1. Introduction

1.1. Background

China is currently implementing its Fourteenth Five Year Plan (2021-2025) that deviates from past practices by not including gross domestic growth (GDP) targets for the next five years [1]. Growth targets are set annually at 4.7% annually for the next 15 years. With a shrinking labor force and aging society, increasing labor productivity is also key. Economic development stimulates domestic demand and consumption and less reliance on exports. Policy recommendations include addressing social and environmental challenges that have occurred due to the rapid economic expansion of the last two decades. Policy recommendations also include strengthening domestic capacity for the innovation services sector and upgrading human capital through increased years of tertiary education. This paper takes a qualitative approach with no use of primary data.

1.2. Research Structure

The rest of this paper is arranged as follows: the second section is a theoretical framework, the third section is a current situation analysis, the fourth is a policy analysis, and the last section is the future economic outlook of China. The theoretical framework explores various economic models that can explain the Chinese economic system, while the current situation analysis paints a picture of how the economy in China is performing. The fourth policy analysis section looks into current fiscal and monetary policies used in China. The last section suggests economic models that can be used in China to ensure future consistent growth. The conclusion shows that in a world where countries are increasingly protective of domestic industries and where investors are withdrawing from China, policymakers will have to focus on internal growth and consumption as the drivers of economic growth.

2. Theoretical Framework

2.1. Classical School of Economics

Adam Smith posited that in an economy, capital is directed to where most profits can be generated. In essence, capital investments generate the most profits. In addition, economic behavior is motivated by players in the economy who are self-interested [2]. An ideal economy should rest on savings, division of labor, and large markets. In the case of China, this theory shows that economic development should be driven by large savings by citizens, increased division of labor, especially in services, and continued expansion of markets internally and externally. Currently, internal markets and domestic consumption have not fully maximized as a driver of economic growth.

2.2. Neoclassical

This theory states that demand and supply are the main drivers of prices, production, and consumption in an economy [3]. It is concerned with the efficient allocation of limited resources of production. It assumes that the main purpose of individuals is to maximize utility and that efficient allocation of resources is achieved when markets are in equilibrium. In the context of China, achieving continued economic growth should be based on the efficient allocation of limited resources. Market equilibrium, where demand and supply are equal, should be used to ensure resources are allocated efficiently. This may translate into continued allocation of resources in the Eastern side of China that drives the economy. China needs to rethink resource allocation to state-owned enterprises versus private enterprises.

2.3. Keynes and New Keynes

Keynesian theory asserts that aggregate demand is the most important driving force in an economy [4]. Aggregate demand consists of spending by government, businesses, and households. Keynesian proponents argue that government intervention is necessary to achieve full employment and maintain price stability. New Keynes digresses from Keynesian theory by emphasizing economic stability and growth rather than full employment. New Keynes theory, in the case of China, can be used to ensure that economic growth and stability are the main focus compared to trying to achieve full employment. This may also entail using elements of Keynesian economics, such as government intervention, to maintain price stability. In this context, the two theories concur in terms of maintaining price stability.

2.4. Logical Framework

A logical framework that combines the theories would combine Keynesian and New Keynesian economic policies. This framework is capable of analyzing the scenarios below of current economic situation analysis and also policy analysis. The aim of the framework is to ensure that aggregate demand is the most important driving force [4]. Aggregate demand consists of spending by the government, businesses, and households. In China, the government is a significant spender at the local and national level. Government spending should be reduced slightly, instead creating an environment where businesses and households spend more. In conjunction with Keynesian policies, New Keynesian policies should also be employed to boost economic stability and growth rather than full employment.

