Volume 22

Published on September 2023Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

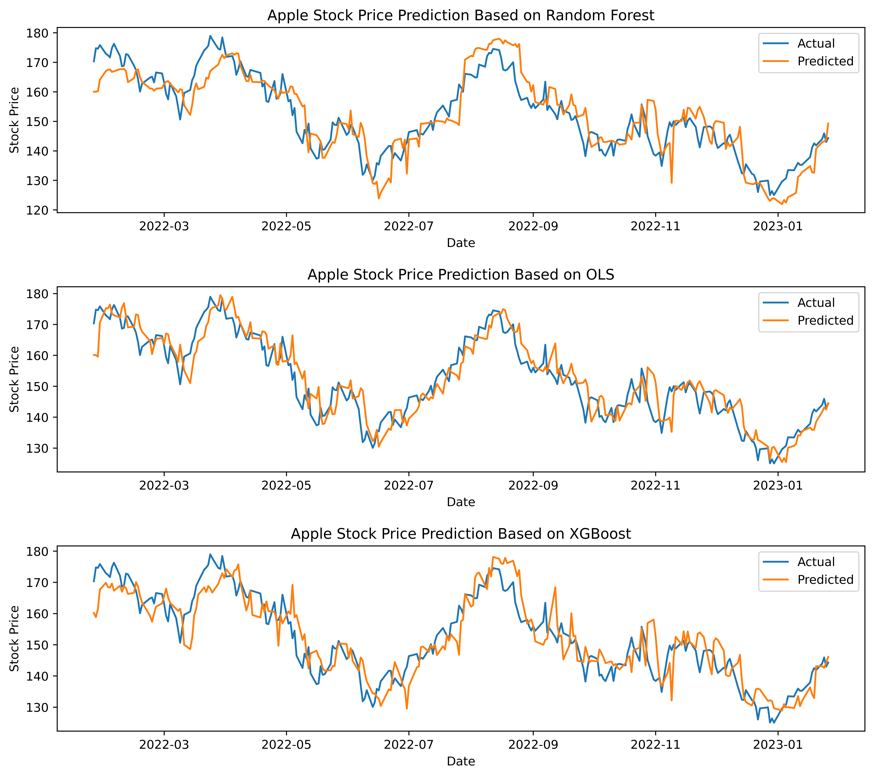

Contemporarily, the marriage of artificial computer intelligence and the financial stock market has gained increasing interest in recent years. In recent years, forecasting stock prices has also been a more prevalent topic of conversation. Investors lack a coherent knowledge of the model mechanism and prediction results behind stock price forecasts. Hence, this paper will examine Apple, Microsoft, and Amazon, the three largest technology businesses. The three models OLS, Random Forest, and XGBoost were used to predict and evaluate historical data from the past five years. The OLS model has a superior performance structure when dealing with data sets with low data frequency, and its anticipated outcomes are also more accurate, according to the research. In addition, different machine learning models are employed for diverse data sets to produce predictions, hence enhancing the accuracy and dependability of the future predictions. Overall, these results shed light on guiding further exploration of investor investments in stocks and researcher studies theories and models.

View pdf

View pdf

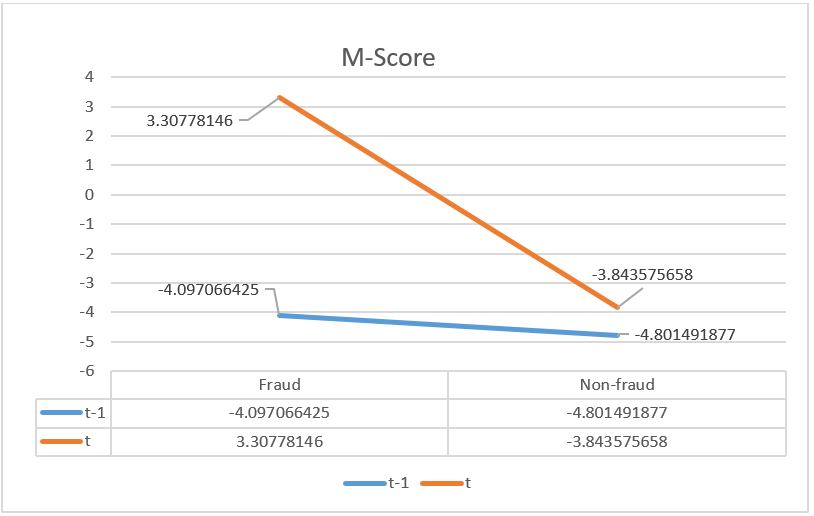

Misreporting numbers in a company’s financial statements is not negligible, as manipulations will not reflect a reliable disclosure. With financial manipulation becoming more and more regular, it is obvious that solving financial manipulation is an issue that needs to be addressed gently. It becomes a necessity to find techniques or mechanisms that can effectively identify the potential of financial report fraud, increase the credibility of the corporation and boost the confidence of investors. In this paper, we argue that the M-score and F-score as two reliable tools for predicting the possibilities of financial manipulations. In this essay, we will introduce the background and principles of these two mechanisms, then verify their reliability and effectiveness on sample Us-listed Chinese companies, which include those associated with financial report frauds in the past. In addition, we will lay out our discovery and full verifying procedure to help readers have a better understanding of our research and perspectives.

