1. Research Background

The COVID-19 pandemic from 2019 to 2022 had a significant impact on the Chinese economy. In 2020, there was a substantial oversupply of office properties in Beijing due to societal restrictions on offline work, leading to a sharp increase in office vacancy rates and a rise in lease terminations and rent reductions. However, due to Beijing's strong economic fundamentals, orderly control measures, and robust commercial demand, there was no significant fluctuation in office property prices. At the same time, the operation of office properties still primarily relied on leasing. Compared to retail and residential properties, office tenants had longer and more stable lease terms, lower risks for property owners, and provided a certain buffer for price fluctuations.

In 2023, as COVID-19 control measures normalized and the Chinese economy steadily recovered, unlike the situation with residential properties, there was no significant suppression or delay in demand for office properties. Therefore, office property prices did not experience significant rebounds or fluctuations [1].

However, apart from market price factors, the COVID-19 pandemic prompted a reassessment of user-profiles and user demands in the Beijing office property market. The primary reasons for changes in user profiles were the varying degrees of impact the pandemic had on different industries, with some industries reducing their demand for physical office spaces in favour of online operations in the post-pandemic era [2]. Changes in user demands primarily focused on concerns and enhancements related to indoor office density, open spaces, air circulation, and property management quality [3].

Based on the above analysis, it can be observed that against the backdrop of the COVID-19 pandemic bringing about changes in investment demands in the Beijing office property market, scholars primarily focused on predicting and analyzing the impact of new policies and demands arising during the pandemic on the future market [4]. However, this also exposed the current research gap among scholars.

This study contends that for the post-pandemic era of the Beijing office property market, the analysis of future market directions can be divided into two approaches: one based on policy changes during the pandemic and the other based on the long-term logic preceding the pandemic for analyzing the future of the Beijing office property market. The rationale for the second analysis approach is as follows: First, the pandemic is an extraordinary event with a low probability of occurrence, and compared to long-term policy systems and economic laws, it cannot fundamentally change the long-term operational logic of the capital market. Second, as previously explained by scholars, the primary goal of the post-pandemic era is to restore the market rules and development trends that existed before the pandemic. The pandemic only serves as a growth point for real estate demand, but the long-term logic still needs to return to the pre-pandemic state. To better establish a continuous development with the pre-pandemic office property market logic, a retrospective analysis of the pre-pandemic office property market is required.

Therefore, this study will focus on the Chaoyang District of Beijing as the research area. It will analyze the investment potential of office properties in close proximity to the pre-pandemic era and summarize the opportunities and challenges for their development. This will provide a new direction for analysis in the post-pandemic real estate market, serving as a reference for future researchers and investors.

2. Research Site and Methods

2.1. Research Site

Chaoyang District is located in the central part of Beijing and is situated in the southern part of the city. According to the Beijing Urban Master Plan (2016-2035), its functional positioning is as follows: The northeastern part of the district will be developed into a world-class business centre, an international hub for science, technology, culture, and sports exchange, as well as a host for various internationalized communities. The southern part of the district will serve as an area for the integrated development of culture, creativity, and technological innovation. Chaoyang District is the economic centre of Beijing, housing numerous landmark buildings, financial centres, distinctive markets, and fashionable consumer hubs [5].

2.2. Research Methods

This article primarily analyzes the development potential of office properties in Chaoyang District, Beijing through three methods:

1. By obtaining and analyzing publicly available urban policies and development goals through government official websites, such as: Beijing Municipal Government and Chaoyang District Government.

2. By gathering and analyzing publicly available data from government official databases, such as: China National Bureau of Statistics and Beijing Municipal Bureau of Statistics.

3. By referencing relevant commercial reports published by the five major real estate agencies, for example: JLL, CBRE, DTZ, Savills, Colliers International, understanding the comments of professional analysts on the performance of Beijing's real estate market and their predictions regarding the future development direction of office properties. Analysis will also be conducted on the textual content and data tables in these reports.

This article categorizes various factors affecting office properties in Chaoyang District, Beijing into three aspects: political factors, economic factors, and social factors. The analysis of each aspect is divided into two parts. First, an analysis of the overall situation of office properties in Beijing under the influence of that factor is conducted. Subsequently, a specific analysis of the situation in Chaoyang District, Beijing, under the influence of that factor is carried out. Furthermore, an analysis of the investment potential, including opportunities and challenges of office properties in Chaoyang District under each factor's influence is conducted. This approach ensures both comprehensive analysis perspectives and diverse analytical scales. Additionally, by combining qualitative and quantitative analyses in textual and graphical forms, objectivity in the analysis is maintained.

3. Findings

3.1. The Political Factors

3.1.1. Beijing City Office Property Policy Trends and Analysis

JLL pointed out that in Beijing, policies continuously shape the future market direction and influence market decisions [6]. Since 2014, relevant policies have gradually tightened, leading to profound impacts of a tightening policy environment on all activities in the market. Currently, there are two main policy directions shaping market trends: restricting supply in the central urban area and directing demand towards peripheral regions.

Restricting supply in the central urban area: Since 2014, Beijing has prohibited the construction of large-scale commercial projects in the city's central areas. Consequently, the transformation of commercial land into office properties has garnered significant attention in the market. In 2017, the Beijing municipal government implemented strict height controls on buildings in the central urban area to limit supply, but the attractiveness of the CBD remains high. In early 2018, the municipal government explicitly restricted the supply of office properties in the central urban area. However, according to JLL, future opportunities are likely to focus on collaboration with technology companies, suggesting that despite this policy limiting office property supply in the city centre, investment potential still exists [6].

Directing demand towards peripheral regions: Shifting demand to the city's outskirts is divided into two phases: first, Beijing is redirecting demand from the central urban area by developing the peripheral regions, with Tongzhou as a sub-centre. Second, by promoting balanced development in the surrounding Jing-Jin-Ji region, it aims to relieve non-capital functions. Guiding demand toward peripheral areas can bring new development and investment potential to sub-centres and satellite cities, potentially benefiting office properties.

