1. Introduction

With the rapid development of digital technology in recent years, how to strengthen the integration and development of digitalization and the real economy has become an important issue in promoting China's economic development at present. From a micro perspective, enterprises carry important functions for the development and transformation of the digital economy [1, 2], therefore, with the advent of the digital economy, accelerating the digital transformation of enterprises has become a major task in the development of the digital economy [3, 4]. More and more companies are embarking on the path of digital transformation, but the results are not very promising, with only 11% of enterprises in China achieving significant results in digital transformation [5].

As the largest manufacturing country, China has the advantage of a huge manufacturing market and product demand, but there are also many loopholes such as low productivity and energy utilization, lack of innovation, and lack of optimization of the industrial structure [6]. Therefore, in order to enhance the independent innovation ability of China's manufacturing industry, improve the industrial structure, optimize the quality and level of the existing manufacturing industry, and enhance the competitiveness of the brand, the digital transformation of the manufacturing enterprises can not be delayed.

At present, the IoT model, as the foundation of intelligent interconnection and a new path for enterprise digital transformation [7], is a basic infrastructure that uses perception technology and network communication technology as the main means to realize ubiquitous connectivity between people, machines, and things, providing services such as information sensing, information transmission, and information processing [8]. So there is less research in China and other countries on how enterprises make money in this model and how they digitally transform related aspects of the enterprise.

At the same time, enterprise digital transformation is a process in which enterprises use digital technology to reshape the company's strategic thinking, organizational structure, business processes and business models, and establish a data-centric value creation system [9].This method can optimize the company's capital structure decisions by reducing the company's debt financing costs and agency costs, thus reducing the company's capital structure adjustment costs, and thus enhancing the management's motivation in making financial decisions and accelerating the pace of capital structure adjustment when aiming to maximize value [10].

Therefore, it will provide new ideas for more manufacturing enterprises to transform by studying the digital transformation of enterprises in the mode of IoT.

2. Research on Digital Transformation of Haier Based on the IoT Model

2.1. Overview of Haier

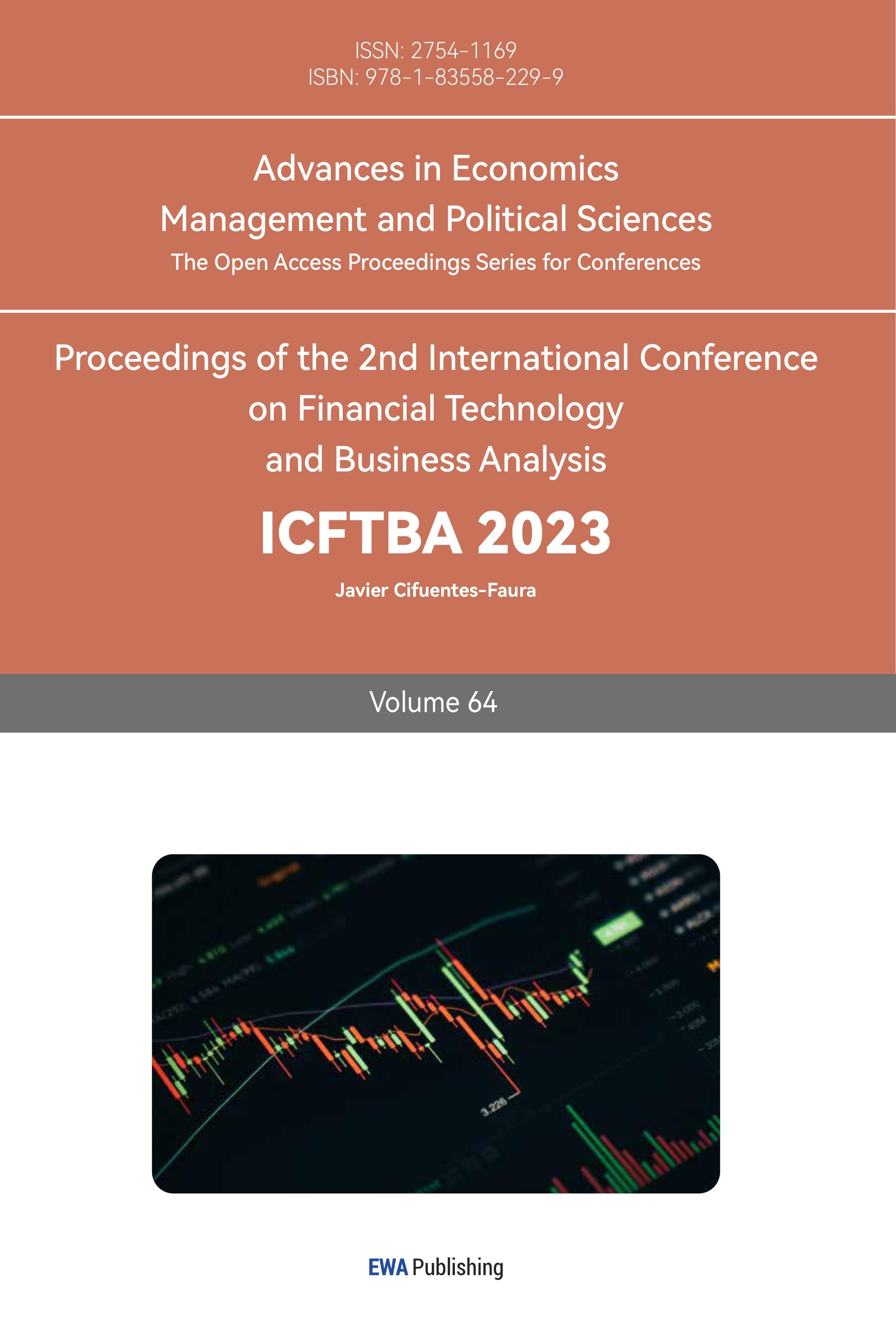

Since its founding in 1984, the Haier Group has now become the market leader in white goods. After 39 years of development, the political, economic and technological environment in which Haier operates has undergone many changes. In order to resonate with the times, the strategic themes of each stage of Haier are closely related to the theme of the times, and from the very beginning of the development of the brand-name strategy to the present, its different stages of the strategy is shown in Figure 1. Haier presented its latest eco-branding strategy in December 2019, aiming to respond to the wave of digitization and lead the IoT eco-brand.

Figure 1: Evolution of Haier's development strategy (source: Haier's official website).

2.2. Haier and the IoT

2.2.1. Intelligence of Products

In terms of products, Haier has upgraded two main aspects of users' experience in order to meet the growing needs of users' living needs in the era of the IoT: on the one hand, Haier relies on the "Smart Home Brain" platform to create a more convenient and natural interaction experience for users through intelligent voice, intelligent vision and other interaction methods. On the other hand, Haier senses changes in the surrounding environment through sensors or big data functions, realizing the upgrade from passive response to active judgment and providing personalized services for users.

In terms of specific product applications, Casadei, a brand under Haier, released both an IoT dual-screen refrigerator and the world's first active service smart home core technology in 2019. The family health management platform released by Haier is based on big data, AI and other technologies, and builds a healthy food ecosystem based on the Internet of Things. It customizes nutritional meal plans for users, conducts smart health management for the whole family, and creates a one-stop food solution for users. While bringing high-quality smart life to users, it also initiates the creation of an Internet of Things ecological brand.

In 2020, Haier released a new scenario brand called Three-Winged Bird, which integrates home appliances, home decoration, home furnishings, and home life. As a one-stop customized smart home platform, Three-Winged Bird starts from user needs and is no longer limited to a single brand model. Instead, it efficiently aggregates and collaborates with resources from various fields on the same platform, using scenarios as a "fusion agent", perfectly solving the problem of the rapid development of IoT application forms but different frequency in electrical appliances, transforming the self-fragmented past into a smart solution that blends food, clothing, housing, and entertainment with people [11].

According to the annual performance released by the Three-Winged Bird Store, the transaction volumes of the two stores in Beijing and Shanghai in 2021 were 183 million yuan and 228 million yuan respectively. Among them, the proportion of scenes and ecology is 58% and 71.8%, respectively, with a total proportion of over 60%, and their revenue proportion is higher than that of household appliances. The revenue generated one year after its release fully demonstrates users' recognition of the Three Winged Bird scene brand and Haier Smart Home's use of smart home core technology.

