1. Introduction

Global warming is a pressing issue, with the IPCC showing its wide-ranging impacts, from climate change affecting health, water, and food security to rising sea levels and coastal wetland loss [1]. While natural factors like volcanic eruptions and solar radiation contribute, fossil fuels (coal, oil, and gas) are the main drivers of recent global warming. Emissions from industry, transportation, and building heating, especially CO₂ from burning fossil fuels, are the primary causes, accounting for over 75% of global greenhouse gas emissions, with CO₂ alone making up nearly 90% [2, 3]. To address this, a carbon tax, which charges polluters for GHG emissions, has been implemented. Economists argue that carbon pricing is the most cost-effective approach to emission reduction [4]. It incentivizes emission cuts and promotes cleaner fuels and energy-efficient technologies. However, as carbon tax policies are still developing globally, implementation challenges remain. Norway, one of the first countries to introduce a carbon tax, offers valuable insights. This paper will use case studies to examine how Norwegian oil companies have adapted to the carbon tax, providing suggestions for future carbon tax policies targeting high-emission industries like oil.

2. Literature review

2.1. Carbon tax definition & policies in different countries (price)

A carbon tax is a form of energy tax on carbon dioxide emissions that is part of a pollution tax and carbon pricing mechanism. Its core objective is to mitigate climate change and its negative impacts on the environment and human health by reducing carbon dioxide emissions through economic means [5]. As an incentive-based policy tool, carbon tax has received widespread attention worldwide since the early 90s of the 20th century [6]. At present, many developed countries have established relatively mature carbon tax systems.

The Nordic countries have emerged as early adopters of carbon tax policies. Finland pioneered this initiative in 1990, initially imposing taxes on fuel, coal, and natural gas. In 1994, the fuel tax was divided into a mixed energy tax and a carbon tax, which reached €20 per tonne of CO2 by 2008 [7]. Latvia followed suit in 2004, implementing a carbon tax primarily on fuel at €30 per tonne of CO2 [7]. Denmark enacted its carbon tax in 1992, applying to fossil fuels (excluding biofuels) with rates of €20.60 per tonne for individuals and industries, and €3.50 per tonne for energy-intensive sectors [8-12]. Norway's carbon tax system, one of the earliest, targets specific industries, particularly those outside the non-EU ETS, with a rate of approximately 560 NOK per tonne of CO₂ (around €55-60 per tonne of CO₂)[13]. Sweden boasts one of the highest carbon tax rates globally, reaching €118 per tonne of CO₂ in 2021, significantly influencing energy transition and the adoption of low-carbon technologies[7].

The Nordic countries exemplify advanced carbon tax policy, demonstrating both common and distinctive characteristics. Commonly, they have established long-standing carbon tax systems, with Finland leading since 199 0[7]. These nations typically pursue gradual reforms, balancing environmental goals with economic impacts through phased adjustments in tax rates and coverage. The carbon tax framework generally encompasses key emitting sectors, such as energy and industry, showcasing greater maturity compared to developing nations.

Distinctively, the Nordic countries have tailored their carbon tax schemes to their specific national contexts. Sweden and Norway employ high tax rates, with Sweden's reaching €118 per tonne of CO₂in 2021 [14], while Finland and Denmark maintain lower rates. Norway's carbon tax emphasizes CO₂emissions, whereas Sweden and Denmark encompass a broader spectrum of greenhouse gases. Additionally, significant variations exist in policy arrangements for energy-intensive industries, reflecting diverse industrial protection strategies.

2.2. Current status of emission reduction technologies in the petroleum industry

The oil industry has adopted a wide range of technologies to achieve emission reduction targets, among which carbon capture and storage is expected to play an important role in achieving the global warming targets set by IPCC6 and COP21.3 [14]. Carbon dioxide from oil and gas fields or fossil fuel combustion can be captured and stored via technologies encompassing CO2 capture, transport, storage, and utilization. The captured CO2 is pressurized to approximately 100 bar or more, then transported to a storage site and injected into stable geological formations, sequestering it for extended periods and preventing its emission into the atmosphere [15]. Therefore, CCS technology can be used not only underground or for enhanced oil recovery. It also solves the problem of environmental pollution and can generate more economic benefits [16]. Chemical absorption methods in the capture process, such as the use of amine solutions, have been widely used to remove carbon dioxide from natural gas [14].While captured CO2 exists primarily as a high-pressure liquid or supercritical fluid, established transport methodologies in CCS enable its conveyance via pipeline, ship, or oil tanker. For large-scale, long-distance transfer, pipeline transport offers the most cost-effective solution [16]. Due to its critical parameters (Tc = 304.25 K, Pc = 7.38 MPa) and phase variability, CO2 is transported via pipelines in gaseous, liquid, dense, or supercritical states. This characteristic differentiates CO2 pipelines from oil or gas pipelines. Globally, over 6,500 km of CO2 pipelines exist, primarily for enhanced oil recovery (EOR) in the U.S. Ship transport of CO2 is also viable, especially for maritime routes. Combined transport methods, such as Norway's Northern Lights Project combining shipping and pipelines, are also effective.

