Volume 111

Published on November 2024Volume title: Proceedings of the 8th International Conference on Economic Management and Green Development

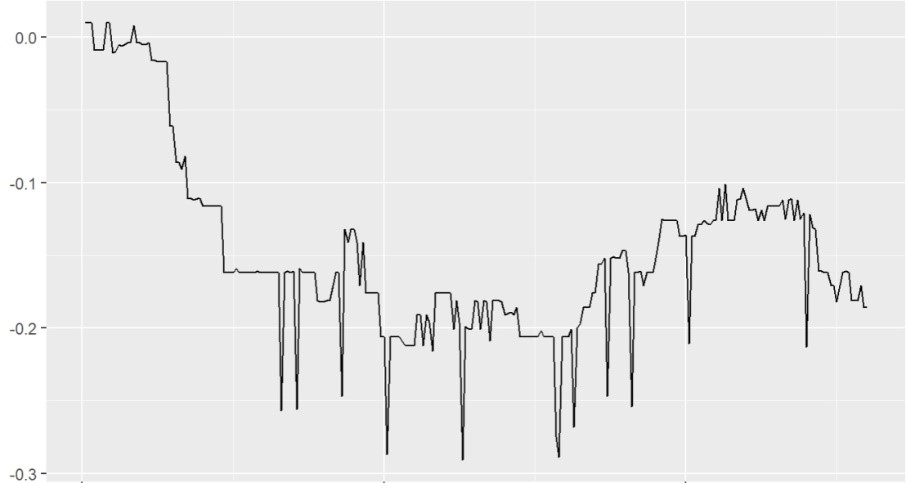

The 2008 financial crisis was the most severe global financial crisis since the Great Depression of 1929. This crisis not only reshaped the international financial landscape but also profoundly influenced the economic policies of countries worldwide. The impact on the Chinese economy was particularly significant. Through empirical research, this paper aims to deeply analyze the specific impacts of the 2008 financial crisis on the Chinese economy and to explore the strategies adopted by the Chinese government in response and the effectiveness of these measures. This study provides a reference for policy-making in the face of potential future financial crises.

View pdf

View pdf

The development of the times has put forward different requirements for management, and technology has also developed with the progress of the times. The development of digital media has changed our traditional perception of management, broadened the boundaries of management, and enabled managers to look at management issues from a more diversified and broader perspective. At the same time, the development of digital media has also improved management efficiency, so that management is no longer a heavy and trivial work, but more systematic and scientific. Based on this, this paper takes automobile enterprises as an example, from the "Ford system" to the "Toyota system" leapfrog breakthrough, in-depth analysis of the current problems of enterprise management, and puts forward the new normal economic situation of enterprise management innovation strategy, in order to provide ideas for China's enterprise management and development. In order to provide ideas for China's enterprise management and development. At the same time, this paper analyzes the innovative development strategy of enterprise management in the new media era from the aspects of the historical development of management and the influence of management on enterprises and people in the new media era, aiming at strengthening the timeliness and reliability of enterprise management, providing a reliable basis for the rectification of the relevant departments, and helping young people in the new era to adapt to the changes in the management system as soon as possible to realize the diversified development, assisting the enterprises and the society in realizing the high-quality development.

View pdf

View pdf

This study explores the impact of macroeconomic factors, particularly GDP, on carbon trading prices in six major Chinese cities. Using a linear regression model, combined with province and quarterly fixed effects, it was found that the influence of economic scale on carbon trading prices exhibits significant regional differences. In the sample analysis, the economic growth in municipalities is positively correlated with carbon trading prices, whereas in other provinces, it is negatively correlated. The study controlled for province and quarterly fixed effects, ensuring the robustness of the results. This research fills a gap in the study of China's carbon market and provides theoretical support for formulating more effective carbon emission policies.

View pdf

View pdf

As one of the largest corporations globally, Apple Inc. generates significant profits, resulting in substantial tax obligations. This paper investigates, through a literature review and case study, how Apple leveraged Ireland's tax laws to minimize its tax burden. The findings reveal that Apple's strategic tax avoidance strategies have had far-reaching implications, both for the company and the Irish economy. Apple's decision to channel its profits through Ireland led to a radical increase in Ireland's GDP, as the company brought substantial investments, talent, and industry development to the country. However, this arrangement also raised concerns about the ethics and legality of Apple's tax practices. In 2017, the change in US tax laws prompted Apple to repatriate its profits back to the United States, where it paid the required taxes under the new regulations.This study examines the complex interplay between multinational corporations, national tax policies, and the broader economic and social implications of tax avoidance strategies. The findings offer insights into the challenges faced by policymakers in balancing the needs of businesses, governments, and the public interest, and highlight the importance of transparency and accountability in the global tax landscape.

View pdf

View pdf

With the rapid development of technologies, financial technology, also known as fintech, has been playing an increasingly important role in the development of the banking system. This article, taking a few products and services that emerged from financial technology and the technologies applied to financial technology as samples, provides an overview of researches on the impact of financial technology on the banking industry. It focus on credit, deposit and financing services, payment, clearing and settlement services, digital currency and investment management services including transactions. The main topics discussed in the article are: using P2P platforms as an example to discuss the impact of financial technology on credit, deposits, financing, and whether it will replace traditional banks; the role of cryptocurrency relative to fiat currency in the central bank payments and settlements, as well as the impact of smart contracts generated by blockchain technology on the banking industry and its activities.