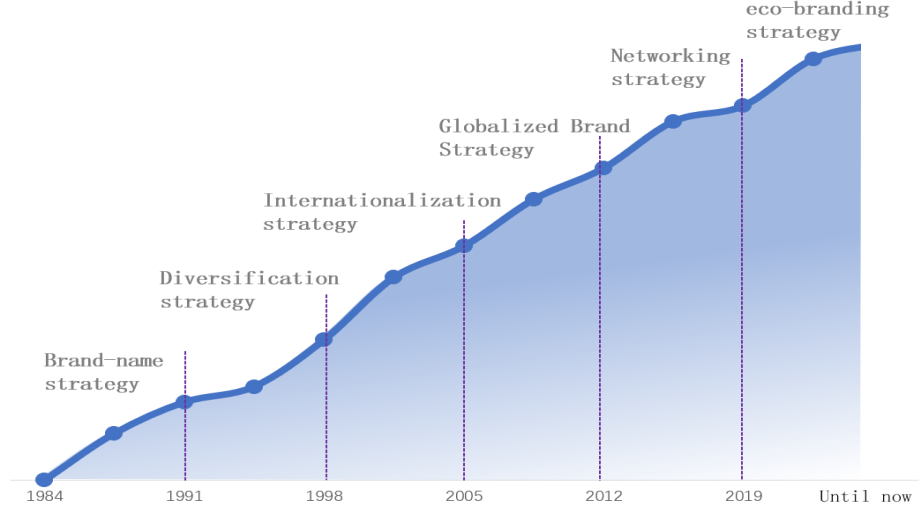

In addition, as shown in Figure 2, with the creation of the IoT ecological brand and the application of big data, AI technology, and smart home core technology, Haier Group's attributable net profit has steadily increased year by year, and its annual growth rate of attributable profit has rapidly increased since 2020. This also demonstrates users' recognition of the intelligent products and their product concepts under the Haier IoT model.

Figure 2: Haier group's attributable net income statement from 2018 to 2022 (source: Haier's official website).

2.2.2. Financial Intelligence

Currently, Haier is transitioning from digital finance to IoT finance. The biggest characteristic of Haier Group's IoT finance is decentralization. Unlike traditional financial management, which focuses on financial personnel or departments to handle the company's business, IoT finance will transform finance into a series of capabilities and integrate these capabilities into a product or scenario into business processes, in order to achieve development from productization to platformization, from regionalization to globalization, and from informatization to intelligence [12].

The core management model of Haier in the era of the IoT is to combine employee value with user value. While creating value for users, employees have generated new ideas, and businesses naturally transform into entrepreneurial platforms, resulting in entrepreneurial entities known as "micro enterprises" [13]. In the era of the IoT, Haier Group has made innovations in its original management model, manifested in three elements: chain group contracts, self driving systems, and value-added sharing [14]:

On the first hand, in chain group contracts, Haier uses blockchain technology to overcome the drawbacks of centralized factors in traditional contracts, and avoids human interference throughout the entire line of operation, eliminating the need for layer by layer issuance and approval of target tasks [12].

On the second hand, the self driving system is reflected in the ecological platform built by small and micro enterprises to meet user needs and achieve user value, which integrates multiple functions such as research and development, design, manufacturing, and supply chain. This platform continuously updates its product quality and service level to meet the constantly changing needs of users, and actively participates in product replacement by continuously meeting user needs, bringing value added to the ecosystem, and rapidly updating the entire ecosystem through self evolution [12].

Thirdly, value-added sharing refers to the value-added sharing of ecological value among stakeholders. In the era of the IoT, Haier focuses more on ecological value rather than product revenue. The Haier Group ecosystem breaks the zero sum game and collaborates with multiple parties to achieve value co creation and sharing. As users increasingly pursue product experience, intelligence and informatization in their use, the Haier ecosystem is reflected in the pursuit and realization of ecological value maximization, which can instantly meet the diverse needs of users, provide users with a good product experience, and service solutions that connect everything [12].

In terms of organizational structure, Haier has broken through traditional organizational boundaries and established a "network node organizational structure". In the era of the IoT, small and micro enterprises need to link internal and external resources to meet the constantly updated needs of users. Small and micro enterprises collaborate with other small and micro enterprises or external resource parties to form an ecological chain small and micro group, abbreviated as a "chain group". The horizontal axis of the chain contract ecosystem map is the "Creative Chain Group", and the vertical axis is the "Experience Chain Group". The small and micro nodes on the horizontal axis are the same as the manufacturing and research and development of traditional enterprises, while the user contacts on the vertical axis transmit user opinions to the small and micro nodes through "user experience engineers", and both parties actively integrate to create real market demand together [13]. As a result, the combination of "single chain group" and "experience chain group" has established an incentive mechanism for self risk and value co creation and sharing, which is conducive to mobilizing the enthusiasm of employees. Finally, the network node organizational structure also enables small and micro enterprises to combine various tasks and objectives with external resource parties, providing solutions to users in a short period of time and adapting to the changing external environment.

To address the difficulties encountered in financial management during the implementation of the "small and micro" model, Haier has innovatively established an ecological intelligence system under the IoT model, forming financial tools represented by win-win value-added tables, helping Haier achieve the transformation from appliances to networks, and then to the IoT ecosystem. The win-win value-added table evaluates and verifies the co creation and win-win model of small and micro enterprises from six aspects, as shown in Table 1.

Table 1: Win-win value-added table (image source: Haier's win-win value-added table research).

Project | Definition and Function | |||

1.User Resources | 1.1Transaction Users | Basic user resources that have been traded on enterprise platforms. | ||

1.2Interactive Users | It refers to users who have engaged in multiple transactions and participated in user experience process iterations and ecosystem design, and these users can also bring value to the enterprise. | |||

1.3Single user value contribution | Measure the value contribution generated by a single user on the platform. | |||

1.4Lifetime users | Participate in system design and will participate in the evolution of enterprise platforms for a long time. It is the core user resource of the platform | |||

2.Resource side | 2.1Interactive resource side | All resource parties linked on this platform | ||

2.2Active resource side | Resources who can continuously participate in value co creation on the platform | |||

3.Total value of ecological platforms | 3.1Profit | 3.1.1Traditional profits | Clarify the realization and sharing of traditional and ecological values. Measure the profits of all parties. Display the synergistic effect between the value created by the platform and the ecosystem. Reflect the co creation and win-win situation of Haier Group's ecosystem. | |

3.1.2Ecological profit | ||||

3.2Value added sharing | 3.2.1Chain group sharing | |||

3.2.2Support Platform | ||||

3.2.3Co creation stakeholders | 3.2.3.1Resource sharing | |||

3.2.3.2User sharing | ||||

3.2.3.3Capital sharing | ||||

4.Income | 4.1Traditional income | It generates revenue through the sale of hardware products such as products and services. Focusing on the iteration of interaction and experience with enterprise users. | ||

4.2Ecological income | Focusing on the iteration of interaction and experience with enterprise users, generating revenue through the sale of hardware products such as products and services. | |||

4.3Single user revenue | (Traditional Income + Ecological Income)/Trading Users | |||

5.Cost | 5.1Traditional costs | Focusing on the iteration of interaction and experience with enterprise users. It is the cost generated by selling hardware products such as products and services. | ||

5.2Ecological costs | The cost of resources and services invested in the continuous iterative upgrade process of the platform | |||

5.3Marginal costs | The more user resources, the smaller the marginal cost. | |||

6.Marginal revenue | 6.1 Marginal revenue | Reflecting the average marginal revenue of active users, used to guide the expansion of the enterprise platform ecosystem and improve the marginal revenue created by individual users. Display the size of ecological value and profit proportion using data to measure the co creation achievements of the entire ecosystem. | ||

In the win-win value-added statement, Haier adheres to the concept of "users are the most important resource in the Haier ecosystem", placing user assets in the most important position, and solving the problem of traditional reports being unable to display user resources. From Table 2, it can be seen that the more users created by small and micro enterprises, the marginal costs of their hardware and software will decrease. From the 3-1 equation, it can be seen that this further promotes small and micro enterprises to acquire more active users, in order to maximize the total amount of value-added sharing [15]. Secondly, the win-win value-added statement fully utilizes the decentralization of the IoT era to enable continuous interaction between enterprises and users. Based on user needs, resource and stakeholder groups are gathered on the same platform, achieving the transformation from traditional accounting entities to platform entities in finance [12]. The win-win value-added table has also transformed the traditional users of the group into interactive users, and then into lifelong users, transforming product value into user interaction value and ecological value. It is through the co creation and win-win situation between small and micro enterprises and users in this system that the traditional unilateral market has been transformed into a multilateral trading platform, rapidly increasing the overall value of Haier Group [13].

The sum of marginal costs of hardware and software = (total revenue - total value-added sharing) / active users (3-1) [15].

Table 2: Refrigerator microenterprise new kitchen "win-win value added table" (image source: Haier Platform).