3. Current Situation Analysis

3.1. GDP and GDP Growth in China

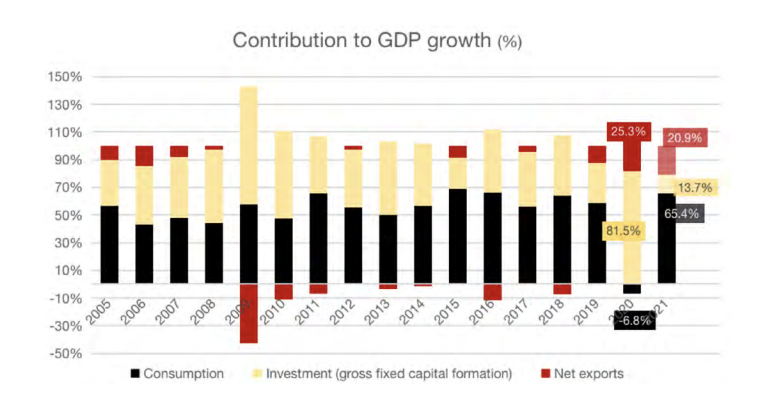

From 2013 to 2023, the economy has been growing at reduced rates annually. The rates were 7.43% in 2013-2014, 7.04% in 2014-2015, 6.85% in 2016-2016, 6.95% in 2016-2017, 6.75% in 2017-2018, 5.95% in 2018-2019, 2.24% in 2019-2020, 8.45% in 2020-2021, and 2.99% in 2021-2022 [5]. This shows a marginal loss in growth that was highest in 2019-2020 due to Covid-19. The main drivers of GDP are consumption, investments, and exports, as shown in the figure below. Consumption became the biggest contributor to GDP growth in 2021 at 65.4% [5]. While China is known for exports and as the world’s factory, exports come third after consumption and investment. At the same time, investments have fallen from 81.5% in 2020 to 13.7% in 2021 [5]. Construction and real estate as a share of the GDP shrank to 6.3% and 6.7% from 7.2% and 7.3%, respectively, in 2020. Construction in China is a major driver of economic growth, especially in real estate. The shrinking numbers in construction are in real estate, where there is oversupply and where supply is greater than demand.

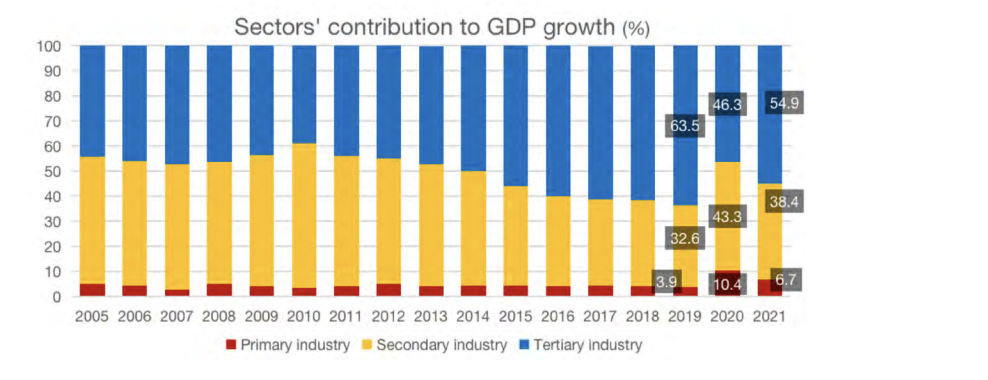

In terms of sector contribution in the industrial sector, primary industry has been low while tertiary industry (services) has been rising, as shown in the figure below. Government expenditure contributed 47.4% of GDP in 2021 and came from local and national governments [5]. The digital economy has continued to rise and contributed 38.6% of GDP in 2020(Figure 1).

Figure 1: China's GDP by Sector, Source: UNDP

3.2. Economic Activities in China

Other economic growth metrics include retail sales, which have steadily risen from 2013 to 2023 and average a year-on-year increase of 2.5% [6]. The Consumer Price Index (CPI) has averaged 106 points and was highest in 2020 at 114 due to Covid-19 [6]. Other factors that may affect the future economic trend include a fast aging population where over 200 million people are above 65 years [5]. Surveyed unemployment has risen from 10.8% in 2018 to 14.3% in 2021. Urbanization has also increased and reached 64.7% in 2021(Figure 2). The Ginni coefficient for income was highest in 2008 at 0.491 and declined to the lowest level at 0.462 in 2015[1].

Figure 2: Sectoral contribution to GDP, Source: UNDP

3.3. Trade Sector in China

Retail sales are a major indicator of private consumption and have been rising steadily in China year-on-year. Retail sales are driven by five main sectors: catering, automobiles, daily used goods, clothing, and pharmaceuticals [7]. The retail market is projected to keep rising with a CAGR of 10% into the future [8]. In 2022, retail sales generated $ 6 trillion and were greatly boosted by e-commerce. The rise in e-commerce was a result of social restrictions during Covid-19. In terms of overall trade activity, the Chinese context has been resilient due to a surge in global demand for electronics and medical goods during and immediately after COVID-19 [7]. The major imports of China are minerals, machinery, and metals. Exports continue to outstrip imports annually.

3.4. Summary

The above reveals that consumption, investments, and exports are China's major drivers of economic growth. Consumption in retail sales is robust and is projected to keep increasing yearly into the future. Keynesian theory asserts that aggregate demand is the most important driving force in an economy [4]. As such, the aggregate demand for consumer goods by government, businesses, and households is high in China. Investments are also a major driver in creating gross fixed capital. Investments from a neoclassical perspective show that investors are concerned with maximizing their utility in Chinese investments due to cheaper labor and efficient allocation of limited production resources [3]. As such, inflows in terms of FDI may continue to play a vital role in the future.

