Volume 20

Published on September 2023Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

This study investigates and predicts the stock price of Shanghai Securities. Our analysis lemma the C-K equation,n step transition to predict the stock price of Shanghai Securities. In this paper, we have put our model into different stocks in reality to test its feasibility. Finally, we envisaged the probable scope for this approach and listed some shortages of using Markov chain in predicting stock price. A great discovery in this page is that utilizing the stock's Markov property; we concluded that Shanghai Securities is martensitic. Also, we have proved the economic benefit of this numerical model.

View pdf

View pdf

Global warming has become a hot issue of common concern to the international community in recent years. With the frequent occurrence of extreme weather events, reducing carbon dioxide emissions has become a priority for governments. The Paris Agreement makes it possible to connect carbon trading platforms of various countries and set up a global carbon emission rights exchange. The carbon price is affected by many factors, among which energy price, economic indicators and temperature are important factors. This paper compares how carbon prices fluctuate in response to different influencing factors in China and Europe. The reason for these differences is that China and Europe have different emission reduction policies, economic systems and energy structures. Research shows that the same influencing factor has a different impact on the carbon price in China and Europe. Participants in carbon trading may find this study useful in helping them comprehend the variations between the carbon trading markets in China and Europe.

View pdf

View pdf

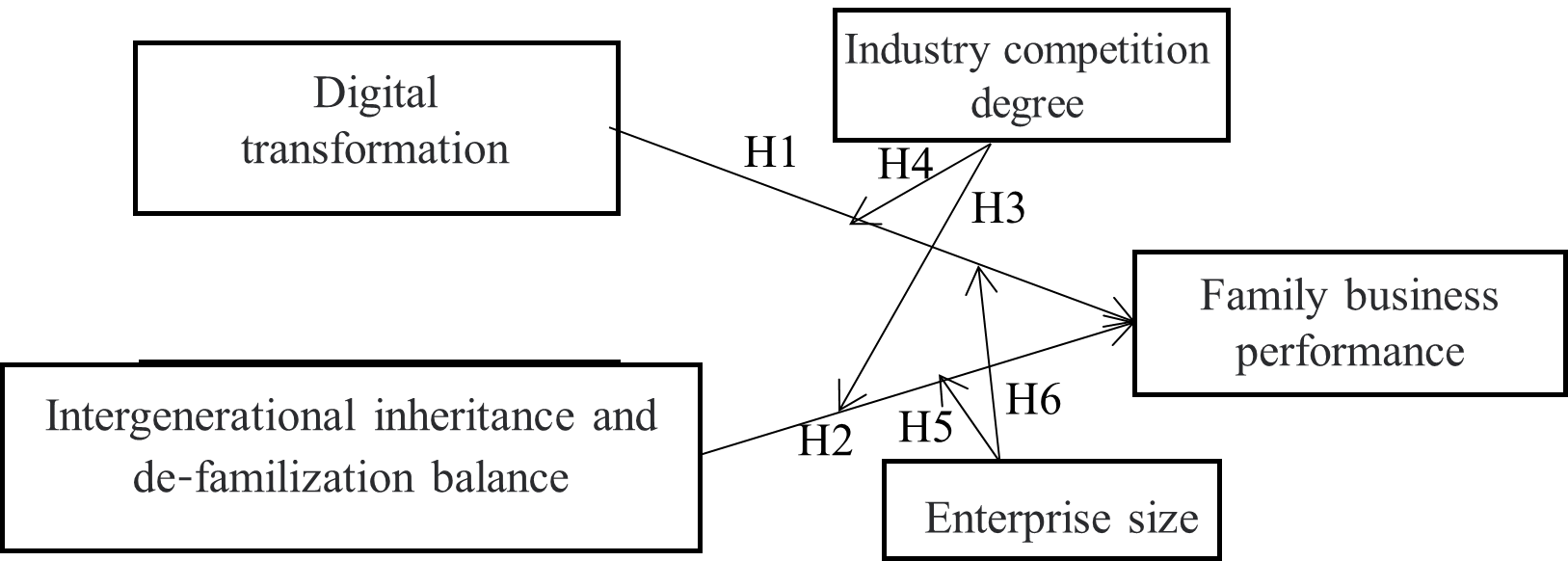

In the dual context of digital transformation and intergenerational inheritance of family enterprises, digital transformation, balanced intergenerational inheritance and de-familization model will jointly contribute to the performance of family enterprises. This paper takes Chinese A-share-listed family enterprises as the research objective. Stata17.0 statistical software is used to describe and regress the data of family enterprises in the fiscal years from 2015 to 2020. The results show that digital transformation has a negative impact on the performance of family enterprises, but the balance between intergenerational inheritance and de-familization will have a positive impact on the performance of family enterprises.