Project | 2016 | 2017 Objectives |

1.User Resources |

|

|

a1.Interactive users | 300,000 | 10,000,000 |

b1.Active users | 100,000 | 1,000,000 |

c1.User makers | 100 | 5,000 |

d1.Lifetime users | 66 | 2,650 |

2. Value added sharing (RMB 10,000) |

|

|

a2. Profit from hardware (product) | 1,537 | 23,070 |

b2. Profit from the ecosystem | 4,340 | 148,040 |

c2.Total profit | 5,877 | 171,110 |

d2. Sharing amount of active users in the ecosystem | 1,899 | 61,792 |

e2. Capital investor share | 1,140 | 38,887 |

f2. Enterprise team members sharing | 23 | 769 |

g2. Total amount of value-added sharing | 3,062 | 101,448 |

3.Revenue (RMB10,000) |

|

|

a3. Revenue from hardware (products) | 25,632 | 256,325 |

b3. Income from ecosystems | 7,940 | 152,000 |

c3.Total revenue | 33,572 | 408,325 |

4. Cost and marginal cost (RMB10,000) |

|

|

a4. Hardware (product) cost | 24,095 | 233,255 |

b4. Ecosystem costs | 3,600 | 3,960 |

Total cost | 27,695 | 237,215 |

c4. Marginal cost of hardware (product) | 180 | 70 |

d4. Marginal cost of ecosystems | 360 | 40 |

5. Marginal income of a single active user (RMB10,000) |

|

|

a5. Marginal revenue of hardware (product) for a single active user | 2,383 | 2,493 |

b5. Marginal income of the ecosystem for a single active user | 434 | 1,480 |

c5. Total marginal income of a single active user | 2,817 | 3,973 |

3. Discussion and Suggestions on Digital Transformation Under the Haier IoT Model

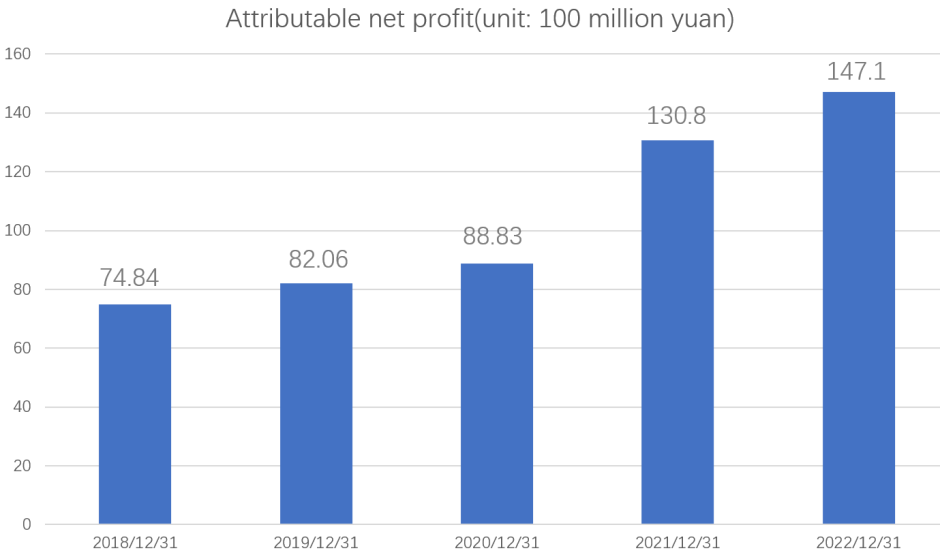

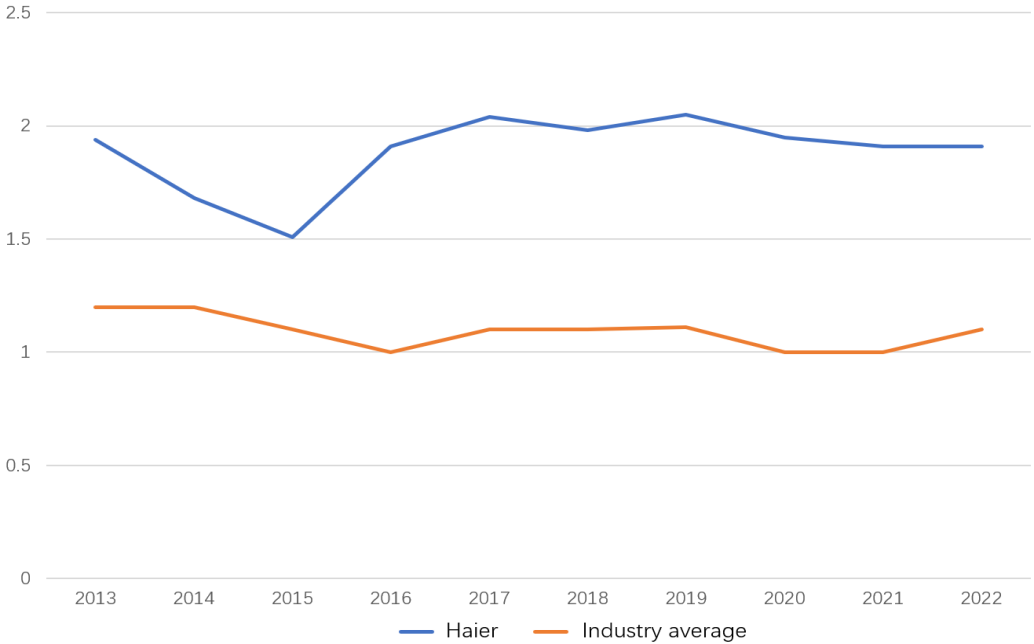

The total asset turnover rate and current asset turnover rate can effectively demonstrate the operational capability of a company. From Figure 3, it can be seen that from 2017 to 2022, the trend of Haier's total asset turnover rate was relatively stable, but its total asset turnover rate has always been higher than the industry average, indicating that its overall operational ability for enterprise assets continues to be at a leading level in the industry.

