1. Introduction

With the advancement of enterprise digital transformation, digital change has become an inevitable trend in enterprise development. As the core institution of enterprise financial services, the financial sharing center plays a vital role. Over the recent years, many Chinese companies have actively promoted digital transformation and achieved significant advancements in the building and running of financial sharing facilities. Sichuan Changhong is used in this article as an example. By comparing its annual report financial data, this article explores the implementation effect of the financial shared service center, summarizes the importance and challenges of the financial shared service center in digital transformation, and puts forward prospects and suggestions for future development.

2. Financial Sharing Center Overview

2.1. Theoretical Research on Financial Shared Services

The theoretical research on shared service centers was first proposed by Robert Gunn. Its core is to effectively share resources such as members of the organization and technology when providing services, and he believes that companies can obtain competitive advantages in decentralized management [1]. On this basis, Bergeron Bryan proposed the effects that shared service centers can achieve. He believed that shared services are a new semi-autonomous business unit that can centralize part of the company's current business operations. In addition, it can decrease costs, enhance efficiency, and improve service quality to internal clients [2]. Scholars generally believe that shared service centers have a certain degree of independence and can operate independently and integrate services that can be standardized while reducing costs [3].

The research and definition of its connotation by domestic scholars are mostly based on foreign theories. The first ones proposed were Gaofeng Zhang, Wei Lu, and Ying Zhang. They believed that it mainly serves internal customers and can be used as an independent business entity which can operates in accordance with the market mechanism, and all "backend" support for each business unit within the enterprise are provided by the service sharing center [4]. Research on the concept of shared service centers for financial transactions are available both at home and abroad has tended to be unified, and a complete definition has gradually emerged.

2.2. Connotation of Financial Sharing Center

Financial Shared Service Center, referred to as FSSC, is a new distributed financial management model established on the ERP system to provide professional production services to internal and external customers from a market perspective. Its core is an internal process, with the purpose of optimizing organizational structure, standardizing processes, improving process efficiency, reducing operating costs or creating value, collects the business of different accounting entities into a shared service center (SSC) for processing.

The theoretical application of financial sharing centers has mainly developed from large multinational enterprises to centrally handle various businesses, thereby generating scale effects which can improving efficiency, and reducing costs. At this time, the sharing center is mainly positioned as a service and transaction processing center. At the beginning of the 21st century, due to the rise of the Internet, the application of information technology and the establishment of databases, efficiency has been further improved, and more and more service contents and transaction links have been included in the sharing.

3. Analysis of Sichuan Changhong’s digital transformation process

3.1. Company Profile

Sichuan Changhong Electric Co., Ltd. was founded in 1958 and listed on the Shanghai Stock Exchange in China in March 1994. After decades of development, Sichuan Changhong has now become a comprehensive multinational business group integrating diversified home appliance production and sales, core component R&D and manufacturing [5]. In 2022, it ranked 78th among the top 500 Chinese manufacturing companies, and in 2023, it ranked 150th among the top 500 listed companies in China by Fortune. Currently, Sichuan Changhong adheres to the business philosophy of "leading technology and winning with speed", actively building an Internet of Things industrial system, and moving towards the ambitious goal of "a globally respected enterprise".

3.2. Motivation for the Construction of Changhong Group’s Financial Sharing Center

3.2.1. Enterprise’s Future Strategic Layout Requirements

With the quick advancement of new technologies like cloud computing, big data, and artificial intelligence, corporate finance continues to move toward automation, digitization, and intelligence. Company scale continues to expand, and business scope increases. Traditional financial organizational structures and accounting processing models cannot complete complex tasks. sex, real-time and diverse data processing [6]. Sichuan Changhong is committed to encouraging the digital transition and innovative business growth. The financial sharing center is constantly given new functions. Improving the construction of the financial sharing center can provide the company with stronger financial support and management capabilities [7].