View pdf

View pdf

Following the founding and operation of a corporation, the biggest challenge it faces is the risk of bankruptcy, so how to prevent, controlling, and analyze the causes of bankruptcy is one of the most critical tasks for every company. As we all know, many factors affect corporate bankruptcy, and most studies are based on a unilateral or small range of factors set to study its impact on bankruptcy. Based on the data provided by Taiwan Economic Journal from 1999 to 2009, this paper adopts univariate and multivariate analysis models to analyze the data. A 3Comparative analysis, Normality test, T-test, non-parametric test, ANOVA test, Factor analysis and logistics were carried out using SPSS auxiliary tools Regression (Regression) controls relatively comprehensive factors that affect a company's bankruptcy from an overall perspective. It aims to demonstrate the selection of bankruptcy factors and analysis ideas. After analysis, we conclude that through the research and analysis, we have a new understanding of the causes of corporate bankruptcy. We find the four most important factors affecting corporate bankruptcy. Namely, ROAC before interest and depreciation before interest, Liability to Equity, Total assets to GNP price, and No credit interval, In addition, many single factors may have no impact on a company's bankruptcy. However, when they coexist with other factors, they will have a chain effect, resulting in even multiple amplification of the risk of bankruptcy. Therefore, different from the specific analysis of the impact of single factors on the bankruptcy of a company, this paper extracts the primary factors and takes the analysis of the relationship between individual factors as a specific example by showing the research perspective of innovation to propose the actual operation of a company from the macro and micro aspects, that is, to clarify which departments and decisions to pay special attention to in daily operation.

View pdf

View pdf

Owing to volatility in stock markets, it is quite elusive to forecast stock prices. Albeit, sometimes regular patterns are manifested in stock prices and a variety of factors are proved to be competent to determine stock prices partly. Hence, using stepwise regression on historical stock price data, this paper proposes determining similar patterns in stock prices and exploring potential rules to select the main factors that can affect stock prices significantly while taking all factors into account. Difference analysis is also employed to probe possible correlations in the data. Eventually, this paper tries to improve stock price prediction using factor analysis and manages to achieve higher accuracy.

View pdf

View pdf

This research uses the literature research method, the case study method, and the qualitative analysis method as research methods to analyze the influence of customer psychology and marketing psychology on business decision-making through four aspects: stock investment selection, necessity purchases, marketing, and discretionary expenditure. Meanwhile, the author chose the specific period of the epidemic because the social background caused people's psychological fluctuations, which have significant implications for business decisions. The delayed investment brought on by the pandemic affects aggregate supply and aggregate demand, and while the impact may take some time to be apparent, the magnitude of the impact depends on the scale and duration of the outbreak. Through analysis, enterprises need to put valuable customers at the center of business decisions as the basis of business decisions, so that businesses can focus on exploring ways to develop in unknown areas.

View pdf

View pdf

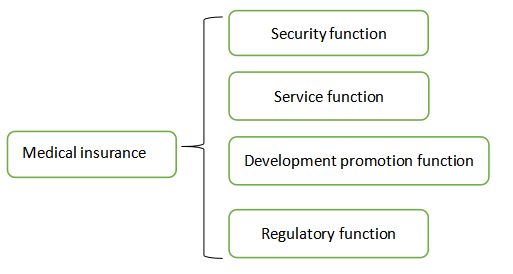

China has made enormous strides in economic development since the reform and opening up., while medicine and health care are relatively backward. Medical insurance is a very important social insurance project and an important institutional arrangement in the modern social security system. In addition to the common functions of social insurance, it also protects the physical and mental health of workers timely. It has special functions such as repairing labor capacity, reducing the economic burden of workers and their families, improving the physical fitness of the whole people, and promoting the healthy development of health services. Research question: which is better, Chinese insurance or American insurance. This paper analyzes the advantages of American insurance and the disadvantages of Chinese insurance through comparative research. This paper compares the coverage and protection, objects of insurance in China and the United States. By summing up the advantages of American insurance, it hopes that it can play a reference role in improving China's insurance. After analysis, this paper can draw the conclusion that the state needs to strengthen the people's awareness of maintenance, control the growth of medical expenses, and implement nationwide medical insurance.

