1. Introduction

Modern society has witnessed an industry-wide transformation toward sustainable transportation because electric vehicles have led the transformation. Electric vehicles (EVs) in China have gained critical importance because the country maintains its position as the world's leading automotive market. The rapid advancement in EV market growth depends significantly on government subsidies and policy measures, which form the backbone of Chinese official intervention. Analysis of these government interventions provides essential knowledge to policymakers, industry representatives, and researchers about their strategy performance and upcoming policy development.

The research body has significantly investigated how government subsidies increase adoption levels of EVs in China. Financial incentives are significant factors that trigger substantial growth in EV sales. A strong positive relationship between government subsidy implementation and growing EV sales in Chinese cities was established through difference-in-differences (DID) and propensity score matching (PSM) methods, as Liu et al. The authors confirm that financial incentive programs succeed in encouraging the adoption of eco-friendly technologies [1].

Various studies have conducted empirical investigations to determine the effect of subsidy framework parameters on markets. According to Tong et al., direct purchase subsidies for Chinese domestic EVs administered between 2016 and 2019 substantially increased adoption rates [2]. The study discussed the necessity of subsidy optimization because unwieldy or misguided subsidy sizes create inefficient outcomes for budget allocation.

The introduction of equity-related concerns has co-occurred. The study by Guo and Xiao determined that people who earn higher incomes received more significant benefits from EV purchase subsidies [3]. According to research findings, manufacturers completely transferred approximately 121.32% of their subsidies to consumer payments. The regressive nature of subsidies and their ability to worsen income disparities concerns researchers since they advance the adoption of electric vehicles.

Hao et al. discovered that the warranty subsidy intensity and efficiency level were crucial in creating effective results in their study. According to Hao et al., the best possible effects resulted from vehicle cost subsidies ranging between 40% and 70%. The combination of subsidies set between 40% and 70% of vehicle costs proved most effective, but support levels lower than or higher than this range demonstrated weak or inefficient outcomes [4].

The EV market receives extensive governmental involvement, extending beyond directly supporting consumers. The industry-wide policy schemes also contribute through investments in charging systems, research initiatives (R&D), and government purchasing preferences. Coupled policies from the government have established an optimal structure for EV advancement, which supports Chinese manufacturers in becoming top international leaders mainly through their excellent battery technology and vehicle manufacturing capabilities [5].

The continued availability of government support for sustainable growth has faced doubts throughout recent years. Since 2019, China has withdrawn EV subsidies gradually while experts are analyzing if the market can expand naturally without governmental aid programs. According to Zheng et al., market development requires subsidies initially, but their extended application might create efficiency problems while obstructing innovation progress [6]. The authors endorse switching from financial aid to the use of carbon pricing together with fuel economy obligations alongside electrical vehicle charging investment networks as the key strategies for sustaining electric vehicle market growth.

Modern studies investigate the precise ways that policy incentives influence when consumers decide to buy electric vehicles. Luo et al. investigated the combined impact of purchase subsidies and charging infrastructure investment on EV adoption. Still, they discovered that this dual support might not produce complete synergies according to their research [7]. Policymakers must observe both the proportion and sequence of incentive programs because it helps them create optimal results.

According to Zhao et al., the effectiveness of subsidies depends on consumer awareness and perception. The number of environmentally conscious people in a region influenced how much the subsidy affected EV adoption, so integrating awareness initiatives improved policy results [8].

The effects of subsidies regarding technological advances in the EV market represent an essential area of inquiry. Costly financial incentives used to promote innovation in domestic manufacturing initially generated advances. Still, domestic manufacturers subsequently lowered their research and development activities as they became dependent on government subsidies, according to Zhao et al. A balanced strategy must be adopted because it supports innovation while minimizing the creation of dependency between resources and innovation activities [9].

Studies have shown that subsidy programs create different levels of effectiveness across various geographical regions. Liu et al. showed how regions with superior infrastructures and elevated economic standing in China employed more excellent subsidy benefits than interior regions. Policymakers should design programs with different specifications for regions because study results demonstrate that generic approaches are ineffective regarding subsidy effectiveness [1].

The study has focused on evaluating the environmental results of EV subsidy programs. According to Li et al., adopting EVs decreased urban air pollutants, yet the total carbon emission reductions depended on the power generation energy mix [10]. The effectiveness of environmental improvements relies heavily on the level of coal usage in specific regions because energy policy needs to align with EV promotion strategies.

