About AORPMAdvances in Operation Research and Production Management (AORPM) is an open-access, peer-reviewed academic journal hosted by Center of Management Case Studies, Beijing University of Technology and published by EWA Publishing. AORPM is published irregularly. AORPM present latest theoretical and methodological discussions to bear on the scholarly works covering operation, applied mathematics and project management. Situated at the forefront of the interdisciplinary fields of operation research and production management, this journal seeks to bring together the scholarly insights centering on management, statistics, mathematical analysis, artificial intelligence and relevant subfields that trace to the discipline of operation, production management, project management, and combined fields of the aforementioned. AORPM is dedicated to the gathering of intellectual views by scholars and policymakers. The articles included are relevant for scholars, policymakers, and students of operation, management, and otherwise interdisciplinary programs.For more details of the AORPM scope, please refer to the Aim&Scope page. For more information about the journal, please refer to the FAQ page or contact info@ewapublishing.org. |

| Aims & scope of AORPM are: ·Operation Research ·Reliability Engineering ·Management Science & Engineering ·Mathematical Sciences & Statistics ·Industrial Engineering ·Logistical Management & Engineering ·Artificial Intelligence |

Article processing charge

A one-time Article Processing Charge (APC) of 450 USD (US Dollars) applies to papers accepted after peer review. excluding taxes.

Open access policy

This is an open access journal which means that all content is freely available without charge to the user or his/her institution. (CC BY 4.0 license).

Your rights

These licenses afford authors copyright while enabling the public to reuse and adapt the content.

Peer-review process

Our blind and multi-reviewer process ensures that all articles are rigorously evaluated based on their intellectual merit and contribution to the field.

Editors View full editorial board

Durham, UK

Glasgow, United Kingdom

anil.fernando @strath.ac.uk

Lahore, Pakistan

Cambridge, UK

Latest articles View all articles

Current common challenges such as high-dimensional data processing and steady-state analysis of complex systems have become increasingly prominent. Eigenvalues and eigenvectors, leveraging their unique mathematical properties, play an irreplaceable role in fields such as data mining and system modeling, serving as a crucial bridge connecting theoretical mathematics with practical applications. Through literature review, this study investigates the application of matrix eigenvalues and eigenvectors in Principal Component Analysis (PCA) and Markov chain steady-state analysis. The results demonstrate that matrix eigenvalues and eigenvectors exhibit significant universality and effectiveness in cross-domain applications. Validated in scenarios including PCA and Markov chain steady-state analysis, they help address key issues including high-dimensional data dimensionality reduction, system steady-state prediction, and information prioritization, thereby providing mathematical support for technological optimization. Simultaneously, they can reveal intrinsic system patterns, reflecting a deep analytical capability for system structures. Future research may focus on optimizing algorithms for solving sparse matrix eigenvalues and exploring integration with deep learning and graph neural networks to expand their application boundaries in large-scale complex systems.

View pdf

View pdf

This study explores Sony’s current brand competitiveness from a global perspective, focusing on three strategic pillars: quality signals, global mythology, and corporate social responsibility (CSR). First, it evaluates Sony’s market position by analyzing its continuous investment in research and development (R&D) to drive technological innovation and maintain product excellence, taking PlayStation series as an example. Second, it examines how Sony shapes and leverages its “Creative Entertainment Company” myth that integrates technological pioneering with emotional storytelling and demonstrates its strategic pivot to creativity-driven segments. Moreover, the paper investigates Sony’s commitment to CSR, including its “Road to Zero” environmental plan, sustainability actions, and diversity targets, which enhance brand trust and long-term resilience. The study concludes with recommendations for the company to address anti-globalization sentiments and wisely manage its national identity by emphasizing local R&D, community engagement, cultural exchange, and highlighting its “Made in Japan” quality where appropriate. Through a case study of Sony, this paper offers insights into brand development strategies for multinational companies in the new era.

