1. Introduction

Gold has several properties, before it had the purchasing power, gold played the value of ordinary commodities, with commodity attributes. After gold is fixed to act as a general equivalent, it evolves into money. Gold naturally plays a monetary function in this situation [1]. In addition, gold also has other special investment values, like risk-avoiding, inflation-proof, and so on. Because of this, the price of gold also got more attention. However, the price of gold often fluctuates, leading to the impact of gold investment, and its characterization has also laid a theoretical analysis for the analysis of the gold reserve function [2]. Therefore, the study of the influence factors of gold price is significant.

There are many factors affecting the price of gold, such as the dollar index, inflation, and so on. Li used Vector Error Correction Model to study the inflation situation, the dollar index, and the dollar interest rate index on the impact of the international gold price. The research pointed out that inflation on the gold price has a significant negative correlation. In a certain period, the dollar interest rate index and the gold price have a negative correlation, but in the long term, there is a significant positive correlation [3]. Yan pointed out that the dollar value index has both a significant impact in the short term and the long term on the price of gold [4]. Zhang analyzed the mechanism of how factors affect China's spot gold price in the role of gold price. The study concluded that the RMB exchange rate has a positive correlation with the international gold price and the price of gold. The Chinese stock price index has a negative correlation with the U.S. Stock Price Index and China's spot gold price. After using the Vector Autoregression Model to analyze the Chinese stock price index, the U.S. Stock Price Index, and China's spot gold price, it concluded that the price of gold itself has the greatest impact, followed by interest rates [5]. Tu used the Generalized Method of Moments and Error Correction Model to analyze the data of gold price and money supply for a total of 117 months from 2002 to 2012 and found that money supply had a significant impact on gold price [6]. In addition to the economic factors mentioned above, many other factors affect the gold price.

Monetary policy and social conditions also have an impact on the gold price. Shang studied the role of the three influencing factors of the asset portfolio balance channel, signaling channel, and liquidity channel under different monetary policies. And found that the tight monetary policy will reduce the gold price; the steady monetary policy has less influence on the gold price; the loose monetary policy will increase the gold price, which shows that the monetary policy is also one of the influencing factors [7]. Lu studied the impact of the gold price on the GDP growth rate, unemployment rate, and other factors. The research found that its influence is not significant in general, but when the announced GDP growth rate, unemployment rate, and other data do not match the market expectations, the price of gold will change [8]. In the long term, the gold price is influenced by the following factors.

In addition, the gold price will be affected by some special events. Wu analyzed the change in the price of gold before and after four events in the trade friction between China and the United States. Only the event that the Chinese and U.S. governments both implement the measures to increase tariffs has a significant negative correlation with the gold price. Other three events that the G20 summit of the U.S. and China consultations, the Trump administration declared to raise tariffs on China, and China and the United States signed a trade agreement all have a positive correlation with gold prices [9]. Wu and Yang selected the data of 10 years before and after the financial crisis. Found that at the end stage of the financial crisis, there was a significant effect on the short-term changes in the price of gold, but the impact of shocks at the outbreak stage was not significant [10].

This paper will use the Ordinary Least Squares to analyze the gold price and other data that may be relevant to the price of gold in recent years. Examining the factors that influence the price of gold in the long run.

2. Methodology

2.1. Data source and description

There are many factors that may affect the price of gold, such as the U.S. stock index, the U.S. dollar index, the exchange rate between the U.S. dollar and other currencies, the price of precious metal futures, and the price of crude oil futures. Therefore, the data from December 2011 to December 2018 are selected for this paper in many aspects. There are sixteen data items in total. Includes Gold Price (GP), S&P 500 Index (SP), Dow Jones Index (DJ), Eldorado Gold Corporation (EG), EUR USD Exchange rate (EU), Brent Crude oil Futures (OF), Crude Oil WTI USD (OS), Silver Futures (SF), US Bond Rate (USB), Platinum Price (PLT), Palladium Price (PLD), Rhodium Prices (RHO), US dollar Index Price (USDI), Gold Miners ETF (GDX), Oil ETF USO (USO) and Cobalt Price (CO).

The research will use this data to describe as fully as possible the various factors that may affect the price of gold. The frequency of each data is the same, and they are all measured in days. The data are all from the Kaggle database.