In carbon capture plant design, energy storage and flexibility are crucial. Post-combustion capture optimizes energy use via time-shifting of energy-intensive processes like amine regeneration, enhancing output during peak demand. Similarly, oxy-fuel or pre-combustion capture technologies allow independent air separation unit (ASU) operation via an oxygen buffer, boosting energy efficiency.

3. The driving role and impact of carbon tax

3.1. The impact mechanism of carbon tax on oil companies

Carbon tax, a key environmental policy instrument, significantly impacts the economy via market mechanisms, particularly in the oil sector, inducing notable structural shifts. This impact is primarily observed in production costs, where carbon tax policies substantially elevate the cost of fossil fuel utilization by assigning a fee per emission unit (e.g., tonnes of CO2 equivalent) [17]. Concurrently, within the oil sector, carbon tax implications predominantly affect extraction, refining, and transport, substantially elevating operational expenditures. A carbon tax of $50/tonne CO₂ is projected to escalate coal power generation costs by 40-60% and natural gas power generation costs by 15-25% [18], and the cost of oil extraction will increase by 15-20%. Market competition often prevents companies from fully passing costs to consumers, compressing profit margins. This economic pressure drives the adoption of emission reduction strategies like process optimization or low-carbon technologies. However, the high initial investment in technologies such as offshore wind, hydrogen, renewable, and carbon capture and storage (CCS) requires substantial financial support, with returns difficult to realize in the short term.

3.2. Economic impact of carbon tax (on steel mills, on the environment, on industrial structure)

Although the long-term impact of a carbon tax on overall GDP growth is not significant, a study by Metcalf and Stock shows that the long-term impact of a carbon tax on GDP growth in the overall economy is positive [19]. In addition, the implementation of the carbon tax will have a profound impact on specific industries (such as the steel industry), the ecological environment, and the industrial structure.

In the steel industry, the carbon tax directly raises the cost of carbon emissions in blast furnace steelmaking, prompting companies to switch to short-process EAF steelmaking or invest in low-carbon technologies, such as hydrogen steelmaking. According to the International Energy Agency [18], a $50/t carbon tax could raise traditional steel production costs by 20-30%, catalyzing green steel adoption. The industry has demonstrated reduced carbon intensity and improved emissions control of SO₂ and NOx. While carbon taxation has contracted high-emission sectors, it has accelerated growth in renewable and CCS technologies. Though initial job displacement may occur in traditional industries, the expansion of low-carbon sectors, coupled with strategic reinvestment of tax revenues into R&D and labor tax reduction, can yield environmental and economic co-benefits.

4. Case study

4.1. International oil company case: equinor, norway

Norway pioneered carbon taxation in 1991, establishing a comprehensive multi-sector emissions framework. Equinor ASA exemplifies this policy's efficacy through its industry-leading energy transition initiatives. Founded in 1972, Equinor ASA evolved from a North Sea petroleum operator to a global energy corporation. Following its 2017 rebranding, the company operates across 40+ nations, integrating hydrocarbon E&P with downstream operations and renewable. Their portfolio emphasizes offshore wind, hydrogen technologies, and CCS solutions, advancing low-carbon energy systems. Equinor's CO2 emissions stem from upstream combustion, processing logistics, and facilities operations. To mitigate carbon tax impacts and meet sustainability targets, the company implemented electrification, waste heat recovery, and LNG transport solutions. Combined with offshore wind investments, these initiatives facilitated early achievement of net-zero emissions by 2020, establishing a blueprint for energy sector decarbonization.

4.2. Sources of greenhouse gases (Co2) produced by norwegian oil companies such as equinor

Hydrocarbon extraction and processing contribute substantially to CO2 emissions through combustion processes. Norwegian offshore operations exemplify two primary emission sources: power generation via gas/diesel turbines for offshore platforms and refineries, and fuel consumption in drilling and production operations. Processing and logistics operations further augment emissions through thermal processing and transportation infrastructure. Equinor's North Sea operations data (2020) indicates 80% of CO2 emissions originate from fuel combustion.