2. Methods

2.1. Data source

The research analyzes how state subsidies affect electric vehicle (EV) sales within China. It depends on publicly accessible secondary information. Two key sources are utilized. Kennedy serves as the source for government subsidy information, which comprises complete annual statistics about EV sector financing support from public funds through consumer incentives alongside R&D investments, infrastructure spending, and tax benefits. This study obtained EV sales data from Statista, which presents BEV and plug-in hybrid electric vehicles (PHEV) yearly market figures from 2016 to 2029.

While EV sales data span a broader period, the analysis focuses primarily on the overlapping years from 2018 to 2023, during which both subsidy and sales figures are available. This allows for a coherent comparison of trends between government financial intervention and consumer adoption patterns.

2.2. Variable description

The study centers around two variables: government support and EV sales volume. The government support variable captures the state's total financial assistance to the EV industry annually, expressed in billions of USD. The EV sales variable represents the annual total number of EVs sold in China, expressed in millions of units. It is further divided into BEVs and PHEVs to provide additional detail on market composition. Table 1 summarizes the variables used in the analysis.

Table 1: Variables definition

Variable Name | Description | Unit | Data Source |

Government Support | Total government funding directed toward the EV sector | Billion USD | Kennedy (2024) |

EV Sales (Total) | Total annual sales of electric vehicles in China (BEVs + PHEVs) | Million units | Statista (2024) |

BEV Sales | Annual sales of battery electric vehicles | Million units | Statista (2024) |

PHEV Sales | Annual sales of plug-in hybrid electric vehicles | Million units | Statista (2024) |

All data were organized and cleaned using Microsoft Excel. No missing values were found in the sales dataset. For the government support variable, years without available subsidy data (e.g., before 2018) were excluded from visual comparisons.

