1. Introduction

The intersection of economics and international relations is a complex and dynamic field that has profound implications for global stability and prosperity. Economic theories serve as foundational pillars for understanding the mechanics of global trade and policy-making, providing insights into the allocation of resources and the dynamics of comparative advantage. Among these theories, the theory of comparative advantage, first proposed by David Ricardo, emphasizes the benefits of specialization and trade based on differences in opportunity costs among nations. This theory posits that countries gain by specializing in the production of goods they can produce more efficiently than others and trading those goods for what they produce less efficiently. In addition to economic theories, probabilistic models play a crucial role in forecasting economic trends and assessing their implications for international relations. Bayesian statistics, for instance, allows for the incorporation of prior knowledge into forecasting models, updating beliefs with new evidence [1]. Similarly, regression analysis enables the evaluation of the relationship between economic indicators and outcomes, providing insights into the impact of economic policies on specific outcomes. Overall, the integration of economic theories and probabilistic models offers valuable insights into the complexities of economic diplomacy and underscores the importance of informed decision-making in fostering international cooperation and stability. This paper aims to explore these dynamics in detail, examining the role of economic theories, trade policies, and diplomatic engagements in shaping international relations.

2. Theoretical Framework

2.1. Economic Theories of International Relations

The economic theories of international relations, particularly the theory of comparative advantage and the Heckscher-Ohlin model, serve as foundational pillars for understanding the mechanics of global trade and policy-making. The theory of comparative advantage, proposed by David Ricardo, posits that countries gain by specializing in the production of goods they can produce more efficiently than others and trading those goods for what they produce less efficiently [2]. This principle can be mathematically represented by the equation:

\( {CA_{ij}}=\frac{{output per unit of input_{i}}}{{output per unit of input_{j}}}\ \ \ (1) \)

Where \( {CA_{ij}} \) represents the comparative advantage of country \( i \) in producing good \( j \) elative to other goods. This equation illustrates how comparative advantage determines trade flows and shapes international economic policies.

The Heckscher-Ohlin model further extends this analysis by focusing on the factors of production - labor, capital, and land [3]. According to this model, a country will export goods that utilize its abundant factors of production and import goods that utilize its scarce factors. The model can be encapsulated by the equation:

\( \frac{{P_{L}}}{{P_{K}}}=\frac{MPL}{MPK}\ \ \ (2) \)

where \( {P_{L}} \) and \( {P_{K}} \) are the prices of labor and capital, respectively, and \( MPL \) and \( MPK \) are the marginal products of labor and capital. This equation demonstrates the relationship between factor endowments and trade patterns, providing a quantitative basis for understanding international trade dynamics.

2.2. Probabilistic Models in Economic Forecasting

Probabilistic models, especially Bayesian statistics and regression analysis, are instrumental in forecasting economic trends and their implications for international relations. Bayesian statistics, in particular, allows for the incorporation of prior knowledge into the forecasting model, updating beliefs with new evidence [4]. This approach can be mathematically represented as:

\( P(θ|X)=\frac{P(θ|X)P(θ)}{P(X)}\ \ \ (3) \)

where \( P(θ|X) \) is the posterior probability of the model parameters \( θ \) given the data X, \( P(θ|X) \) is the likelihood of observing X given \( θ \) , \( P(θ) \) is the prior probability of \( θ \) , and \( P(X) \) is the marginal likelihood of X. This formula is crucial for understanding how economic forecasts can be adjusted based on new information, impacting policy decisions and international negotiations.

Regression analysis, another key probabilistic tool, evaluates the relationship between economic indicators and outcomes. A simple linear regression model can be expressed as:

\( Y={β_{0}}+{β_{1}}{X_{1}}+ϵ\ \ \ (4) \)

where Y represents the economic outcome of interest, \( {X_{1}} \) is an economic indicator, \( {β_{0}} \) and \( {β_{1}} \) are coefficients, and \( ϵ \) is the error term. This model helps quantify the impact of economic policies or indicators on specific outcomes, facilitating informed decision-making in international relations.

3. Impact of Trade Policies

3.1. Global Trade Agreements

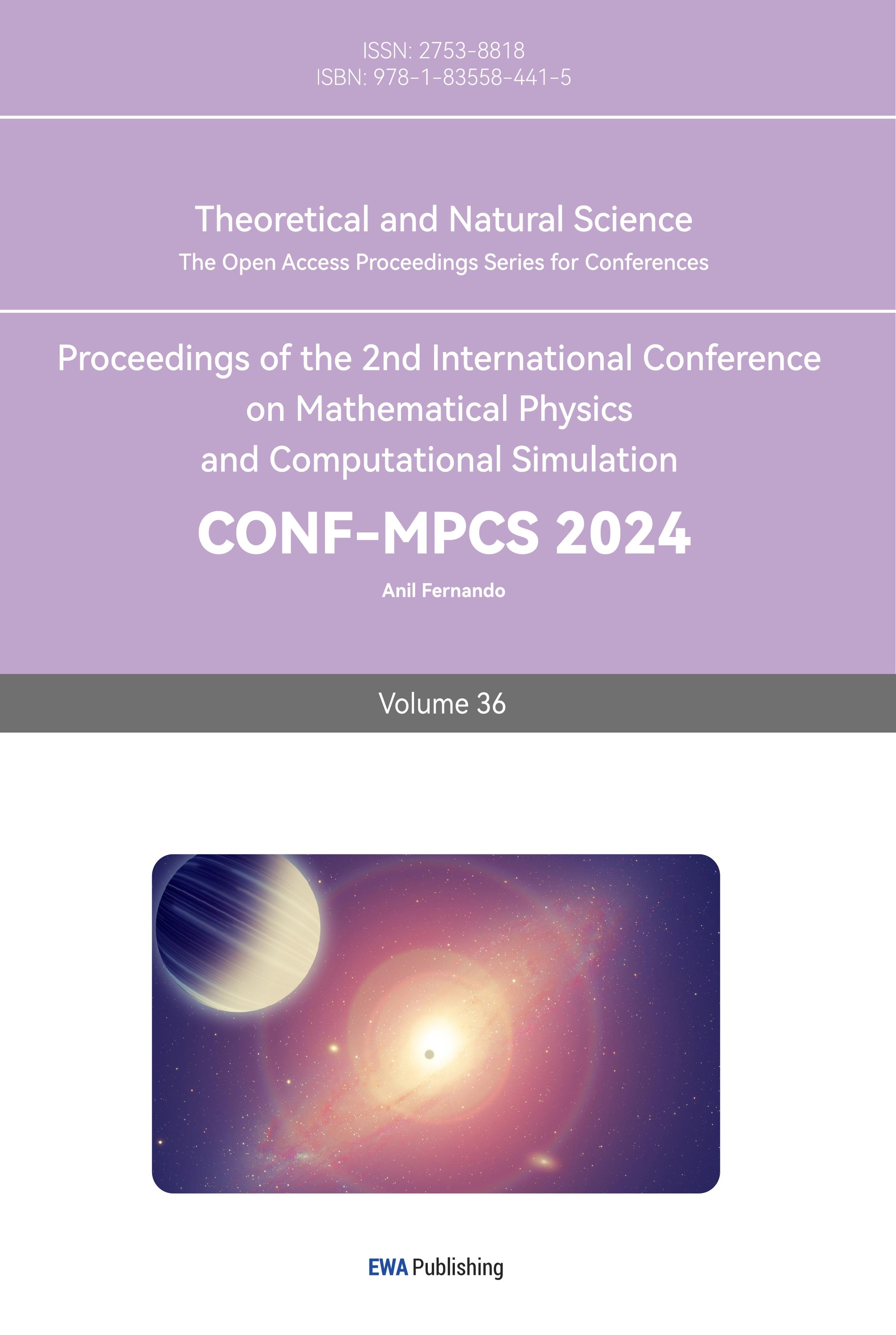

Global trade agreements, such as the North American Free Trade Agreement (NAFTA) and the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), significantly influence the economic and diplomatic landscapes of member countries. To analyze their impact, we apply a computable general equilibrium (CGE) model, which simulates the economic effects of trade agreements on GDP, employment, and trade flows among participating nations, as shown in Figure 1. For instance, the CGE model predicts that the CPTPP, by removing tariffs on 95% of goods traded among member countries, would increase GDP by an average of 1.1% across all members by 2030 [5]. This model incorporates data on tariffs, trade volumes, and production costs, allowing for a detailed analysis of the strategic importance of such agreements. The outcomes highlight the potential of trade agreements to foster economic growth, enhance international cooperation, and reduce geopolitical tensions through the mutual benefits of increased trade.