CH₄ emissions constitute 15-20% of petroleum industry emissions, with a GWP 25x that of CO2. Leakage occurs during hydrocarbon extraction, processing, and transport phases. Equinor's 2021 data indicates 8-12% methane contribution to their total emissions, below industry average but remaining significant for climate impact mitigation.

Petroleum industry GHG emissions span production, transport, and end-use phases. Combustion of refined products releases significant CO2, with use-phase emissions constituting a major component of the sector's carbon footprint. According to the International Energy Agency [18], global carbon dioxide emissions totaled about 33 billion tonnes, of which oil and gas-related emissions reached 18.2 billion tonnes, accounting for 55% of the total emissions. This data fully illustrates that the end-use of petroleum products is one of the main sources of greenhouse gas emissions. It is worth noting that this type of emission is dispersed, involving transportation, industrial production, residential life, and other fields, so its emission reduction work is also facing greater challenges.

4.3. Policy-driven role and impact of norwegian carbon tax

Norway's carbon tax policy significantly impacts the oil and gas sector, particularly exerting cost pressure on firms like Equinor. The non-ETS sector carbon tax is currently NOK 1176 (approximately US$100) per ton of CO2, but the actual carbon cost for oil companies, including the EU ETS fees, is about NOK 130. The planned increase to NOK 175 by 2030 will intensify emission reduction pressure. Equinor must reassess investment strategies, shifting from traditional oil extraction to cleaner technologies such as offshore wind, hydrogen, and CCS, given that approximately 80% of the oil sector's CO2 emissions originate from offshore facilities.

Equinor believes that CCS technology is the champion of achieving the net-zero emission target in 2050 and is actively investing in the field of carbon capture and storage (CCS). It has developed a detailed carbon reduction plan, aiming to reduce net carbon emission intensity by 20% by 2030, 40% by 2035, and achieve net zero emissions by 2050 [20]. Equinor's Sleipner project, the pioneering commercial CCS initiative, mitigates approximately 1 MTPA of CO2 emissions via North Sea sequestration. Furthermore, Equinor is involved in projects like Norway's Northern Lights, targeting 1.5 MTPA of CO2 storage in the North Sea. Equinor's renewable energy portfolio includes investments in offshore wind farms, such as the Dogger Bank project in the UK, projected to power 6 million households annually.

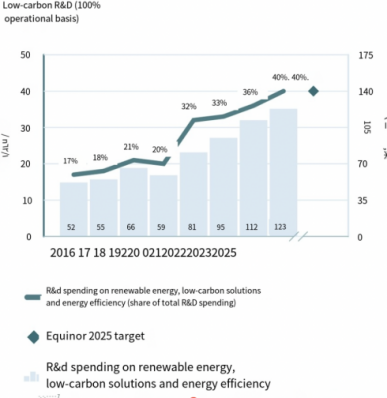

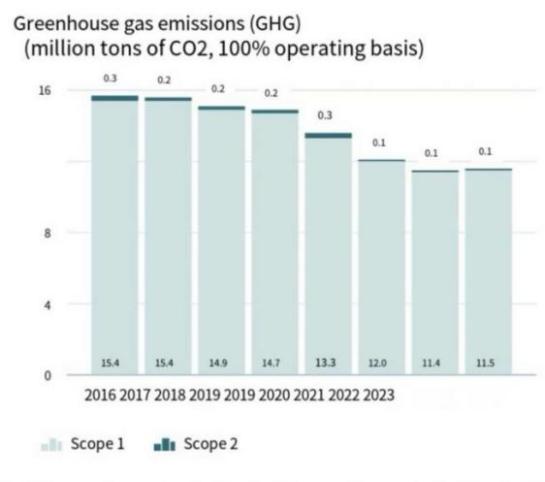

Despite high initial costs, these technologies reduce carbon tax burdens and enhance market competitiveness. Equinor's R\&D investment in renewable and low-carbon technologies increased from 17% in 2016 to 40% in 2023, with sustained investment planned for 2025 (Figure 1). This shift has yielded significant emission reductions, with greenhouse gas emissions dropping from 15.4 million tons in 2016 to 11.5 million tons in 2023, a 25.3% decrease (Figure 2). This achievement lowers carbon tax expenditures and improves market competitiveness through optimized production, improved energy efficiency, and clean energy development.

