Volume 36

Published on November 2023Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

With over 300 million registered members, Xiaohongshu, a social media network that mixes e-commerce and content development, has grown to be a crucial marketing tool for small enterprises. By providing visually appealing and educational content, Xiaohongshu enables businesses to build trust and loyalty with their target audience and perhaps affect consumer behavior and purchase intention. This study aims to examine the effect of Xiaohongshu marketing on consumer purchase intention for small enterprises, using the Theory of Planned Behavior (TPB), the Social Influence Theory, and the Technological Acceptance Model (TAM) to provide insights and suggestions. The conclusion of this study is that Xiaohongshu marketing can have a significant impact on consumer behavior for small businesses.

View pdf

View pdf

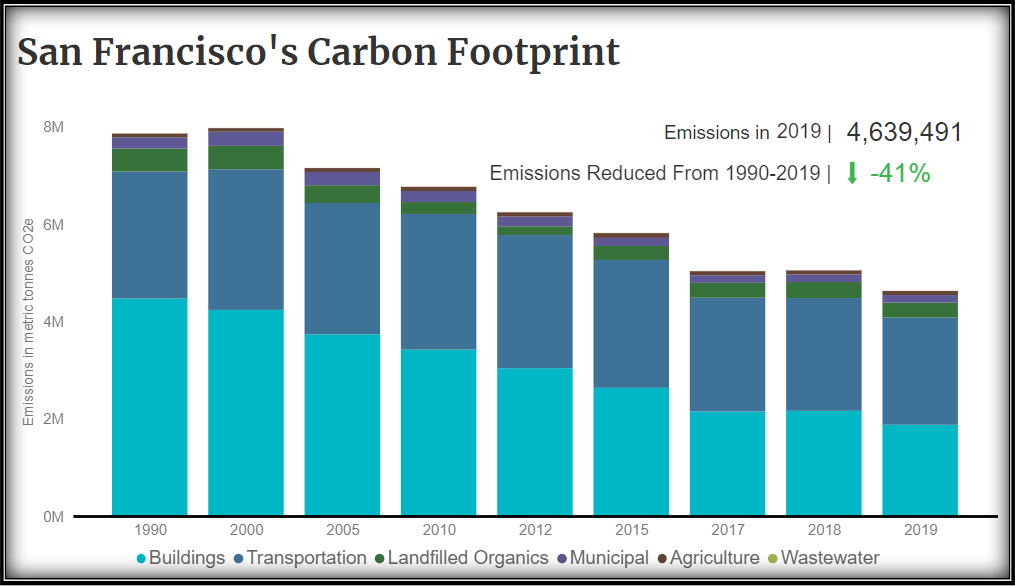

A habitable environment is required for the economy. This necessitates that the economies have the most affordable housing, the highest environmental standards, and the finest public transportation. These parameters must be better defined in the majority of developing economies. However, developed economies have improved housing affordability, environmental quality, and public transportation. The paper illustrates the affordability of accommodation, environmental quality, and public transport in both developed and developing economies through a review of the relevant literature. To achieve this objective, the study investigates the cities based on their success in terms of housing affordability, environmental quality, and public transportation. The significance of the study lies in the fact that it demonstrates that, despite the fact that developed cities possess affordable housing and environmental qualities, they still require refinement to be livable. Moreover, despite the fact that the developing cities of China have the finest public transport in the world, China and India still have room for improvement in this area. This further demonstrates that developed and developing economies should take macroeconomic parameters significantly into account in order to make their cities habitable.

View pdf

View pdf

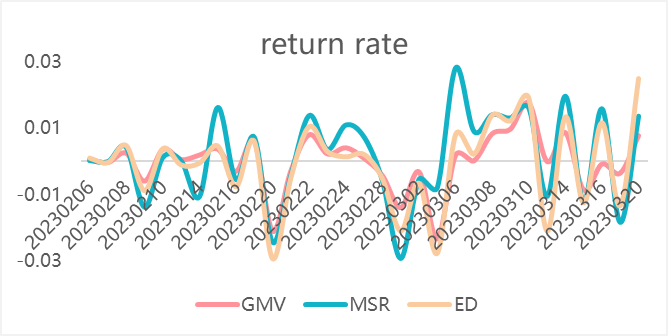

The stock market often carries investment risks, and portfolio investment can to some extent reduce investment risk, helping investors to achieve certain goal in the financial market. In this paper, stock data from March 15th, 2022, to March 20th, 2023, is collected, and the ARIMA prediction model is ap-plied in the mean-variance framework for constructing optimized portfolios. The results are summarized as follows. First, the data passed the white noise test and was used to conduct ARIMA prediction. The residual sequence of the prediction results is stable, and the model performance is good. Then, the minimum-variance model and the maximum Sharpe ratio model are imple-mented according to the predicted data. Ping An Insurance has the largest weight in the minimum variance model, and Baosteel has the largest weight in the maximum Sharpe ratio model. Overall, the result in this paper provides insightful point for financial investors.

