Volume 130

Published on September 2025Volume title: The 3rd International Conference on Applied Physics and Mathematical Modeling

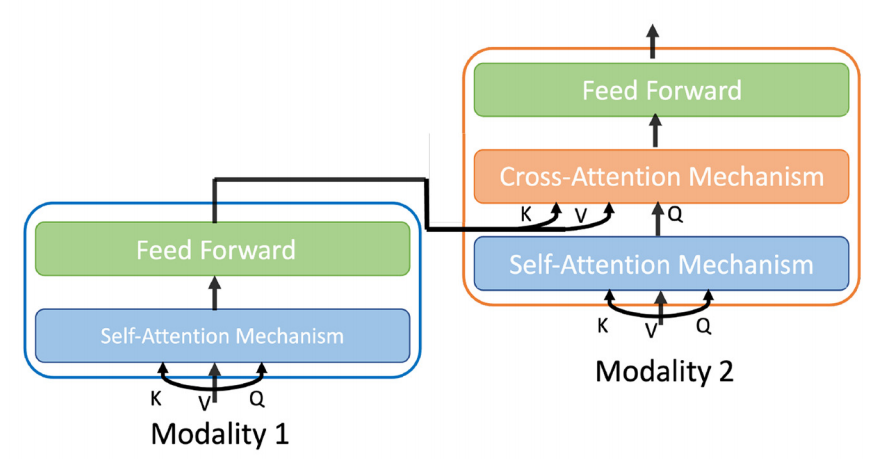

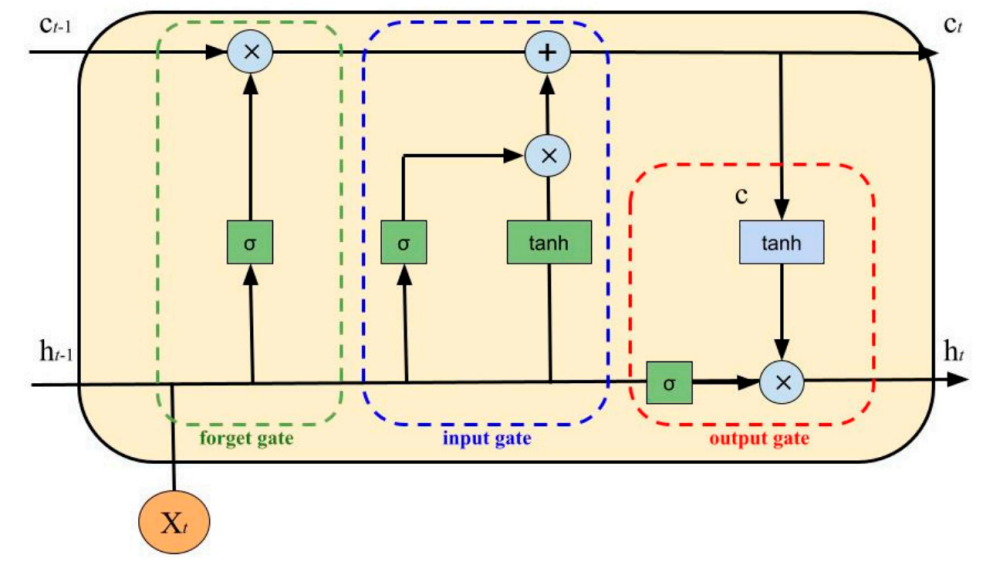

In response to the limitations of traditional consumer-credit pricing models that rely on single-modal demographic and financial tables, this study develops and empirically validates a multimodal intelligent pricing framework that jointly exploits textual declarations, profile images and granular in-app behavioral logs. Each modality is encoded into a 128-dimensional embedding and fused through gated multimodal units and cross-modal attention to capture latent signals of repayment risk. The fused representation feeds a two-stage pipeline in which a deep classifier estimates individualized default probability and a reinforcement-learning policy converts this risk score into compliant, profit-maximising price adjustments. Using 120,000 real loan applications from an international fintech platform, the proposed model reduces mispricing loss by 17 % and lifts AUC to 0.879 compared with the best unimodal and gradient-boosted baselines, while meeting interest-rate caps in five regulatory regimes and sustaining 94 ms online latency. Attention heat-maps and SHAP analyses confirm that pricing decisions remain interpretable and free of single-feature dominance, satisfying emerging AI-governance requirements. The results demonstrate that rich multimodal cues substantially enhance pricing accuracy, fairness and operational robustness, offering a scalable blueprint for next-generation responsible consumer-finance systems.

