1. Introduction

Business restructuring is the restructuring of a company's legal, ownership, operational, financial, or other structure to make it more profitable or to better organize its current needs. It involves transactions that reduce the size of a company through asset disposals (divestitures), spin-offs into separate entities (equity divestments or spin-offs), or transfers to private ownership (acquisitions).

Financial restructuring can be commonly understood as a kind of acquisition and acquisition behavior, which generally refers to the asset transaction behavior in which the company purchases and sells assets to a specific scale outside of daily business activities, resulting in major changes in the main business, assets, and income. According to the acquisition target, it can be divided into two types: equity acquisition and asset acquisition. The specific acquisition consideration will be different due to debt commitment and non-debt commitment. In the process of asset restructuring, it is necessary to make reasonable arrangements for the corresponding debt [1].

Debt restructuring, including single debt restructuring, overall debt restructuring, debt-to-equity swap, and other forms, specifically refers to the creditor and the debtor in the debt principal and interest amount, repayment term, repayment method, collateral guarantee, interest rate and other elements of the readjustment and agreement. With the economic downturn, many real enterprises have the tight cash flow or even overdue conditions, so some financial institutions (AMC is the main player) through the acquisition of a single financial/non-financial institution debt, or the overall acquisition of multiple or even all debtors' debt (including defaulted bonds) for restructuring, etc. The income earned includes the consideration discount portion, the reset interest rate corresponding income, and the flexible bet arrangement corresponding income. The purpose of this paper is to explore the various methods of corporate restructuring and the motivations and results behind them [2-3].