View pdf

View pdf

This paper examines the impact of Japanese yen (JPY) interest rates on the JPY exchange rate, focusing on the signal model within information asymmetry theory. Information asymmetry influences financial decision-making, and the signal model suggests that parties may use signals to convey private information, affecting market behaviors. Changes in JPY interest rates serve as signals, reflecting the Japanese economy's strength, inflation expectations, and central bank policies. Market participants interpret these signals, adjusting their trading strategies and influencing the JPY exchange rate. In March, the Bank of Japan ceased the implementation of negative interest rates. To gain a deeper understanding of the underlying factors influencing the dollar-yen exchange rate, the dollar one-month treasury bond and the yen one-month treasury bond prices, a regression and correlation analysis was conducted between April 2023 and April 2024.

View pdf

View pdf

The concept of ESG (Environmental, Social, and Governance) has become a crucial framework for corporate strategies and investment decisions globally. This paper explores the origin and development of ESG, its rapid growth in China, and focuses on case studies of the implementation of its three core components: environmental management, social responsibility, and governance structures. Despite its increasing importance, ESG still faces challenges in standardization and industry-specific performance assessment. The study demonstrates that companies integrating ESG principles significantly enhance strategic planning, operational efficiency, risk management, and market competitiveness, thereby achieving sustainable growth and innovation. Future research should prioritize the unification of global ESG standards and the enhancement of cooperation and transparency in corporate ESG implementation to further improve sustainability and investment appeal.

View pdf

View pdf

As the field of social media has made progress so far, Bilibili, which is one of these outstanding platforms or enterprises concentrating on social media, has adopted profitable strategies contributing to Bilibili’s success of operation. Nevertheless, taking these potential negative factors into account, Bilibili can recently face these underlying difficulties which can be common in other similar firms and even the entire industry of social media. Therefore, it can be beneficial for related organizations to analyze performances of Bilibili or other platforms to find out these solutions to cope with these potential issues efficiently. In this paper, research has been done to analyze the changes of price of Bilibili by WMA, SES and LR models. Furthermore, these prospective reasons to explain these changes of price in different periods, which are relatively climbing, rocketing, reaching a peak and plummeting, have been further analyzed according to the most accurate model. After having finished this step, these potential solutions for latent issues faced by Bilibili in the future are expressed at the same time.

View pdf

View pdf

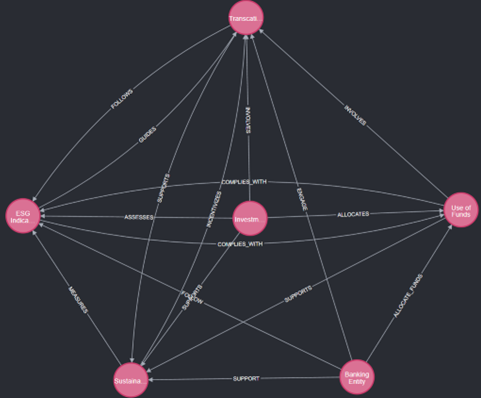

In the era of globalization and digitalization, the banking industry plays a crucial role in economic development through its stability and efficiency but faces various traditional and emerging risks. The development of artificial intelligence has brought revolutionary changes to bank risk management. Knowledge graph technology, which constructs a graph structure of entities and their relationships, provides new perspectives for risk identification and analysis. This study explores the application of knowledge graph technology in bank risk management using Neo4j, demonstrating its advantages in risk identification, assessment, and prediction. By leveraging the interconnected nature of data in a graph database, banks can uncover hidden patterns and relationships that traditional methods might overlook. This approach enables a more comprehensive and dynamic understanding of risk factors, allowing for proactive management and mitigation. Additionally, the use of Neo4j's advanced querying capabilities facilitates real-time analysis and visualization of complex risk scenarios, further enhancing decision-making processes in the banking sector. The integration of machine learning with knowledge graphs can also predict future risks with higher accuracy, making it an invaluable tool for modern risk management practices.

View pdf

View pdf

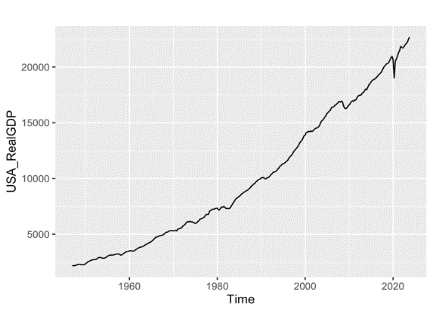

In the circumstances of the post-pandemic period, a lot of economic bodies are facing the problem of economic recession. Meanwhile, monetary policy is playing a key role in the restoration of economic growth. This paper will do an overview of the current monetary policy and economic situation of three countries (namely, the US, China, and Japan), then investigate and decide the monetary policy that should be applied by different countries. To solve the problem, this paper will use the Granger Causality test to test how the currency supply and the GDP of a country will correlate and affect each other. This paper will collect data from the FRED from these countries, dated from 1999 to 2024. This paper will also collect an analysis of the current economic policies and discuss whether they are effective or not. After the analysis, it could be reached to a conclusion that the M2 of China and Japan is the Granger cause of the GDP of the two countries, while the US has an opposite trend, where the GDP of the US is the Granger cause of the US’s M2. To push this investigation further, researchers could investigate the result of the test at different periods so that a dynamic conclusion could be reached.

View pdf

View pdf