3.2.2. Challenges and Responses to Global Risk Management and Control

Sichuan Changhong actively promotes its internationalization strategy. By the end of 2022, it has as many as 170 equity-holding subsidiaries spread across the world. The development of such a huge global market also poses challenges to company risk management and control, such as coping with different accounting legal regulations and policy restrictions; overcoming low management efficiency due to language and other factors; how to establish a reliable transnational supply chain network, etc [8]. In response to the above challenges and risks, building a center for financial sharing can centrally process and manage the financial services of multiple subsidiaries or departments, and achieve the standardization and intensification of financial processes. As shown in Figure 1, nearly 70% of the subsidiaries and branches of the companies surveyed can enjoy related services provided by their headquarters shared service centers. By sharing resources and optimizing processes, they can improve the efficiency of financial processing [8].

Figure 1: Whether the Financial Sharing Center provides services to overseas

Data source: "2022 China Shared Services Field Research Report"

3.2.3. Enterprise Internal Finance Management Models Must be Quickly Enhanced.

Before the comprehensive construction of the financial sharing center, Sichuan Changhong's internal management had problems such as a chaotic organizational structure and an unreasonable performance management system, which greatly affected the efficiency and accuracy of the company's decision-making, and also brought about accounts receivable and other accounts. processing problems [9]. The company's receivable project management procedure can be managed centrally and standardized by the financial sharing center, and achieve resource optimization and cost control by establishing effective risk management and credit policies.

3.3. Development History of Changhong Group Financial Sharing Center

Currently, the enterprise's data center is the financial sharing center, preserving a substantial volume of data produced by the enterprise's regular business operations. As mobile Internet technology is already available in the financial sharing center, the sharing platform and the mobile Internet have been effectively combined, and cloud computing technology has been widely used in finance. The wide application in sharing centers has influenced the financial sharing center to expand progressively in the direction of virtualization and commercialization [10].

As the business has grown quickly and its number of subsidiaries has increased, the traditional organizational model in the past has put pressure on the company's financial system, forcing Changhong Group to undergo digital transformation. Its business development can be mainly divided into three stages, namely the basic development period (2014-2016), the comprehensive development period (2017-2019), and the intelligent development period (2020- present).

(1) Basic development period: In 2014, mainly responsible for the financial management and shared services of the subsidiaries of Changhong Group. In 2015, they began to provide financial shared services to external partners. In 2016, they strengthened communication and coordination with partners and provided more comprehensive and professional services.

(2) Comprehensive development period: In 2017, it began to provide financial shared services to overseas subsidiaries. In order to increase the effectiveness and precision of financial management in 2018, they investigated the use of cutting-edge technologies like artificial intelligence and big data analysis. In 2019, a mobile financial management platform was launched to strengthen collaboration with other departments of Changhong Group and provide more comprehensive financial consulting and support services.

(3) Intelligent development period: From 2020 to the present, new financial management systems and software tools have been introduced to enhance the ability to process and analyze financial data. At the same time, they have actively investigated the usage of emerging technologies like smart contracts and blockchain technology to improve financial management security and transparency.