2.2. Indicators selection

In this paper, SP and DJ are chosen to represent the situation of the U.S. stock market. EG and GDX represent the situation related to gold mining. EU represents the exchange rate between the U.S. dollar and other currencies. OF, OS, and USO represent the situation related to crude oil. SF, PLT, PLD, RHO, and CO represent the situation of precious metal futures. USB and USDI represent the situation related to the U.S. economy (Table 1).

The mean value of gold price in the sample is $127.323, the minimum is $100.92, and the maximum is $173.2, while the standard deviation is 17.527, which indicates that the price of gold fluctuates a lot in the period selected in this paper. The standard deviation of the EUR USD Exchange rate is only 0.101, the standard deviation of the US Bond Rate is only 0.433, and the standard deviation of the Cobalt Price is only 0.493, which indicates that its volatility is small, while all other variables are more volatile especially Dow Jones Index and Silver Futures.

Table 1. Descriptive Analysis.

Items | Min | Max | Mean | Std. Deviation |

GP | 100.920 | 173.200 | 127.323 | 17.527 |

SP | 122.060 | 293.090 | 204.49 | 43.832 |

DJ | 11769.210 | 26833.471 | 18161.094 | 3889.752 |

EG | 2.770 | 80.200 | 28.277 | 20.326 |

EU | 1.039 | 1.393 | 1.208 | 0.101 |

OF | 27.880 | 126.220 | 77.505 | 27.401 |

OS | 26.550 | 110.300 | 70.153 | 23.472 |

SF | 33170.000 | 65292.000 | 43284.478 | 7530.704 |

USB | 1.358 | 3.239 | 2.263 | 0.433 |

PLT | 775.600 | 1737.600 | 1183.915 | 273.842 |

PLD | 470.450 | 1197.500 | 766.805 | 148.307 |

RHO | 0.000 | 2600.000 | 1130.442 | 570.013 |

USDI | 78.300 | 103.288 | 89.809 | 7.516 |

GDX | 12.700 | 57.520 | 26.747 | 10.621 |

USO | 7.820 | 41.600 | 22.113 | 11.431 |

CO | 1.936 | 3.954 | 2.938 | 0.493 |

2.3. Research method

This paper aims to investigate the factors that affect the price of gold. Therefore, it will be analyzed using ordinary least squares regression (OLS) analysis, which can be used to study the effect of independent variables on dependent variables. The basic formula of ordinary least squares regression analysis is:

\( y={β_{0}}+{β_{1}}{x_{1}}+{β_{2}}{x_{2}}+…+{β_{P}}{x_{P}}+ε\ \ \ (1) \)

Where y is the dependent variable, \( {x_{i}} \) is the independent variable, \( {β_{0}} \) is the regression constant, \( {β_{p}} \) represents the regression coefficient, and ε is the random error.

3. Results and discussion

3.1. Correlation analysis

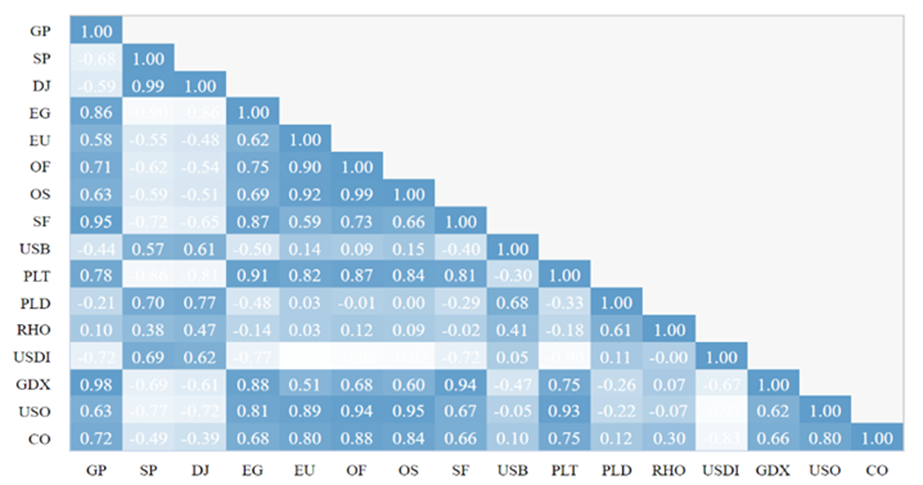

According to the results of correlation analysis, all the data have a significant correlation with GP, so all of them are selected as indicators of this study. Based on the positive and negative correlation coefficients in the graph it can be concluded whether there is a positive or negative correlation between the variables. The results show that GP has a significant negative correlation with SP, DJ, USB, PLD, and USDI. Besides, GP has a significant positive correlation with EG, EU, OF, OS, SF, PLT, PLD, RHO, GDX, USO, and CO (Figure 1).