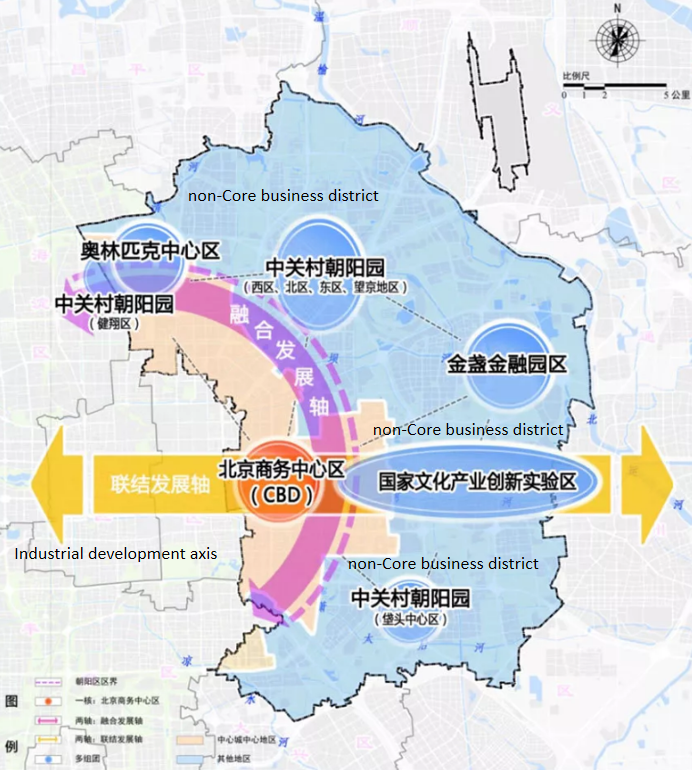

3.1.2. Beijing's Chaoyang District Office Property-Related Political Trends and Analysis

Adjustment of Chaoyang District's Regional Industrial Layout: According to the Chaoyang District Zoning Plan (2017-2035) for industrial development, Beijing's Chaoyang District is restructuring its industrial layout [5]. This includes developing the Beijing Central Business District into a world-class business centre to enhance international competitiveness. It involves creating two industrial development axes mainly relying on circular transportation to connect multiple industrial functional areas, constructing corridors between the urban core area and sub-centres, and fostering clusters of business districts and high-tech industries. Therefore, it is evident that the Chaoyang District government is aligning with the policy requirement of the Beijing municipal government to direct demand towards peripheral areas, offering development potential for office properties in non-core business districts within the region.

Figure 1: The functional plan of the regional industrial of CYD [5].

3.1.3. Opportunities and Challenges in Chaoyang District's Office Property Investment Due to Political Factors

Opportunities: Influenced by Beijing's policy of directing demand towards peripheral areas, non-core business districts in Chaoyang District have gained potential for office property development. Additionally, the Chaoyang District government has used policy documents to plan industrial zones, ensuring policy implementation. This enables investors to more accurately assess the office property market cycle, maximize investment interests, and reduce investment risks.

Challenges: With office property supply in Beijing's central urban area constrained by policies, the development of the central CBD in Chaoyang District is limited. Furthermore, the redirection of demand towards peripheral areas may lead to increased competition in the non-core business district office property market in Chaoyang District. Hence, office property investments in the central business district of Chaoyang District carry a certain level of risk.

3.2. The Economic Factors

3.2.1. Beijing City Office Property-Related Economic Trends and Analysis

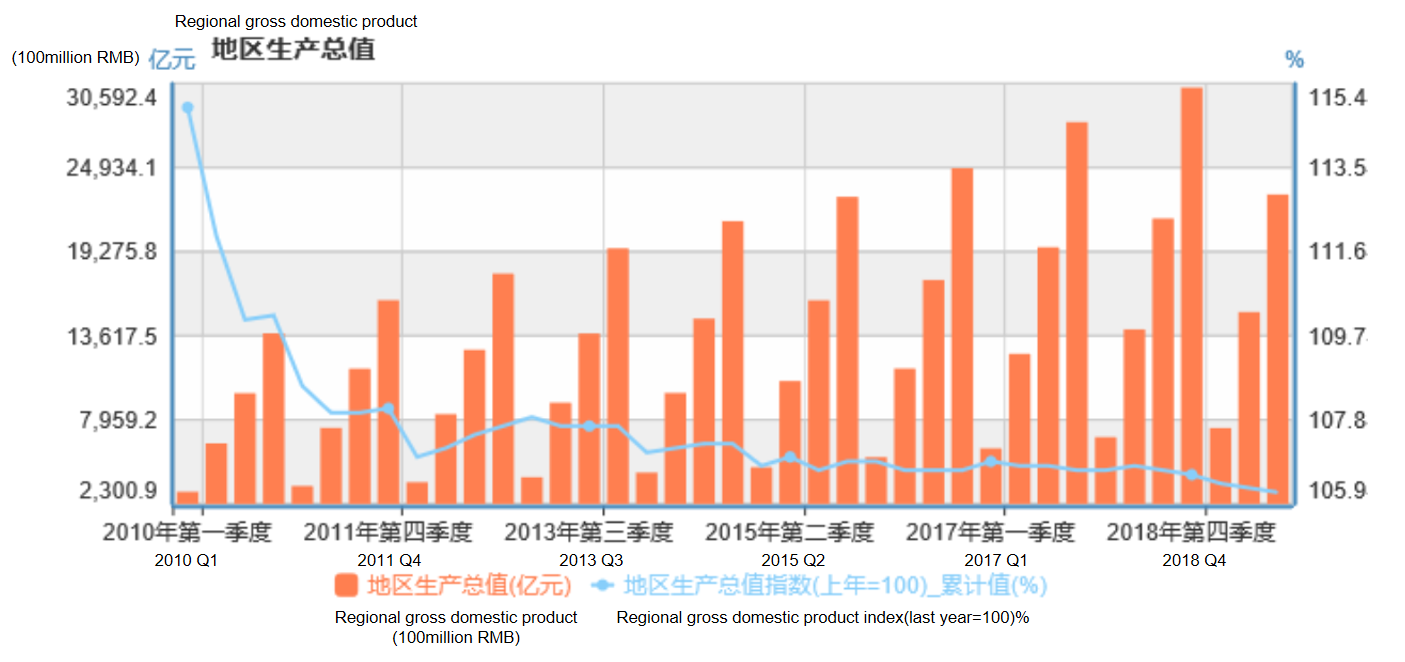

Beijing's Regional Gross Domestic Product (GDP) Shows a Trend of Slow but High-Quality Growth: According to statistical data charts from the China National Bureau of Statistics [7], it is evident that Beijing's regional GDP has steadily increased proportionally over the past decade. However, the growth rate has gradually slowed since 2010, maintaining a net GDP increase of around 5-7% per year. This indicates that the overall growth of the Chinese economy is more focused on development quality rather than speed. According to CBRE's analysis, the Beijing office property market will gradually move towards improving office building quality [8]. Consequently, the office property market will have new development potential.

