Volume 122

Published on November 2024Volume title: Proceedings of the 8th International Conference on Economic Management and Green Development

In the digital era, supply chain resilience (SCR) has become a key pillar of the real economy. Enterprises face various challenges, including cybersecurity threats, market volatility, technological change and changing global conditions. A strong SCR not only ensures continued business operations but also maintains market stability and consumer well-being. Digital transformation helps businesses anticipate market changes, optimize inventory management, improve operational efficiency, and assist in management decisions when necessary by providing unprecedented data transparency and real-time insights. The purpose of this paper is to examine the extent of digital transformation in the supply chains of physical firms globally through a literature review, to identify the factors influencing the resilience of digital transformation in the supply chains of physical firms, and to discover the barriers to digital transformation in the supply chains of physical firms. The study finds that the digital transformation of physical firms' supply chains is still in its infancy, and there are barriers at both managerial and physical levels. Solutions to address these barriers include enhancing employee training, correctly introducing appropriate digital technologies, and improving information security.

View pdf

View pdf

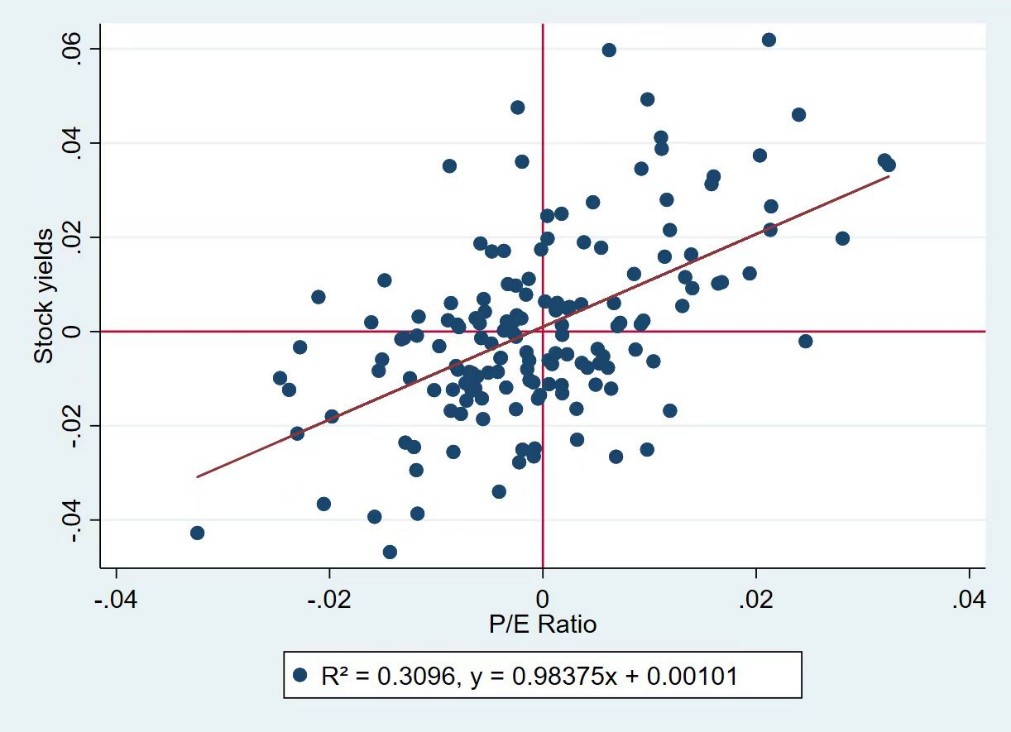

As global environmental issues become increasingly severe, investors are paying more attention to corporate sustainability. They realize that focusing solely on financial performance is insufficient; a company's environmental, social, and governance (ESG) performance must also be considered. In China, with the goal of carbon neutrality highlighting the importance of ESG, concepts such as ESG investment, reporting, and rating are flourishing. Corporate ESG actions are becoming a new focal point for investors. This paper takes the ESG information disclosure of Midea Group as a case study, using an event study model to explore the stability of the company’s stock price and the variation in its returns during the event window, thus analyzing the market's short-term reaction to ESG information. The study finds that the ESG reports issued by Midea Group have a positive impact on the stock market to some extent, significantly reducing stock price volatility and inducing a positive trend in abnormal returns.

