1. Introduction

The study of consumer behavior has its roots in the late 19th and early 20th centuries, and it can be divided into three periods: the nascent stage, the applied stage, and the transformative and developmental stage [1-5]. In 1899, “Theory of the Leisure Class" was published by American sociologist Veblen, which introduced the concept of conspicuous consumption and its social implications. In December 1901, psychologist Scott highlighted the important role that psychology could play in sales and advertising during a presentation at Northwestern University. In 1923, Copeland proposed a classification method for consumer goods, dividing them into convenience goods, shopping goods, and specialty goods, based partly on an analysis of consumer behavior in three aspects.

The study of consumer behavior developed extensively during the economic crises of the 1930s and World War II in the 1940s. In the 1940s and 1950s, various experts conducted research on motivations for consumer behavior. In 1950, Mason Haire conducted research on instant coffee. And American scholars Cuest and Brown started studying consumer brand loyalty, aiming to find effective ways to encourage consumers to repeatedly choose a specific brand. Researchers such as M. Sherif, Harlod H. Kelley, and Shibutoni conducted studies on reference groups. At this stage, Maslow's hierarchy of needs theory was proposed [1, 6].

In 1960, the Consumer Psychology Division was established within the American Psychological Association, marking the establishment of consumer behavior as a discipline.

James et al. from Ohio State University authored and released the pioneering consumer behavior textbook, “Consumer Behavior,” in 1968. In 1969, the Association for Consumer Research was officially founded in the United States. In 1974, the Journal of Consumer Research (JCR) was launched. Raymond Bauer's paper at Harvard University in 1960 played an important role in challenging the assumption of consumers' high rationality. He argued that consumers' actions would always lead to outcomes they cannot be completely certain about. Rogers conducted research on innovation adoption and diffusion. Lavidge and Steiner conducted research on advertising effectiveness. Fishbein and others conducted research on organizational behavior. Sheth and others conducted research on organizational buying behavior and consumer rights protection [7-9]. Cox et al. conducted research on managing perceived risk. Prominent e-commerce platforms have adopted big data analytics technology as a standard practice in recent years. By analyzing consumer's purchase history, browsing records, click-through rates, and other data, e-commerce platforms can provide personalized product recommendations to consumers, thereby increasing conversion rates. Additionally, big data analytics technology can also help e-commerce platforms optimize pricing, inventory management, and supply chain distribution, enhancing operational efficiency and profitability. In the retail industry, by analyzing data on consumer shopping habits, spending power, and brand preferences, retailers can better adjust product display locations, promotional strategies, and marketing activities, thereby increasing sales and customer satisfaction [10-12]. Furthermore, big data analytics technology can be applied in industries such as finance, healthcare, and tourism. In the field of finance, personalized financial advice and risk assessments can be provided by analyzing consumer financial data and investment behavior. In healthcare, personalized treatment plans and health management advice can be offered by analyzing patient medical records, genetic data, and lifestyle habits. In the tourism sector, personalized travel recommendations and customized itineraries can be provided by analyzing consumer travel preferences and social media data.

This study mainly understands the specific application of big data analysis in consumer behavior in social media and mobile payment. This article is structured as follows: The first part provides an overview of the development of consumer behavior and discusses recent applications of big data analysis in consumer behavior in recent years. The second part explores the application scenarios of big data analysis methods and models in the realm of consumer behavior. Application, the third part explains the application of big data analysis technology from two aspects: social media consumer behavior analysis and mobile payment consumer behavior analysis. Finally, it briefly introduces the limitations of big data analysis and the research significance of this article.

2. Basic Descriptions of bigdata analysis

In the past decade, the number of academic papers on big data has experienced a significant growth, showing its extensive applications in almost every research field. Big data analysis of consumer behavior involves primarily collecting data from social media, online activities, and consumption records for studying consumer behavior and purchase decisions. It enables businesses to understand consumer needs and market trends, helping them to adjust their marketing strategies in real-time. As a result, they can better meet consumer demands and improving their market competitiveness.