2.3. Analytical approach

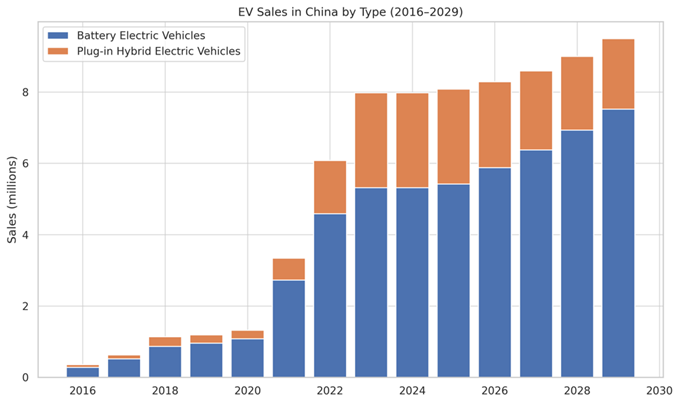

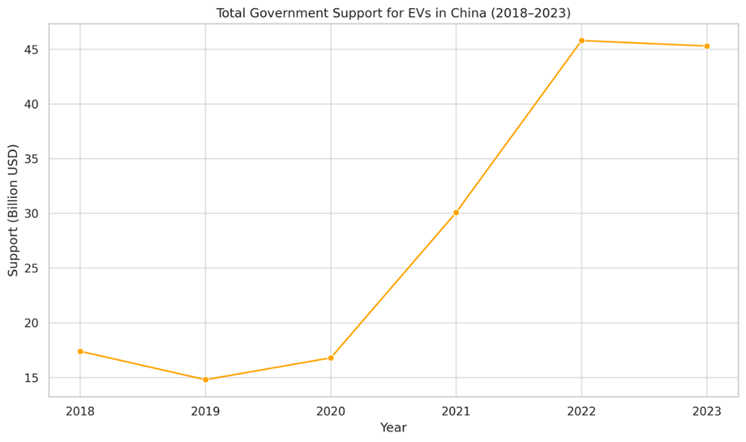

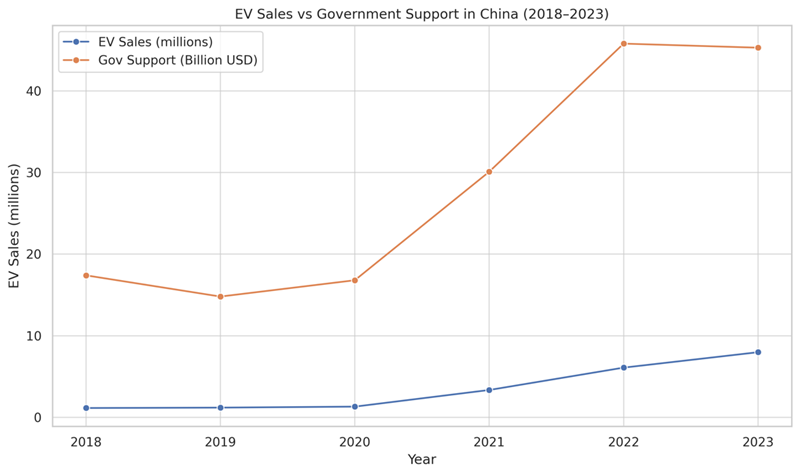

Rather than applying econometric models or causal inference techniques, this study adopts a descriptive visual approach to explore the dynamics between government intervention and EV market growth. Three types of visualizations are used to interpret the data.

First, a stacked bar chart shows the annual breakdown of EV sales into BEVs and PHEVs. This chart clearly shows how the composition of the EV market has changed over time. Second, a line plot presents annual government support for EVs from 2018 to 2023. This provides insight into the scale and evolution of the Chinese government's fiscal commitment. The comparison between total EV sales and government support through a dual-line chart displays these trends alongside each other for evaluating temporal patterns between them. The visual interpretations present simple yet profound explanations about how policies relate to market performances for electric vehicles in the Chinese market.

3. Results and discussion

3.1. Trends in electric vehicle sales

Figure 1 shows that EV sales in China rose from 2016 until 2029, as the data shows. According to the available data, EV adoption demonstrates a defined rising pattern that began intensifying in 2021. The total yearly sales of EV units reached 0.37 million units in 2016. The number of EV sales in China reached 7.98 million in 2023, following the initial 0.37 million units from 2016, and it demonstrates a rising trend that extends to 2029.

The analysis of EV sales through BEV and PHEV categories presents an extra understanding of the market. In every measured period, Chinese consumers have selected BEVs as their preferred choice, maintaining their leading position in the EV sales market. The BEV segment has been the market leader since 2021, increasing its sales share yearly. The proportion of BEVs reached almost two-thirds of overall EV sales figures in 2023 because consumers preferred them, and the government strongly encouraged zero-emission vehicles. PHEV sales increased gradually during the observation period but carried low momentum, which may result in minimal sales following 2025.

Chinese consumer acceptance of rapidly developing EV infrastructure and improvements in technology and price levels along with internal combustion engine vehicles has led to this market sales outcome. BEVs primarily serve as China's essential component for implementing its green transportation plan.

Figure 1: EV sales in China by type (2016-2029)

3.2. Government support and policy dynamics

Figure 2 displays the evolution of total government financial support for the EV industry from 2018 to 2023. Contrary to expectations of a linear phase-out, public spending increased sharply during this period. After a modest dip between 2018 (USD 17.4 billion) and 2019 (USD 14.8 billion), total support rose to USD 16.8 billion in 2020, followed by a dramatic surge to USD 30.1 billion in 2021 and USD 45.8 billion in 2022. Although a slight decline was observed in 2023 (USD 45.3 billion), overall support remained exceptionally high.

Figure 2: Total government support for EVs in China (2018-2023)

This trajectory highlights the Chinese government's strategic flexibility in adjusting its subsidy structure. The increased support in recent years may have been aimed at ensuring market resilience during economic uncertainties such as the COVID-19 pandemic and global chip shortages. It may also reflect the government’s push to maintain global EV manufacturing and technology leadership.

The government provides support through resources that extend beyond consumer subsidies. It implements three fundamental policy intervention components: funding infrastructure development, offering research grants, and procuring product incentives. The implemented government measures improved production capabilities through advanced battery technology and increased production scale alongside market demand growth.

3.3. Visual correlation between sales and subsidies

Figure 3 compares EV sales versus total government support between 2018 and 2023. An apparent pattern between the two variables shows that government support measures correspond with EV sales growth rates. EV sales followed the significant growth in federal subsidies when those payments surged during the two years from 2020 to 2022.