Figure 1. Correlation results.

In this study, GP was used as the dependent variable, and SP, DJ, EG, EU, OF, OS, SF, USB, PLT, PLD, RHO, USDI, GDX, USO, and CO were the independent variables. Based on this, the formula of the OLS model built is:

\( GP = 201.209-0.216*SP + 0.002*DJ-0.049*EG-33.247 *EU + 0.095*OF + 0.051*OS + 0.000*SF-4.320*USB + 0.016*PLT + 0.003*PLD + 0.001*RHO-0.903*USDI + 0.783*GDX-0.843*USO + 4.068*CO \) (2)

3.2. OLS regression results

In this study, GP was used as the dependent variable, and SP, DJ, EG, EU, OF, OS, SF, USB, PLT, PLD, RHO, USDI, GDX, USO, and CO were the independent variables. By using OLS regression, it can be seen that the model R2=0.987, which indicates that each independent variable can explain the cause of 98.7% of the change in GP. The F-test of the model was conducted and it was found that the model passed the F-test (F=8446.244, p=0.000<0.05). It shows that at least one of SP, DJ, EG, EU, OF, OS, SF, USB, PLT, PLD, RHO, USDI, GDX, USO, and CO will have an impact relationship on GP.

The regression coefficient is a parameter that indicates the magnitude of the effect of the independent variable on the dependent variable. The larger the value of the regression coefficient, the greater the influence of the independent variable on the dependent variable. A positive regression coefficient indicates that the dependent variable increases as the independent variable increases, which means that there is a positive influence relationship. A negative regression coefficient indicates means that there is a negative influence relationship.

The variable presents significance when P<0.01, which means that there is a significant influence relationship between the variable on the dependent variable. Conversely, it means that the variable does not have a critically effect relationship with the dependent variable. Among the indicators, all of them showed significance with p<0.01 except for OS with p=0.056>0.01.

From the analysis, it can be seen that DJ, OF, SF, PLT, PLD, RHO, GDX, CO will have a significant positive influence relationship on GP. and SP, EG, EU, USB, USDI, USO will have a significant negative effect on GP. However, OS does not have an impact on GP.

Table 2. OLS model results.