View pdf

View pdf

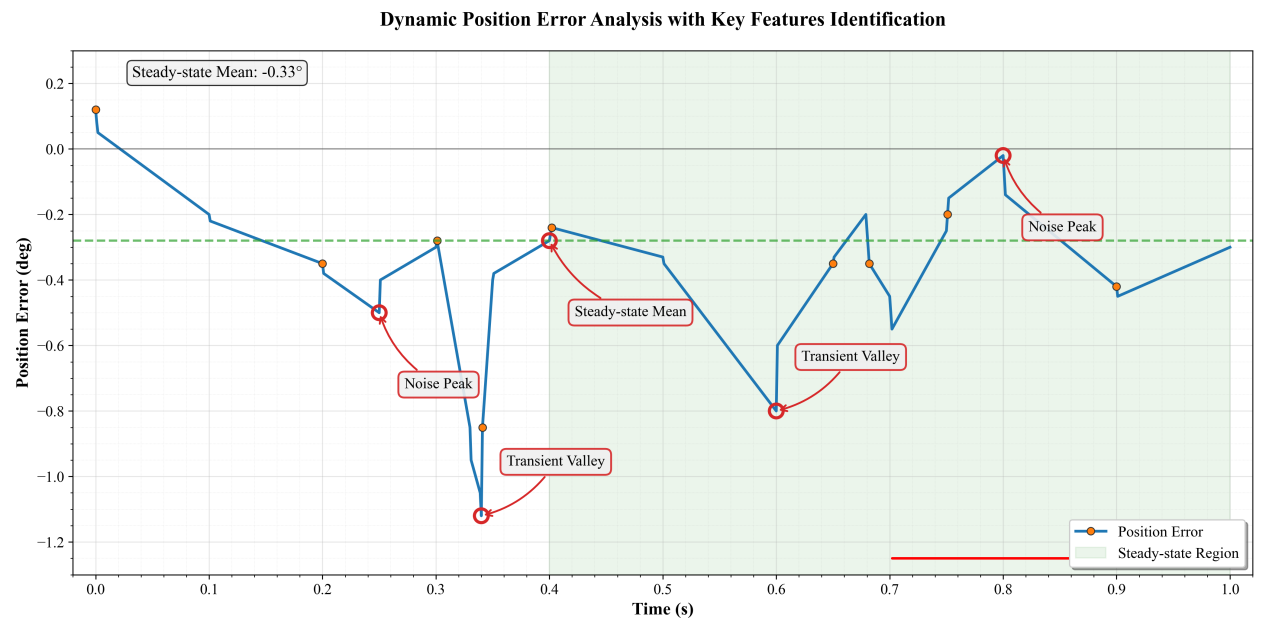

Traditional sensorless control methods suffer from performance degradation at low speeds and under parameter variations. The introduction of sliding mode control effectively addresses this issue. In this paper, a mathematical model of the PMSM is first established, and an improved sliding mode observer is designed. Through robust analysis of key motor parameters such as stator resistance, inductance changes, and flux linkage deviation, it is found that sliding mode control exhibits strong disturbance rejection capability against resistance changes, moderate robustness against inductance changes, while flux linkage deviation significantly affects system accuracy. Experimental results demonstrate that the sliding mode control scheme exhibits significant advantages over traditional methods in terms of low-speed observation accuracy, dynamic response speed, and system overshoot control. The feasibility of this control method in industrial applications is validated through experiments, particularly under high-load conditions, where it demonstrates good robustness.