4. Current Status of Implementation of Changhong Group’s Financial Sharing Center

4.1. The Location of the Financial Sharing Center of Changhong Group in the Organizational Structure

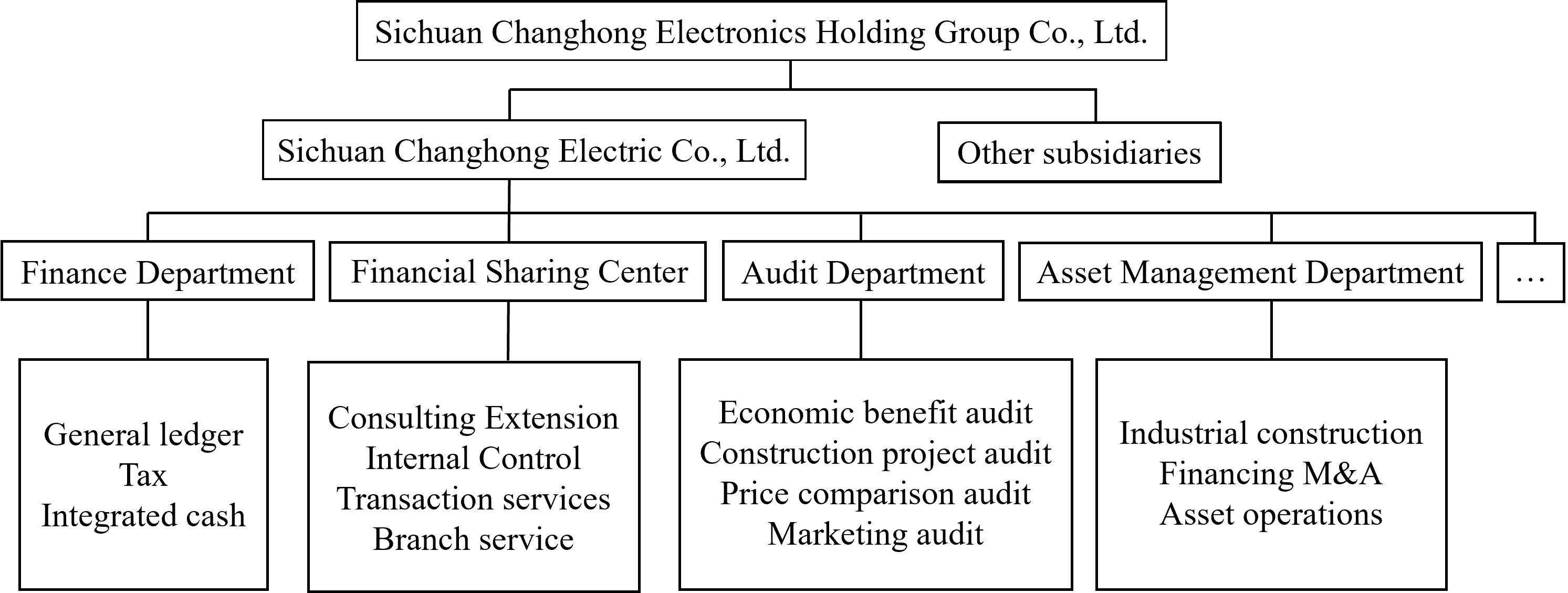

ACCA in 2022 shows that 61.23% of the shared service centers among the companies surveyed are affiliated with the headquarters finance department, and only 12.33% are at the same level as the finance department. Sichuan Changhong has been operating at the same level since 1995. At first, they tried to centralize financial information, established a center for financial management and service in 2005, and in 2008, they established a service for financial sharing. It can be said that when it was first established, the management decided to classify FSSC, the Finance Department, the Fund Management Center, etc. as secondary departments, rather than being one of the subordinate departments of the Finance Department. They have the ability to conduct independent daily activities and performance management, with greater flexibility and autonomy, reflecting the leadership's emphasis on the construction of the Financial Sharing Center (see Figure 2).