Coefficient | Standard Error | t | p | 95% CI | |

Constant | 201.209 | 14.474 | 13.902 | 0.000** | 172.841 ~ 229.577 |

SP | -0.216 | 0.015 | -13.964 | 0.000** | -0.246 ~ -0.185 |

DJ | 0.002 | 0.000 | 9.030 | 0.000** | 0.002 ~ 0.002 |

EG | -0.049 | 0.018 | -2.762 | 0.006** | -0.083 ~ -0.014 |

EU | -33.247 | 5.635 | -5.900 | 0.000** | -44.291 ~ -22.202 |

OF | 0.095 | 0.020 | 4.814 | 0.000** | 0.056 ~ 0.134 |

OS | 0.051 | 0.027 | 1.916 | 0.056 | -0.001 ~ 0.103 |

SF | 0.000 | 0.000 | 14.533 | 0.000** | 0.000 ~ 0.000 |

USB | -4.320 | 0.340 | -12.712 | 0.000** | -4.987 ~ -3.654 |

PLT | 0.016 | 0.001 | 14.955 | 0.000** | 0.014 ~ 0.018 |

PLD | 0.003 | 0.001 | 3.080 | 0.002** | 0.001 ~ 0.006 |

RHO | 0.001 | 0.000 | 8.148 | 0.000** | 0.001 ~ 0.001 |

USDI | -0.903 | 0.089 | -10.176 | 0.000** | -1.076 ~ -0.729 |

GDX | 0.783 | 0.026 | 30.073 | 0.000** | 0.732 ~ 0.834 |

USO | -0.843 | 0.067 | -12.526 | 0.000** | -0.975 ~ -0.711 |

CO | 4.068 | 0.291 | 13.994 | 0.000** | 3.498 ~ 4.637 |

R2 | 0.987 | ||||

Adj R2 | 0.987 | ||||

F | F (15,1702)=8446.244,p=0.000 | ||||

D-W | 0.274 | ||||

Dependent Variable: GP | |||||

* p<0.05 ** p<0.01 | |||||

4. Conclusion

This paper finds that in the long run Dow Jones Index, Brent Crude oil Futures, Silver Futures, Platinum Prices, Palladium Prices, Rhodium Prices, Gold Miners ETF, and Cobalt Prices have a significant positive impact on GP. S&P 500 Index, Eldorado Gold Corporation, EUR USD Exchange rate, US Bond Rate, US Dollar Index Price, Oil ETF USO significantly negatively impact gold price.

From the results, it can be seen the overall situation of the U.S. stock market, the situation related to gold mining, and the exchange rate between the U.S. dollar and other currencies. the situation related to crude oil, the situation of precious metal futures, and the situation related to the U.S. economy all have an impact on the price of gold. However, only the situation of precious metal futures has a positive relationship with the Gold Price. Only the situation related to the U.S. economy has a negative relationship with Gold Prices. Other aspects of the data from different perspectives have different results, still need to follow up on this aspect of a more in-depth and comprehensive study.

This paper explores the impact of various factors on the price of gold, and the results of this paper can help the research on gold price prediction. Some factors that can be based on the data selected in this paper can be certain conclusions, but there is a need to carry out more in-depth research to confirm. Some factors need to be analyzed by selecting a wider range of data to obtain more certain conclusions.

References

[1]. Wang R 2014 Influencing factors and trend analysis of international gold price. Shandong University of Finance and Economics.

[2]. Zou Q 2014 Research on the financial function of gold. Shanghai Academy of Social Sciences.

[3]. Li J T 2021 Analysis of Factors Affecting the Trend of Gold Price. University of International Business and Economics.

[4]. Yan H X 2022 Empirical Analysis and Suggestions on the Influencing Factors of Gold Price. Shanghai University of Finance and Economics.

[5]. Wu Z H 2023 Study on the impact of China-US trade friction on international gold price changes. Yunnan University of Finance and Economics.

[6]. Tu Z 2014 Research on the impact of China's money supply on gold price. Southwest University of Finance and Economics.

[7]. Shang T Y 2022 Research on the impact of monetary policy on gold price. Guizhou University of Finance and Economics.

[8]. Lu Q Y 2022 Analysis of factors influencing the international gold price. Shanghai Academy of Social Sciences.

[9]. Zhang Q 2021 Research on the influencing factors of Chinese spot gold price. Shenyang University of Science and Technology.

[10]. Wu Y M and Yang F 2014 Dynamic analysis of influencing factors of gold price before and after financial crisis. Gold, 35(8).

Cite this article

Zhang,J. (2024). Analysis of the factors affecting the price of gold based on multiple linear regression. Theoretical and Natural Science,52,19-24.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of CONF-MPCS 2024 Workshop: Quantum Machine Learning: Bridging Quantum Physics and Computational Simulations

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Wang R 2014 Influencing factors and trend analysis of international gold price. Shandong University of Finance and Economics.

[2]. Zou Q 2014 Research on the financial function of gold. Shanghai Academy of Social Sciences.

[3]. Li J T 2021 Analysis of Factors Affecting the Trend of Gold Price. University of International Business and Economics.

[4]. Yan H X 2022 Empirical Analysis and Suggestions on the Influencing Factors of Gold Price. Shanghai University of Finance and Economics.

[5]. Wu Z H 2023 Study on the impact of China-US trade friction on international gold price changes. Yunnan University of Finance and Economics.

[6]. Tu Z 2014 Research on the impact of China's money supply on gold price. Southwest University of Finance and Economics.

[7]. Shang T Y 2022 Research on the impact of monetary policy on gold price. Guizhou University of Finance and Economics.

[8]. Lu Q Y 2022 Analysis of factors influencing the international gold price. Shanghai Academy of Social Sciences.

[9]. Zhang Q 2021 Research on the influencing factors of Chinese spot gold price. Shenyang University of Science and Technology.

[10]. Wu Y M and Yang F 2014 Dynamic analysis of influencing factors of gold price before and after financial crisis. Gold, 35(8).