View pdf

View pdf

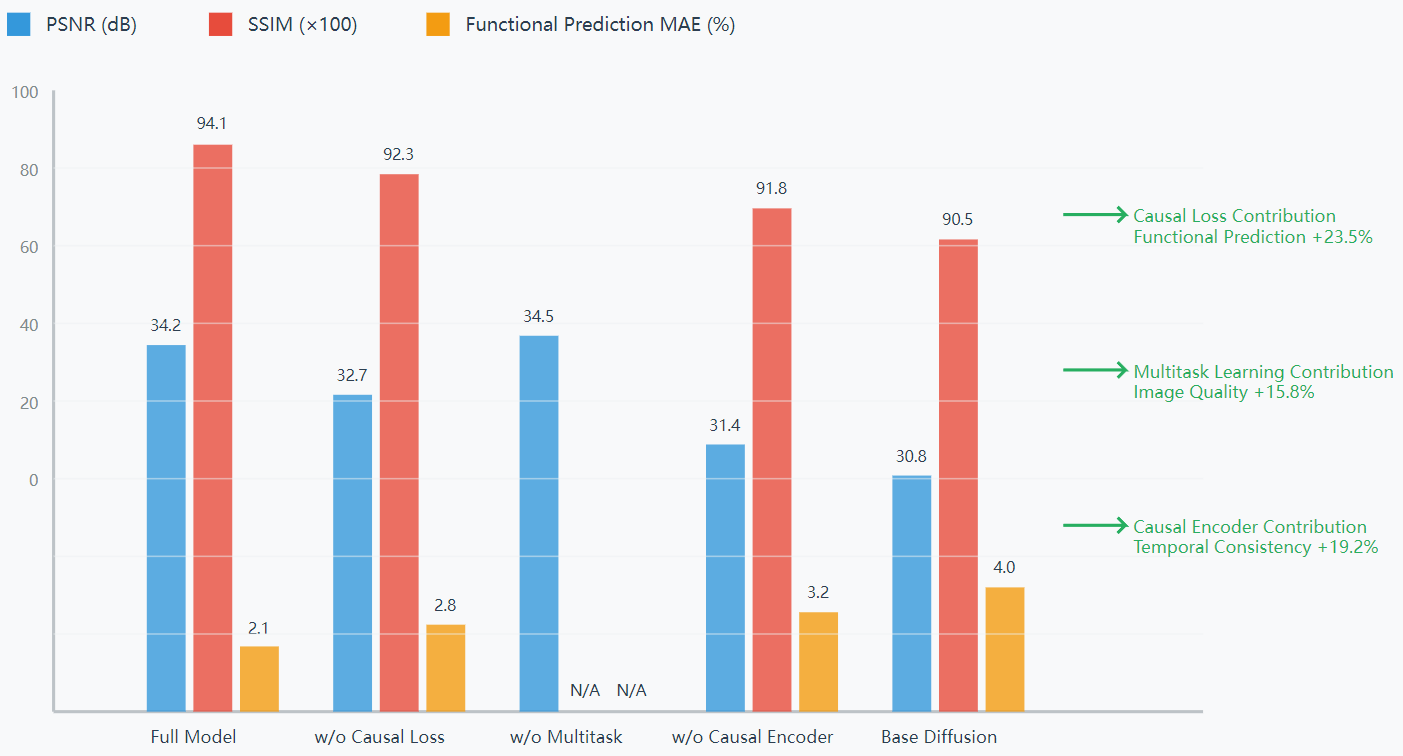

Cardiac magnetic resonance imaging (Cardiac MRI) is an important noninvasive tool for evaluating cardiac structure and function, but its spatial resolution and temporal consistency are often limited by imaging equipment, which affects the accurate portrayal of complex cardiac dynamics. Existing methods mostly regard image reconstruction and functional assessment as independent tasks, failing to establish a causal link between structure and function, resulting in inefficient information utilization and unstable prediction accuracy. To solve the above problems, this paper proposes a causality-aware multitask diffusion model, which embeds causal reasoning mechanism into the diffusion denoising process to realize the joint assessment of super-resolution reconstruction of cardiac MRI images and functional indexes such as ejection fraction and ventricular volume. The model architecture includes a causal encoder, a multi-task diffusion network and a joint decoder, and the causal consistency loss is introduced during the training process to constrain the structure-function dynamic association. Experiments are conducted on multiple cardiac MRI public datasets, and the results show that the model outperforms existing methods in PSNR, SSIM, temporal consistency, and functional prediction error, and has stronger interpretability and clinical potential. This study provides new ideas for building an interpretable medical AI system that integrates image quality and functional reasoning.