View pdf

View pdf

Option, BSM and mean-variance pricing model have always been hot topics in financial statistics, as well as basic concepts to master when learning financial knowledge and engaging in the financial industry. With the increasingly mature theoretical research on financial risk control, many pricing models related to risk control have been established based on BSM model and mean-variance model. Therefore, this paper mainly studies BSM model and mean-variance model. So, this paper mainly discusses the learning achievements of option contract, BSM model and mean-variance model. Firstly, this paper introduces the basic concept of option contract, explains what option contract is, the components of option contract, and the formation history and development process of option and option contract. Secondly, the formation and development process of BSM model and mean-variance model are explained respectively in the work, and related concepts are described and explained rationally. From the historical and realistic point of view, this paper explains the risk avoidance effect of option contract, BSM model and mean-variance model on financial transactions.

View pdf

View pdf

In just ten years, POP MART has developed rapidly and become the leader in the national LOMO market. It would be worthwhile to analyze and summarize its marketing strategy. This paper expounds on the brand background, industry background, STP analysis and 4P theory of the POP MART brand, and analyzes the marketing strategy of the POP MART brand. By reviewing the relevant literature in the last three years, this paper analyzes the brand problems and brand advantages. The advantages of the brand are obvious, such as the cooperation with many IP products, and exquisite product design. The acceptability of price and unit price of products is high. Brand marketing takes advantage of consumer psychology. Online and offline promotions are also plentiful. However, there are still some problems, such as low brand recognition, unsatisfactory customer promotion and insufficient product development. Customer loyalty and competitiveness of POP MART need to be improved. According to the above information, this paper puts forward several suggestions: The business should open a new market, such as the male market. Also, businesses should improve the product emotional value of the product and make the product become story innovative, etc. In cooperation with IP, the brand should analyze and understand the corresponding consumer groups of each IP, which can make more targeted update plans. Also, it enhances the brand awareness and recognition of its own brand.

View pdf

View pdf

The deals in the dynamic media and entertainment industries have been paid great attention to in recent years. One of the most valuable things that companies competed for was customers’ attention. Hence deals were made to provide unparalleled technologies or content. The case studies adopted in this study are objective and specific. Focusing on the analysis of two representative acquisition deals in the media and entertainment industries, this article gives a comprehensive introduction to Walt Disney Company, Pixar Animation Studios, Microsoft Corporation and Activision Blizzard, lists essential contract terms and summarizes the changes. To conclude, in the process of merger or acquisition, technologies and entertainment content are key elements in companies’ consideration. Through exchanging and sharing resources, parties involved in the deals could achieve a win-win relationship. Nevertheless, there are also many problems that need to be solved, including the interference of the third party, cultural conflict and changing market requirements.

View pdf

View pdf

This paper examines the US-CN Audit Agreement’s influences on investors’ reactions towards US-listed Chinese companies and the potential spillover effect on US domestic listed companies with the same auditors that Chinese companies have. The sample consists of 282 Chinese US-listed companies and 3986 U.S. companies with the same auditors as those Chinese companies. We then compare the average stock return of U.S.-listed Chinese companies and the U.S. companies based on the sample period for the stock return data begins from July 27, 2022, to Aug 29, 2022. By using T-test separately, we found that U.S. companies have higher average stock returns in the previous 21-days period, and in the 3-day announcement window, the difference in stock returns between U.S.-listed Chinese companies and U.S. companies is not material. Therefore, we document that although investors become so alarmed by the publication of the US-China Audit Agreement that stock returns suffer. As a result, the success of US-China audit cooperation will increase investor confidence and help Chinese companies' stock returns and mitigate the negative effects.

