Volume 200

Published on July 2025Volume title: Proceedings of ICEMGD 2025 Symposium: Innovating in Management and Economic Development

Constructing risk control strategies that are adaptive to market movements is an important trend in portfolio selection. In the existing literature, constructing a tail risk control model based on conditional value-at-risk (CVaR) has been widely used. Traditional literature is based on a singleβlevel for risk control, However, the portfolio effect is highly sensitive to theβlevel, which makes it difficult to output stable and reliable strategies. In addition, there have been studies examining the control of tail risk under multipleβklevels at the same time for differentβkits risk threshold is set the same. However, this uniform threshold makes it difficult to differentiate the responsiveness to the market. Accordingly, this study introduces the CVaR in multiple confidence levels of the differentiated thresholds so that the strategy has a more elastic risk control ability. In addition, the fixed threshold setting is easy to use in the highly variable market environment to show the limitations. Accordingly, this study constructs a linearly scaled dynamically adjusted portfolio strategy based on the market Chicago Board Options Exchange Volatility Index (VIX), As a result, it is found that the strategy has good adaptability with high risk-adjusted returns on different types of asset datasets. This suggests that the strategy provides the responsiveness of traditional CvaR strategies to tail risk and structural adaptation to market movements.

View pdf

View pdf

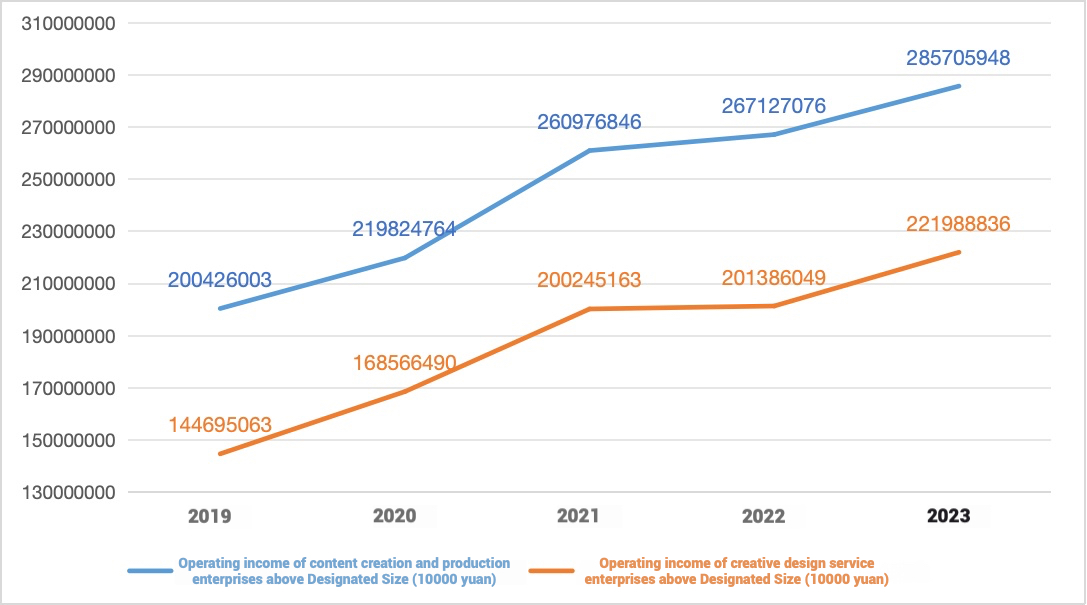

Against the backdrop of the rapid development of the cultural and creative industry, the contradictory relationship between cost control and service quality has become increasingly prominent due to the characteristics of non-standardized production, making traditional large-scale methods difficult to meet its needs. From the perspective of lean supply chain theory, this study explores how the cultural and creative industry can achieve a dynamic balance between cost and quality through lean supply chain management. Taking film and television content creation as a typical case, this study constructs its supply chain model, compares and analyzes its differences from traditional manufacturing industries, and reveals that the root cause of the contradictions faced by current cultural and creative enterprises lies in the structural conflict between "non-standard creative production" and "industrialized logic". By introducing lean management concepts, this study proposes a lean supply chain cost management model adapted to the cultural and creative industry. The research shows that cultural and creative enterprises can implement supply-side structural adjustments through lean supply chain management to achieve collaborative development of cost control and quality optimization, providing a practical and systematic solution to address the industry's cost control challenges, promote sustainable industry development, and enhance enterprise competitiveness.

