Volume 161

Published on January 2025Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

This study explores the integration of accounting tools with innovative business models to improve financial transparency and foster consumer trust among rural smallholder farmers in China. The report highlights common challenges faced by smallholder farmers, such as irregular financial records and inadequate costing, which hinder their access to finance and limit their competitiveness in the marketplace. Drawing on international case studies such as India's kata Book and Kenya's M-Pesa, the study highlights the significant benefits of accounting tools in improving financial flows and increasing economic efficiency. This study uses literature research methods and case study methods to explore the impact of accounting tools on the standardization of financial records and the improvement of production efficiency. The findings suggest that greater financial transparency can not only increase farmers' market participation but also increase consumers' trust in their products. Based on these findings, the study makes policy recommendations, including expanding education and training, developing offline accounting tools suitable for rural settings, and encouraging their adoption through tax incentives. The results emphasize the important role of accounting tools in promoting the sustainable development of the rural economy and provide practical insights for realizing the goal of rural revitalization

View pdf

View pdf

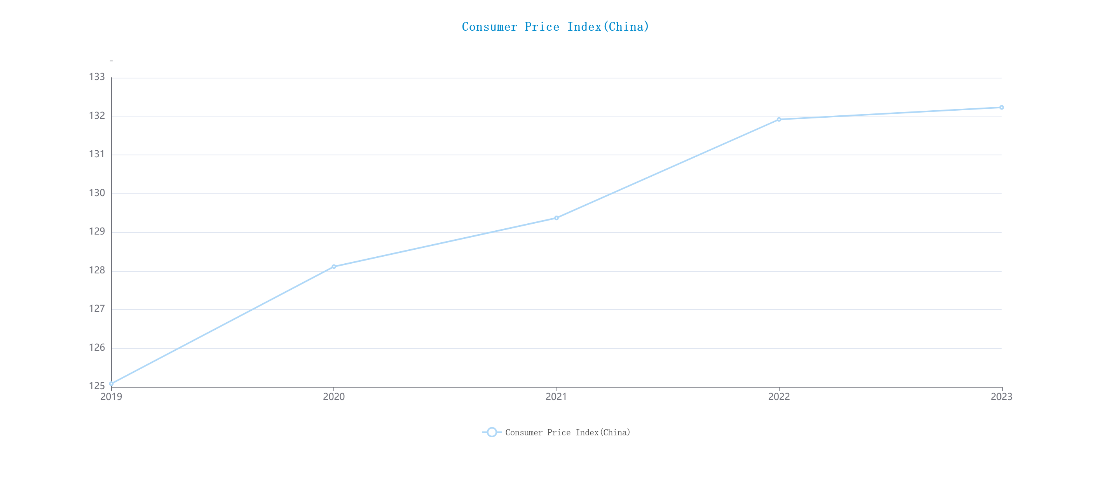

The COVID-19 epidemic has had a dramatic impact on consumer behavior in both China and the United States. At the same time, physical health has become an increasingly important factor affecting consumers. Through the epidemic, the way of consumption has also realized digital transformation and upgrading. Based on the qualitative analysis of the economic data and facts related to the epidemic in China and the U.S., this paper finds that the epidemic has had a different degree of impact on consumption patterns (especially online consumption), consumer confidence, and consumer products in both countries. More specifically, the experience of the COVID-19, along with the cultural and social context, has led to a shift in consumer behavior from offline face-to-face to online no-touch consumption behavior, and has accelerated the growth of the digital economy such as e-commerce platforms. At the same time, consumer confidence has been significantly undermined by the deflation brought about by the outbreak. Finally, consumer products have also changed as a result of the mass hygiene outbreak