In 2016, Haier began using big data technology for mass customization production. From Figure 4, it can be seen that the current asset turnover rate of Haier showed a downward trend from 2013 to 2015, and continued to rise from 2016 until 2019 when the current asset turnover rate slightly decreased. Then, entering the period of ecological brand strategy, the current asset turnover rate gradually stabilized.

Overall, after the transformation of Haier, it has performed well in terms of asset operation efficiency and efficiency, and its operational capacity has significantly improved since 2016, showing a good overall development trend.

Figure 3: Trend chart of Haier's total asset turnover rate and industry average from 2014 to 2022.

Figure 4: Trend chart of Haier's current asset turnover rate and industry average from 2013 to 2022.

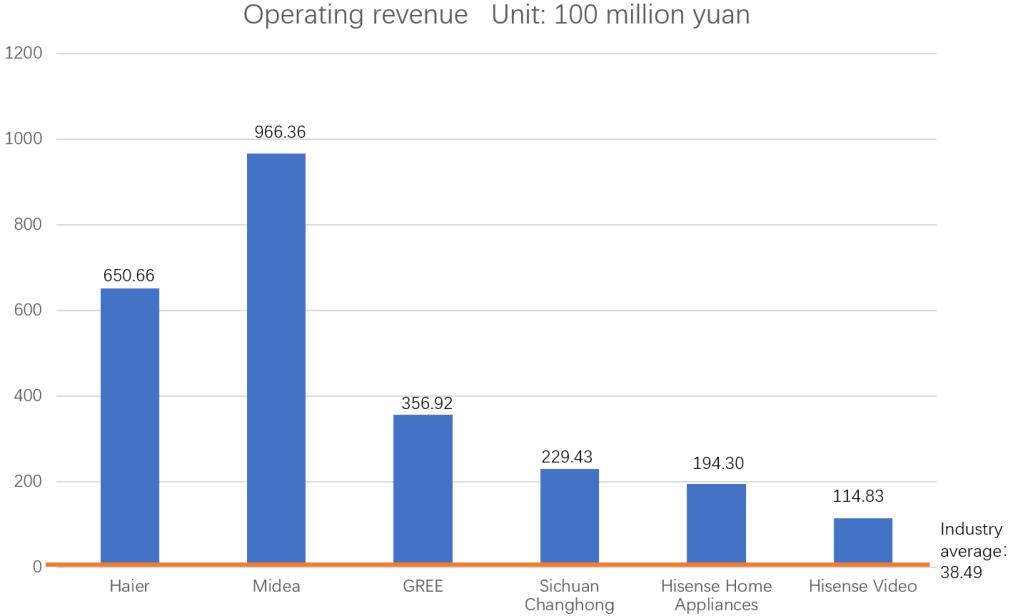

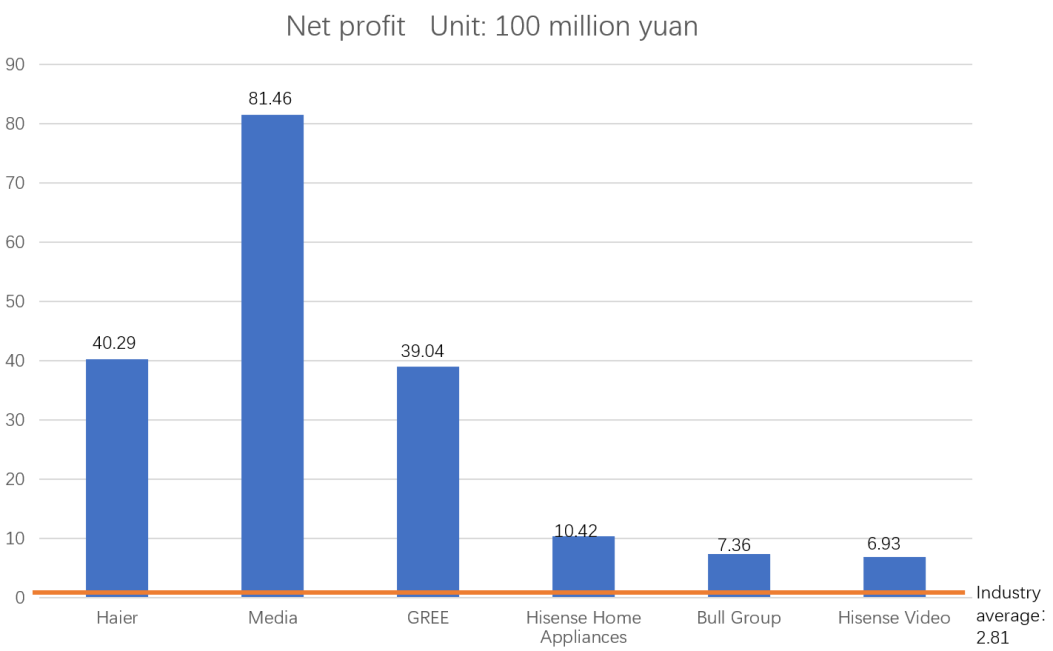

As shown in Figures 5 and 6, in the first quarter of 2023, compared with the same industry, Haier is currently second only to Midea Group in terms of operating revenue and net profit, ranking second in the same industry. Its operating revenue and net profit are not only much higher than those of the third and fourth ranked enterprises, but also far ahead of the average operating situation in the industry. This further demonstrates the success of Haier's digital transformation in the era of the IoT. However, compared to the more advanced Midea Group in the same industry, Haier still needs to continuously innovate and improve various aspects of its own enterprise, learn from other successful digital transformation enterprises, make continuous progress, bring users a more comfortable experience, open up new paths for other enterprises, and make digital transformation more perfect in the era of the IoT.

Figure 5: Comparison of operating revenue between Haier and its peers in the first quarter of 2023 (source: Haier official website).

Figure 6: Comparison of net profit between Haier and its peers in the first quarter of 2023 (source: Haier official website).

4. Conclusion

With the arrival of the digital economy era, accelerating the digital transformation of enterprises has become the main task of developing the digital economy, and enterprises in various fields are facing an important turning point of digital transformation. Each enterprise should continuously improve their own enterprises, and keep up with the pace of the times.