2. Business restructuring

2.1. Wesfarmers and Cole

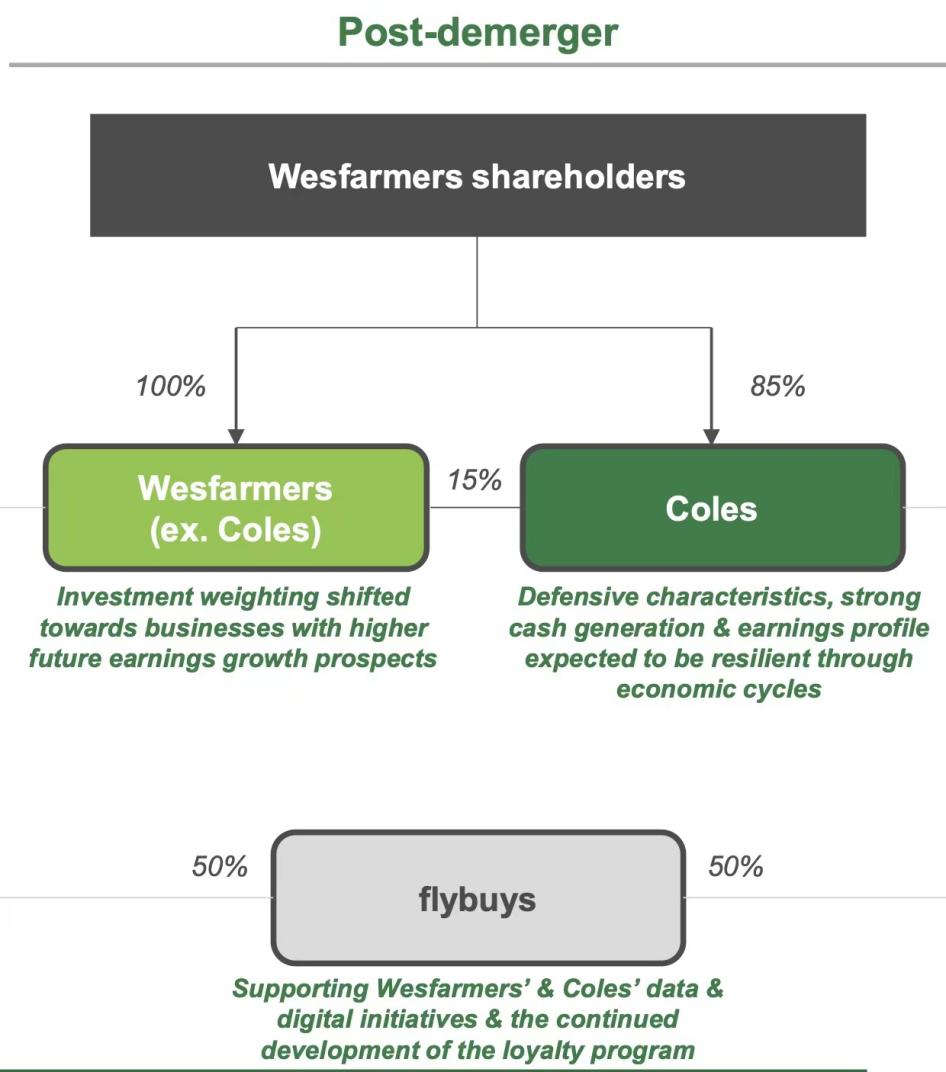

Figure 1: Wesfarmers shareholders [1].

After Wesfarmers bought Coles in 2007, the two companies' capital was pooled in one place. But over time, capital needs and strategies changed, and Wesfarmers decided to spin off Coles in 2018, making it an independent listed company.

This decision allows both companies to make independent capital allocation and investment decisions based on their own business needs. In this way, the allocation and use of resources are more targeted and efficient shown in below “Post-demerger Wesfarmers corporate structure”.

Table 1: Introduction to Wesfarmers during two periods

Wesfarmers today | Wesfarmers post-demerger | Coles | |

FY17 revenue ($b) | 68.4 | 27.5 | 39.2 |

FY17 EBIT ($b) | 4.4 | 2.4 | 1.6 |

FY17 operating cash flow | 5.2 | 2.6 | 2.2 |

Dec-17 R12 ROC | 15.9/33.6 | 23.6/38.6 | 9.0/24.2 |

Dec-17 R12 capital employed | 27.2 | 10.1 | 16.5 |

Employees | ~223.000 | ~114000 | ~109000 |

Retail stores (Australia) | 3813 | 1313 | 2500 |

From the two company’s EBIT contributions, the study can determine that Both Wesfarmers and Coles will be able to focus more on their core businesses. Wesfarmers has more energy to focus on other retail and industrial divisions, while Coles has increased its focus on food and daily retail. This allows both companies to target their go-to-market strategies more precisely to better meet customer needs[4].