View pdf

View pdf

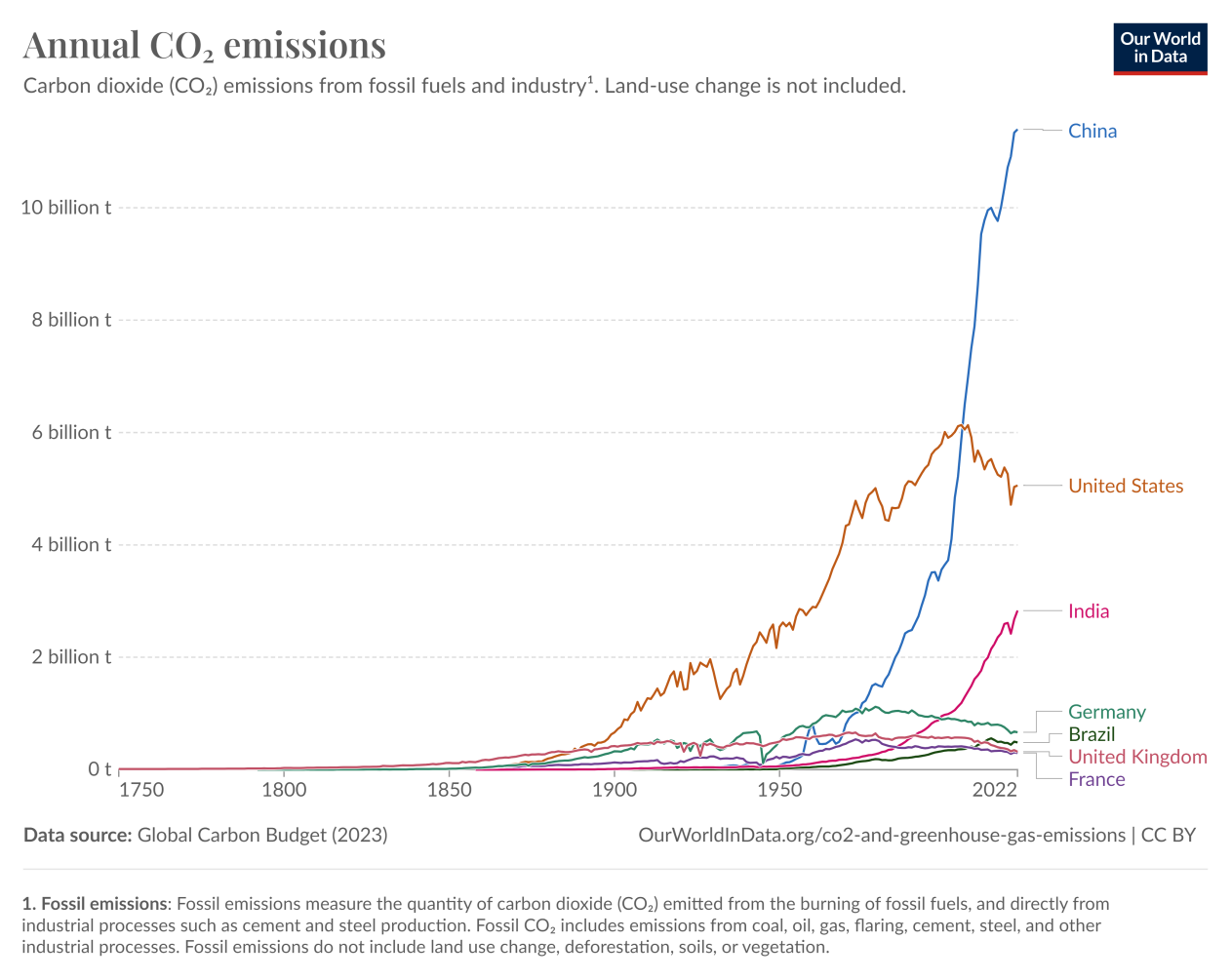

The People's Republic of China, as one of the world's largest emitters, has a markedly different approach to achieving an energy transition in a relatively short period of time due to the specific characteristics of its population, geographic location, distribution of resources, and political policies, which collectively present significant challenges to the realization of its goals. This study examines China's current energy policy and how it balances economic growth, energy security, and environmental protection. The study found that China faces considerable challenges, including the need to reconcile the unequal distribution of resources and address issues such as the imbalance in population distribution, as well as the necessity to achieve a complete energy transition in a relatively short period of time. This study analyses China's current energy policy in order to ascertain how it balances economic growth, energy security, and environmental protection

View pdf

View pdf

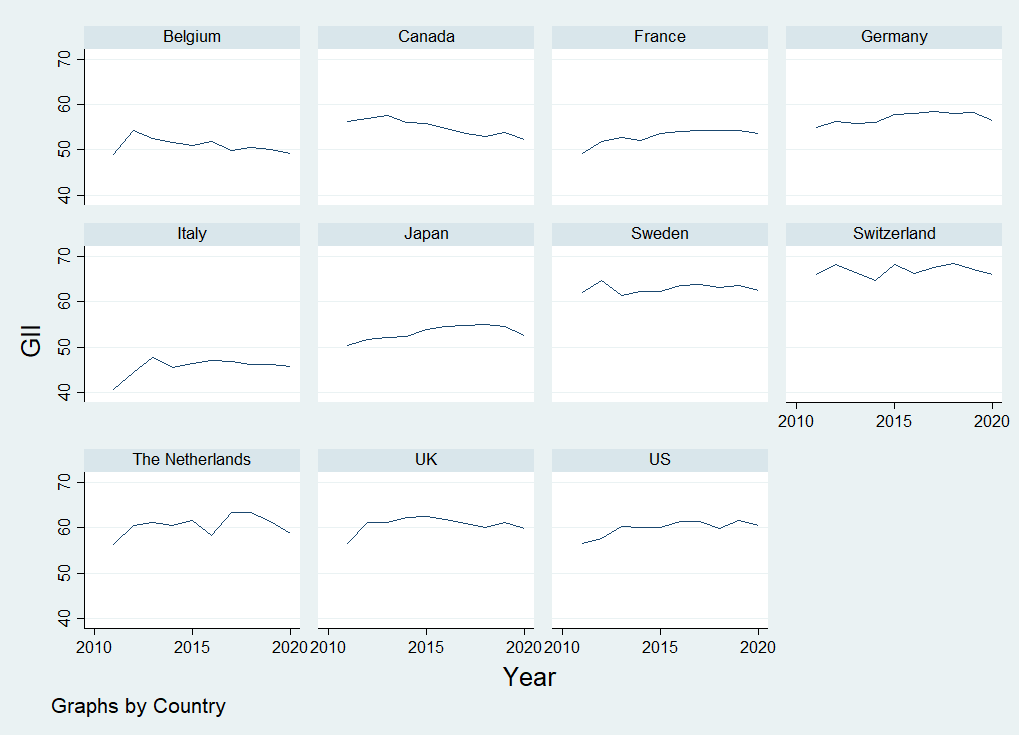

Innovation plays a crucial role in the financial growth and development of the nation. This is because an increase in portfolio investment attracts foreign capital into the economy, which further adds to innovation due to increased capital. In addition, financial growth signifies a rise in the production of goods and services in an economy, which further stimulates the wages and profitability of businesses in the long run. Thus, this research incorporates a panel data analysis to explore the association between financial determinants and innovation index in G10 economies using the RE model, the FE model, and the Hausman test. The results of the research indicate that a rise in financial determinants adds to the innovation index in G10 economies

View pdf

View pdf

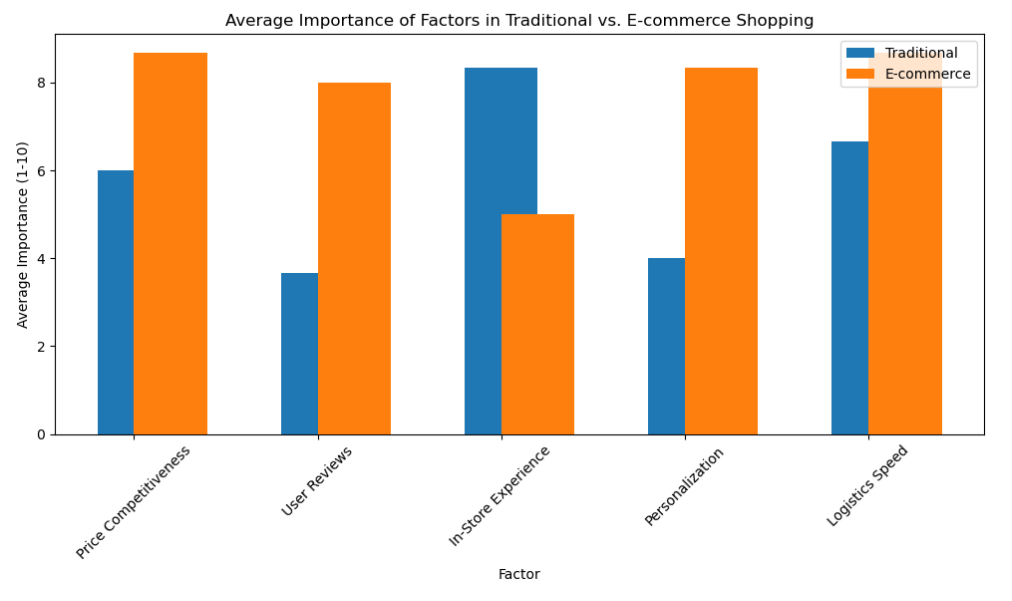

This study aims to analyse the main factors influencing consumers' purchasing decisions under traditional consumption and e-commerce platforms, and to explore the differences in behaviour between these two environments. By comparing factors such as price competitiveness, user evaluation, personalised recommendation, logistics speed and in-store experience, it reveals their performance in different shopping environments. In this paper, Relevant consumer behaviour theories such as the Theory of Rational Behaviour, the Theory of Planned Behaviour and the Technology Acceptance Model were cited. Walmart, Nike and Jingdong are also selected as representative companies, and the case study method is used to study the impact of their operational strategies on consumer behaviour. The results show that on e-commerce platforms, price competitiveness, logistics speed, user reviews and personalised recommendations have more significant influence, while in-store experience remains an important factor in consumer decision-making in traditional retail environments. The study reveals the differences between online and offline shopping environments, provides theoretical support for companies to develop targeted marketing strategies, and offers practical suggestions for future omni-channel integration