View pdf

View pdf

This study uses SWOT analysis to systematically assess the competitive landscape, investment value, and challenges for the Sherwin-Williams Company in the U.S. paint and coatings industry. The research finds that industry growth is primarily driven by demand from construction and industrial sectors but faces challenges including raw material price volatility, digitalization impacts, and regulatory fragmentation. Sustainable technologies such as low-volatile organic compound coatings have become central to competition, with leading companies building on their strengths through vertical integration and research and development investments. Financial analysis reveals that Sherwin-Williams demonstrates strong profitability with a high Return on Equity, though revenue growth has slowed to 0.2%, indicating a need for vigilance against cyclical market risks. The study concludes that future industry success will depend on innovation and policy adaptability, and investors should focus on environmental technology development and cost control capabilities. This research contributes to understanding how leading companies like Sherwin-Williams maintain competitive advantages through technological innovation and strategic adjustments in a transforming industry.

View pdf

View pdf

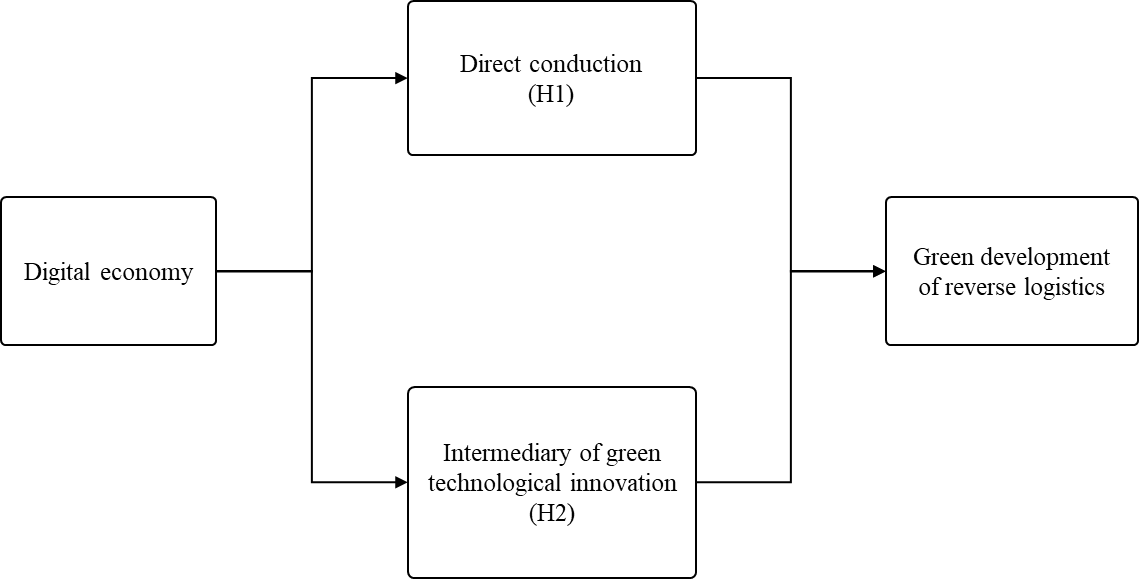

Against the backdrop of increasingly stringent global environmental regulations and the advancement of the “dual carbon” goals, the green transformation of reverse logistics has become a crucial topic for the sustainable development of a circular economy. This paper focuses on the intrinsic mechanism and practical path of how the digital economy empowers the green development of reverse logistics, using the Yangtze River Delta region as a case study. A theoretical framework of “Digital Economy–Green Technological Innovation–Green Reverse Logistics” is constructed. Based on provincial panel data from 2011 to 2022, a comprehensive evaluation index system is systematically built, and benchmark regression models as well as mediation effect models are used to verify the transmission paths. The findings indicate that: (1) The digital economy significantly promotes the green development of reverse logistics through both direct transmission and indirectly driving the diffusion of green technological innovation; (2) Regional heterogeneity analysis shows that Shanghai has formed a “growth pole” due to its advantages in digital infrastructure and technological innovation, while provinces such as Anhui are characterized by “low-efficiency lock-in” due to limitations in technology absorption capacity and lack of policy coordination. These findings provide theoretical support for addressing the dilemma of the “green premium” in reverse logistics. It is suggested that efforts should be made to promote regional synergy and green transformation in the Yangtze River Delta through a tiered digital infrastructure network, cross-regional green technology alliances, differentiated carbon governance mechanisms, and integrated digital-market mechanisms.

View pdf

View pdf

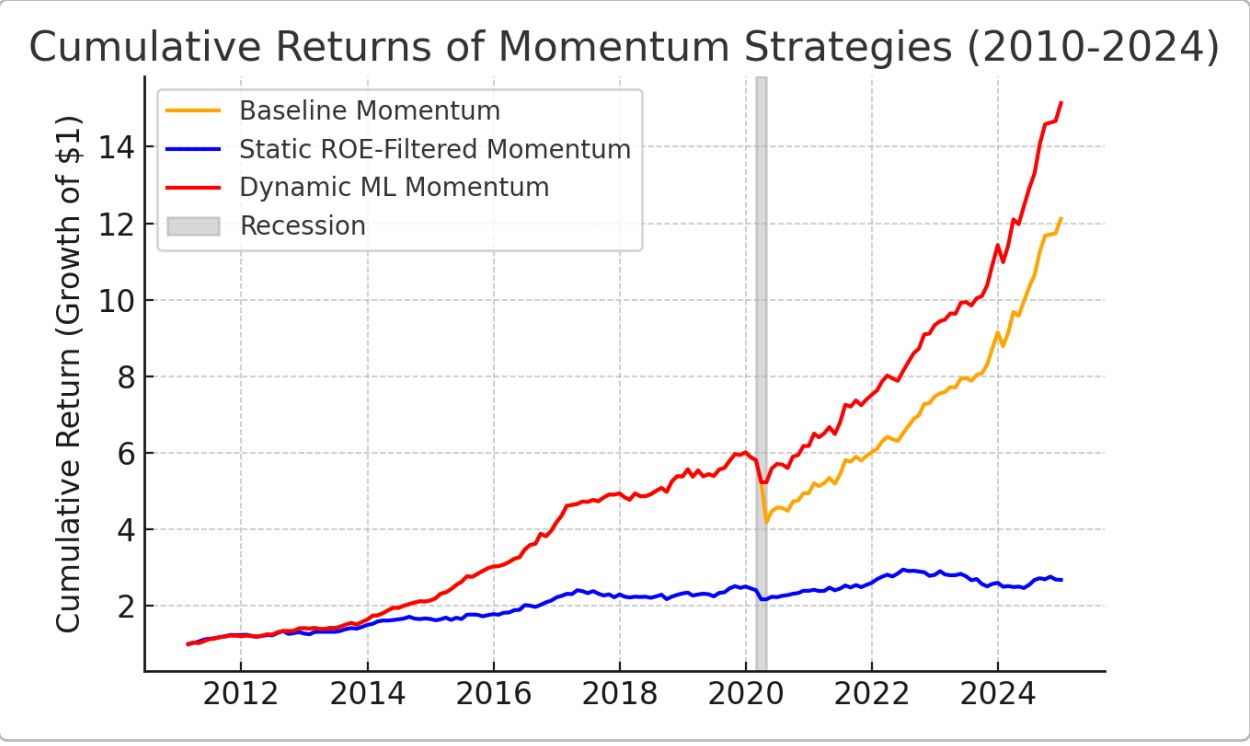

Momentum investing, while historically profitable, is prone to severe crashes during market reversals. This paper addresses the challenge of improving a momentum strategy’s risk–return profile by incorporating fundamental filters and dynamic weighting through machine learning, a question of great importance in quantitative finance given momentum’s popularity and risks. This paper compared three momentum-based equity strategies on S&P 500 stocks from 2010–2024: (1) a baseline cross-sectional price momentum strategy with no filters, (2) a momentum strategy with a static Return-on-Equity (ROE) profitability filter, and (3) a dynamic multi-factor momentum strategy using a LightGBM machine learning model for adaptive signal weighting. The baseline momentum approach delivers strong average returns but suffers large drawdowns during recessions (momentum crashes). Adding a static ROE filter improves downside risk by avoiding low-quality stocks, at the cost of significantly lower returns and Sharpe ratio. In contrast, the dynamic ML-based strategy achieves the highest risk-adjusted performance: it maintains high momentum-driven returns while substantially reducing drawdowns by emphasizing high-quality fundamentals during downturns. Notably, the dynamic strategy’s Sharpe ratio is about 30% higher than the baselines, and its maximum drawdown is less than half, indicating much greater robustness in the 2020 COVID-19 crash. These findings demonstrate that blending momentum signals with fundamental indicators via machine learning can significantly enhance Sharpe ratios and reduce crash risk. The study’s results suggest a viable approach for building more resilient momentum portfolios and advancing the integration of machine learning into factor investing strategies.

View pdf

View pdf

Financial crises have repeatedly devastated economies, prompting a search for deeper explanations beyond traditional finance. Episodes from the 17th-century Dutch Tulip Mania to the 2008 global meltdown reveal patterns of speculative bubbles and crashes that classical theories struggle to explain. This paper, based on relevant theories from behavioral