A perfect linear relationship does not exist between these two variables. EV sales rose moderately between 2018 and 2019 when government assistance decreased. Even though subsidies substantially influence EV adoption, these incentives do not act as the exclusive motivators. The growth of EV sales can also be attributed to better automobile pricing, enhanced brand competition, and greater customer enlightenment combined with expanding charging facilities.

The 2023 data show early signs of market maturity because government support decreased while EV sales kept growing. The industry has developed to a stage where it could maintain growth while receiving less governmental assistance. Subsidies track China’s policy of canceling subsidies to develop domestic technology capabilities and reach a larger scale.

Figure 3: EV sales VS government support in China (2018-2023)

3.4. Interpretation and policy implications

This study strongly proves H1 as government subsidies positively increased electric vehicle (EV) sales within China's market. Research shows a clear relationship between public investment increases and immediate heightening of EV sales numbers, demonstrating that fiscal stimulation works well for demand promotion. The market development process benefited significantly from subsidy programs, providing entry barrier reduction support to new entrants and consumers during the initial and intermediate stages. The adoption of EVs developed more slowly because of insufficient infrastructure combined with high purchase costs for vehicles, except for the financial assistance programs from the government.

BEV sales have become the leading choice among EV shoppers as the market continues evolving towards government-established goals. A review of the provided results demonstrates that BEVs have regularly outperformed PHEVs in market share since 2021 and more so since then. Customers choose EVs because they perceive technological advancements, environmental consciousness, transportation network expansion, and price discounts. The agreement between market preferences and governmental policies regarding zero-emission vehicles creates positive prospects for reaching carbon neutrality goals and improving city air quality standards.

The strong visual connection between EV sales and government subsidies shows diminishing power as time passes. A reduced level of governmental support in 2023 did not prevent EV sales from growing because the relationship between these factors might be separating. According to this data pattern, the EV market in China appears to shift from policy dependence toward independent demand-based growth. Such a policy change represents a highly favorable outcome. The market foundation created by previous subsidy policies demonstrates that the Chinese EV market sustains growth through consumer demand and increased industrial competitiveness.

This emerging transition needs a reevaluation of policy instruments for future development. The development phase warranted direct subsidies, but continuing these subsidies might result in dependency and inefficiency problems. Policymakers must carefully plan the transition from purchase subsidies to market-based and infrastructure elements such as carbon pricing systems, emission regulations, and public charging infrastructure support. These policies will drive future market expansion without affecting government budgets while avoiding market interference.

This observational methodology based on descriptive and visual data collection has effectively shown how policies react with markets, even though it cannot prove direct cause-effect relationships. Trend lines and comparative charts provide an obvious visual representation of market interactions, which researchers can use to establish further econometric analysis. The examined approach provides researchers with a flexible method to study the effects of various subsidy programs on EV adoption across multiple countries worldwide.

4. Conclusion

The research analyzes Chinese EV market responses to government financial support through visual analysis of publicly accessed data. The study shows a perfect time-based link between enhanced government backing and increasing EV market penetration from 2018 through 2023. EV market growth has gained significant momentum during the early stages through transportation subsidies, infrastructure investments, and government funding R&D.

Current market statistical data demonstrates constant BEV dominance, demonstrating the public interest in zero-emission transportation systems. The decreasing government support during 2023 failed to inhibit the continuing growth of EV sales, showing that the market was transitioning toward self-fuelled expansion rather than external incentives.

This visual analysis fails to demonstrate cause-effect relationships yet delivers essential information about Chinese EV market development and policy effects. The evidence indicates that carefully designed and adequately directed subsidies serve as practical triggers to hurry up green technology penetration but demand a market-oriented transition in the long run.

The Chinese experience proves that successful policy development must adapt according to market development levels. Political leaders who wish to achieve similar results should implement financial benefits alongside strategic investments in regulatory systems and ecosystem growth.

References

[1]. Liu, B.C., et al. (2023) Regional Differences in China’s Electric Vehicle Sales Forecasting: Under Supply-Demand Policy Scenarios. Energy Policy, 177, 113554.

[2]. Tong, Z.M., Paul, J.B. and Wang, Z.H. (2023) Effectiveness of Electric Vehicle Subsidies in China: A Three-Dimensional Panel Study. Resource and Energy Economics, 76.