View pdf

View pdf

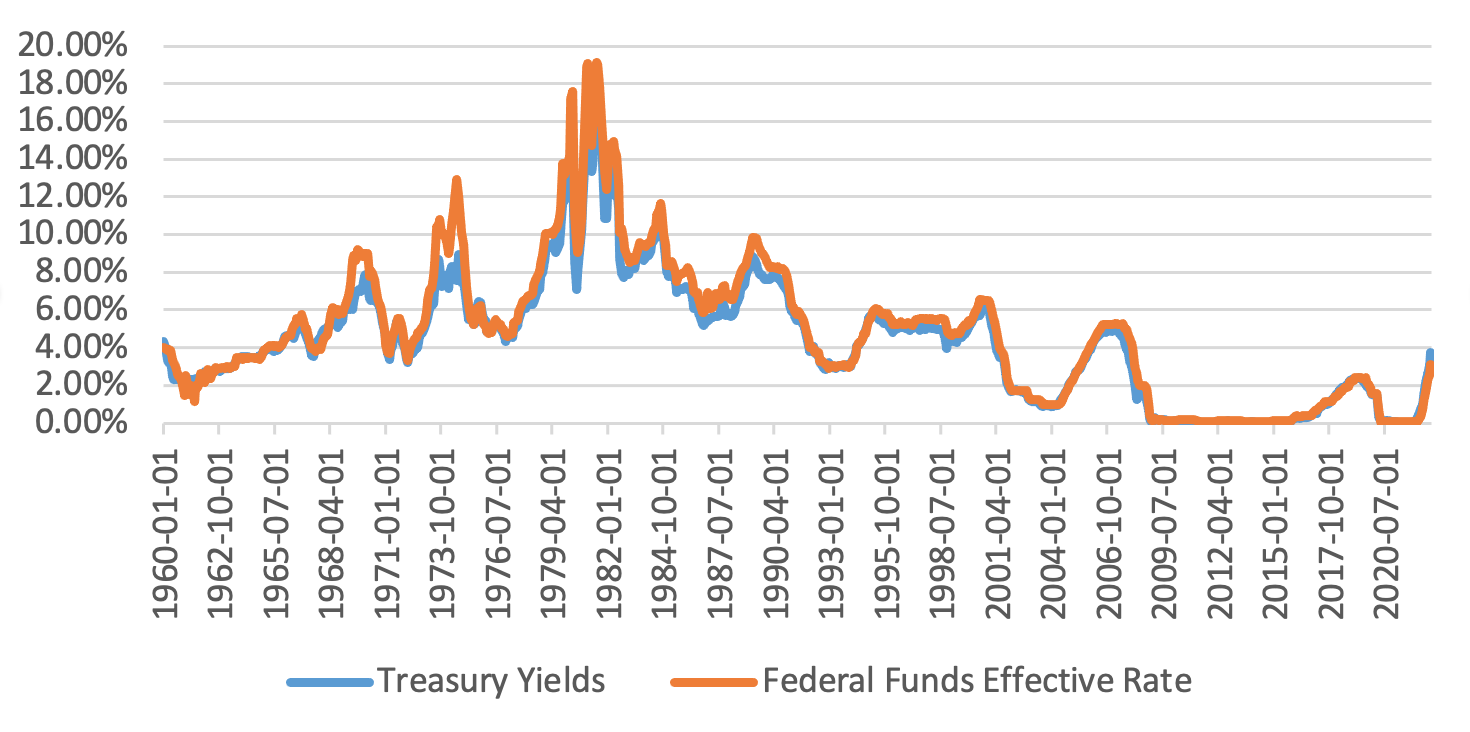

In this research, we aim to utilize linear regression estimated by ordinary least squares (OLS) to construct a predictive model for the federal funds rate in the U.S.. It is a crucial instrument of implementing monetary policy, including financial institutions, investors, and policymakers. To construct the model, we will obtain data on various economic and financial indicators that affect the federal funds rate. This will include macroeconomic variables such as inflation and GDP growth, as well as financial market indicators such as the yield on government bonds and the reserve balance level held by Federal Reserve banks. We will then use this data to fit a linear regression model and evaluate its performance using various statistical metrics. Once the model has been developed, we will use it to make predictions about future federal funds rate actions and determine the leading causes of these movements. Additionally, we will test the model's accuracy given changes in the underlying data and assumptions. The findings of this study will be helpful to a wide range of academic and practical audiences and will offer insightful information on the factors affecting the federal funds rate.

View pdf

View pdf

Tiktok is a very popular streaming video media that is popular with many Chinese viewers. The Chinese government is currently promoting the policy of rural revitalization. With the advancement of internet technology, more and more villagers are promoting their hometowns through short videos and live streaming video, and using them to sell their agricultural products. However, there are many drawbacks to this, such as poor information and literacy level make it more challenging to promote their videos. Through qualitative and quantitative research methods, this research examines factors affecting the effectiveness of the rural area broadcasting economy from some specific perspectives. In this research, data analysis and interviews are both included. The results have shown that the long-term existence of this vicious cycle of low illiteracy and low quality of agricultural goods will have a negative impact in the long run.

View pdf

View pdf

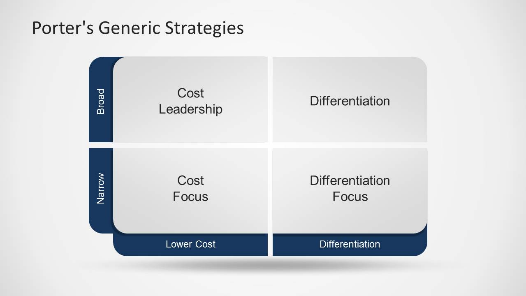

McDonald's has grown steadily since its establishment and has gradually grown into a leader in the fast food industry over the years. How McDonald’s becomes so profitable may be questioned and learned by other enterprises. That is because, throughout the development of McDonald’s, many successful strategies have been used to improve its competitiveness and market share. This paper explores McDonald’s concrete marketing strategy in corporate finance and risk assessment. It is organized as follows: In the first part, the achievements of McDonald’s will be briefly introduced. In the second part, this paper analyzes some specific strategies that McDonald’s has used in its corporate finance. In the third part, this paper discusses McDonald’s strategies to assess its risk. In the end, the successful strategies that McDonald’s has utilized are summarized. This paper can help readers understand McDonald’s experience and how they become so successful.

View pdf

View pdf