View pdf

View pdf

This essay intends to offer an essential insight of the American retail giant Costco, using its business model, an accounting measurement, performance evaluation, and future estimation to determine whether it is a company worth investing in. The research is significant as it helps investors validate and evaluate their investment decisions in light of the rapid changes in the retail industry and the economic environment. The paper shows that Costco is an ideal company for investors to invest in, as it has a successful business mod-el that focuses on offering high-quality goods at low prices, providing excel-lent customer service, and paying its employees well. The company's ac-counting measurement is also reliable, with its financial statements reflecting its true financial performance. Furthermore, the paper evaluates Costco's performance over the years and finds that the company has consistently achieved strong financial results and has been able to maintain its competi-tive position in the retail industry. Finally, the paper provides a positive fu-ture estimation of Costco's performance based on the company's growth strategies and the anticipated growth in the retail industry. In conclusion, the fundamental analysis of Costco presented in this paper shows that the com-pany is a worthy investment for investors. The research is based on reliable data and analysis, which can be used to support investment decisions in the retail industry.

View pdf

View pdf

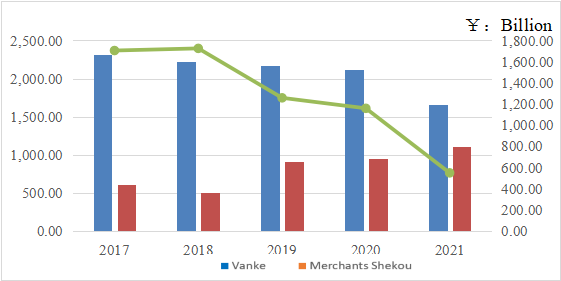

Contemporarily, China's real estate has been boosted dramatically, attracting many investors to participate. Although the real estate industry experienced a long winter during the three-year epidemic, the rapid recovery of the real estate market began with the liberalization of the epidemic. The overall scale of China's real estate continues to grow, and it has become the largest real estate industry in the world. At the same time, with the rapid development of real estate, many problems also arise spontaneously. This paper mainly uses the method of case analysis to analyze the financing situation of REITS of two real estate enterprises, Vanke and Shekou Merchants. First, the financing motivation of the two companies is analyzed, and second, the project participants, underlying assets, and transaction structure of the two companies are analyzed. Then, the case is further analyzed, including the financing cost, the financial situation of the enterprise, the risk level, and other aspects. Finally, the financing effect of the two companies is analyzed, including the reduction of comprehensive financing cost, the increase of cash flow and the improvement of capital structure, etc.

View pdf

View pdf

The strategic approach of TikTok to achieving continuous expansion in international markets is one of the topical issues of interest in society today, and some researchers have found that the strengths of TikTok in capital operations, localised operations and content production models have had a significant impact on its success. However, there is a lack of a unified explanation of the potential problems behind it and possible responses to it. The aim of this paper is therefore the risks involved in the overseas operations of TikTok and offers suggestions for corresponding strategies. The research methodology of this paper is as follows: firstly, we introduce the current situation of TikTok, the subject of the study, and then we explain the four problems of the cross-border development of TikTok in a logical system of "what - why - how". This paper has found that the trend of homogenisation of content, lack of protection for young people, data security concerns and copyright licensing are the main issues affecting the stable development of TikTok. The research identifies specific issues that TikTok should address and suggests some measures that can be taken.

View pdf

View pdf

This paper discusses the factors which influence the environmental, social, and governance performance of enterprises by reviewing previous studies. The article is analyzed from the external and internal environment of enterprises and developed from three dimensions: social institution, policy, and executives’ characteristics. Social institution and policy are external environments, and executives’ characteristic is the internal environment. The factor of social institutions, political institutions, labor institutions, and cultural institutions are discussed. They will be detailed on corruption, unemployment rate, labor protection, social cohesion, and equal opportunities. Unemployment rate and labor protection pose a positive impact on enterprise ESG performance, while high levels of country corruption, social cohesion, and equal opportunities contribute to negative ESG performance. Spanish, French, and Japanese enterprises are listed as an example. Spanish and French firms have similar levels of social and corporate governance performance, while Japanese firms are more committed to environmental issues due to cultural institutional differences. In the factor of policy, the article focuses on the positive influence of China’s environmental regulation on technology innovation in the paper industry. The factor of executives’ characteristics, international background, and diversity, specifically in female proportion, of corporate executives are helpful to enterprise ESG performance. ESG performance is influenced by the external and internal environment of the enterprise. There is a mutual promotion between external and internal environments. This paper analyzing several factors will provide a reference for developing enterprise ESG performance in different countries.

