Volume 183

Published on May 2025Volume title: Proceedings of the 3rd International Conference on Management Research and Economic Development

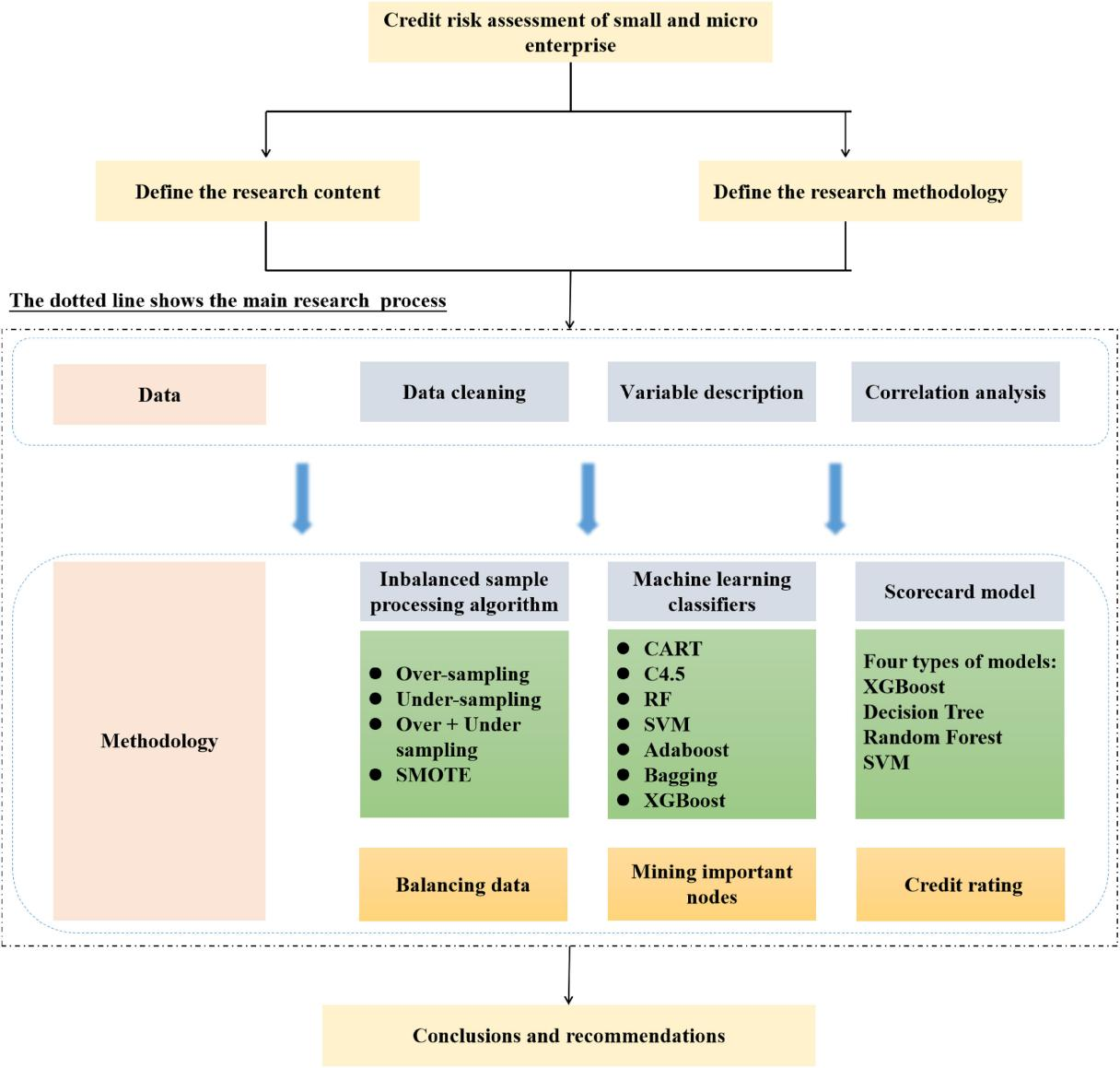

Digital finance is a crucial part of the “Five Major Articles” in the digital finance era, representing not merely a technology-driven innovative endeavor but also serves as a cornerstone for advancing high-quality economic development and constructing a modern financial architecture. Its evolution integrates cutting-edge technological applications with systemic financial reforms, thereby fostering inclusive growth, optimizing resource allocation efficiency. Credit risk management models for commercial banks are a common focus nowadays for both the academic and practical fields. This paper categorizes the fundamental risk control models and analyzes real-world cases. The findings indicate that although commercial banks actively adopt new models and have proposed new evaluation criteria for the technology sector, these models still face issues such as high training costs, poor interpretability, and inadequate early warning capabilities. Simultaneously, data quality also constitutes a persistent concern. In conclusion, credit risk models still have significant room for optimization in the context of the digital finance era.