4. Policy Analysis

4.1. Monetary Policy

The monetary policy in the last five years has targeted several areas, including maintaining reasonable growth in credit and stabilizing employment [9]. The monetary policy has ensured price stability, keeping the consumer price index below 2% and a market-based exchange rate to stabilize the macroeconomy. In 2018, the need to maintain stability in credit growth was identified as a pivotal monetary policy pillar to match levels of GDP growth [10].

This emphasis aimed at ensuring that debt growth relative to GDP growth was reasonable. At the same time, price-based policy tools such as adjusting interest rates have been diminished. In the last five years, the Chinese government has reduced the reserve ratio for financial institutions by 0.25% to ensure reasonable liquidity [10]. RMB 400 billion was injected into markets through the Medium-term Lending Facility, while RMB 200 billion was launched through the central bank for lending to sci-tech firms [10].

4.2. Fiscal Policy

The fiscal policies since 2018 have aimed at ensuring high-quality economic growth in the short and medium term [10]. When COVID-19 hit China in 2020, the government undertook policies aimed at recalibrating the macro-economy and easing COVID-19 restrictions. The policy has shifted from infrastructure projects with low investments to supporting households. Measures put in place included temporary cuts in social security contributions and short-term relief in labor tax. In addition, the government instituted policies to end the real estate crisis where demand is determined by household income rather than investment-driven demand [10]. Another fiscal policy aimed to raise domestic productivity growth in the medium term.

The measures instituted above include the removal of local protectionism, making the competitive space between private and state-owned enterprises more neutral, and reducing resource allocation to state-owned enterprises. After COVID-19, exports started to lag, and the government allocated significant resources to promote local consumption, with RMB 45.9 billion set aside for agricultural insurance [10]. Overall, the fiscal policy over the last five years has been expansionary.

5. Chinese Economy in the Future

5.1. Outlook

The current global economic situation is bleak with the current Ukraine-Russia war that has made global markets cautious. The war has resulted in significant geo-political realignments, more so with BRICs becoming larger and starting the process of de-dollarization. The domestic situation is equally blea, with many investors shifting to India and Vietnam due to the political uncertainty of the Chinese government.

One of the most prominent future trends is local innovation to make China competitive as an original manufacturer. Innovation is also necessary as an aging population and shrinking labor make China lose its edge as a location for cheap manufacturing. In this sense, China must invest in value-added manufacturing and production of original goods that can compete globally. Another future trend will be a shift from resource allocation to state-owned enterprises and leaving market forces to establish equilibrium where demand and supply are optimal. Reducing investments in low-return infrastructure in favor of welfare distribution will also be a future trend in the Chinese economy.

5.2. Policy Recommendation

The policy recommendation is for the Chinese government to enforce Keynesian and New Keynesian economic policies. The aim is to ensure that aggregate demand is the most important driving force [4]. Aggregate demand consists of spending by the government, businesses, and households. At the same time, government spending should be reduced slightly, instead creating an environment where businesses and households spend more. This will reduce infrastructural spending that has low returns and sometimes creates ghost investments. In equal measure, some Keynesian elements are necessary where government intervention is necessary to achieve price stability. This should be mostly through monetary policies that widen the circulation of credit and low-interest rates. In conjunction with Keynesian policies, New Keynesian policies should also be employed to boost economic stability and growth rather than full employment. New Keynes theory, in the case of China, can be used to ensure that economic growth, even at lower annual rates below 5% and stability, is the main focus compared to trying to achieve full employment.

6. Conclusion

The future economic trend is for monetary and fiscal policies to remain expansionary. The trend should stimulate local consumption while making sure export levels remain high. Stabilizing employment and widening credit circulation is also another future trend in the Chinese economy. The trend will also focus in the future on domestic capacity for innovation, improving the services sector, and upgrading human capital through increased years of tertiary education. Innovation is tied to increased years of tertiary education to make China capable of innovating indigenous products with global appeal. It has to become a producer of original products that can compete globally.

The conclusion shows that in a world where countries are increasingly protective of domestic industries and where investors are withdrawing from China, policymakers will have to focus on internal growth and consumption as the driver of economic growth.