View pdf

View pdf

The global automotive industry has entered a phase of energy-saving and low-carbon development, with the advancement of new energy vehicles becoming the strategic direction for automotive industries worldwide. However, the large-scale integration of electric vehicles into the power grid has imposed significant challenges on the operation of the electrical grid. This article analyzes Vehicle-to-Grid (V2G) technology, introducing its main functions, key technologies, and advantages, and outlines the current state of its application both domestically and internationally. Additionally, the obstacles hindering the development of V2G technology in China are examined, and several strategies to accelerate the development of V2G technology in China are proposed. It is hoped that these measures will encourage both the government and enterprises to take active steps towards promoting the rapid development of V2G technology.

View pdf

View pdf

With the rapid growth of the new energy vehicle market, the construction of battery swapping stations has become an effective solution to the problem of insufficient charging facilities. Battery swapping technology can improve energy replenishment efficiency, alleviate pressure on the power grid, reduce charging costs through overnight charging, and increase battery utilization and profitability. However, battery swapping technology faces issues such as standardization, high costs, technical and safety challenges, and low market acceptance. It is suggested to promote standardization, government policy support, technological innovation and safety enhancement, the construction of a widespread battery swapping network, as well as innovation in business models and market promotion to promote the development of battery swapping technology.

View pdf

View pdf

With the rapid development of e-commerce, an increasing number of companies, such as Huawei, Apple, and Adidas, are no longer confined to offline physical stores for product sales. They leverage third-party e-commerce platforms or establish online stores on their official websites. Modern consumers have access to various purchasing channels, including e-commerce platforms, offline stores, and manufacturer direct sales. In recent years, a new e-commerce model, live streaming sales, has emerged. In live streaming sales, professional salespersons or key opinion leaders (KOLs) showcase product performance, aiming to sell products online. Unlike traditional online channels, live streaming sales alleviate new consumers' uncertainty about product information through real-time interaction or comments from KOLs. Live streaming has been adopted by e-commerce giants worldwide, such as Taobao, JD.com, and Amazon, due to its significant sales revenue potential. Additionally, channels with KOLs may generate negative or positive spillover effects on other channels. These effects are crucial parameters for exploring the impact of seller profits in the multi-channel supply chain under live streaming conditions. Both domestic and international research have focused on live streaming sales, multi-channel sales, and spillover effects, with many studies yielding significant economic and social benefits. However, challenges faced by multi-channel supply chains, including complex channel management, difficulty in information synchronization, brand consistency issues, and increased costs, need to be addressed. To overcome these challenges, recommendations include integrating channel resources, optimizing channel experience, establishing cross-channel data analysis systems, strengthening supply chain coordination, continuous innovation and improvement, and strengthening brand building.

View pdf

View pdf

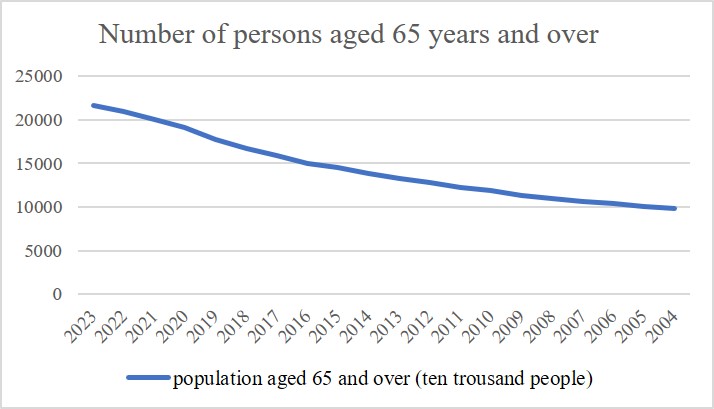

The relationship between demographic change and economic development is one of the most recent and important research topics. Researchers have found that aging will have a certain impact on inflation, but there is still a research gap and controversy on China's inflation problem. Therefore, this paper collects data on the aging process of China's population and inflation rate between 2004 and 2023 and applies graphical analysis and literature analysis to study the data to try to find a cleaner relationship. Through the research, it can be concluded that China's changing population structure has a relatively inhibitory effect on inflation and a negative effect on economic development. The reason may be that the decline in the labor force caused by population aging has a greater impact on aggregate demand than on aggregate supply. Overall, to reduce the impact of the deepening process of population aging, postponing the retirement age and developing the elderly care industry can be an effective way to boost aggregate supply growth to control the increased inflation rate.