Figure 1. Computable general equilibrium (CGE) model

3.2. Tariffs and Their Economic Effects

The imposition of tariffs, as seen in the recent trade conflict between the United States and China, serves as a pivotal case study for examining the economic effects of tariffs. Using a probabilistic model, specifically a Monte Carlo simulation, we assess the impact of tariffs on trade volumes, prices, and diplomatic relations. This simulation incorporates variables such as tariff rates, price elasticities of demand and supply, and substitution effects to generate a range of potential outcomes. For example, the model suggests that a 10% increase in tariffs on Chinese goods by the United States could lead to a 2-3% decrease in import volumes from China, with a concomitant increase in prices for U.S. consumers by approximately 0.5% [6]. The analysis extends to the diplomatic sphere, where increased tariffs correlate with heightened tensions and a reduction in bilateral cooperation, as evidenced by the suspension of trade talks. The quantitative analysis, supported by empirical data from trade volumes and price indices, underscores the complex effects of tariffs on both the economy and international relations.

3.3. Non-tariff Barriers and International Economics

Non-tariff barriers (NTBs), such as quotas, embargoes, and technical standards, play a critical role in shaping trade and diplomatic relations. Utilizing a panel data regression model, we analyze the impact of NTBs on trade flows and international diplomacy among European Union (EU) member states and their trading partners. The model incorporates data on the prevalence of NTBs, trade volumes, and compliance costs to assess their effects on trade. For instance, the analysis reveals that stringent sanitary and phytosanitary (SPS) measures imposed by the EU can reduce agricultural imports from Africa by up to 15%, highlighting the economic implications of such barriers. Furthermore, the regression analysis explores the diplomatic repercussions, where countries facing higher barriers may seek retaliation or dispute resolution through international bodies like the World Trade Organization (WTO) [7]. This section illustrates the multifaceted impact of NTBs, revealing how they not only affect trade volumes and market access but also contribute to the complexity of international economic diplomacy.

4. Economic Sanctions as a Diplomatic Tool

4.1. Case Studies of Sanction Implementation

In analyzing the implementation of economic sanctions, we examine three distinct cases: sanctions against Iran due to its nuclear program, sanctions against Russia following its annexation of Crimea, and the economic embargo against Cuba. Each case offers unique insights into the effectiveness and economic repercussions of sanctions.

Iran’s Nuclear Program: The international community, led by the United States, imposed sanctions on Iran aiming to curb its nuclear program, as shown in Figure 2 [8]. The sanctions targeted Iran’s oil exports and financial transactions, leading to a significant drop in its GDP and a sharp devaluation of its currency. A statistical analysis utilizing interrupted time series models indicates a direct correlation between the imposition of sanctions and the decline in Iran’s economic indicators. However, the 2015 Joint Comprehensive Plan of Action (JCPOA) illustrated the potential for sanctions to bring about diplomatic negotiations, as evidenced by Iran’s agreement to curb its nuclear activities in exchange for lifting some sanctions.

Figure 2. Iran’s Nuclear Program (Source: The Iran Prime)

Russia’s Annexation of Crimea: Sanctions imposed by the EU and the US on Russia targeted its energy, defense, and financial sectors. Using a difference-in-differences analysis, we assess the impact of these sanctions on Russia’s economic growth and foreign direct investment. The findings suggest a moderate impact on Russia’s economy, with a slight decrease in GDP growth rates and a reduction in foreign investment. However, the sanctions did not significantly alter Russia’s foreign policy, highlighting the limitations of sanctions as a tool to achieve complex diplomatic objectives.