View pdf

View pdf

With the development and broad adoption of digital technology, digital transformation (DT) is becoming an increasingly crucial factor in the long-term growth of small and medium-sized businesses (SMEs). SMEs account for the majority of employment and tax revenue in China. Yet, as a result of COVID-19 and the economic depression, Chinese entrepreneurs are confronted with several hurdles and obstacles. Thus, the purpose of this study is to identify suitable methods for SMEs’ adoption and application of DT by analyzing existing literature and statistics and the successful case of DT adoption by existing firms. According to the study, digital assessment, corporate operations and management with DT, digital ecosystem integration, and optimization of DT practices would increase efficiency, expand market reach, enhance competitiveness, and facilitate collaboration. So, the results give the Chinese government policy suggestions for the long-term, sustainable growth of small and medium-sized enterprises (SMEs) and practical advice for dealing with economic changes after an epidemic.

View pdf

View pdf

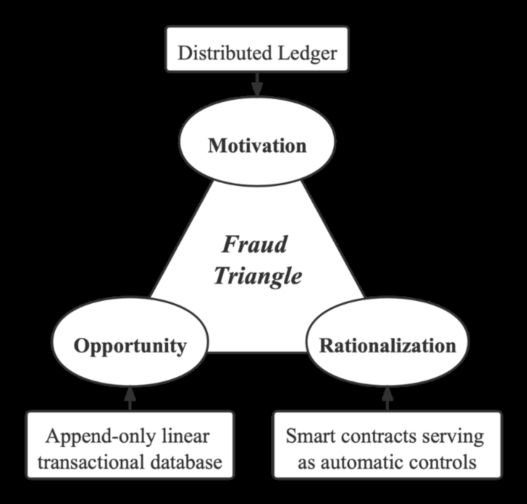

Blockchain technology has been the topic of several recent studies in area of accounting and auditing. These studies explored the potential of blockchain on changing the traditional approach to accounting and providing more secure and efficient methods of bookkeeping. Results of these studies suggest that the blockchain has the potential of being a powerful tool or even something disruptive in sector of accounting, auditing, and accountability. Blockchain can significantly increase trust, transparency, and accountability since its nature of decentralized ledger system and the cryptographic algorithms under the system. These studies also suggest that blockchain has the potential to tackle fraud in accounting activities, which is always a challenging topic in accounting industry. Current focus of blockchain research in accounting, auditing and accountability is about exploring blockchain’s positive impact on accounting industry, especially on trust, fraud detection, and the design of accounting systems.

View pdf

View pdf

The exploration of anchoring effect has developed for a long time in history, and there are many outstanding works. This paper briefly introduces the possible influence of anchoring bias on individual behavior and economic outcomes in behavioral economics, and summarizes the definition, background and significance of this bias. It also uses three applications, including the estimation in the stock market, the retrospective data in the empirical research and the marketing and advertising to prove that the anchoring effect could be important and common both in daily life and economic activities as thinking and decision-making will be affected by this effect. This article finds that the anchoring effect does exist in many economic activities and affects judgments and decisions. This kind of influence sometimes leads to misjudgment and brings negative significance, but sometimes it can be used by people.

View pdf

View pdf

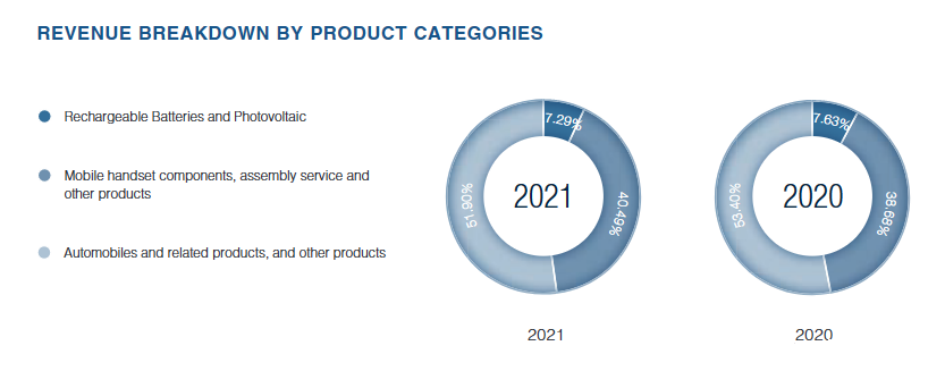

With the rapid development of modern financial industry, the valuation methods for modern enterprises are becoming more and more diverse. However, the DCF financial model is still a relatively common and accurate one. This paper will adopt the DCF valuation method, which is one of the cash flow discounting-based methods, to valuate a Chinese new energy enterprise called BYD. The result of the valuation is 7.39 trillion yuan, which is about 0.6 trillion from the actual result. The result is slightly different from the normal valuation, because it is still affected by the fixed debt and the estimation error of the future inflation rate and China's growth rate.

View pdf

View pdf