For businesses, adaptability is not achieved through specific changes in organizational structure, but rather through their ability to comprehensively capture consumer activities and uncover hidden insights. Companies should actively respond to changes in the external environment by leveraging big data to capture consumer signals and predict consumer decision preferences and market trends, thus better anticipating the future. By effectively utilizing big data analytics, businesses can significantly enhance their adaptability. With advancements in technology, new technologies, channels, and consumer behaviors are gradually becoming more prevalent, making the understanding of contemporary consumer behavior in various fields increasingly complex. At the same time, technological progress enables data analysts to capture richer consumer data at a faster pace and in more diverse ways. The diverse sources of information available to data analysts enable them to identify new gaps or areas of uncertainty in the understanding of consumer behavior. With the increasing richness of data, marketers are better equipped to identify these gaps and advance their understanding of consumer behavior.

3. Application in Social Media

Social media is a platform that allows people to quickly, effectively, and in real-time, transmit information to others. It can be used to share images, comments, events, and more. Social media has become a popular application platform today. People can socialize and purchase various goods through social media platforms. Utilizing social media for marketing purposes means connecting oneself with customers through different platforms, thereby shaping brand awareness, increasing revenue, and boosting website traffic. This marketing approach involves publishing a certain amount of promotional content on social media, which allows it to be pushed to others. Additionally, by paying a certain fee, one can have their content featured as classified advertisements. A simple example is the renowned fast-fashion brand H&M initiating a campaign for promoting sustainable development. The campaign, led by musician M.I.A., encourages customers to bring their unwanted clothes to the recycling stations at H&M stores and participate in H&M's Global Recycling Week.

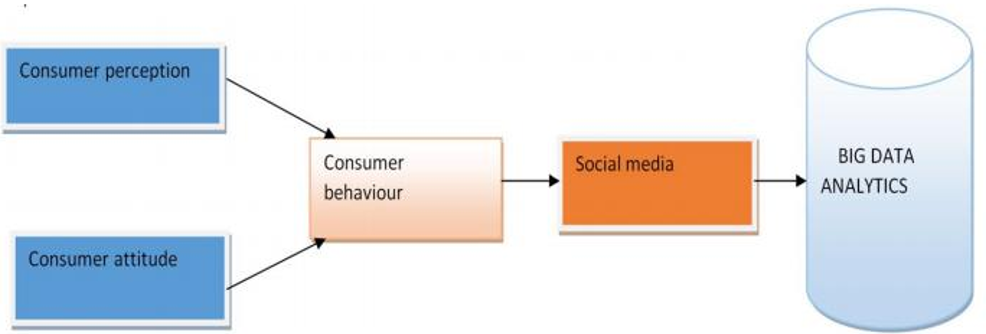

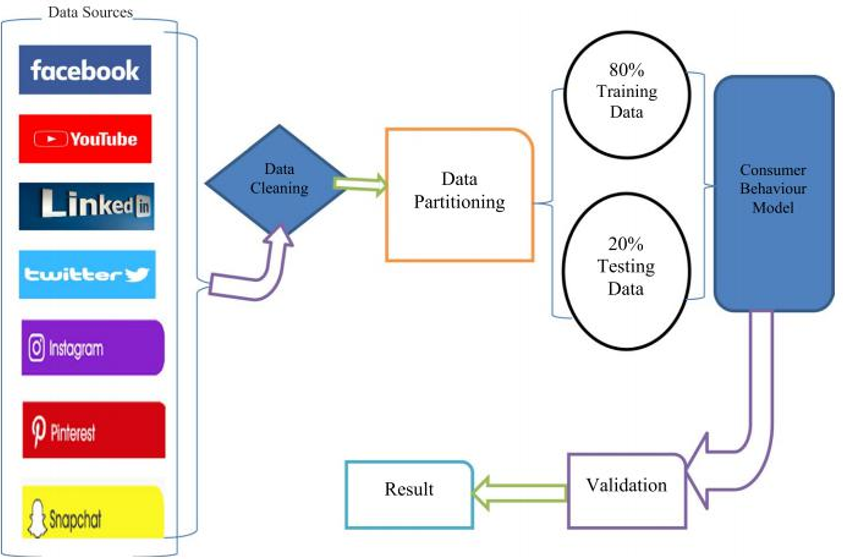

Researchers collect extensive data from various social media platforms and analyze it to make predictions about consumer behavior. These data primarily come from social media platforms such as Facebook, Twitter, LinkedIn, YouTube, and Instagram. To effectively manage the vast and varied data obtained from different social media platforms, researchers employ data preprocessing techniques to cleanse and ensure the high quality of the data. In this experiment, researchers leveraged big data technology to process and analyze the data, and they developed mathematical models to predict consumer behavior towards products on social media. The researchers divided the data, using 80% for training the model and setting aside 20% for testing. By understanding consumer preferences and predicting their behavior and activities after making purchases, this experiment helps businesses gain insights into consumer brand perception. It also assists businesses in improving their advertising strategies to increase consumer brand preferences.