2.2. Diversification and management of risks

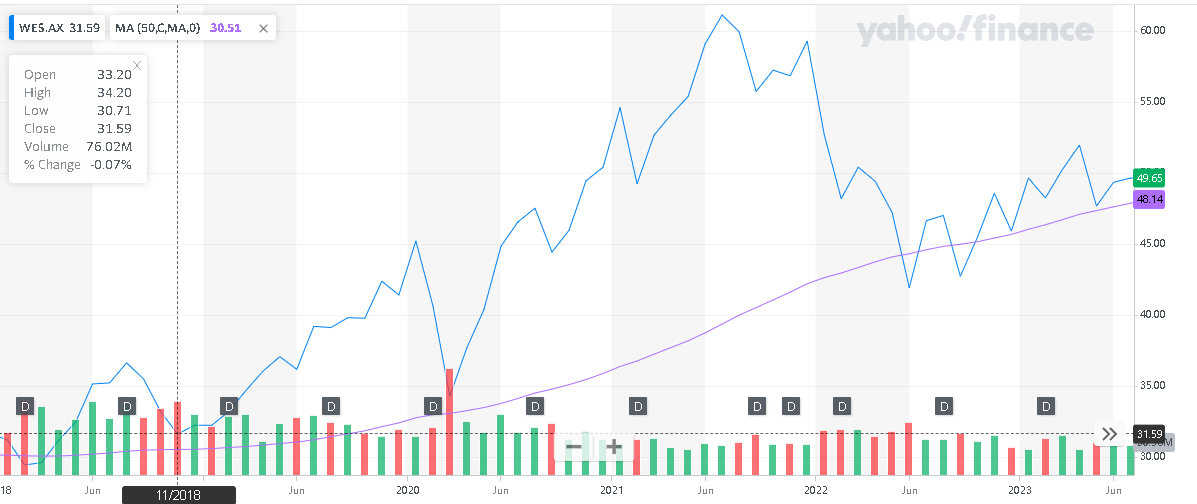

With the spin-off of Coles, Wesfarmers has managed to diversify its business risk. Any market shock to Coles before the spin-off could affect Wesfarmers as a whole. Now, by diversifying its operations, Wesfarmers has ensured the stability and resilience of the overall business. From this process, the split into two separate publicly traded companies gives investors more options. Now, investors can choose to invest in Wesfarmers or Coles, depending on their risk tolerance and investment strategy, rather than just one large group that spans multiple business areas. Such a choice is more attractive to different investor groups and strengthens the market's confidence in the two companies. In addition, Sometimes, the overall market value of a large conglomerate may be less than the combined market value of its subsidiaries. A breakup of Kohl's would likely boost the market value of both companies because it would be easier for investors to see the underlying value of each company. This spin-off strategy unlocks previously hidden value and creates greater returns for shareholders, leading Wesfarmer's share price is continuously increase after spin-off from 2018.

Figure 2: Yahoo Finance. WES.AX financials [2].

2.3. Why Wesfarmers decided to spin off Coles

The reason can be that for a business of the scale of Coles, there are not that many logical buyers for a business this large.

Shareholder value: Spin-offs typically provide direct value to shareholders. When Coles was split up, Wesfarmers shareholders were given shares in the new Coles Group, giving them a direct stake in both entities. Compared to a simple divestiture, in which the parent company may sell assets and keep the proceeds, this may protect the profit.

Tax considerations: Wesfarmers was theoretically for sale, but a demerger was the best way of separating Coles from the Wesfarmers business without incurring capital gains tax.

In summary, the case of Wesfarmers and Coles provides us with a window into corporate restructuring. By effectively restructuring, companies can not only better meet market demand and improve efficiency, but also provide more opportunities and value to investors[5-6].

3. Introduction to financial restructuring

3.1. Analysis of LBO-Dell

By the early 2010s, Dell, as a major player in the PC market, was under intense competitive pressure, especially with the rise of the mobile device market. These competitive factors have led to the stagnation of Dell's growth and the urgent need for strategic redirection.

Dell's financial restructuring (LBO): The transition from a public company to a private company

In 2013, Michael Dell and Silver Lake partners proposed taking Dell private for $24.4 billion. This decision is intended to free Dell from the short-term pressures of the public markets so it can focus more on long-term strategic transformation. As a private company, Dell has been able to make more flexible and aggressive strategic adjustments to adapt to evolving market conditions[7].

3.2. Result and impact

Dell's acquisition of EMC in 2016 marked a major shift in its strategy, for about $67 billion, largely financed with debt, in what was considered a mega-deal in the technology industry at the time. This strategic move is intended to shift Dell's business area from traditional hardware manufacturing to a broader IT solution offering, particularly data storage and cloud services.

Financial strategy and market re-entry: Due to the large amount of debt taken on by the EMC acquisition, Dell decided in 2018 to go public again to provide liquidity and diversity to its debt management strategy. This decision helps Dell further simplify its corporate structure while providing a clear investment outlook.

Dell's financial restructuring and subsequent strategic decisions enabled IT to successfully transform itself from a PC-centric business to an integrated IT solutions provider. In addition, while the process is controversial in some respects, the purpose of this transformation is to better position the company for future technology trends and enhance long-term shareholder value[8].