The advent of the IoT era not only brings about the interconnection between things, but also reshapes business models and changes in user experience. In manufacturing enterprises, it is not only reflected in product interconnection and digitization, but also in the improvement, optimization, and financial digitization of management models.

In the era of the IoT, financial digitization is not just about technological innovation, but also about upgrading management models, enterprise organizational structures, financial tools, and other aspects: firstly, develop corresponding strategies or business models for enterprises based on users; secondly, always adapt to changes in the times and technological changes, and improve the organizational structure of the enterprise; finally, innovative financial tools are also crucial. In the era of the IoT, ecological value and user resources can help enterprises make more accurate decisions quickly. Therefore, Haier's win-win value-added statement reflects these two elements that traditional financial statements cannot display.

For Chinese enterprises, Haier's digital transformation path is very worth learning from. It is important to learn its transformation ideas and methods, effectively solve the practical problems of enterprises in the current era, and complete digital transformation as soon as possible. Each enterprise should actively learn from experience and adapt to the development of the times, so that Chinese enterprises can move from management to operation.

References

[1]. Wu F, Hu H Z, Lin H Y, et al. (2021) Digital Transformation of Enterprises and Capital Market Performance: Empirical Evidence from Stock Liquidity. Management World, 37, 130-144+10.

[2]. Wei Y C, Liu X Y, He F. (2022) Research on Digital Transformation and Corporate Governance Level: Empirical Evidence from A-share Main Board Listed Companies. Financial Development Research, 3, 18-25.

[3]. Chen D M, Wang L Z, Chen A.N. (2020) Digital and Strategic Management Theory - Review, Challenges, and Prospects. Management World, 36, 220-236+20.

[4]. Qi Y D, Xiao X. (2020) The Transformation of Enterprise Management in the Digital Economy Era. Management World, 36, 135-152+250.

[5]. Chen L, Wang X F, Guan T, et al. (2023) The Path of Enterprise Digitalization: Internal Transformation to External Empowerment. Scientific Research Management, 44, 11-20.

[6]. Ulijitu, Zhou B B, Wang Y L. (2023) Research on the Digital Transformation Path of Small and Medium Sized Manufacturing Enterprises in China. Scientific Research, 1-14.