View pdf

View pdf

This study explores the challenges faced by Macy’s in the United States and its strategy for digital transformation. Firstly, it introduces the rise and fall of the U.S. department store industry and the challenges Macy’s faces as a representative of the traditional department store industry, such as the rise of e-commerce and changes in consumer shopping habits. Then, taking Macy’s as a case study, it describes its digital transformation strategy, ‘Polaris’, including cost reduction, accelerated digitization, reshaping the supply chain and other initiatives and the results achieved. It then proposes specific plans for staffing adjustments, enterprise transaction process optimization and online business model modifications. Finally, the challenges that may be faced in implementing digital transformation programs, such as data silos, change management and financial overheads, are analyzed, and solutions are proposed. By summarizing and learning from the successful experiences of modern enterprises, this study proposes a series of feasible digital transformation plans for Macy's to emerge from the predicament of the traditional department store industry, meet the challenges of the digital era, and achieve a renaissance.

View pdf

View pdf

With the development and advancement of technology, the manufacturing industry has undergone a major transformation in recent years. The emergence of digital transformation has become a defining force in the global manufacturing landscape, reshaping traditional paradigms and driving companies toward greater efficiency and innovation. This study delves into the far-reaching impact of digitalization on manufacturing companies, combining a comprehensive analysis of several Chinese companies. By seamlessly integrating advanced digital technologies such as the Internet of Things, big data analytics and artificial intelligence into traditional manufacturing processes, companies are opening up new realms of productivity and competitiveness. However, the road to digital integration is challenging, and companies need to deal with technical challenges and organizational resistance. This study illuminates the path for manufacturing companies to thrive in digitalization through empirical insights and strategic recommendations. By fostering a culture of innovation, optimizing productivity and expanding market reach, digital transformation becomes a key underpinning for sustainable growth in manufacturing.

View pdf

View pdf

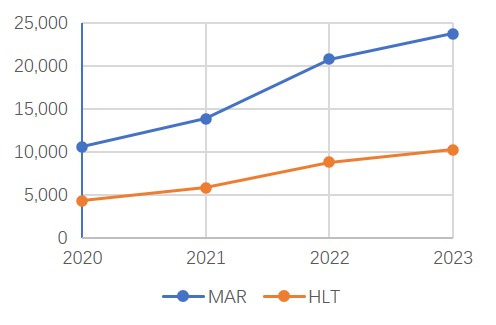

The COVID-19 has had a negative impact on the global economy, and the hotel industry has also been impacted. In the post-pandemic era, the hotel industry has entered a recovery phase. Taking Marriott, an internationally renowned hotel, as a case study, this paper uses SWOT analysis, financial analysis and relative valuation methods to study the development situation and investment value of the hotel after the epidemic. The analysis shows that Marriott has a fast recovery speed, strong operational capabilities, and obvious competitive advantages, but it is vulnerable to the negative impact of external environmental turbulence on its own revenue. This paper provides investors with a reference to Marriott's post-pandemic financial health, while suggesting areas for improvement for Marriott hotels.

View pdf

View pdf

The rational valuation of the healthcare industry and the analysis and research of the financial risks faced by enterprises can not only provide a basis for rational investment and transaction pricing decisions, but also help enterprises to find out the shortcomings of the production and operation, so as to improve the management mode of the enterprise, and help enterprises to achieve the maximisation of management. Firstly, this paper analyse the risks faced by Pfizer from a financial point of view by quantitatively comparing the data of Pfizer and its two competitors, Amgen and Unitedhealth Group, and then qualitatively analysing their characteristics in terms of liquidity, solvency and profitability and the reasons for this. Next, Pfizer is valued by looking at its leverage, business risk, earnings per share, etc. to measure the financial risk of the business and the reasons for the capital structure. It then gives investors an objective investment recommendation by forecasting Pfizer's future share price. The study concludes that Pfizer Inc. is illiquid, has poor corporate solvency, is at risk of debt servicing, and has suffered a significant decline in profitability. Valuing Pfizer, the forecast suggests that Pfizer's stock is currently undervalued.

View pdf

View pdf