4. Introduction to debt restructuring

4.1. The course of debt restructuring of General Motors and its consequences

In 2009, the United States General Motors, which was deeply affected by the financial crisis, faced unprecedented economic pressure: consecutive years of losses, shrinking market demand, and heavy debt burden. On June 1, the company formally filed for bankruptcy protection in Manhattan Bankruptcy Court. The one-time industrial giant's filings put its assets at $82.29 billion, in stark contrast to its total debt of $172.8 billion, with more than 100,000 creditors showing how burdened it is.

The U.S. government considers GM "too big to fail," given its position in the U.S. economy. So, the government decided to intervene forcefully. The initial step is a $19.4 billion loan to GM, but that is far from enough to restructure. After a series of negotiations, the government provided an additional $30 billion in loans if the company agreed to restructure.

To effectively restructure, GM came up with a strategy: transfer its core brands, overseas subsidiaries, and some of its liabilities into a newly formed company - dubbed "New GM." The "former GM" will include most of the units and businesses that will be terminated or sold and enter bankruptcy proceedings.

The plan makes clear that shares in the new GM will be split between 60 percent for the US Treasury, 12.5 percent for the Canadian government, 17.5 percent for the UAW health fund, and 10 percent for unsecured bondholders.

At the same time, the new GM has drawn up a plan to deal with its old debts: first, to repay $6 billion of bank mortgages directly; Second, the initial conversion of $27.38 billion of unsecured bonds into shares in the new GM, while giving those creditors the right to buy more shares at favorable prices in the future. Third, work with the United Auto Workers union to create an estimated $20.5 billion retiree health care fund for retired workers' health care. Fourth, the U.S. government's investment will be used to buy debt and preferred equity in the new GM, estimated to be worth $8.8 billion.

After a series of complex and critical steps, General Motors successfully re-listed on the New York Stock Exchange on November 18, 2010, raising $23.1 billion. Subsequently, in 2011, the company achieved sales growth, with global sales reaching 9.03 million vehicles, an increase of 7.6% over the previous year. This marks not only GM's successful comeback from the crisis but also the effectiveness of the government's intervention and restructuring strategy [9].

4.2. Influence of Debt Restructuring

It is necessary to maximize the protection of creditors' interests in insolvency reorganization in this bankruptcy reorganization.

If the debt and equity restructuring is not carried out, the collateral of the bank mortgage loan is not regarded as the bankruptcy property first. Auction debt, probably less than 50%. The repayment ratio of unsecured bonds and the United Auto Workers (equivalent to ordinary creditors in China) may be less than 30%. This is the average American investor.

The pension and medical care of GM workers in the United States, the families involved, and the number of people may be hundreds. Millions of Americans have also been saved through debt-for-equity restructurings. That's all. At the end of the day, it would be worth $10 billion for the U.S. government.

The U.S. government's rescue is through the means of the market. For the US government's rescue of American General Motors, The action invested 50 billion yuan and recovered 40 billion yuan, which is also the way of debt-for-equity exchange, though. It is appropriate for the market to transfer the shares to recover the investment [10].

5. Comparison between business, financial, and debt restructuring

With the examples of Wesfarmers, Coles, Dell, and General Motors described above, the paper compares the advantages and disadvantages of each type of restructuring.

In business restructuring with Western Farmers and Coles, the advantages lie in the process of business reorganization. The two sides can realize diversification benefits, focus more on their core business, and improve efficiency. At the same time, business risk is reduced, and the continued rise in the value of the stock has also helped shareholder value.

The downside can be the complexity of execution. In the process of restructuring the business, Wesfarmers self-assessed a long time before 2018, indicating that the spin-off required more time and resources to ensure a smooth transition. At the same time, the separation may also lead to the loss of certain business units.

In the financial restructuring (Dell), the advantage was that as a private company, Dell had the flexibility to adjust its strategy in response to changing market conditions, while allowing Dell to accelerate its transformation from a PC-centric company to a comprehensive IT solutions provider.

However, the disadvantages of financial restructuring usually require high debt risks. In the process of Dell's acquisition of EMC, it took on a large amount of debt, which led to certain financial risks. In addition, Dell needs to re-apply for IPO in the process of re-listing, and complex procedures such as prospectus also require time and financial resources, but due to debt problems, Dell must go public again, reflecting that this is a complex and time-consuming process.