View pdf

View pdf

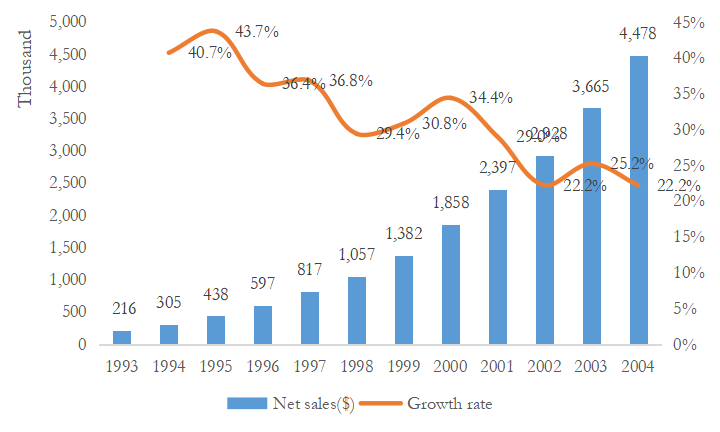

The retail industry has undergone profound changes in recent years, particularly with the rapid rise of e-commerce and shifts in consumer shopping habits. Many traditional retailers have had to adjust their business models and capital structures to cope with market competition and financial pressures. Bed Bath & Beyond, as an iconic home goods retailer in the United States, was once a market leader in the home furnishings sector. This study focuses on BBBY's capital structure and its implications for the retail industry. By analyzing BBBY's debt levels, equity structure, and financing strategies, this paper found that the low return on cash holdings drags down the ROE and there is inefficient use of capital since BBBY has a lot of cash but no debt. This research aims to reveal the impact of capital structure on a company's financial health and long-term development. The findings not only provide an in-depth explanation for BBB's financial situation but also offer valuable insights for other retailers in optimizing capital structures and managing financial risks. The opinion of this paper to use trade off theory that appropriate level of debt can improve the profitability of Bed Bath & Beyond.

View pdf

View pdf

The Gold Market plays an dominant role in the world economic and has significant impact on financial stability worldwide. Therefore, this paper focuses on investigating the underlying reasons for the sustained growth in gold prices and continuous expansion of the gold market using a literature analysis approach. The trends of the Gold Market are affected by the overall market, inflation, economic cycle as well as the inherent properties of gold. Market growth is influenced by internal factors, including profit growth, dividend reinvestment, asset reallocation, and the international environment. Besides, it is also influenced by external factors, such as inflation, technological advancements and shifts in productivity.

View pdf

View pdf

This paper studies the empowerment mechanisms, innovative pathways, and countermeasures of digital economy in driving the green upgrading of the energy industry in Liaoning Province. First, the paper analyzes the innovative mechanisms, talent mechanisms, and structural mechanisms of digital economy in driving the green upgrading of the energy industry in Liaoning Province. Then, based on the theory of digital empowerment, the paper explores the development model of energy industry intelligent green upgrading in Dalian, and takes IBM's digital transformation as an example to provide insights into how digital economy drives industrial transformation and upgrading. The paper also constructs a measurement model to empirically verify the impact and pathways of digital economy on the green upgrading of the energy industry. Finally, it proposes countermeasures such as relying on digital economy to drive the intelligent upgrading of industries, promoting the construction of intelligent industrial management systems, and building a complete digital empowerment capital support system to promote the digitalization, intelligentization, and high-end development of the energy industry in Liaoning Province.

View pdf

View pdf

In the current developmental context, the world is entering an era of digitization and informatization, and digital finance is rapidly developing in China. This paper uses data from the 2019 China Household Finance Survey (CHFS) to empirically examine the impact of digital finance on household financial asset allocation. The findings reveal that the development of digital finance significantly increases the likelihood of household participation in financial markets. Further analysis of the mechanisms indicates that digital finance enhances household financial literacy, thereby raising the probability of their engagement in financial markets. This effect is particularly pronounced among rural households and low-income families.

View pdf

View pdf

Generation Z in China is increasingly becoming a prominent consumer segment, characterized by unique shopping behaviors. Marketers aiming to properly target this group must have a thorough awareness of the psychological and environmental factors driving their impulsive buying habits. This study investigates the impulsive purchasing behavior of Chinese Generation Z in online and offline shopping contexts, focusing on the roles of shopping motivation, shopping situations, and decision-making processes. Statistical methods including regression and variance analysis were used to investigate the correlations between 406 survey participants' responses and impulsive purchase behavior. The results reveal that shopping motivation, shopping situations, and decision-making processes all significantly and positively influence impulsive buying behavior. Additionally, differences in impulsive buying behavior were observed across various demographic groups, including age, gender, city type, and income level. These findings provide valuable insights for marketers aiming to tailor strategies to effectively engage Generation Z consumers in both online and offline shopping environments.

View pdf

View pdf