[7]. Regan, Zhang C, Yang H. (2023) The Development Process and Effectiveness of International Standardization of the Internet of Things in China. Information Technology and Standardization, 5, 16-20.

[8]. Eight Departments. (2022) Three Year Action Plan for the Construction of New Infrastructure of the Internet of Things (2021-2023). Automation Expo, 39, 5.

[9]. Vial G. (2019) Understanding Digital Transformation: A Review and A Research Agenda. Journal of Strategic Information Systems, 28.

[10]. Zhang Y C, Liu J B. (2023) Will Digital Transformation of Enterprises Affect Capital Structure Decisions - Evidence from the Speed of Capital Structure Adjustment. Financial Development Research, 1-10.

[11]. Haier. (2023) Behind the 85% of Haier Smart Home's Products Not Entering the Warehouse - Entering Haier to See the Digital Transformation of the Manufacturing Industry.

[12]. Yuan T R, Wang X. (2021) Research on Enterprise Digital Financial Innovation in the Internet of Things Era - Taking Haier Group as an Example. Aviation Finance and Accounting, 3, 4-10.

[13]. Wang J Q, Chen Y. (2020) Research on the Fourth Report Driven Enterprise Transformation in the Era of the Internet of Things: An Analysis Based on Haier's Win-Win Value-Added Statement. Business Accounting, 22, 19-22.

[14]. Chen Q. (2019) Haier: The Evolutionary Path from RenDanHeYi to Chain Group Contract. Business School, 10, 83-85.

[15]. Guo C L. (2020) Research on the Impact of "Betting Incentive" on Enterprise Value Based on the "Win Win Value Added Table". Jinan University.

Cite this article

Liu,S. (2023). Digital Transformation of Enterprises in the Mode of IoT - A Case Study of Haier. Advances in Economics, Management and Political Sciences,64,52-61.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Wu F, Hu H Z, Lin H Y, et al. (2021) Digital Transformation of Enterprises and Capital Market Performance: Empirical Evidence from Stock Liquidity. Management World, 37, 130-144+10.

[2]. Wei Y C, Liu X Y, He F. (2022) Research on Digital Transformation and Corporate Governance Level: Empirical Evidence from A-share Main Board Listed Companies. Financial Development Research, 3, 18-25.

[3]. Chen D M, Wang L Z, Chen A.N. (2020) Digital and Strategic Management Theory - Review, Challenges, and Prospects. Management World, 36, 220-236+20.

[4]. Qi Y D, Xiao X. (2020) The Transformation of Enterprise Management in the Digital Economy Era. Management World, 36, 135-152+250.

[5]. Chen L, Wang X F, Guan T, et al. (2023) The Path of Enterprise Digitalization: Internal Transformation to External Empowerment. Scientific Research Management, 44, 11-20.

[6]. Ulijitu, Zhou B B, Wang Y L. (2023) Research on the Digital Transformation Path of Small and Medium Sized Manufacturing Enterprises in China. Scientific Research, 1-14.

[7]. Regan, Zhang C, Yang H. (2023) The Development Process and Effectiveness of International Standardization of the Internet of Things in China. Information Technology and Standardization, 5, 16-20.

[8]. Eight Departments. (2022) Three Year Action Plan for the Construction of New Infrastructure of the Internet of Things (2021-2023). Automation Expo, 39, 5.

[9]. Vial G. (2019) Understanding Digital Transformation: A Review and A Research Agenda. Journal of Strategic Information Systems, 28.

[10]. Zhang Y C, Liu J B. (2023) Will Digital Transformation of Enterprises Affect Capital Structure Decisions - Evidence from the Speed of Capital Structure Adjustment. Financial Development Research, 1-10.

[11]. Haier. (2023) Behind the 85% of Haier Smart Home's Products Not Entering the Warehouse - Entering Haier to See the Digital Transformation of the Manufacturing Industry.

[12]. Yuan T R, Wang X. (2021) Research on Enterprise Digital Financial Innovation in the Internet of Things Era - Taking Haier Group as an Example. Aviation Finance and Accounting, 3, 4-10.

[13]. Wang J Q, Chen Y. (2020) Research on the Fourth Report Driven Enterprise Transformation in the Era of the Internet of Things: An Analysis Based on Haier's Win-Win Value-Added Statement. Business Accounting, 22, 19-22.

[14]. Chen Q. (2019) Haier: The Evolutionary Path from RenDanHeYi to Chain Group Contract. Business School, 10, 83-85.

[15]. Guo C L. (2020) Research on the Impact of "Betting Incentive" on Enterprise Value Based on the "Win Win Value Added Table". Jinan University.