Figure 2: Sichuan Changhong organizational structure chart

4.2. Internal Implementation Structure of Changhong Group Financial Sharing Center

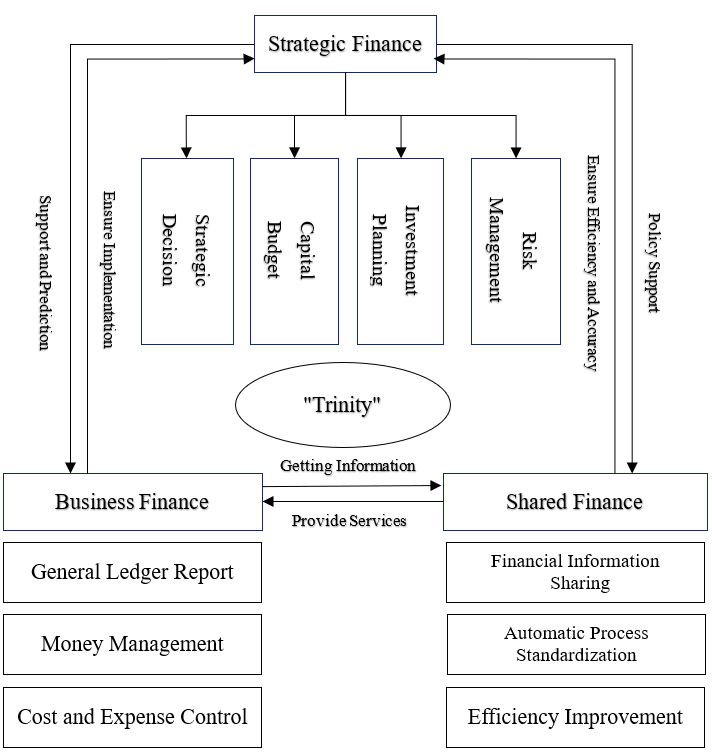

In order to promptly identify and respond to potential financial operating risks, Sichuan Changhong has established a "trinity" financial management organizational structure of strategic finance, shared finance and business finance to support corporate decision-making and management and optimize resource allocation and utilization [11]. The details are shown in Figure 3.

(1) Strategic finance refers to the formulation and implementation of plans at the corporate management group level to support the long-term development and profitable growth of the enterprise [12]. Its main responsibilities include strategic-level goal determination and planning, as well as capital budgeting and investment decisions, to provide financial support for the company's strategic goals. In order to secure the long-term success of the business, it is also essential to evaluate and manage the financial risks connected with strategic choices.

(2) The financial management tasks are the responsibility of the business finance staff, carried out in various departments of the enterprise, including cost and expense control, evaluation and analysis of financial performance, providing support and suggestions for business decision-making, and managing the flow and operation of funds in various departments to support various corporate strategies. Decision implementation and adjustment [13].

(3) Shared finance is responsible for centrally processing and managing financial activities and related information, ensuring information communication between various departments and business units, improving efficiency and reducing costs by realizing standardized and automated financial processes, and achieving collaborative advancement among various businesses [12].

Figure 3: Schematic diagram of Sichuan Changhong’s “Trinity” financial management organizational structure

4.3. Analysis of the Implementation Effect and Impact of Changhong Group Financial Center

4.3.1. Achieve Revenue Growth and Optimize Resource Allocation

By establishing a financial sharing center, companies can centrally handle related business activities, improve the timeliness and accuracy of decision-making, and thus have a positive impact on operating income. As shown in Table 1, Sichuan Changhong's operating income was 23.047 billion yuan in 2007, and reached 924.82 in 2022, a year-on-year increase of nearly 4 times [9]. The number of financial personnel declined significantly in 2017 and has maintained this trend, but the per capita output of financial personnel has increased by 95 million yuan. It is clear that the use of digital technology presents difficulties for the duties and job placement of financial people. Financial personnel need to continuously improve their financial knowledge and professional qualities to adapt to new requirements. At the same time, better human resources will also bring In the future, enterprise efficiency will be improved and operating income will be significantly increased [14].

Table1: Changes in Sichuan Changhong’s operating income and number of financial personnel from 2007 to 2022

Years | Operating income (100 million yuan) | Financial personnel (person) | Per capita output of financial personnel (100 million yuan) |

2007 | 230.47 | 957 | 0.24 |

2008 | 279.30 | 1157 | 0.24 |

2009 | 314.58 | 1149 | 0.27 |

2010 | 417.12 | 1154 | 0.36 |

2011 | 520.03 | 1223 | 0.43 |

2012 | 523.34 | 1273 | 0.41 |

2013 | 588.75 | 1194 | 0.49 |

2014 | 595.04 | 1180 | 0.50 |

2015 | 648.48 | 1172 | 0.55 |

2016 | 671.75 | 1167 | 0.58 |

2017 | 776.32 | 818 | 0.95 |

2018 | 833.85 | 991 | 0.84 |

2019 | 887.93 | 842 | 1.05 |

2020 | 944.48 | 906 | 1.04 |

2021 | 996.32 | 816 | 1.22 |

2022 | 924.82 | 776 | 1.19 |

Data source: Sichuan Changhong Annual Report

4.3.2. Reduce Management Costs and Improve Operational Efficiency

While implementing digital technology, the financial sharing center reduces the labor and cost management expenses incurred by each business department by centrally managing financial resources. In addition, through the automated processing and data integration of the financial system, the labor and cost of manual processing are reduced. workload, greatly improving work efficiency [14]. It can be seen from Table 2 that since the construction of the "Financial Cloud" in 2012, Sichuan Changhong's management expense projects have shown an overall downward trend from 2007 to 2022. In 2014, the increase in many new companies and non-controlling mergers caused a temporary decline. The administrative expenses increased, but then the downward trend of administrative expenses gradually stabilized [8]. While overall operating expenses are still rising, the proportion of administrative expenses in total operating costs continues to decrease. The establishment of a financial sharing center has a significant impact on enterprises in reducing costs and increasing efficiency.