5. Conclusion

This study examines the role of carbon tax in energy transition, using Equinor as a case study to demonstrate its impact on promoting green technology innovation and business transformation in the oil industry. While carbon tax policies may initially pressure companies, they can drive long-term emission reduction and enhance competitiveness in the low-carbon economy through investments in renewable energy and CCS technology. However, the study's limitations include a focus on a single case study, insufficient analysis of synergistic effects with other environmental policies, and limited research on applicability in developing countries. Future research should compare the implementation effects of carbon tax policies across different economic development levels, assess social costs during energy transition, and explore the commercialization of emerging low-carbon technologies to improve the global climate policy system.

References

[1]. Intergovernmental Panel on Climate Change. (2018). Global warming of 1. 5°C: An IPCC special report on the impacts of global warming of 1. 5°C above pre-industrial levels and related global greenhouse gas emission pathways. Retrieved from https://www. ipcc. ch/sr15/chapter/chapter-3/

[2]. M. P. O’Connor, & T. F. O’Connor. (2021). The role of education in climate change mitigation and adaptation. Physics Education, 68(6), R02. https://doi. org/10. 1088/0034-4885/68/6/R02

[3]. Ravanchi, M. T. , & Soleimani, M. (2023). Global warming and the greenhouse effect resulted from oil, gas, and petrochemical units. In Crises in Oil, Gas and Petrochemical Industries (pp. 257-282). Elsevier.

[4]. Stern, N. , & Stiglitz, J. E. (2017). Report of the high-level commission on carbon prices.

[5]. Tsai, W. H. (2020). Carbon emission reduction—Carbon tax, carbon trading, and carbon offset. Energies, 13(22), 6128.

[6]. Dong, H. , Dai, H. , Geng, Y. , Fujita, T. , Liu, Z. , Xie, Y. , . . . & Tang, L. (2017). Exploring impact of carbon tax on China’s CO2reductions and provincial disparities. Renewable and Sustainable Energy Reviews, 77, 596-603.

[7]. Ghazouani, A. , Xia, W. , Ben Jebli, M. , & Shahzad, U. (2020). Exploring the role of carbon taxation policies on CO2emissions: Contextual evidence from tax implementation and non-implementation in European Countries. Sustainability, 12(20), 8680.

[8]. Liang, Q. M. , & Wei, Y. M. (2012). Distributional impacts of taxing carbon in China: Results from the CEEPA model. Applied Energy, 92, 545-551.

[9]. Dehejia, R. H. , & Wahba, S. (2002). Propensity score-matching methods for nonexperimental causal studies. Review of Economics and statistics, 84(1), 151-161.

[10]. Caliendo, M. , & Kopeinig, S. (2008). Some practical guidance for the implementation of propensity score matching. Journal of economic surveys, 22(1), 31-72.

[11]. Imbens, G. W. (2004). Nonparametric estimation of average treatment effects under exogeneity: A review. Review of Economics and statistics, 86(1), 4-29.

[12]. Lin, B. , & Zhu, J. (2017). Energy and carbon intensity in China during the urbanization and industrialization process: A panel VAR approach. Journal of Cleaner Production, 168, 780-790.

[13]. Banet, C. (2017). Effectiveness in climate regulation: simultaneous application of carbon tax and a emissions trading scheme to the offshore petroleum sector in Norway. Cclr, 11, 25.

[14]. Bui, M. , Adjiman, C. S. , Bardow, A. , Anthony, E. J. , Boston, A. , Brown, S. , . . . & Mac Dowell, N. (2018). Carbon capture and storage (CCS): the way forward. Energy & Environmental Science, 11(5), 1062-1176.

[15]. Boot-Handford, M. E. , Abanades, J. C. , Anthony, E. J. , Blunt, M. J. , Brandani, S. , Mac Dowell, N. , . . . & Fennell, P. S. (2014). Carbon capture and storage update. Energy & Environmental Science, 7(1), 130-189.

[16]. Golomb D. (1997) Transport systems for ocean disposal of CO2and their environment al effects. Energy Conversion and Management, 38: 279-286.

[17]. Huseynov, A. , Huseynov, E. , & Samusevych, Y. (2021). Innovative development of oil & gas industry: role of environmental taxation. Marketing i menedžment innovacij, (4), 79-91.

[18]. IEA, P. (2022). World energy outlook 2022. Paris, France: International Energy Agency (IEA).

[19]. Metcalf, G. E. , & Stock, J. H. (2020, May). Measuring the macroeconomic impact of carbon taxes. In AEA papers and Proceedings (Vol. 110, pp. 101-106). 2014 Broadway, Suite 305, Nashville, TN 37203: American Economic Association.