Economic Embargo against Cuba: The United States’ decades-long economic embargo against Cuba serves as a study in the long-term effects of economic sanctions. Regression analysis using historical economic data from Cuba indicates a persistent negative impact on the Cuban economy, with estimates suggesting a substantial reduction in GDP over the decades. Despite the economic toll, the embargo has had limited success in effecting political change within Cuba, suggesting that prolonged isolation may entrench rather than alter a country’s political dynamics.

4.2. Mathematical Modeling of Sanction Effects

To quantitatively analyze the effects of economic sanctions, we employ a range of mathematical models, including the Solow-Swan growth model modified to incorporate external economic shocks such as sanctions, and game-theoretical models to understand the strategic interactions between imposing and receiving countries.

Modified Solow-Swan Model: By incorporating sanctions as an external shock, the model demonstrates how sanctions reduce the steady-state level of capital per capita and long-term economic growth in the targeted country. The model quantitatively predicts the decrease in GDP growth rate as a function of the severity of sanctions, calibrated using historical data from sanctioned countries [9].

Game-Theoretical Models: These models illustrate the strategic decision-making process of both sanctioning and targeted countries. By defining payoffs based on economic and political objectives, the model predicts conditions under which sanctions lead to desired outcomes. Nash equilibrium concepts are applied to analyze the scenarios under which both parties might reach a compromise or escalate conflict.

4.3. Policy Implications and Recommendations

The quantitative analysis and mathematical modeling of economic sanctions underscore several key policy implications and recommendations for the use of sanctions as a diplomatic tool, as shown in Table 1 [10]:

Table 1. Policy Recommendations for Effective Implementation and Diplomatic Engagement

Policy Recommendations | Description |

Targeted Sanctions | To minimize unintended economic harm to civilian populations, sanctions should be carefully targeted at key sectors or individuals directly involved in the policies or actions being contested. Our models suggest that targeted sanctions are more likely to achieve objectives with fewer negative externalities. |

Multilateral Approaches | The effectiveness of sanctions significantly increases with broad international support. Statistical analysis of case studies shows that unilateral sanctions often have limited impact compared to coordinated efforts by multiple countries or international organizations. |

Exit Strategies and Flexibility | Sanctions should be designed with clear criteria for lifting them, based on measurable changes in behavior or policy of the target country. This approach encourages compliance by providing a direct pathway for the targeted country to restore normal relations. |

Alternative Diplomatic Tools | Sanctions should not be the only tool in diplomatic negotiations. Quantitative analysis indicates that combining sanctions with diplomatic incentives (such as economic aid or trade agreements contingent on policy changes) increases the likelihood of achieving desired outcomes. |

In conclusion, while economic sanctions can be an effective diplomatic tool under certain conditions, their implementation requires careful consideration of the economic and political context, supported by quantitative analysis and statistical modeling to maximize their effectiveness and minimize unintended consequences.

5. Conclusion

In addition to the foundational principles provided by economic theories, probabilistic models serve as indispensable tools in forecasting economic trends and gauging their ramifications on international relations. Bayesian statistics, for example, facilitates the assimilation of prior knowledge into predictive models, enabling the refinement of beliefs based on new evidence. Similarly, regression analysis plays a pivotal role in elucidating the connection between economic variables and outcomes, offering valuable insights into how economic policies influence specific results. The integration of economic theories and probabilistic models yields invaluable insights into the intricate dynamics of economic diplomacy. By combining theoretical frameworks with quantitative analysis, policymakers gain a deeper understanding of the multifaceted nature of global trade and diplomatic negotiations. This comprehensive approach fosters informed decision-making, enabling policymakers to navigate the complexities of international relations with greater precision and efficacy. This paper has endeavored to delve into the complexities of economic diplomacy, examining the symbiotic relationship between economic theories, trade policies, and diplomatic engagements. Through the exploration of theoretical frameworks and empirical analysis, we have sought to shed light on the mechanisms driving international economic relations. By elucidating the role of economic theories and probabilistic models in shaping diplomatic interactions, this study underscores the critical importance of informed decision-making in promoting international cooperation and stability.