In the debt restructuring (General Motors), the advantage is that under the intervention and support of the US government to provide the necessary funds and resources for General Motors, the bankruptcy of General Motors was avoided, its long-term survival was ensured, and stakeholders were protected. By restructuring its debt, for example, GM has managed to protect creditors, workers, and investors. However, government intervention could impose certain policy constraints on GM, imposing relatively onerous legal requirements.

In conclusion, each of the three reorganization methods has its advantages and disadvantages. Business restructuring focuses on the business and strategic aspects of a company and may result in greater operational efficiency and risk reduction. Financial restructuring focuses on a company's capital structure and financial health but may bring financial risks. Debt restructuring, on the other hand, is a solution under financial stress, designed to ensure the long-term survival of the company. Different companies choose different restructuring strategies according to their specific situations and needs [11].

6. Conclusion

In this research, three main methods of corporate restructuring are discussed in depth: business restructuring, financial restructuring, and debt restructuring, and analyzed in combination with specific cases. The results show that each restructuring method has its unique advantages and coping strategies, which provide different choices for companies to face different market and economic challenges.

Business restructuring by redirecting the company's business and strategic direction, can improve the company's operational efficiency and reduce the associated risks. Financial restructuring focuses on the capital structure and financial health of the company, and while it may increase certain financial risks, it can provide the company with greater financial flexibility and soundness under the right circumstances. Debt restructuring mainly provides solutions for companies facing financial difficulties and ensures their long-term survival[12-13].

However, there are some shortcomings in this paper. First, although we combined the analysis with specific cases, the number of selected cases may not fully reflect the actual effects of various restructuring strategies. Second, this paper does not delve into the potential negative effects of various restructuring strategies, such as employee layoffs and the reduction of shareholders' equity.

To address these shortcomings, future studies can expand the sample size, select more company cases for analysis, and study the risks and challenges of various restructuring strategies in greater depth. In addition, it can be combined with qualitative and quantitative research methods to conduct a more comprehensive and in-depth discussion.

In the future, research in this area could focus more on corporate restructuring strategies in different cultural and economic contexts, as companies in different countries and regions face similar challenges due to increasing globalization. For the future development of this field, we recommend that researchers and practitioners pay more attention to human resource management and stakeholder communication in the restructuring process to ensure that the restructuring is not only in line with the long-term objectives of the company but also supported and understood by all stakeholders.

References

[1]. ABC News. (2018, March 16). Coles cut by Wesfarmers as it goes back to trading assets. https://www.abc.net.au/news/2018-03-16/coles-cut-by-wesfarmers-as-it-goes-back-to-trading-assets/9555286.

[2]. Afr.com. (2018, March 21). Cole’s demerger a better bet than a sale or IPO, says CEO Rob Scott. https://www.afr.com/companies/retail/coles-demerger-a-better-bet-than-a-sale-or-ipo-says-ceo-rob-scott-20180321-h0xryc.

[3]. Chen Shou, Luo Yongheng, Shu Tong. Excess earnings of the long-term enterprise m&a research and empirical [J]. Journal of Quantitative Technical Economics, 2004 (1): 6. DOI: 10.3969 / j.i SSN. 1000-3894.2004.01.015.

[4]. Google Finance. (n.d.). COL: ASX. https://www.google.com/finance/quote/COL:ASX?window=MAX.

[5]. Reuters. (2013, February 6). Dell to go private in landmark $24 billion deal. https://www.reuters.com/article/us-dell-buyout-idUSBRE9140NF20130206.

[6]. Aseem Kaul.Technology and Corporate Scope: Firm and Rival Innovation as Antecedents of Corporate Transactions[J].Strategic Management Journal, 2011.DOI:10.1002/smj.1940.

[7]. Wesfarmers. (n.d.b). Reports. https://www.wesfarmers.com.au/investor-centre/company-performance-news/reports. The report shows in detail information after Wesfarmers demerge (1).