Figure 1: A research framework for bigdata consumer behavior analysis.

The researchers established a framework (seen from Fig. 1) for big data analytics specifically designed to analyze social media consumer data. And the details can be found in the literature [4]. They also develop a model for analyzing social media consumer behavior. In this model, the data is sourced from popular social media platforms. To ensure the data quality, researchers perform thorough data cleaning, which involves removing noise, errors, duplicates, and outliers. Other researchers measure consumer allocation using social media. Consumer allocation integrates consumer responses to marketing communications [6]. They also explore the motivations behind persuasive social media usage, particularly in assisting seniors in developing positive attitudes toward social networking sites. Additionally, they examine how these attitudes subsequently influence attitudes towards sellers on social networking sites. The cleaned data is divided into two parts. They take 80% of the data to train the model, and the remaining 20% is used to test the model, as illustrated in the Fig. 2. The output of the model is validated and got the final result. One uses ds to represent the data source, and f, y, l, and t to represent Facebook, YouTube, LinkedIn, and Twitter respectively. The data source can be derived using the equation ds = \( \sum (f,y,l,t) \) Researchers predict consumer behavior using social media data from platforms such as Facebook, YouTube, LinkedIn, Twitter, and Instagram. This model helps businesses utilize social media data to forecast consumer behavior towards their products. The researchers believe that this model is the most optimal for predicting consumer behavior using social media data. And the detailed data can be found in the literature [4].

Figure 2: Data processing.

4. Application in Payment Methods

As a modern alternative to cash, checks, and credit cards, mobile payment has gained increasing interest from consumers to merchants contemporarily. The advancements in mobile technology and the growing mobility of consumers have prompted retailers and financial institutions to develop new payment services through mobile platforms. The total volume of digital payments in China has grown from 16.5 trillion yuan in 2018 to approximately 26-27 trillion yuan in 2021, with an annual growth rate of around 15% to 20%. Over the past five years, the number of mobile payment users has exceeded 500 million, with Alipay and WeChat Pay dominating around 93% of the market share, maintaining a duopoly. The widespread use of mobile payment in China showcases a cashless future to the world.

Apart from China, many countries around the world have started promoting cashless payments. At the end of 2016, the Indian government's ban on high-denomination banknotes catalyzed the flourishing of local cashless payments. Paytm and PhonePe are the major mobile payment service providers in India, widely adopted by consumers and retailers after the demonetization. As of 2017, the South American mobile market is the fourth-largest in the world, with approximately 414.4 million unique users, equivalent to a user penetration rate of 65% of the population [11]. In Colombia, Grupo Aval is a major mobile payment service provider. In 2020, Brazil started using WhatsApp for money transfers or shopping, marking the integration of a payment platform into its social network. The widespread spread of COVID-19 since 2020 has caused concerns about cash payments. Cashless payments have become an excellent alternative. These phenomena indicate that as one moves towards a cashless society, mobile wallets are becoming more prevalent. However, the role of consumer emotional states and individual personalities in the adoption of mobile payments is still not fully explored. This study aims to investigate how customers' emotions influence their adoption of mobile payments in-store, and how individual decision-making styles and satisfaction needs moderate this influence.