In conclusion, the integration of economic theories and probabilistic models provides a robust foundation for understanding and navigating the complexities of economic diplomacy. By leveraging these analytical tools, policymakers can formulate more effective strategies for promoting global prosperity and fostering diplomatic relations. It is our hope that this paper contributes to a deeper appreciation of the intricate interplay between economics and international relations, ultimately paving the way for more informed and collaborative approaches to global governance.

References

[1]. Bisin, Alberto, and Thierry Verdier. “Advances in the economic theory of cultural transmission.” Annual Review of Economics 15 (2023).

[2]. Aghaei, Majid, Mahdieh Rezagholizadeh, and Farideh Bagheri. “The effect of human capital on economic growth: The case of Iranâ s provinces.” Quarterly Journal of Research and Planning in Higher Education 19.1 (2023): 21-44.

[3]. Rader, Trout. The economics of feudalism. Taylor & Francis, 2023.

[4]. Antsygina, Anastasia, and Mariya Teteryatnikova. “Optimal information disclosure in contests with stochastic prize valuations.” Economic Theory 75.3 (2023): 743-780.

[5]. Glushchenko, Valery Vladimirovich. “The scientific and practical significance of the paradigm of the development of scientific support of the 10th technological order in the world economy.” ASEAN Journal of Science and Engineering Education 3.3 (2023): 245-264.

[6]. Hill, Christopher, and Sophie Vanhoonacker-Kormoss. International relations and the European Union. Oxford University Press, 2023.

[7]. Vig, Norman J. “Introduction: Governing the international environment.” The Global Environment. Routledge, 2023. 1-26.

[8]. Weiss, Uri, and Joseph Agassi. “Game theory for international accords.” Games to Play and Games not to Play: Strategic Decisions via Extensions of Game Theory. Cham: Springer Nature Switzerland, 2023. 45-60.

[9]. Reus-Smit, Christian, and Ayşe Zarakol. “Polymorphic justice and the crisis of international order.” International Affairs 99.1 (2023): 1-22.

[10]. Reus-Smit, Christian, and Ayşe Zarakol. “Polymorphic justice and the crisis of international order.” International Affairs 99.1 (2023): 1-22.

Cite this article

Gao,J.;Ye,X. (2024). Economic diplomacy: Analyzing theories and models for informed policy. Theoretical and Natural Science,36,42-47.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Mathematical Physics and Computational Simulation

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Bisin, Alberto, and Thierry Verdier. “Advances in the economic theory of cultural transmission.” Annual Review of Economics 15 (2023).

[2]. Aghaei, Majid, Mahdieh Rezagholizadeh, and Farideh Bagheri. “The effect of human capital on economic growth: The case of Iranâ s provinces.” Quarterly Journal of Research and Planning in Higher Education 19.1 (2023): 21-44.

[3]. Rader, Trout. The economics of feudalism. Taylor & Francis, 2023.

[4]. Antsygina, Anastasia, and Mariya Teteryatnikova. “Optimal information disclosure in contests with stochastic prize valuations.” Economic Theory 75.3 (2023): 743-780.

[5]. Glushchenko, Valery Vladimirovich. “The scientific and practical significance of the paradigm of the development of scientific support of the 10th technological order in the world economy.” ASEAN Journal of Science and Engineering Education 3.3 (2023): 245-264.

[6]. Hill, Christopher, and Sophie Vanhoonacker-Kormoss. International relations and the European Union. Oxford University Press, 2023.

[7]. Vig, Norman J. “Introduction: Governing the international environment.” The Global Environment. Routledge, 2023. 1-26.

[8]. Weiss, Uri, and Joseph Agassi. “Game theory for international accords.” Games to Play and Games not to Play: Strategic Decisions via Extensions of Game Theory. Cham: Springer Nature Switzerland, 2023. 45-60.

[9]. Reus-Smit, Christian, and Ayşe Zarakol. “Polymorphic justice and the crisis of international order.” International Affairs 99.1 (2023): 1-22.

[10]. Reus-Smit, Christian, and Ayşe Zarakol. “Polymorphic justice and the crisis of international order.” International Affairs 99.1 (2023): 1-22.