Figure 2: The Regional GDP of Beijing in past 10 years [7].

The investment market for office properties in Beijing continues to develop and is gradually stabilizing. According to the analysis of Colliers International regarding the new supply, net absorption, and vacancy rates of office properties in Beijing from 2017 to 2023, the total market supply is expected to continue increasing in the coming years, with the growth rate gradually slowing down [9]. It is projected to reach a state of supply saturation by 2023. Demand is also expected to keep rising, but the growth rate is gradually decreasing. The office property vacancy rate in Beijing reached its peak in 2020 and has been declining year by year since then. This indicates that the office property market in Beijing is becoming more competitive and exhibits a higher level of dynamism.

Figure 3: New supply, net absorption and vacancy rate, 2017-2023 [9].

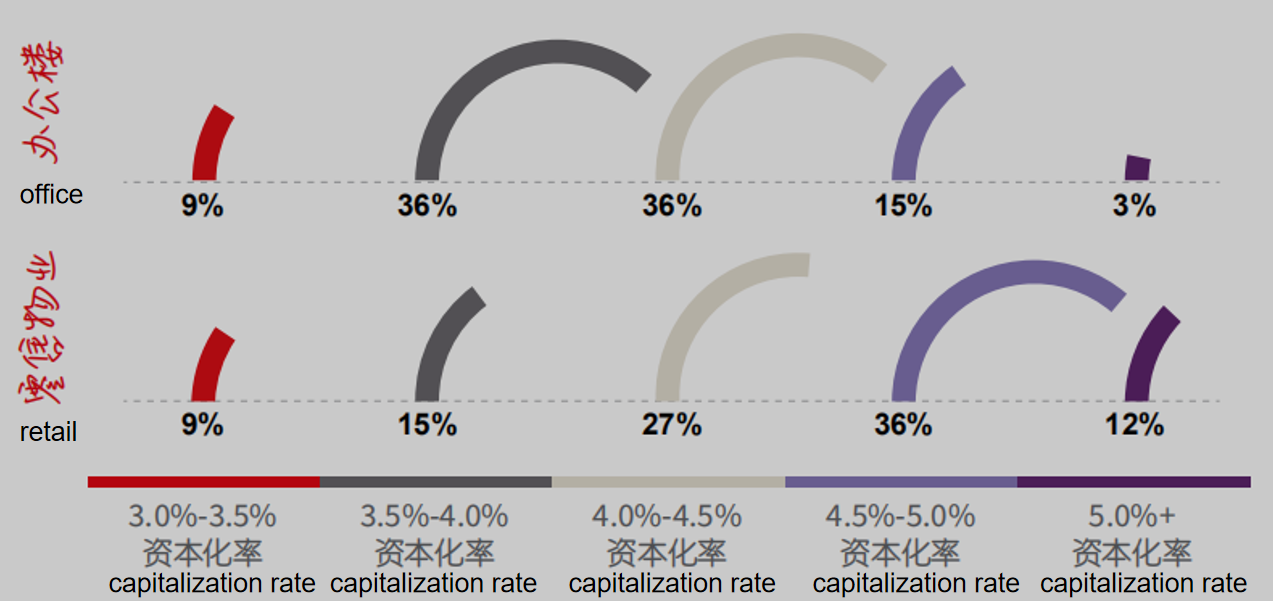

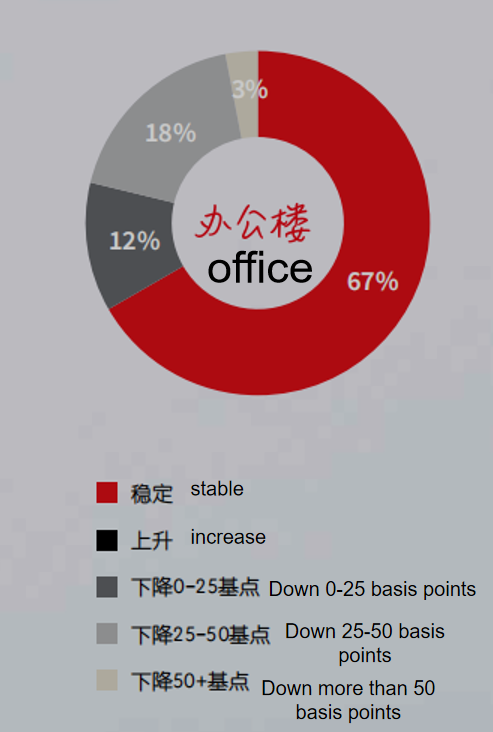

For office property, the average minimum capitalization rate that investors can accept is approximately 4.0%. According to JLL and their estimations of the future capitalization rates for office properties in Beijing, around 55% of office properties in Beijing have capitalization rates higher than the market average, and nearly 80% of these office properties are expected to maintain stability or see an increase in their capitalization rates [6]. Therefore, it can be inferred that office property rents will continue to rise slowly, driven by sustained market demand.

The remaining 45% of office properties have capitalization rates lower than the market average. It can be assumed that these investors will gain a competitive advantage in non-core business district markets by offering capitalization rates below the market average. Overall, it appears that the Beijing market is experiencing continuous growth in both supply and demand, with growth rates tending to stabilize. As a result, investment in Beijing office properties holds significant potential.

Figure 4: The future capitalization rate of the office and retail property in Beijing [6].

Figure 5: The future trend of the capitalization rate of office property in Beijing [6].

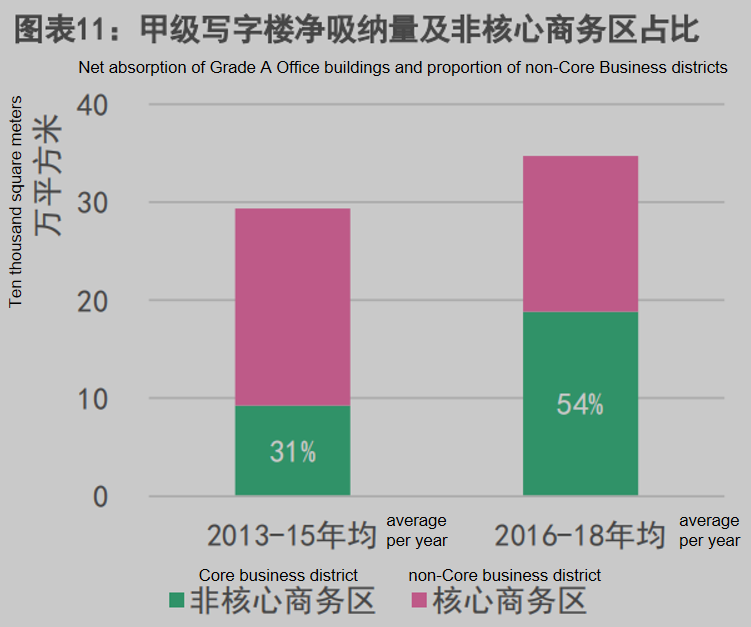

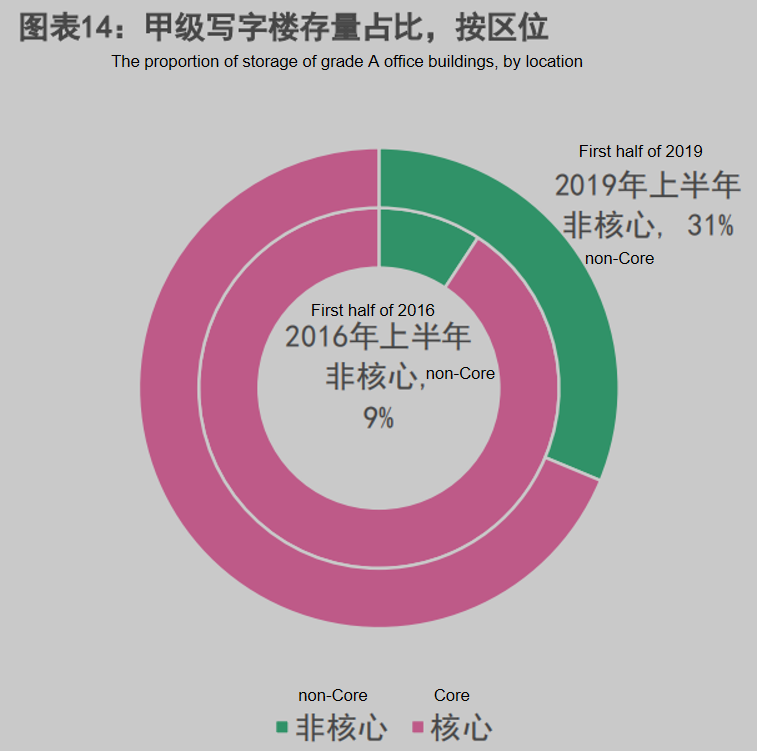

Rise of Non-Core Business District Office Properties: According to CBRE and their analysis of the net absorption of Grade A office space in Beijing and the proportion of non-core business districts, the emergence of non-core business districts has driven a rapid increase in the overall demand for Grade A office space in the city [8]. From 2016 to 2018, there was a significant increase in the net absorption of Grade A office space in non-core business districts and their share in the overall market, coinciding with a general increase in the net absorption of Grade A office space in Beijing. This demonstrates the activating effect of non-core business districts on the overall market.

On the other hand, the proportion of Grade A office space inventory in Beijing increased from 9% to 31% in the city from 2016 to 2019, providing tenants with more investment choices through new supply. Therefore, the growth in supply and net absorption of office properties in non-core business districts presents investment potential in this sector.

Figure 6: Net absorption of grade A office and proportion of non-core business districts in Beijing [8].

Figure 7: The proportion of storage of grade A office buildings, by location [8].

3.2.2. Economic Trends and Analysis of Office Properties in Chaoyang District, Beijing

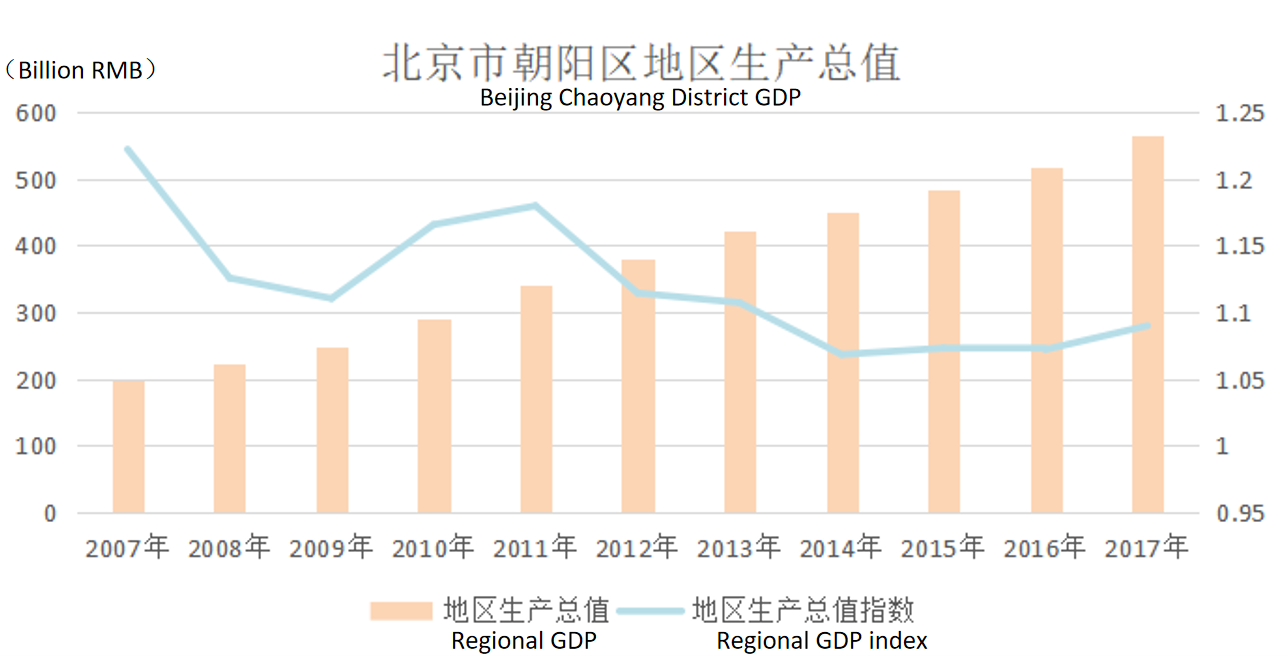

Steady and Slow Growth in Chaoyang District's Regional Gross Domestic Product (GDP): According to the 2018 Statistical Yearbook of Chaoyang District, Beijing, Chaoyang District's regional GDP has maintained steady growth over the past decade [10]. Moreover, the growth rate has slowed down since 2011, indicating a focus on high-quality economic development. This has increased the attractiveness of office properties in Chaoyang District to meet the growing demand. Consequently, it has enhanced the investment potential of office properties in Chaoyang District.