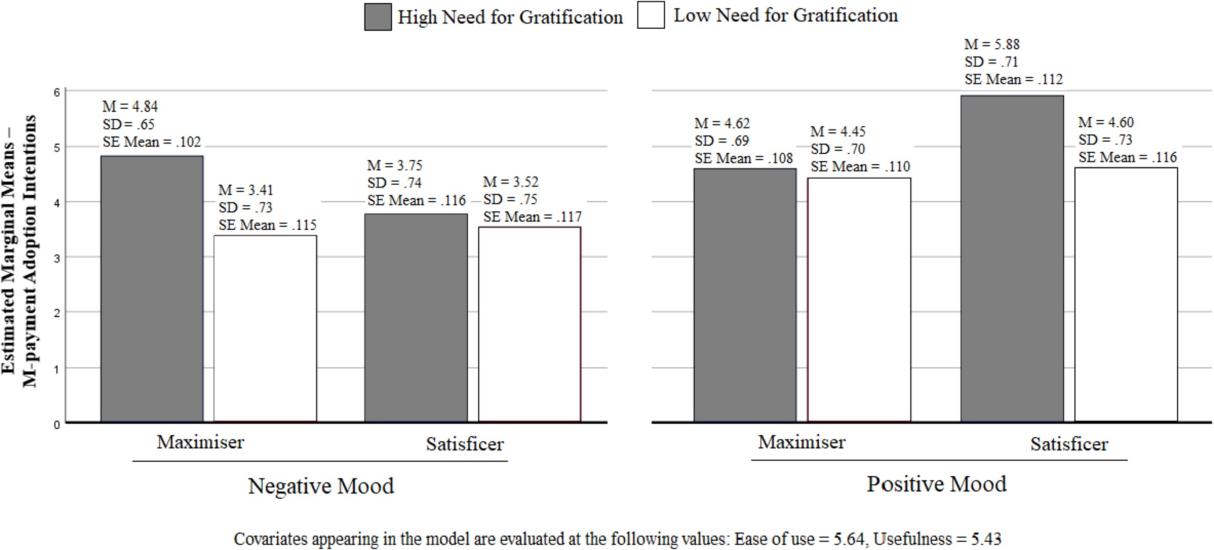

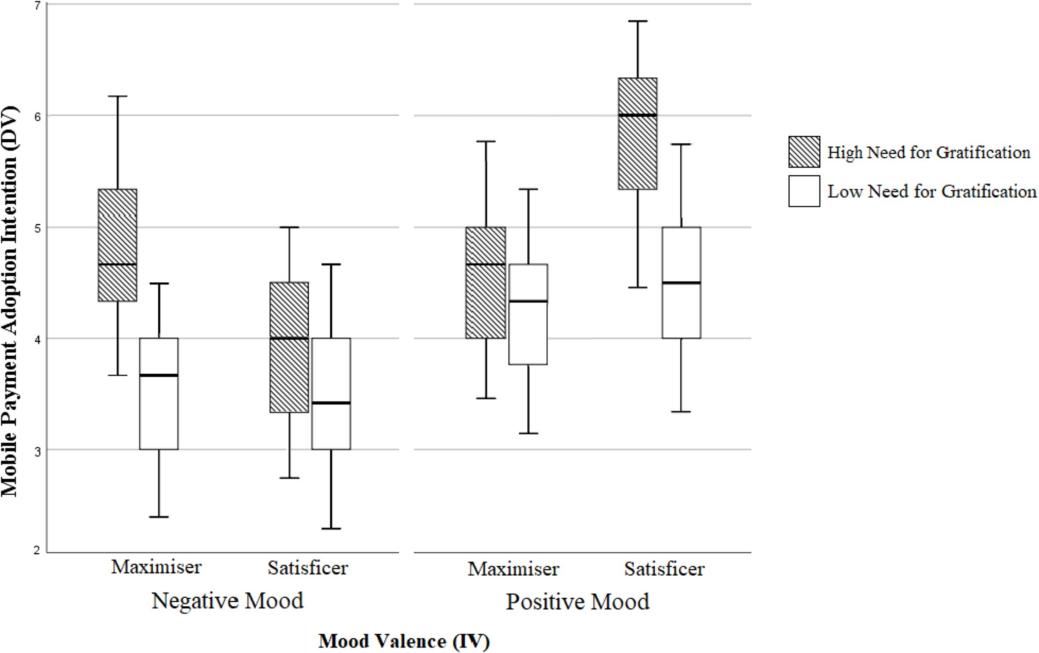

First, 170 male participants aged 19 and above and 152 female participants who have never used in-store mobile payments but have smartphones that support the service were recruited through Prolific Academic. Other detailed information on the sample persons selected by the researcher can be found [12]. Subsequently, the researchers randomly assigned them to one of two groups. For the specific operation methods of each group [12]. For group A and B, the researchers introduced an emotion induction task, followed by a comment question about the store. Afterward, participants were required to carry out the next task or scenario. Importantly, there were no obvious differences in demographics between the groups that were randomly assigned (p >0 .05). And for the second task, one can refer to the literature [12]. Next, one conducted two two-way ANCOVA tests and the specific implementation methods and results of these two two-way ANCOVA tests can be found in the Fig. 3 [12].