Table 2: Proportion of administrative expense items in Sichuan Changhong from 2007 to 2022

Years | Management expenses (100 million yuan) | Total operating costs (100 million yuan) | Total assets (100 million yuan) | Administrative expenses/total operating costs | Management expenses/total assets |

2007 | 8.53 | 229.85 | 230.57 | 3.71% | 3.70% |

2008 | 11.48 | 276.92 | 287.25 | 4.15% | 4.00% |

2009 | 12.95 | 310.38 | 365.36 | 4.17% | 3.54% |

2010 | 16.19 | 418.34 | 445.56 | 3.87% | 3.63% |

2011 | 20.67 | 518.62 | 516.51 | 3.99% | 4.00% |

2012 | 22.63 | 523.32 | 545.46 | 4.32% | 4.15% |

2013 | 27.10 | 582.77 | 588.37 | 4.65% | 4.61% |

2014 | 30.14 | 598.98 | 602.25 | 5.03% | 5.00% |

2015 | 28.46 | 661.30 | 556.15 | 4.30% | 5.12% |

2016 | 27.30 | 665.74 | 598.63 | 4.10% | 4.56% |

2017 | 26.52 | 770.36 | 654.23 | 3.44% | 4.05% |

2018 | 15.56 | 832.05 | 715.05 | 1.87% | 2.18% |

2019 | 16.90 | 886.13 | 739.89 | 1.91% | 2.28% |

2020 | 14.98 | 938.15 | 785.88 | 1.60% | 1.91% |

2021 | 17.66 | 985.55 | 794.00 | 1.79% | 2.22% |

2022 | 17.43 | 904.50 | 855.38 | 1.93% | 2.04% |

Data source: Sichuan Changhong Annual Report

4.3.3. Improve Management Processes and Enhance Operational Capabilities

As can be seen from Figure 4, Sichuan Changhong's inventory turnover rate has basically shown an upward trend year by year from 2007 to 2022. Taking into account the use of the ERP system, the inventory turnover efficiency can be improved by formulating standardized inventory management processes. The inventory turnover rate declined slightly from 2015 to 2017, but rose again in 2018. Sichuan Changhong has maintained efficient supply chain management and inventory management capabilities, proving the positive effect of the financial sharing center on the company's operational capabilities [14].

Figure 4: Schematic diagram of changes in inventory turnover rate of Sichuan Changhong from 2007 to 2022 (Data source: Sichuan Changhong Annual Report)

4.3.4. Providing Support for Enterprise Transformation

Financial sharing does not stop at handling basic financial accounting operations. Sichuan Changhong Financial Cloud Center As of the end of 2019, except for a few subsidiaries that have not been included in the service scope, all other branches have been included in the service scope. For instance, Sichuan Changhong connected to the accounts receivable financing service platform of the Bank of China using big data technology and supply chain data held in the financial cloud center to conduct accounts receivable financing pilot projects. To a certain extent, it helps its suppliers solve the problems of difficult financing and complicated financing procedures in response to the requirements of enterprise transformation, and provides certain support for enterprise transformation [15].

4.3.5. Ensure Information Security and Strengthen Risk Control

Financial information exchange must guarantee the security of such data, as well as its confidentiality, integrity, and dependability. Technical assistance and management of information security must be improved. Financial sharing enables the exchange of financial information and data, as well as enhancing communication and cooperation amongst group subsidiaries. This can strengthen business collaboration within the group and improve the accuracy and timeliness of decision-making.

4.3.6. The Financial Sharing Function is not Fully Utilized

Sichuan Changhong’s value management has independent departments, which inevitably makes people suspect that the basic work of value management information collection, processing, comparison, and analysis is still done manually, and the financial cloud center has not fully utilized. Function [15].