Figure 8: The GDP of CYD, Beijing [10].

Non-core Business District Office Property Market Maintains Development Vitality: According to JLL and their analysis of supply, vacancy, and rental rates in Chaoyang District's non-central business districts, the Wangjing Business District has shown a fluctuating upward trend in rental rates from 2015 to 2019, with a rapid increase in total floor area since the end of 2016 [6]. During these five years, the vacancy area for office properties in the Wangjing Business District has consistently decreased. The Olympic Business District exhibits similar trends in rental rates and total floor area. There has been more significant fluctuation in the vacancy area, but ultimately, it has shown a decreasing trend. It is evident that the demand for office properties in the two non-core business districts of Chaoyang District continues to grow, while the current rate of supply growth is relatively slow, gradually leading to a situation where supply falls short of demand. Therefore, there is significant investment potential in office properties in Chaoyang District's non-core business districts.

Figure 9-10: Wangjing and Olympic areas: supply, vacancy and rent analysis [6].

3.2.3. Opportunities and Challenges in Office Property Investment Due to Economic Factors

Opportunities: Economic growth in Chaoyang District follows a similar trend to that of Beijing, and non-core business districts are gradually experiencing a supply shortage, providing significant potential for the office property investment market.

Challenges: While the office property market in non-core business districts of Chaoyang District is gradually facing a supply shortage, it's important to acknowledge that market competition will continue to intensify, making it more challenging for investors to secure opportunities.

3.3. The Social Factors

3.3.1. Beijing City Office Property-Related Social Trends and Analysis

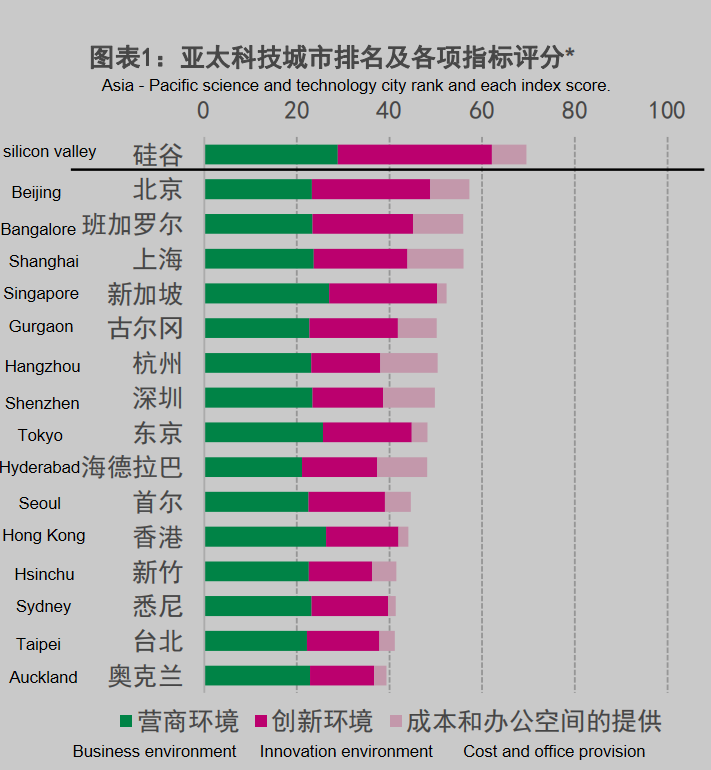

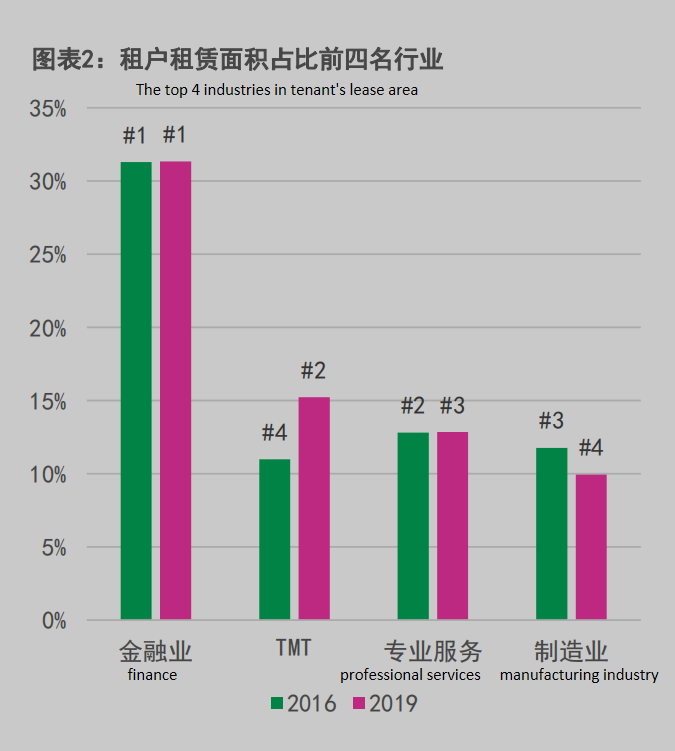

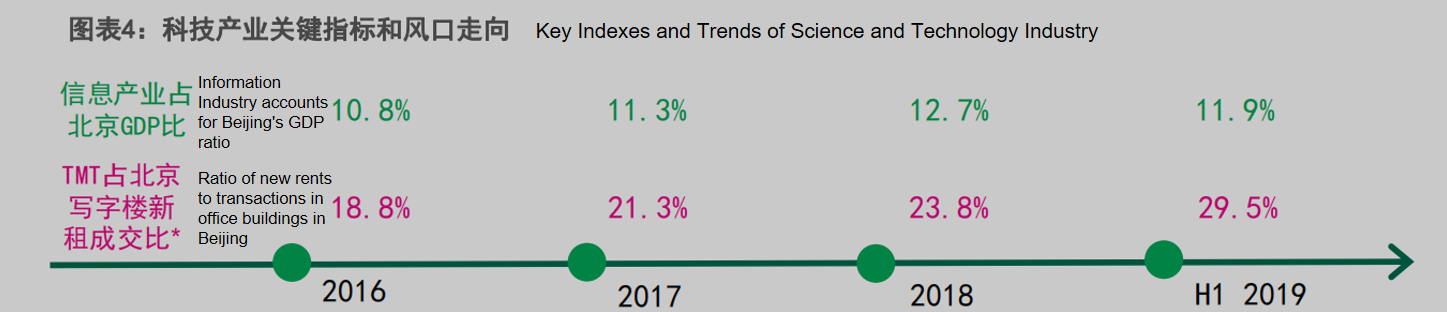

Emerging Dominance in the Technology and Innovation Industry: TMT stands for the technology, media, and telecommunications industries, and the development of these three sectors reflects a city's level of technological innovation. According to a comprehensive analysis by CBRE of Beijing's TMT industry, Beijing ranks as a leader in overall technological innovation capability in the Asia-Pacific region [8]. Moreover, the TMT industry has become the second-largest tenant industry for Grade A office spaces in the past three years, just behind the financial sector. Large-scale office leasing in the TMT industry saw significant growth in 2019 compared to 2016. Additionally, the TMT industry's proportion in Beijing's office properties has been increasing year by year from 2016 to 2019. It is evident that the TMT industry in Beijing is thriving, exhibiting substantial demand for office properties with year-on-year growth, which provides a new direction for the development of office properties in Beijing.