Figure 3: Statistic results.

The study suggests that consumer sentiment influences their decision to choose in-store payment methods. Interestingly, the impact of emotions on this decision depends on two individual characteristics: consumers' decision-making style (maximizers or satisfices) and their level of need fulfillment. This experiment provides the evidence of the influence of consumers' emotional states on their judgment and decision-making processes. This experiment highlights the important role of emotions as a determinant of technology adoption.

5. Limitations & Future Outlooks

The application of big data analytics technology also faces some challenges. Firstly, privacy and security issues of data are important considerations. Consumer's personal information and behavioral data often involve privacy concerns, and protecting consumer privacy becomes an urgent problem to be solved. Secondly, data quality and data cleansing are also key issues. The quality and accuracy of data directly affect the accuracy and reliability of the analysis results.

In general, the application of big data analysis technology in consumer behavior research provides companies with more accurate and comprehensive consumer insights, helping companies predict and meet consumer needs. With the continuous advancement of science and technology, the application of big data analysis technology in consumer behavior research will continue to develop and improve. With the development of technologies such as artificial intelligence and machine learning, big data analytics can better reveal hidden patterns and trends and obtain consumer data more effectively. For example, by building predictive models and algorithms, consumers’ purchasing intentions and behaviors can be predicted more accurately [11, 12]. In addition, the application of big data analytics technology can also help companies better segment and position their markets. Through the analysis of consumer data, characteristics, and differences in needs of different groups can be discovered, enabling targeted marketing strategies and product positioning.

However, it is worth noting that big data analytics technology is not a panacea. Although it can provide a large amount of data and insights, it still requires the combination of artificial intelligence and professional knowledge to interpret and analyze these data. Only by combining scientific technology with human wisdom can the true potential of big data analytics technology be realized. In the future, the application of big data analytics technology will face more challenges and opportunities. With the continuous development of technology, the scale and complexity of data will continue to increase, placing higher demands on data processing and analysis capabilities. At the same time, privacy and security issues will also be a continuous focus, and suitable solutions need to be found to balance data utilization and privacy protection.

6. Conclusion

In summary, the application of big data analytics in consumer behaviour studies provides businesses with stronger decision-making foundations and market insights. Big data analytics has been employed to varying degrees in analysing consumer behaviour in social media and mobile payment contexts. By gaining a deeper understanding of consumer needs and behaviours in these areas, businesses can better formulate product strategies, optimize marketing campaigns, and enhance competitiveness and market share. In the future, as the scale and complexity of data continue to increase, these areas will inevitably demand higher data processing and analytical capabilities. At the same time, privacy and security issues will remain a continuous concern. With advancements and innovation in technology, big data analytics will continue to bring forth breakthroughs and innovations in the field of consumer behaviour.

References

[1]. Liu, H., Huang, F., and Ye, R. (2020). Field experiments in consumer behavior research: concept, operational introduction and implementation suggestions. Foreign Economics and Management, 42(3), 35-56.

[2]. Corea, F. (2016). Big data analytics: A management perspective (Vol. 21). Switzerland: Springer.

[3]. Erevelles, S., Fukawa, N., and Swayne, L. (2016). Big Data consumer analytics and the transformation of marketing. Journal of business research, 69(2), 897-904.

[4]. Chaudhary, K., Alam, M., Al-Rakhami, M.S., and Gumaei, A. (2021). Machine learning-based mathematical modelling for prediction of social media consumer behavior using big data analytics. Journal of Big Data, 8(1), 1-20.

[5]. Chu, S.C., Chen, H.T., and Gan, C. (2020). Consumers’ engagement with corporate social responsibility (CSR) communication in social media: Evidence from China and the United States. Journal of Business Research, 110, 260-271.