economics and adopting a case-study approach, focuses on herd behavior, overconfidence, heuristics, and loss aversion to analyze three historic crises (1637 Tulip Mania, 1929 Wall Street Crash, 2008 Global Financial Crisis). In each case, psychological factors proved pivotal. During booms, widespread overconfidence and herd mentality fueled asset-price bubbles, as investors irrationally extrapolated recent gains and ignored fundamental risks. At the tipping point, these same forces flipped to fear: herding in reverse as panicked sell-offs ensued, with loss aversion driving investors to liquidate at any price. The analysis presented in this paper finds that collective euphoria and panic—rather than purely rational responses—largely triggered the collapse of each bubble. These findings underscore the significance of behavioral biases in financial crises. Recognizing and mitigating such biases is crucial for economists and policymakers seeking to prevent future bubbles and cushion market collapses.

View pdf

View pdf

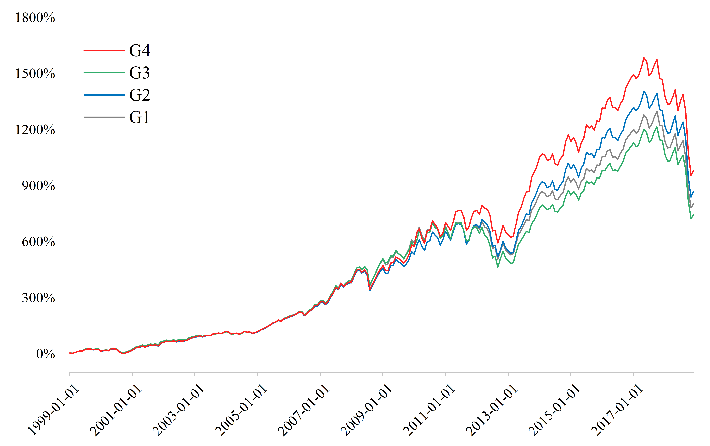

With the development of the financial industry and the accumulation of financial risks, the application scenario of momentum strategy has expanded from the traditional stock market to the multi-asset field, which is helpful to predict and deal with future risks. However, the effectiveness of momentum strategy varies significantly among different industries. Therefore, this paper systematically summarizes the influence mechanism and research progress of industry characteristic heterogeneity on momentum strategy performance by means of literature analysis. The research shows that high volatility and innovation-driven industries tend to show stronger momentum effect, while defensive industries are prone to reversal. At present, there are still gaps in the research, such as insufficient quantification of industry heterogeneity and limited cross-market adaptability verification. In the future, it is necessary to build an "industry-momentum" interaction model to improve the strategy robustness. This paper provides a theoretical framework and practical enlightenment for the fine application of momentum strategy in the industry.