View pdf

View pdf

Faced with unprecedented changes, the emergent energy sector has evolved the new high ground of international competition, among which the development of the new energy vehicle industry is particularly crucial and of great significance to the global energy transformation. To strengthen the role of fiscal policy in promoting innovation in new energy technologies, this article has introduced a sequence of fiscal policies to promote the development of high-tech, while using tax incentives and subsidies to guide new energy enterprises to increase their research and development efforts and achieve technological innovation. This article takes the strategic emerging industry represented by the new energy vehicle industry as an example, analyzes the role and constraint mechanism of fiscal policy on enterprise innovation, explores how fiscal policy affects the technological innovation capability of new energy enterprises, and analyzes the differentiated impact of fiscal policy on different new energy enterprises. Finally, this article proposes strategic recommendations for coordinating fiscal policies to promote innovation in strategic emerging industry enterprises, which has practical significance for the development of China's strategic emerging industries

View pdf

View pdf

With the rapid development of technologies such as artificial intelligence (AI), deep learning and high performance computing (HPC), Nvidia has gradually become the technology company with the upper hand in the world in the last decade with its technical advantages in the graphics processing unit (GPU) field. The purpose of this article is to analyze the future development prospects of Nvidia and explore its competition and challenges in the AI and GPU markets. Through the review and analysis of existing literature, combined with NVIDIA's financial data, SWOT analysis and industry environment assessment, the main opportunities and threats facing the company are revealed. The research shows that despite Nvidia's dominant position in GPU technology and AI, its future growth faces challenges from different aspects, including competitive pressure in the core market (GPU), bottlenecks in technological progress, saturation of the gaming graphics card market, and supply chain risks. The conclusion is that Nvidia's long-term growth prospects remain strong, especially in high-potential areas such as artificial intelligence and autonomous driving. However, with the rise of competitors such as AMD and Intel, as well as uncertainties in the global economy and supply chain, Nvidia will face fierce market competition. Therefore, Nvidia should continue to increase its technological innovation efforts, optimize supply chain management, and strengthen its strategic positioning in new technology areas. Nvidia may encounter many challenges in the next few years, but relying on its strong technological innovation capabilities, extensive market applications and strategic layout, it still has huge development potential

View pdf

View pdf

This study explores the changes in risk preferences of individual investors in response to market fluctuations from the perspective of behavioral finance, and its impact on investment decisions. It was found that individual investors' risk preferences are influenced by various psychological factors including overconfidence, anchoring effect, and loss aversion tendencies. Additionally, market volatility and changes in economic environments significantly affect investors' willingness to accept risks. Through analyzing investment behaviors under different risk preferences, this paper reveals strategies for optimizing investment decision-making processes through education, emotional management, and policy-making. Moreover, the study points out that enhancing market information transparency and innovating investment tools can effectively guide individual investors towards more rational investment choices

View pdf

View pdf

The real estate sector plays a pivotal role in driving economic growth. However, it faces significant challenges related to credit risk and sustainable supply chain practices. The management of credit risk and the integration of Environmental, Social, and Governance (ESG) factors into credit risk assessment have garnered increasing attention. This paper investigates the influence of sustainability practices within the real estate supply chain on credit risk management, focusing on the case study of China Evergrande Group. Through an analysis of Evergrande Group's financial reports and relevant policy changes via literature review and case study methodology, this research delves into the underlying causes of its credit risk as well as its repercussions on the supply chain. The findings indicate that Evergrande Group's high leverage coupled with an aggressive debt expansion strategy has resulted in a heightened accumulation of credit risk amid evolving policies and market conditions. Consequently, it is recommended that real estate enterprises enhance their mechanisms for assessing supply chain-related credit risks, establish early warning systems for potential credit issues, promote information sharing among stakeholders, and refine their contractual agreements and guarantee frameworks to mitigate credit risks while promoting sustainable development within their supply chains

View pdf

View pdf

In recent years, the escalating environmental problems posed by climate change have prompted countries to expedite their energy transition. Headed by the Paris Agreement, which sets temperature control targets for the world, countries have taken a variety of measures to promote the development of low-carbon energy. Among them, electric vehicles have played an indelible role in China's energy transition. In terms of energy structure, electric vehicles can assist in reducing reliance on traditional fossil fuels, lowering greenhouse gas emissions, and providing an effective route to achieving the “dual-carbon” objective. In terms of environmental benefits, electric vehicles can effectively reduce urban air pollution and improve the quality of life of residents. This research analyses government economic instruments, such as carbon pricing, carbon taxes and infrastructure development. Understanding the impacts of policies on consumers, businesses and identifying current shortcomings provides recommendations for a sustainable future with enhanced life-cycle use and a circular economy. This paper is designed to encourage further research, standardisation work, public communication, and future progress

View pdf

View pdf