[6]. Bailey, A.A., Bonifield, C.M., and Elhai, J.D. (2021). Modeling consumer engagement on social networking sites: Roles of attitudinal and motivational factors. Journal of Retailing and Consumer Services, 59, 102348.

[7]. Hu, Y., Xu, A., Hong, Y., Gal, D., Sinha, V., and Akkiraju, R. (2019). Generating business intelligence through social media analytics: Measuring brand personality with consumer-, employee-, and firm-generated content. Journal of Management Information Systems, 36(3), 893-930.

[8]. Salehan, M., and Kim, D.J. (2016). Predicting the performance of online consumer reviews: A sentiment mining approach to big data analytics. Decision Support Systems, 81, 30-40.

[9]. Teng, S., and Khong, K.W. (2021). Examining actual consumer usage of E-wallet: A case study of big data analytics. Computers in Human Behavior, 121, 106778.

[10]. Oliveira, T., Thomas, M., Baptista, G., and Campos, F. (2016). Mobile payment: Understanding the determinants of customer adoption and intention to recommend the technology. Computers in human behavior, 61, 404-414.

[11]. Bailey, A.A., Bonifield, C. M., Arias, A., and Villegas, J. (2022). Mobile payment adoption in Latin America. Journal of Services Marketing, 36(8), 1058-1075.

[12]. Karimi, S., and Liu, Y.L. (2020). The differential impact of “mood” on consumers’ decisions, a case of mobile payment adoption. Computers in Human Behavior, 102, 132-143.

Cite this article

Li,Y. (2023). Big Data Analysis in Consumer Behavior: Evidence from Social Media and Mobile Payment. Advances in Economics, Management and Political Sciences,64,269-275.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Liu, H., Huang, F., and Ye, R. (2020). Field experiments in consumer behavior research: concept, operational introduction and implementation suggestions. Foreign Economics and Management, 42(3), 35-56.

[2]. Corea, F. (2016). Big data analytics: A management perspective (Vol. 21). Switzerland: Springer.

[3]. Erevelles, S., Fukawa, N., and Swayne, L. (2016). Big Data consumer analytics and the transformation of marketing. Journal of business research, 69(2), 897-904.

[4]. Chaudhary, K., Alam, M., Al-Rakhami, M.S., and Gumaei, A. (2021). Machine learning-based mathematical modelling for prediction of social media consumer behavior using big data analytics. Journal of Big Data, 8(1), 1-20.

[5]. Chu, S.C., Chen, H.T., and Gan, C. (2020). Consumers’ engagement with corporate social responsibility (CSR) communication in social media: Evidence from China and the United States. Journal of Business Research, 110, 260-271.

[6]. Bailey, A.A., Bonifield, C.M., and Elhai, J.D. (2021). Modeling consumer engagement on social networking sites: Roles of attitudinal and motivational factors. Journal of Retailing and Consumer Services, 59, 102348.

[7]. Hu, Y., Xu, A., Hong, Y., Gal, D., Sinha, V., and Akkiraju, R. (2019). Generating business intelligence through social media analytics: Measuring brand personality with consumer-, employee-, and firm-generated content. Journal of Management Information Systems, 36(3), 893-930.

[8]. Salehan, M., and Kim, D.J. (2016). Predicting the performance of online consumer reviews: A sentiment mining approach to big data analytics. Decision Support Systems, 81, 30-40.

[9]. Teng, S., and Khong, K.W. (2021). Examining actual consumer usage of E-wallet: A case study of big data analytics. Computers in Human Behavior, 121, 106778.

[10]. Oliveira, T., Thomas, M., Baptista, G., and Campos, F. (2016). Mobile payment: Understanding the determinants of customer adoption and intention to recommend the technology. Computers in human behavior, 61, 404-414.

[11]. Bailey, A.A., Bonifield, C. M., Arias, A., and Villegas, J. (2022). Mobile payment adoption in Latin America. Journal of Services Marketing, 36(8), 1058-1075.

[12]. Karimi, S., and Liu, Y.L. (2020). The differential impact of “mood” on consumers’ decisions, a case of mobile payment adoption. Computers in Human Behavior, 102, 132-143.