View pdf

View pdf

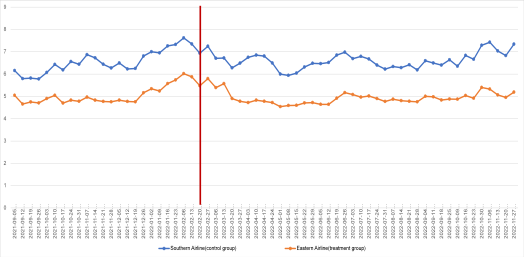

This research project investigates the impact of uncontrollable factors on companies, which can include natural disasters, political instability, and global pandemics. This paper focuses on the impact of an air crash on airline companies, this uncontrollable factor has significant consequences for the financial, operational, and reputational aspects of airlines, and understanding the impact is crucial for developing effective strategies to mitigate them. The study utilizes a mixed-methods approach, combining quantitative analysis of airline data with a special case study of the air crash that happened on the Eastern Airline, to provide a comprehensive analysis of the topic. The research findings reveal that uncontrollable factors can lead to the loss of reputation, reduced customer demand, and facing operational disruptions. The public's perception of the airline's safety record will be negatively impacted, which can result in a loss of customer trust and loyalty. Following an air crash, people may be hesitant to fly with the airline, resulting in a reduction in demand for their services. The significance of this research lies in its contribution to the understanding of the impact of uncontrollable factors on airlines, especially the impact of an air crash on an airline company. Even in an air crash due to factors beyond human control, people still try to avoid flying or flying with the same company for a period of time after the accident.

View pdf

View pdf

In the process of expanding operations, enterprises often encounter bottlenecks in terms of capital, technology, management, and other aspects. In order to tackle these problems, enterprises often choose to issue bonds, go public, mergers and acquisitions, etc. to expand their production and business scope, update management models, and improve their competitiveness. Due to the short introduction of the merger and acquisition mechanism, the analysis and research of mergers and acquisitions by various enterprises are relatively shallow, and the success rate of mergers and acquisitions by Chinese enterprises is low. This study conducts a research and analysis on the first merger and acquisition case on the Science and Technology Innovation Board, i.e., the case of Huaxing Yuanchuang's acquisition of Olyto. Based on PEG and EVA valuation models, it analyzes the motivation and results of Huaxing Yuanchuang's acquisition of Olyto's business behavior. By valuing and comparing the stock price of Huaxing Yuanchuang before and after the merger and acquisition behavior, the conclusion that the merger and acquisition behavior is not successful is drawn. Research has found that under the PEG valuation model, the stock price of Huaxingyuan Chuang after the merger is slightly overvalued, while under the EVA valuation model, the stock price is greatly underestimated.

View pdf

View pdf

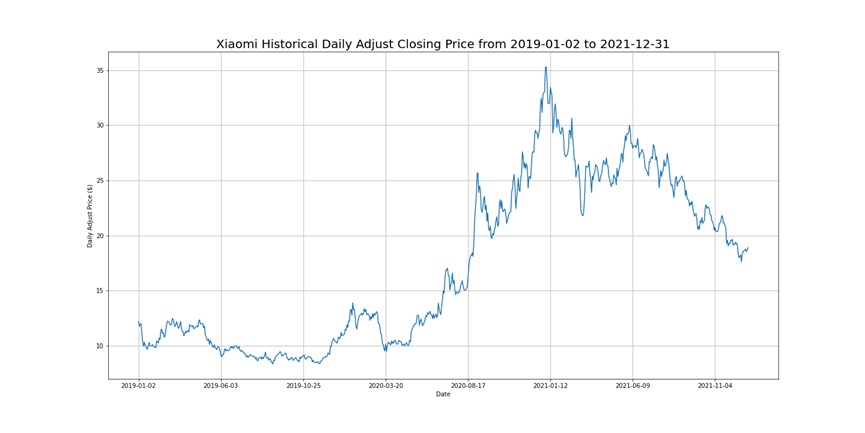

Under the assumption that the operation of corporations is stable and the economic environment is steady, there are mathematical rules in the changing of stock prices, making prediction of stock price possible. This paper selects stock price data of Xiaomi Inc, one of the leading technology companies in China, from January 2, 2019 to December 31, 2021 from Yahoo Finance. Three moving average methods, SMA, EMA and MACD, are implemented to analyze the data. Among the three moving average methods, the effect of MACD is better than that of SMA and EMA. Afterwards, Markov chain is employed to calculate from another angle The stable probability distribution of stock price is obtained by using the stability and ergodicity of Markov chain. The feasibility and accuracy of two angles of forecasting methods are verified through being compared.

View pdf

View pdf