[3]. Guo, X.D. and Xiao, J.J. (2023) Welfare Analysis of the Subsidies in the Chinese Electric Vehicle Industry. Journal of Industrial Economics, 71, 675-727.

[4]. Han, H., Ou, X.M., Du, J.Y., Wang, H.W. and Ouyang. M.G. (2014) China’s Electric Vehicle Subsidy Scheme: Rationale and Impacts. Energy Policy, 73, 722-732.

[5]. Lutsey, N., Mikhail, G., Sandra, W. and Huan, Z. (2018) POWER PLAY: HOW GOVERNMENTS ARE SPURRING the ELECTRIC VEHICLE INDUSTRY. Government White-Paper.

[6]. Zheng, X.M., Flavio, M., Zheng, X.F. and Wu, C.K. (2022) An Empirical Assessment of the Impact of Subsidies on EV Adoption in China: A Difference-In-Differences Approach. Transportation Research Part A: Policy and Practice, 162, 121-136.

[7]. Qi, L., Yin, Y.L., Chen, P.Y. Zhan, Z.F. and Saigal. R. (2022) Dynamic Subsidies for Synergistic Development of Charging Infrastructure and Electric Vehicle Adoption. Transport Policy,

[8]. Zhao, X.L., et al. (2024) Policy Incentives and Electric Vehicle Adoption in China: From a Perspective of Policy Mixes. Transportation Research Part a Policy and Practice, 190, 35.

[9]. Qiu, Z., Li, Z.Q. and Zhang, C. (2024) The Impact of R&D and Non-R&D Subsidies on Technological Innovation in Chinese Electric Vehicle Enterprises. World Electric Vehicle Journal, 15, 304-314.

[10]. Li, F.Y., et al. (2019) Regional Comparison of Electric Vehicle Adoption and Emission Reduction Effects in China. Resources, Conservation and Recycling, 149, 714-726.

Cite this article

Wu,T. (2025). How Does Government Intervention, such as Subsidizing, Affect the EV Market in China. Theoretical and Natural Science,106,52-58.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Mathematical Physics and Computational Simulation

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Liu, B.C., et al. (2023) Regional Differences in China’s Electric Vehicle Sales Forecasting: Under Supply-Demand Policy Scenarios. Energy Policy, 177, 113554.

[2]. Tong, Z.M., Paul, J.B. and Wang, Z.H. (2023) Effectiveness of Electric Vehicle Subsidies in China: A Three-Dimensional Panel Study. Resource and Energy Economics, 76.

[3]. Guo, X.D. and Xiao, J.J. (2023) Welfare Analysis of the Subsidies in the Chinese Electric Vehicle Industry. Journal of Industrial Economics, 71, 675-727.

[4]. Han, H., Ou, X.M., Du, J.Y., Wang, H.W. and Ouyang. M.G. (2014) China’s Electric Vehicle Subsidy Scheme: Rationale and Impacts. Energy Policy, 73, 722-732.

[5]. Lutsey, N., Mikhail, G., Sandra, W. and Huan, Z. (2018) POWER PLAY: HOW GOVERNMENTS ARE SPURRING the ELECTRIC VEHICLE INDUSTRY. Government White-Paper.

[6]. Zheng, X.M., Flavio, M., Zheng, X.F. and Wu, C.K. (2022) An Empirical Assessment of the Impact of Subsidies on EV Adoption in China: A Difference-In-Differences Approach. Transportation Research Part A: Policy and Practice, 162, 121-136.

[7]. Qi, L., Yin, Y.L., Chen, P.Y. Zhan, Z.F. and Saigal. R. (2022) Dynamic Subsidies for Synergistic Development of Charging Infrastructure and Electric Vehicle Adoption. Transport Policy,

[8]. Zhao, X.L., et al. (2024) Policy Incentives and Electric Vehicle Adoption in China: From a Perspective of Policy Mixes. Transportation Research Part a Policy and Practice, 190, 35.

[9]. Qiu, Z., Li, Z.Q. and Zhang, C. (2024) The Impact of R&D and Non-R&D Subsidies on Technological Innovation in Chinese Electric Vehicle Enterprises. World Electric Vehicle Journal, 15, 304-314.

[10]. Li, F.Y., et al. (2019) Regional Comparison of Electric Vehicle Adoption and Emission Reduction Effects in China. Resources, Conservation and Recycling, 149, 714-726.