[8]. Guo Xuan. Geely to buy Volvo's successful cases and its enlightenment [J]. Foreign economic and trade practice, 2010 (12) : 3. DOI: 10.3969 / j.i SSN. 1003-5559.2010.12.021.

[9]. Yahoo Finance. (n.d.). WES.AX financials. https://finance.yahoo.com/quote/WES.AX/financials?p=WES.AX The reference shows the fluctuation of share price to Wesfamers(2).

[10]. Allen, N, Berger, et al. How does capital affect bank performance during financial crises?[J]. Journal of Financial Economics, 2013.DOI:10.1016/j.jfineco.2013.02.008.

[11]. Zhu Shuying. Response of financial policy to financial crisis [J]. Finance and Accounting Learning,2022,(24).

[12]. Yu Changmei. Enterprise investment and financing Countermeasures under the background of the financial crisis [J]. National Circulation Economy,2021,(34).

[13]. Li Xingshen, Gou Qin, Tan Xiaofen. Global financial cycle, digital technology development, and bilateral equity capital flow [J]. Economic Science,2023,(05).

Cite this article

Fang,Y. (2024). Investigating the Impact of Business, Financial, and Debt Restructuring on Enterprises. Advances in Economics, Management and Political Sciences,71,292-298.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. ABC News. (2018, March 16). Coles cut by Wesfarmers as it goes back to trading assets. https://www.abc.net.au/news/2018-03-16/coles-cut-by-wesfarmers-as-it-goes-back-to-trading-assets/9555286.

[2]. Afr.com. (2018, March 21). Cole’s demerger a better bet than a sale or IPO, says CEO Rob Scott. https://www.afr.com/companies/retail/coles-demerger-a-better-bet-than-a-sale-or-ipo-says-ceo-rob-scott-20180321-h0xryc.

[3]. Chen Shou, Luo Yongheng, Shu Tong. Excess earnings of the long-term enterprise m&a research and empirical [J]. Journal of Quantitative Technical Economics, 2004 (1): 6. DOI: 10.3969 / j.i SSN. 1000-3894.2004.01.015.

[4]. Google Finance. (n.d.). COL: ASX. https://www.google.com/finance/quote/COL:ASX?window=MAX.

[5]. Reuters. (2013, February 6). Dell to go private in landmark $24 billion deal. https://www.reuters.com/article/us-dell-buyout-idUSBRE9140NF20130206.

[6]. Aseem Kaul.Technology and Corporate Scope: Firm and Rival Innovation as Antecedents of Corporate Transactions[J].Strategic Management Journal, 2011.DOI:10.1002/smj.1940.

[7]. Wesfarmers. (n.d.b). Reports. https://www.wesfarmers.com.au/investor-centre/company-performance-news/reports. The report shows in detail information after Wesfarmers demerge (1).

[8]. Guo Xuan. Geely to buy Volvo's successful cases and its enlightenment [J]. Foreign economic and trade practice, 2010 (12) : 3. DOI: 10.3969 / j.i SSN. 1003-5559.2010.12.021.

[9]. Yahoo Finance. (n.d.). WES.AX financials. https://finance.yahoo.com/quote/WES.AX/financials?p=WES.AX The reference shows the fluctuation of share price to Wesfamers(2).

[10]. Allen, N, Berger, et al. How does capital affect bank performance during financial crises?[J]. Journal of Financial Economics, 2013.DOI:10.1016/j.jfineco.2013.02.008.

[11]. Zhu Shuying. Response of financial policy to financial crisis [J]. Finance and Accounting Learning,2022,(24).

[12]. Yu Changmei. Enterprise investment and financing Countermeasures under the background of the financial crisis [J]. National Circulation Economy,2021,(34).

[13]. Li Xingshen, Gou Qin, Tan Xiaofen. Global financial cycle, digital technology development, and bilateral equity capital flow [J]. Economic Science,2023,(05).