View pdf

View pdf

Accurately converting short-horizon machine-learning forecasts into investable equity portfolios remains difficult once transaction frictions are acknowledged. This study therefore asks whether a closed-form mean–variance allocator that embeds one-month-ahead LightGBM return estimates can outperform a passive benchmark after realistic costs. The proposed method exploits the diagonal structure of realised variances to derive an O(n) analytic weight-update that simultaneously penalises quadratic turnover and enforces per-stock position caps, eliminating the need for numerical solvers and supporting daily rebalancing across large universes. Five-year back-tests on the S&P 500 (January 2020-January 2025) show that the strategy achieves an annualised gross Sharpe ratio of 1.03 versus 0.60 for the total-return index, while limiting maximum drawdown to 21 % compared with 34 % for the benchmark. Average yearly turnover is contained at 94 %, and robustness tests under 50 bp proportional trading costs still leave the net Sharpe above 0.90. These results demonstrate that non-linear predictive signals can be translated into scalable, transparent, and cost-aware portfolios without sacrificing computational efficiency, furnishing a practical template for institutional automation of signal-driven equity allocation.

View pdf

View pdf

In January 2025, the United States introduced a new round of tariff hikes on Chinese imports, leading to significant volatility in global stock markets. This study investigates the immediate impact of these measures and identifies potential strategies for responding to tariff-related market shocks—a topic of growing importance in financial economics. An event-based analysis was conducted using market index performance and sectoral trends. Following the announcement, major indices such as the S&P 500 and Nasdaq Composite entered correction territory. Trade-sensitive sectors—including technology, manufacturing, and consumer goods—suffered sharp declines, while defensive assets like gold and long-term bonds gained value amid a shift in investor risk preferences. The sell-off was driven by rising concerns over supply chain disruptions, increased input costs, and downward revisions in corporate earnings expectations. Institutional investors moved into safe-haven assets, while retail investors faced greater exposure with fewer risk management tools. These findings highlight the importance of portfolio diversification, strategic hedging, and transparent policy communication in reducing market instability caused by geopolitical events.

View pdf

View pdf

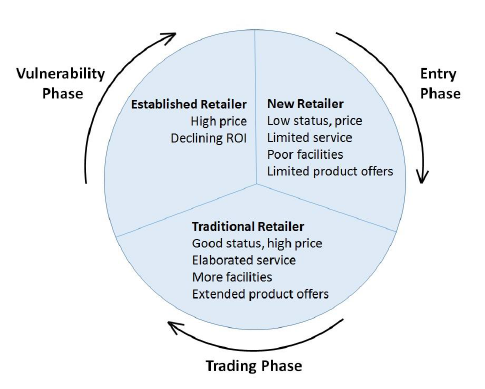

This paper takes Pangdonglai, a regional retail enterprise in China, as a case study to explore the key factors behind its success in a highly competitive market. As China’s retail sector experiences rapid growth and evolving consumer demands, Pangdonglai has established strong customer loyalty and regional influence via precise market positioning, a distinctive corporate culture, and flexible marketing strategies. Utilizing qualitative research methods such as case studies and interviews, this study analyzes how Pangdonglai applies classical retail theories, including the 4P Theory, the Wheel of Retailing, and the Retail Life Cycle Theory, in its product strategies, pricing mechanisms, channel distribution, and brand promotion. Furthermore, it investigates the Company’s strategic approaches in management innovation, digital transformation, supply chain efficiency, and cultural development. The results suggest that that Pangdonglai’s success is rooted in a customer-first strategy, strong local adaptation, and ongoing innovation. Moreover, the paper proposes strategies for future development, such as advancing omnichannel integration, strengthening the membership system, leveraging predictive analytics, and enhancing service capabilities, to offer insights into the sustainable growth of China’s retail sector.

View pdf

View pdf