Figure 11: Asia-Pacific science and technology city rank and each index score [8].

Figure 12: The top 4 industries in tenant’s lease area [8].

Figure 13: TMT area range tenant rental area to (full sample) ratio [8].

Figure 14: Key Indexes and trends of science and technology industry [8].

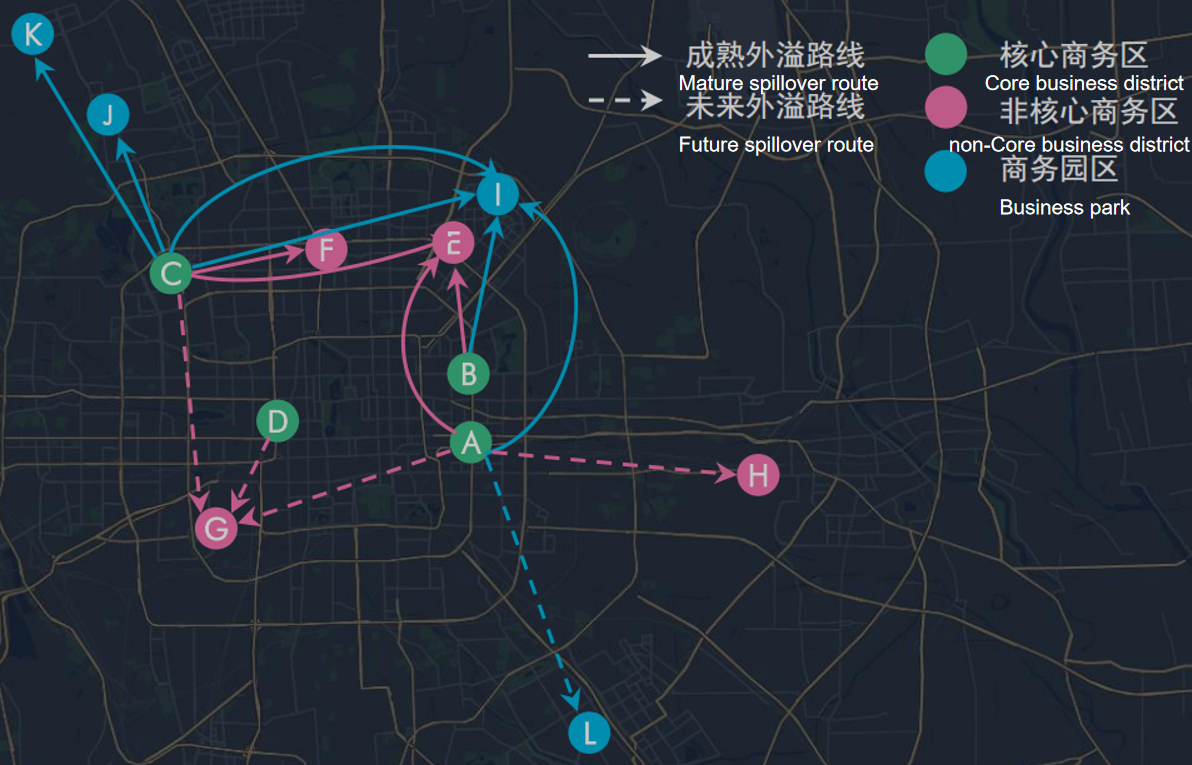

Continuous Optimization and Development of Urban Transportation: According to CBRE's analysis in 2019 regarding the connectivity provided by the Beijing subway system, the improvement of rail transit enhances connectivity between various business districts, facilitating tenant mobility between these districts. This is a crucial prerequisite for tenant demand spilling over into non-core business districts [8]. The travel time between non-core business districts and adjacent core business districts is within 40 minutes, which is a significant factor contributing to the rapid maturity of non-core business districts. Therefore, the rapid development of transportation infrastructure has the potential to contribute to the growth of the office property market in Beijing.

Figure 15: The connectivity of each business district in Beijing [8].

3.3.2. Social Trends and Analysis of Office Properties in Chaoyang District, Beijing

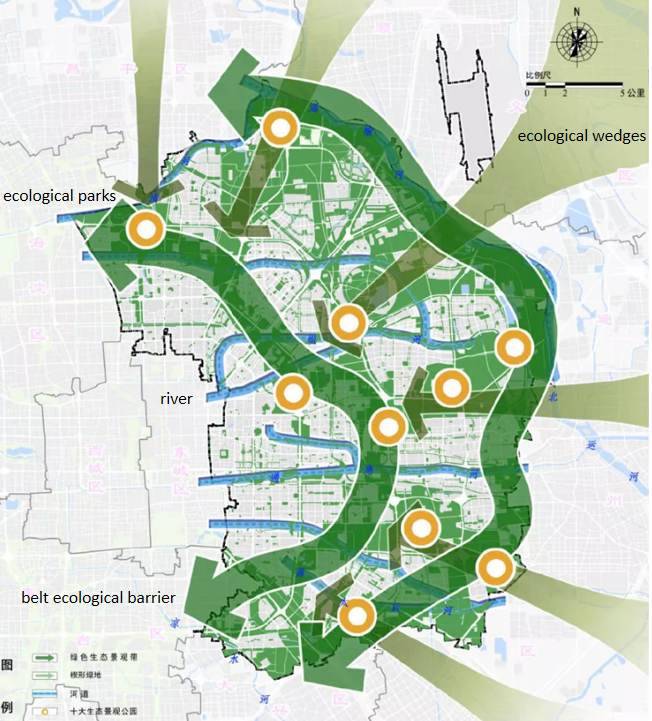

Enhancement of Regional Ecological Environment Quality: According to the planning for the ecological space in Chaoyang District (2017-2035), there will be a systematic improvement of the green space pattern in the region [5]. This includes the development of linear ecological barriers and ecological spaces, as well as the construction of multiple ecological parks along the five rivers that flow through the area. Through a series of ecological developments, Chaoyang District aims to enhance the overall environmental quality of the region, making office properties in this area more attractive and increasing the demand for office properties. Therefore, the construction and enhancement of the ecological environment have the potential to bring significant opportunities for office property investments.