View pdf

View pdf

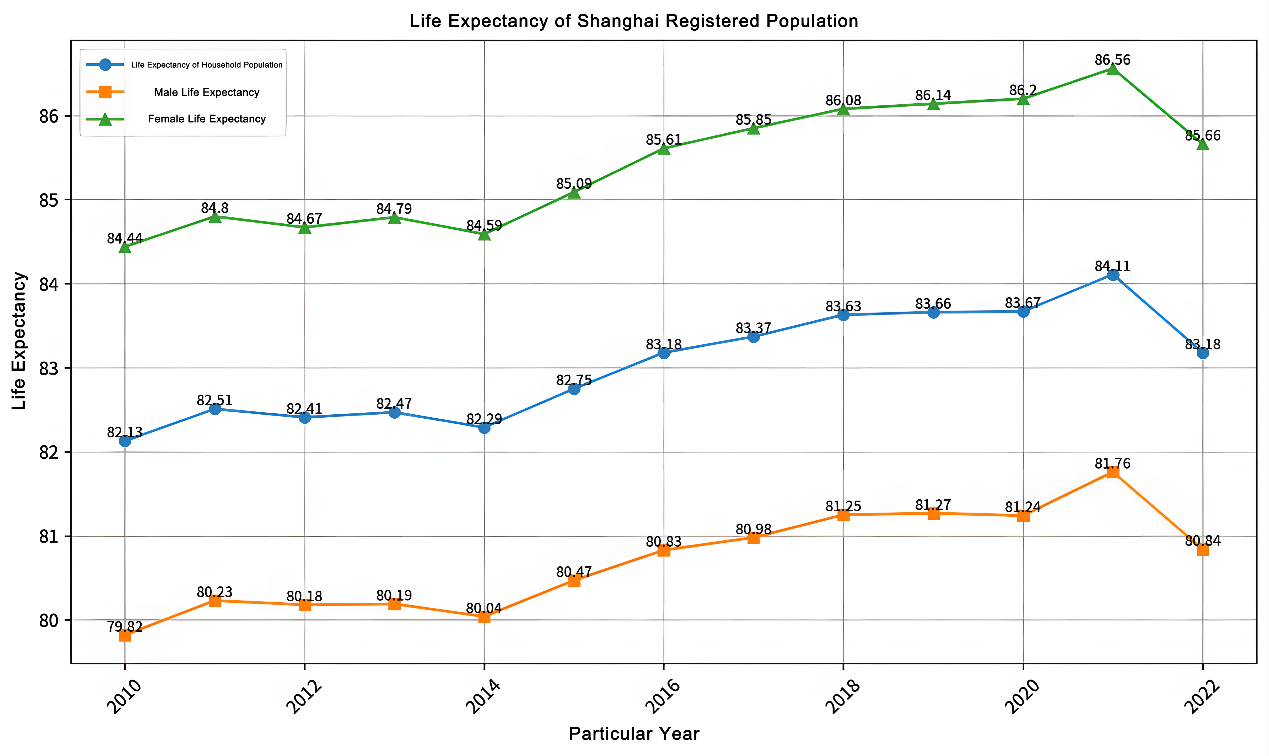

The issue of population aging has long been a key focus in the field of demography, involving multiple factors such as social development, economy, and policy. This study utilizes the grey prediction GM(1,1) model, calculating residuals between actual data and predicted values, then applying grey prediction to the residuals. By superimposing the initial forecast with the residuals, the model corrects errors and verifies that the resulting calculations exhibit high accuracy. Focusing on Shanghai's elderly population aged 60 and above, subdivided into young-old, middle-old, and old-old age groups, the error-corrected GM(1,1) method is separately applied to forecast changes in the proportion of elderly population across these cohorts. From the perspectives of economic and social sustainability, the results are analyzed to address population-related issues, and relevant recommendations are provided for policymakers' consideration.

View pdf

View pdf

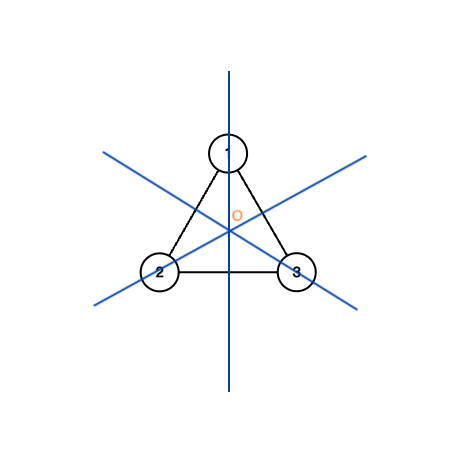

The paper investigates quantum stabilizer codes and our innovative construction methodology. At first, we began with representing fundamental concepts and theories of quantum computing. In order to identify quantum error correcting codes, we extend the method of using polynomials to represent qudits on square lattices to accommodate more complicated situations in general Cayley graphs. The paper briefly reviews essential definitions and examples related to graphs, groups, and stabilizer codes, and later we propose the novel method and demonstrate its application by using the dihedral groupD4.

View pdf

View pdf

Volumes View all volumes

2025

Volume 4November 2025

Find articlesVolume 4November 2025

Find articlesVolume 4July 2025

Find articles2024

Volume 2July 2024

Find articlesAnnouncements View all announcements

Advances in Operation Research and Production Management

We pledge to our journal community:

We're committed: we put diversity and inclusion at the heart of our activities...

Advances in Operation Research and Production Management

The statements, opinions and data contained in the journal Advances in Operation Research and Production Management (AORPM) are solely those of the individual authors and contributors...

Indexing

The published articles will be submitted to following databases below: