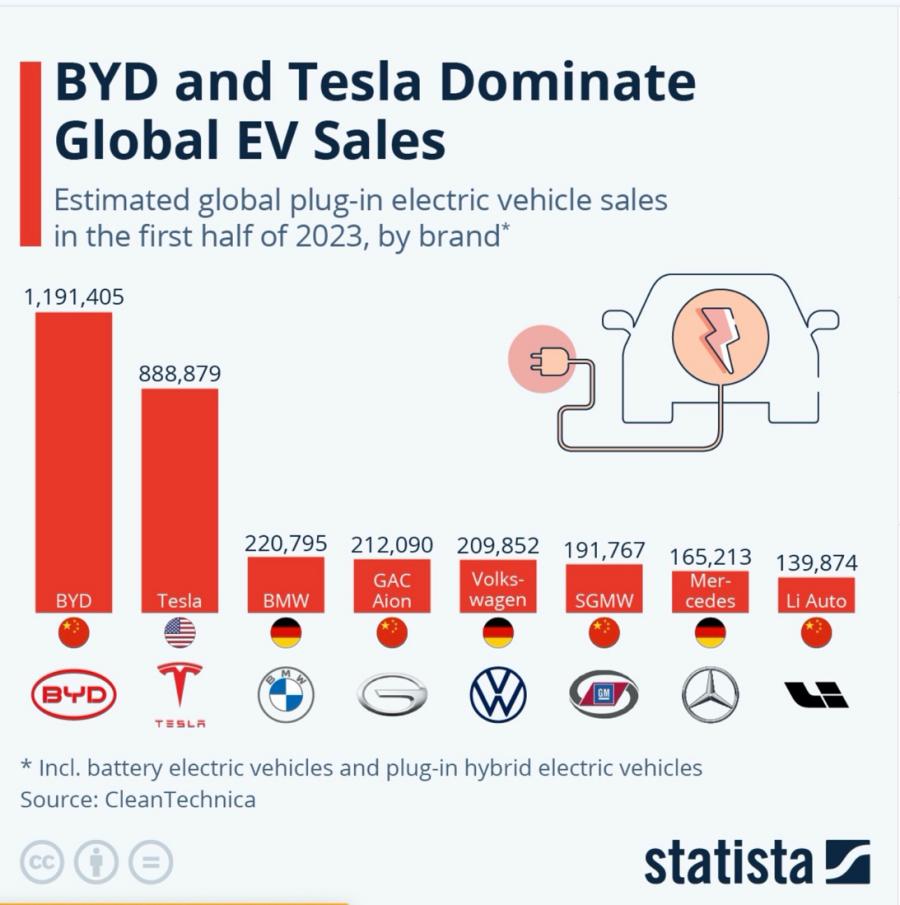

Threats refer to serious problems and tests caused by external factors such as market competition. A major threat to Tesla is competition from established luxury gasoline vehicles and emerging electric vehicle brands. This problem will become more severe, for example, when new electric car companies launch cheaper or more advanced electric vehicles. Since Tesla's current models are expensive compared to other electric car companies, they currently face threats from China's BYD. According to statistics provided by Tesla, BYD ranked second and became a rival to Tesla. BYD produced 900,000 electric vehicles in 2022 last year. Although BYD's output does not exceed Tesla's, the price of BYD's best-selling model in Asia is lower than Tesla's Model 3 model. Tesla has an advantage in terms of production volume, but it does not have an advantage in terms of price in the Asian market. Therefore, Tesla had to once again adjust their pricing strategy. Although Tesla's sales continued to rise, the profit of the Model 3 model was still very low. This is undoubtedly a potential threat when facing lower-priced competitors. Additionally, external risks include Tesla's production, as Tesla relies on the global supply chain, including batteries, semiconductors and other key components. Supply chain issues, raw material price increases or supply disruptions could negatively impact Tesla's production and deliveries. Beyond that, self-driving cars remain a concern for pedestrians, with U.S. experts still feeling unsafe walking around self-driving cars, according to a YouGov survey. People over the age of 55 are most fearful of being exposed to self-driving cars. According to report that at the latest 2023 Munich International Motor Show (IAA Mobility 2023), some leading global car manufacturers are once again focusing on the future of electric mobility. However, while legacy German car brands such as Volkswagen, Mercedes and BMW try to make an impression in their home market, they have recently lagged in the transition to electric vehicles as they continue to develop traditional internal combustion engine vehicles. In contrast, smaller, more specialized companies like Tesla and Chinese market leader BYD are at the forefront. According to Figure 1, BYD alone will sell nearly 1.2 million plug-in electric vehicles (including plug-in hybrids) by 2023, nearly twice the combined sales of BMW, Volkswagen and Mercedes. Yes, the company that recently overtook China to become the country's No. 1 car brand now has VW Europe as its target, showing off six new models for the European market in Munich on Monday. The company has sold 92,469 electric vehicles overseas, exceeding the total sales in 2022.

Figure 1: BYD and Tesla Dominate Global EV Sale.

6. Conclusion

Tesla enjoys a global leadership position in electric vehicles and sustainable energy, which is a significant advantage. However, in order to remain successful, it is critical to improve its semiconductor supply chain management. As the industry evolves, Tesla's innovation and foresight will play a key role in achieving its mission of advancing sustainable energy. Tesla continues to invest in research and development to address these challenges and maintain its leadership position in the industry.

References

[1]. Tesla official report, (2020), 2022-Tesla-impact-Report-highlight, https://www.tesla.com/ns_videos/2022-tesla-impact-report-highlights.pdf

[2]. Thomas, V. J., & Maine, E. (2019). Market entry strategies for electric vehicle start-ups in the automotive industry–Lessons from Tesla Motors. Journal of Cleaner Production, 235, 653-663.

[3]. Derval, D. (2022). The right sensory mix: Decoding customers’ behavior and preferences. Springer Nature.

[4]. Vance, A. (2015). Elon Musk: How the billionaire CEO of SpaceX and Tesla is shaping our future. Random House.

[5]. Lindholm, E., Nickolls, J., Oberman, S., & Montrym, J. (2008). NVIDIA Tesla: A unified graphics and computing architecture. IEEE micro, 28(2), 39-55.

[6]. Danielis, R., Rotaris, L., Giansoldati, M., & Scorrano, M. (2020). Drivers’ preferences for electric cars in Italy. Evidence from a country with limited but growing electric car uptake. Transportation Research Part A: Policy and Practice, 137, 79-94.

Cite this article

Xin,M. (2023). Research on the Tesla’s Strengths and Weakness. Advances in Economics, Management and Political Sciences,63,185-189.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Tesla official report, (2020), 2022-Tesla-impact-Report-highlight, https://www.tesla.com/ns_videos/2022-tesla-impact-report-highlights.pdf

[2]. Thomas, V. J., & Maine, E. (2019). Market entry strategies for electric vehicle start-ups in the automotive industry–Lessons from Tesla Motors. Journal of Cleaner Production, 235, 653-663.

[3]. Derval, D. (2022). The right sensory mix: Decoding customers’ behavior and preferences. Springer Nature.

[4]. Vance, A. (2015). Elon Musk: How the billionaire CEO of SpaceX and Tesla is shaping our future. Random House.

[5]. Lindholm, E., Nickolls, J., Oberman, S., & Montrym, J. (2008). NVIDIA Tesla: A unified graphics and computing architecture. IEEE micro, 28(2), 39-55.

[6]. Danielis, R., Rotaris, L., Giansoldati, M., & Scorrano, M. (2020). Drivers’ preferences for electric cars in Italy. Evidence from a country with limited but growing electric car uptake. Transportation Research Part A: Policy and Practice, 137, 79-94.