Figure 16: The spatial plan of the regional ecology of CYD [5].

Comprehensive Development of Cultural and Innovative Industries: According to the zoning plan for Chaoyang District (2017-2035) and the 2019 Chaoyang District Government Work Report, Chaoyang District will systematically plan cultural development [5,11]. This includes the integration of traditional and modern fashion cultures, with a focus on new media and creative design. Additionally, there is a push to transform old factories and attract and support internationally renowned exhibitions and large-scale performance events. Efforts are being made to accelerate the integration and collaborative development of culture with technology, finance, business, and other industries. Therefore, the development of the cultural industry will create new demand directions for office properties in Chaoyang District, offering new potential for office property development in this area.

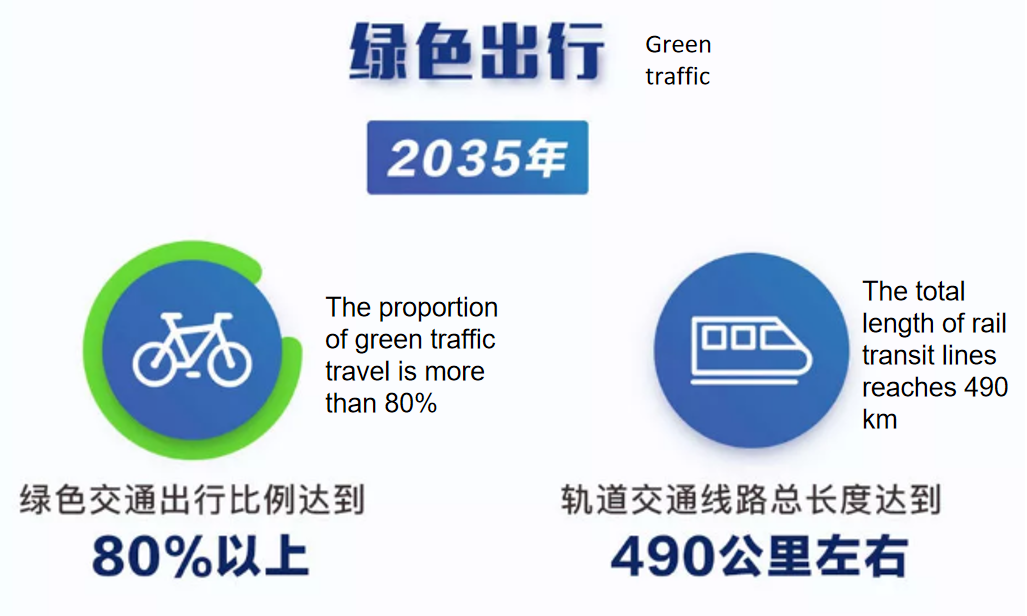

Enhancement of Green Transportation Systems: According to the zoning plan for Chaoyang District (2017-2035) regarding regional transportation, Chaoyang District aims to significantly increase the proportion of environmentally friendly commuting and the total length of the regional rail transit system by 2035 [5]. Building upon Beijing's existing transportation infrastructure, Chaoyang District is improving the integration of non-motorized transportation and rail transit, further enhancing accessibility between business districts. This, in turn, leads to improved office efficiency in various business districts, providing greater investment potential for office properties in Chaoyang District.

Figure 17: The plan of the green traffic in CYD [5].

3.3.3. Social Factors: Opportunities and Challenges for Office Property Investment

Opportunities: The development opportunities for office properties in Chaoyang District mainly stem from the rise of Beijing's technology and innovation industry. These opportunities also come from improvements in the region's ecology, transportation, and culture. These improvements at the social level create new directions for the office property market's development, enhance the quality of existing office properties, increase tenant demand, and provide new growth potential for office property demand.

Challenges: The challenges for office properties in Chaoyang District are primarily related to the government's ability to implement the planned policies effectively at the social level. Quantitative analysis of social factors is difficult at the current stage, and it remains primarily qualitative. Therefore, from the perspective of social factors, there is still uncertainty in office property investments in Chaoyang District.

4. Conclusion and Perspective

Through this comprehensive analysis of the investment potential of office properties in Chaoyang District, Beijing, considering political, economic, and social factors, it is evident that before the pandemic, office property investment in Chaoyang District presented both opportunities and challenges. However, overall, the opportunities outweigh the challenges, making Chaoyang District a location with high potential for commercial real estate investment. It is worth noting that most economic and social factors are subject to government policy regulation. Therefore, investors intending to enter the Chinese real estate market should continually monitor government policies to make accurate assessments of supply and demand dynamics in the market.

Looking ahead to the post-pandemic era and considering the changes in market demand relationships based on scholars' analysis of market trends dominated by the pandemic and the retrospective analysis of Beijing's office property market before the pandemic, this research offers the following insights:

Firstly, from the perspective of real estate analysis methods, this study suggests that reviewing market trends before unexpected events can provide a reference basis for economic and market order recovery in the aftermath of such events. The main content of this research supports this point. Therefore, in future real estate analyses, scholars can integrate short-term and long-term logic, in other words, make judgments based on a larger and more time-spanning dataset. This can lead to a more comprehensive analysis and more accurate predictions of future market conditions.

Secondly, for the post-pandemic era, the overall stability of the Beijing office property market has been confirmed. This also validates the economic resilience of the Chinese economy under government macroeconomic control. Therefore, it can be said that the pandemic served as a "touchstone" for Beijing's office property market. Furthermore, the analysis by scholars reveals that the pandemic had a significant impact on demand structures but also optimized them. In simple terms, industries that required physical stores before the pandemic but transitioned to online operations afterwards no longer have a strong need for physical office spaces. On the other hand, industries that continue to lease office properties long-term demonstrate strong demand. Thus, the average strength of tenant demand for office properties has increased. This implies that office properties are gradually stabilizing in the future supply-demand logic of the real estate market. It can be said that the pandemic created an opportunity for the redistribution of market supply and demand relationships. This is also a vivid case of market economics at work in the real world and is worthy of in-depth consideration.