[20]. Equinor. (n. d. ). Reaching net zero by 2050. Retrieved April 9, 2025, from https://www. equinor. com/magazine/our-plan-the-energy-transition

Cite this article

Fu,T. (2025). Research on the Development of Norwegian Oil Companies in the Context of Carbon Dioxide Revenue. Theoretical and Natural Science,119,41-48.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICEGEE 2025 Symposium: Sensor Technology and Multimodal Data Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Intergovernmental Panel on Climate Change. (2018). Global warming of 1. 5°C: An IPCC special report on the impacts of global warming of 1. 5°C above pre-industrial levels and related global greenhouse gas emission pathways. Retrieved from https://www. ipcc. ch/sr15/chapter/chapter-3/

[2]. M. P. O’Connor, & T. F. O’Connor. (2021). The role of education in climate change mitigation and adaptation. Physics Education, 68(6), R02. https://doi. org/10. 1088/0034-4885/68/6/R02

[3]. Ravanchi, M. T. , & Soleimani, M. (2023). Global warming and the greenhouse effect resulted from oil, gas, and petrochemical units. In Crises in Oil, Gas and Petrochemical Industries (pp. 257-282). Elsevier.

[4]. Stern, N. , & Stiglitz, J. E. (2017). Report of the high-level commission on carbon prices.

[5]. Tsai, W. H. (2020). Carbon emission reduction—Carbon tax, carbon trading, and carbon offset. Energies, 13(22), 6128.

[6]. Dong, H. , Dai, H. , Geng, Y. , Fujita, T. , Liu, Z. , Xie, Y. , . . . & Tang, L. (2017). Exploring impact of carbon tax on China’s CO2reductions and provincial disparities. Renewable and Sustainable Energy Reviews, 77, 596-603.

[7]. Ghazouani, A. , Xia, W. , Ben Jebli, M. , & Shahzad, U. (2020). Exploring the role of carbon taxation policies on CO2emissions: Contextual evidence from tax implementation and non-implementation in European Countries. Sustainability, 12(20), 8680.

[8]. Liang, Q. M. , & Wei, Y. M. (2012). Distributional impacts of taxing carbon in China: Results from the CEEPA model. Applied Energy, 92, 545-551.

[9]. Dehejia, R. H. , & Wahba, S. (2002). Propensity score-matching methods for nonexperimental causal studies. Review of Economics and statistics, 84(1), 151-161.

[10]. Caliendo, M. , & Kopeinig, S. (2008). Some practical guidance for the implementation of propensity score matching. Journal of economic surveys, 22(1), 31-72.

[11]. Imbens, G. W. (2004). Nonparametric estimation of average treatment effects under exogeneity: A review. Review of Economics and statistics, 86(1), 4-29.

[12]. Lin, B. , & Zhu, J. (2017). Energy and carbon intensity in China during the urbanization and industrialization process: A panel VAR approach. Journal of Cleaner Production, 168, 780-790.

[13]. Banet, C. (2017). Effectiveness in climate regulation: simultaneous application of carbon tax and a emissions trading scheme to the offshore petroleum sector in Norway. Cclr, 11, 25.

[14]. Bui, M. , Adjiman, C. S. , Bardow, A. , Anthony, E. J. , Boston, A. , Brown, S. , . . . & Mac Dowell, N. (2018). Carbon capture and storage (CCS): the way forward. Energy & Environmental Science, 11(5), 1062-1176.

[15]. Boot-Handford, M. E. , Abanades, J. C. , Anthony, E. J. , Blunt, M. J. , Brandani, S. , Mac Dowell, N. , . . . & Fennell, P. S. (2014). Carbon capture and storage update. Energy & Environmental Science, 7(1), 130-189.

[16]. Golomb D. (1997) Transport systems for ocean disposal of CO2and their environment al effects. Energy Conversion and Management, 38: 279-286.

[17]. Huseynov, A. , Huseynov, E. , & Samusevych, Y. (2021). Innovative development of oil & gas industry: role of environmental taxation. Marketing i menedžment innovacij, (4), 79-91.

[18]. IEA, P. (2022). World energy outlook 2022. Paris, France: International Energy Agency (IEA).

[19]. Metcalf, G. E. , & Stock, J. H. (2020, May). Measuring the macroeconomic impact of carbon taxes. In AEA papers and Proceedings (Vol. 110, pp. 101-106). 2014 Broadway, Suite 305, Nashville, TN 37203: American Economic Association.

[20]. Equinor. (n. d. ). Reaching net zero by 2050. Retrieved April 9, 2025, from https://www. equinor. com/magazine/our-plan-the-energy-transition