5. Financial Shared Service Centers' Development in the Age of Digital Empowerment

5.1. Impact and Enlightenment

The financial shared service center can implement automated accounting and reporting operations with the help of digitization, which would reduce labor and time costs. Digitization can help financial shared service centers collect, organize and analyze large amounts of financial data and provide more accurate and detailed financial reports. This data can help companies better understand their financial health and make smarter business decisions. By automating financial processes, you can increase productivity and accuracy and reduce errors and duplication of work. Financial shared service centers need to pay attention to data security and privacy protection. Financial data is one of the most important assets of a business, by automating accounting and reporting operations, the financial shared service center can save personnel and time costs.

5.2. Benefits and Challenges

Digitization can realize automated processes and operations, reducing manual time and energy consumption. Employees can quickly complete tasks through digital systems, improving work efficiency and productivity. Digital systems can reduce the possibility of human error and data omissions, and increase the data's precision and dependability. Modern technical infrastructure is needed for digitalization, including cloud computing, big data analysis, artificial intelligence, etc. However, the adoption and use of these technologies typically involve significant financial investment and technical expertise, which can be difficult for businesses. Digitization has brought about massive data collection and processing, but it has also increased risks to data security and privacy. Enterprises usually have different systems and data sources, and digitalization requires the integration and integration of these systems and data.

5.3. Digital Future Prospects

As artificial intelligence develops, machines will become more automated and intelligent.

Artificial intelligence will be applied to various industries, including medical care, finance, transportation, education, etc., to bring more efficient, convenient and intelligent services to people. The digital economy will change the business models of traditional industries, promote innovation and entrepreneurship, and accelerate economic growth. Digital education will provide students with more personalized and high-quality education.

Digital technology will change traditional education methods and make learning more flexible, convenient and interactive. Digital medical care will increase the effectiveness and caliber of medical care. Digital technology will enable a more equitable distribution of medical resources and provide patients with better diagnosis, treatment and health management services. Digital cities will improve urban management and residents’ quality of life. Digital technology will be applied to urban transportation, environment, public safety and other aspects to realize the construction of smart cities. We can look forward to further development and innovation of digital technology to bring more convenience and changes to people's lives.

6. Conclusion

A key aspect of an enterprise's digital transformation is the creation and growth of a financial sharing center. Enterprises now need to employ financial sharing centers to optimize financial processes, enhance efficiency, lower costs, and meet the demands of global operations due to the rapid development of information technology and the popularity of intelligent apps. Second, the full application of cutting-edge technologies like digital technology and cloud computing is necessary for the creation of the financial sharing center. These technologies may perform tasks including real-time information sharing, centralized data administration, and collaborative work processing, all of which increase the effectiveness of financial management.

The Financial Sharing Center is a leader in the "big intelligence moves to the cloud" era's digital transformation of businesses. The financial sharing center is able to enhance financial processes, increase productivity, and assist the long-term growth of businesses by utilizing cutting-edge digital technology, cloud computing, and other technologies. The real-world example of Sichuan Changhong offers experience and motivation for other businesses building financial sharing centers.

Authors Contribution

All the authors contributed equally and their names were listed in alphabetical order.

References

[1]. Gunn R W ,Carberry D P ,Frigo R, et al. (1993) Shared services: major companies are re-engineering their accounting function.

[2]. Bergeron B .Essentials of shared services. (2002) J. Wiley,.

[3]. Zhou Jie, Qiao Ying. (2019) Review of research on financial shared services. Shopping Mall Modernization, (18), 3.

[4]. Zhang Gaofeng, Lu Wei, Zhang Ying. (2003) Enterprise's new "backend" service sharing center [J]. Enterprise Reform and Management, (2), 2.

[5]. Li Zhimin. (2023) Analysis of the impact of the financial sharing center model on enterprises—taking Changhong Group as an example. China Township Enterprise Accounting, (04), 91-93.

[6]. Hou Yuxin. (2023) Research on the impact path and effect of financial sharing on corporate performance. Shanghai Normal University.

[7]. Cheng Zhimeng. (2023) Discussion on optimization of operation management of financial shared service center. Quality and Market, (11), 37-39.