References

[1]. Zhou Xin & Zhang Bo. (2021). Research on Price Trends in Beijing's Office Property Market and Policy Implications. China Price, 81-84.

[2]. Xie Yun & Ci Wenhui. (2020). Analysis of the Impact of COVID-19 on Commercial Real Estate and CMBS/CMBN. National Circulation Economy, 139-140. doi:10.16834/j.cnki.issn1009-5292.2020.13.062.

[3]. Zhou Xin & Zhang Bo. (2019). The Impact of Livability on Office Rental Prices: A Case Study of Beijing CBD. National Circulation Economy, 135-141. doi:10.16834/j.cnki.issn1009-5292.2019.20.056.

[4]. Colliers Research Institute. (2020). Risks and Opportunities in the Commercial Real Estate Market Under the Epidemic - Colliers Brilliant Commercial Real Estate Epidemic Special Report. Real Estate Guide (Z2), 18-21.

[5]. Chaoyang District People's Government (2019) Chaoyang district planning (2017-2035). Available at: https://mp.weixin.qq.com/s?__biz=MzI2MjExNjQwNw==&mid=2650059977&idx=1&sn=c100ec4f4a26444333fe15cdbe8b972b&chksm=f2501191c5279887e062c6b681308a503f2b58a82ee09b0b9cbb66484e5fd699c97210776cbc&mpshare=1&scene=23&srcid=0102eKwVMjgcSJ45voC6SytZ#rd (Accessed: 10 December 2019).

[6]. Jones Lang LaSalle. (2019) Take advantage of the wind and wave to explore value opportunities - Beijing Commercial Real Estate Investment Market White Paper. Available at: https://www.joneslanglasalle.com.cn/zh/trends-and-insights/research/jll-2019-beijing-commercial-real-estate-investment-report (Accessed: 8 December 2019).

[7]. China National Bureau of Statistics (2019) Regional GDP in Beijing. Available at: http://data.stats.gov.cn/ks.htm?cn=E0102 (Accessed: 10 December).

[8]. CBRE Group, Inc. (2019) The Evolution of the First Class of Office Building in Beijing. Available at: https://www.cbre.com.cn/zh-cn/research-reports/Special Report on Greater China -- The evolving Grade A office market in Beijing (Accessed: 8 December 2019).

[9]. Colliers International (2019) Opportunities and challenges coexist - The office market is facing a greater challenge, but it is also a good opportunity for tenants and investors. Available at: https://www.colliers.com/-/media/files/marketresearch/apac/china/northchina-research/bj-outlook-h2-2019-cn.pdf?la=zh-CN (Accessed: 10 December 2019).

[10]. Chaoyang District Bureau of Statistics (2018) CHAOYANG DISTRICT BEIJING STATISTICAL YEARBOOK 2018. Available at: http://www.bjchy.gov.cn/UserFiles/File/9abfe6744e6143d993b0396089467750.pdf (Accessed: 9 December 2019).

[11]. Chaoyang District People's Government (2019) Report on the work of Chaoyang District Government. Available at: http://www.bjchy.gov.cn/affair/ghjh/zhfgzbg/8a24fe83691212cf016914497fe20179.html (Accessed: 10 December 2019).

Cite this article

Zheng,Z. (2023). Post-Pandemic Office Property Market Analysis and Policy Evaluation: A Case Study of Chaoyang District, Beijing. Advances in Economics, Management and Political Sciences,65,17-30.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zhou Xin & Zhang Bo. (2021). Research on Price Trends in Beijing's Office Property Market and Policy Implications. China Price, 81-84.

[2]. Xie Yun & Ci Wenhui. (2020). Analysis of the Impact of COVID-19 on Commercial Real Estate and CMBS/CMBN. National Circulation Economy, 139-140. doi:10.16834/j.cnki.issn1009-5292.2020.13.062.

[3]. Zhou Xin & Zhang Bo. (2019). The Impact of Livability on Office Rental Prices: A Case Study of Beijing CBD. National Circulation Economy, 135-141. doi:10.16834/j.cnki.issn1009-5292.2019.20.056.

[4]. Colliers Research Institute. (2020). Risks and Opportunities in the Commercial Real Estate Market Under the Epidemic - Colliers Brilliant Commercial Real Estate Epidemic Special Report. Real Estate Guide (Z2), 18-21.

[5]. Chaoyang District People's Government (2019) Chaoyang district planning (2017-2035). Available at: https://mp.weixin.qq.com/s?__biz=MzI2MjExNjQwNw==&mid=2650059977&idx=1&sn=c100ec4f4a26444333fe15cdbe8b972b&chksm=f2501191c5279887e062c6b681308a503f2b58a82ee09b0b9cbb66484e5fd699c97210776cbc&mpshare=1&scene=23&srcid=0102eKwVMjgcSJ45voC6SytZ#rd (Accessed: 10 December 2019).

[6]. Jones Lang LaSalle. (2019) Take advantage of the wind and wave to explore value opportunities - Beijing Commercial Real Estate Investment Market White Paper. Available at: https://www.joneslanglasalle.com.cn/zh/trends-and-insights/research/jll-2019-beijing-commercial-real-estate-investment-report (Accessed: 8 December 2019).

[7]. China National Bureau of Statistics (2019) Regional GDP in Beijing. Available at: http://data.stats.gov.cn/ks.htm?cn=E0102 (Accessed: 10 December).

[8]. CBRE Group, Inc. (2019) The Evolution of the First Class of Office Building in Beijing. Available at: https://www.cbre.com.cn/zh-cn/research-reports/Special Report on Greater China -- The evolving Grade A office market in Beijing (Accessed: 8 December 2019).

[9]. Colliers International (2019) Opportunities and challenges coexist - The office market is facing a greater challenge, but it is also a good opportunity for tenants and investors. Available at: https://www.colliers.com/-/media/files/marketresearch/apac/china/northchina-research/bj-outlook-h2-2019-cn.pdf?la=zh-CN (Accessed: 10 December 2019).

[10]. Chaoyang District Bureau of Statistics (2018) CHAOYANG DISTRICT BEIJING STATISTICAL YEARBOOK 2018. Available at: http://www.bjchy.gov.cn/UserFiles/File/9abfe6744e6143d993b0396089467750.pdf (Accessed: 9 December 2019).

[11]. Chaoyang District People's Government (2019) Report on the work of Chaoyang District Government. Available at: http://www.bjchy.gov.cn/affair/ghjh/zhfgzbg/8a24fe83691212cf016914497fe20179.html (Accessed: 10 December 2019).