References

[1]. Asian Development Bank. “The Fourteenth Five-Year Plan of the People’s Republic of China-fostering high-quality development.” 2021, www.adb.org/sites/default/files/publication/705886/14th-five-year-plan-high-quality-development-prc.pdf Accessed 6 October 2023

[2]. Ashraf, Nava, Colin F. Camerer, and George Loewenstein. "Adam Smith, behavioral economist." Journal of economic perspectives, Vol. 19, No. 3, 2005, pp. 131-145.

[3]. Arnsperger, Christian, and Yanis Varoufakis. "What Is Neoclassical Economics? The three axioms responsible for its theoretical oeuvre, practical irrelevance and, thus, discursive power." Panoeconomicus, Vol. 53, No. 1, 2006, pp. 5-18.

[4]. Drakopoulos, Stavros A. "Keynes ‘Economic Thought and the Theory of Consumer Behaviour." Scottish Journal of Political Economy, Vol. 39, No. 3, 1992, pp. 318-336.

[5]. UNDP. “Issue Brief: China in numbers” July 2022, www.undp.org/sites/g/files/zskgke326/files/2022-08/China%20in%20numbers%20%282022%29.pdf Accessed 9 October 2023

[6]. National Bureau of Statistics. “Total retail sales of consumer goods in July 2023.” August 2023, www.stats.gov.cn/english/PressRelease/202308/t20230818_1942127.html Accessed 7 October 2023

[7]. World Bank. “From recovery to rebalancing: China’s economy in 2021.” 2020, pp. 1-57

[8]. Mordor Intelligence. “China retail market size & share analysis-growth trends & forecasts (2023-2028.” 2023, www.mordorintelligence.com/industry-reports/retail-industry-in-china Accessed 23 October 2023

[9]. The State Council Information Office (PRC). “China’s monetary policy supports high-quality growth.” March 6, 2023, http://english.scio.gov.cn/m/pressroom/2023-03/06/content_85147250.htm Accessed 9 October 2023

[10]. IMF. “People’s Republic of China: 2022 Article IV Consultation Press Release.” February 2023, Monetary Policy Analysis Group (PRC). “China Monetary Policy Report (Q1 2022).” May 9, file:///C:/Users/User/Downloads/1CHNEA2023001.pdf Accessed October 2023

Cite this article

Liao,S. (2024). Economic Growth and Policy Dynamics in Contemporary China: A Comprehensive Analysis and Future Outlook. Advances in Economics, Management and Political Sciences,71,42-47.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Asian Development Bank. “The Fourteenth Five-Year Plan of the People’s Republic of China-fostering high-quality development.” 2021, www.adb.org/sites/default/files/publication/705886/14th-five-year-plan-high-quality-development-prc.pdf Accessed 6 October 2023

[2]. Ashraf, Nava, Colin F. Camerer, and George Loewenstein. "Adam Smith, behavioral economist." Journal of economic perspectives, Vol. 19, No. 3, 2005, pp. 131-145.

[3]. Arnsperger, Christian, and Yanis Varoufakis. "What Is Neoclassical Economics? The three axioms responsible for its theoretical oeuvre, practical irrelevance and, thus, discursive power." Panoeconomicus, Vol. 53, No. 1, 2006, pp. 5-18.

[4]. Drakopoulos, Stavros A. "Keynes ‘Economic Thought and the Theory of Consumer Behaviour." Scottish Journal of Political Economy, Vol. 39, No. 3, 1992, pp. 318-336.

[5]. UNDP. “Issue Brief: China in numbers” July 2022, www.undp.org/sites/g/files/zskgke326/files/2022-08/China%20in%20numbers%20%282022%29.pdf Accessed 9 October 2023

[6]. National Bureau of Statistics. “Total retail sales of consumer goods in July 2023.” August 2023, www.stats.gov.cn/english/PressRelease/202308/t20230818_1942127.html Accessed 7 October 2023

[7]. World Bank. “From recovery to rebalancing: China’s economy in 2021.” 2020, pp. 1-57

[8]. Mordor Intelligence. “China retail market size & share analysis-growth trends & forecasts (2023-2028.” 2023, www.mordorintelligence.com/industry-reports/retail-industry-in-china Accessed 23 October 2023

[9]. The State Council Information Office (PRC). “China’s monetary policy supports high-quality growth.” March 6, 2023, http://english.scio.gov.cn/m/pressroom/2023-03/06/content_85147250.htm Accessed 9 October 2023

[10]. IMF. “People’s Republic of China: 2022 Article IV Consultation Press Release.” February 2023, Monetary Policy Analysis Group (PRC). “China Monetary Policy Report (Q1 2022).” May 9, file:///C:/Users/User/Downloads/1CHNEA2023001.pdf Accessed October 2023