[8]. ZTE Xinyun. Research Report on China’s Shared Services Field in 2022 - Towards a World-Class. 2022-05-21.2023-07-25. https://mp.weixin.qq.com/s/Xtq1xPuPmMJijPuWmHqyNA

[9]. Gao Gao. Research on the Implementation Effect of Group Enterprise Financial Shared Service Center. Jilin University of Finance and Economics, 2020.

[10]. Wang Huimin, Xu Min, Zhang Kaiyan. (2023) Analysis on the development and construction of enterprise financial shared service centers in the digital economy era. Chinese Market, (15), 145-148.

[11]. Lisa Gu. Discussion on the application of financial shared services in Chinese enterprise groups. Jiangxi University of Finance and Economics, 2020.

[12]. Huang Changyin, Wang Ying, Wu Zhongsheng, et al. (2022) Research on risk management in the construction and operation of financial shared service centers. Business Accounting, (22), 60-64.

[13]. Liu Wencheng. (2023) Research on the practice and optimization of business and financial integration of modern enterprises. China Logistics and Procurement, (04), 116-117.

[14]. Wu Yanwen. (2020) Application research on the financial shared service model in the Internet+ era—taking Sichuan Changhong as an example. Western Accounting, (09),31-35.

[15]. Zhou Qin. (2020) Research on the impact of financial shared services based on technology upgrade on corporate financial management--taking Sichuan Changhong Financial Cloud as an example, (04):71-75.

Cite this article

Xu,K.;Yu,X.;Zheng,Y. (2024). Financial Sharing Centers Lead Digital Transformation in the Era of “Great Wisdom Moves to the Cloud” —Taking Sichuan Changhong as an Example. Advances in Economics, Management and Political Sciences,70,1-11.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Gunn R W ,Carberry D P ,Frigo R, et al. (1993) Shared services: major companies are re-engineering their accounting function.

[2]. Bergeron B .Essentials of shared services. (2002) J. Wiley,.

[3]. Zhou Jie, Qiao Ying. (2019) Review of research on financial shared services. Shopping Mall Modernization, (18), 3.

[4]. Zhang Gaofeng, Lu Wei, Zhang Ying. (2003) Enterprise's new "backend" service sharing center [J]. Enterprise Reform and Management, (2), 2.

[5]. Li Zhimin. (2023) Analysis of the impact of the financial sharing center model on enterprises—taking Changhong Group as an example. China Township Enterprise Accounting, (04), 91-93.

[6]. Hou Yuxin. (2023) Research on the impact path and effect of financial sharing on corporate performance. Shanghai Normal University.

[7]. Cheng Zhimeng. (2023) Discussion on optimization of operation management of financial shared service center. Quality and Market, (11), 37-39.

[8]. ZTE Xinyun. Research Report on China’s Shared Services Field in 2022 - Towards a World-Class. 2022-05-21.2023-07-25. https://mp.weixin.qq.com/s/Xtq1xPuPmMJijPuWmHqyNA

[9]. Gao Gao. Research on the Implementation Effect of Group Enterprise Financial Shared Service Center. Jilin University of Finance and Economics, 2020.

[10]. Wang Huimin, Xu Min, Zhang Kaiyan. (2023) Analysis on the development and construction of enterprise financial shared service centers in the digital economy era. Chinese Market, (15), 145-148.

[11]. Lisa Gu. Discussion on the application of financial shared services in Chinese enterprise groups. Jiangxi University of Finance and Economics, 2020.

[12]. Huang Changyin, Wang Ying, Wu Zhongsheng, et al. (2022) Research on risk management in the construction and operation of financial shared service centers. Business Accounting, (22), 60-64.

[13]. Liu Wencheng. (2023) Research on the practice and optimization of business and financial integration of modern enterprises. China Logistics and Procurement, (04), 116-117.

[14]. Wu Yanwen. (2020) Application research on the financial shared service model in the Internet+ era—taking Sichuan Changhong as an example. Western Accounting, (09),31-35.

[15]. Zhou Qin. (2020) Research on the impact of financial shared services based on technology upgrade on corporate financial management--taking Sichuan Changhong Financial Cloud as an example, (04):71-75.