View pdf

View pdf

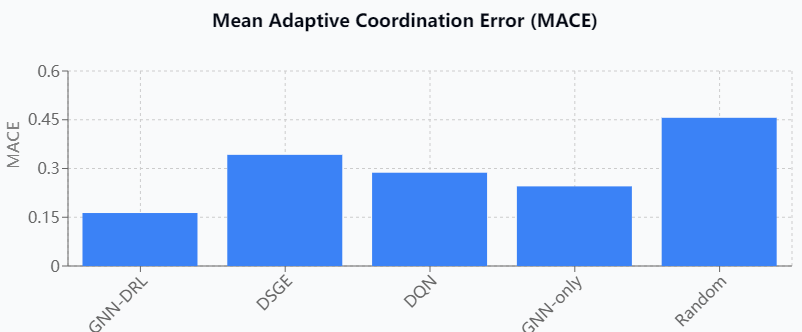

Against the backdrop of accelerating global climate change and advancing green transitions, national fiscal instruments deployed by countries, such as carbon taxes, green subsidies and public investment, are increasingly generating unintended cross-border spillover effects, undermining the macroeconomic stability and fiscal space of other countries through trade linkages, capital flows and regulatory arbitrage, and creating complex interdependencies that challenge traditional economic coordination. While traditional dynamic stochastic general equilibrium models and extended IS-LM frameworks provide some insight into cross-border policy interactions, their rigidity, equilibrium focus, and reliance on static assumptions prevent them from adequately capturing the adaptive, nonlinear, and high-dimensional nature of real-world fiscal dynamics. Combining advances in artificial intelligence techniques of graph neural networks and deep reinforcement learning, the study proposes a framework for generating adaptive policy responses to climate fiscal spillovers, which simulates state behavior in a multi-intelligence policy system and dynamically generates context-aware and forward-looking policy responses. A cross-country fiscal impact network is constructed by using empirical fiscal data from IMF and OECD sources, and model performance is evaluated in scenarios involving carbon tax spillovers and green subsidy competition. This study advances the learning paradigm of international macroeconomic coordination and provides a robust and scalable tool for smart climate policy governance.

View pdf

View pdf

A patient-centric digital-twin architecture that fuses ontology-grounded knowledge graphs with structural causal inference is presented to simulate the five-year evolution of type 2 diabetes mellitus and cardio-renal comorbidities. A harmonised health-information-exchange corpus comprising 12 318 adults, 22.7 million encounter rows and 7.4 million laboratory records (2010 – 2024) was mapped to a 168 402-node, 1 217 965-edge graph aligned to SNOMED-CT. Counterfactual trajectories under 17 therapeutic bundles were generated by a differentiable do-calculus engine nested inside a temporal graph transformer, producing 1 000 Monte-Carlo roll-outs per patient. External validation on an independent 2 975-subject cohort yielded a dynamic concordance index of 0.842, an integrated Brier score of 0.091 and a calibration-in-the-large of –0.013, surpassing recurrent neural and mechanistic baselines by 18.5 % and 11.2 % respectively. Sensitivity analyses confirmed robustness to 24 % MCAR missingness and ±15 % hidden-confounding bias. The findings demonstrate that knowledge-graph-driven causal twins deliver granular, well-calibrated forecasts and quantitatively rank preventive strategies, paving the way for learning-health-system deployment in chronic-disease management.

View pdf

View pdf

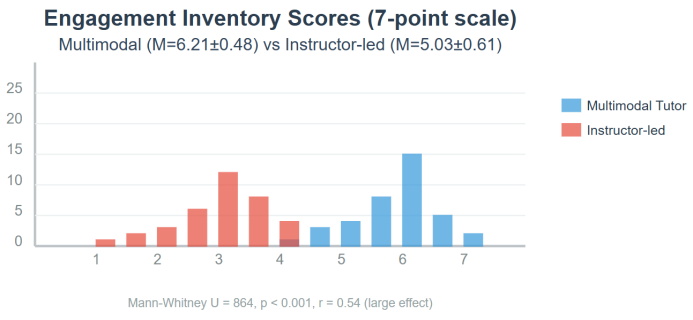

Adaptive multimodal generation now enables artificial interlocutors that perceive speech, gaze, and gesture simultaneously and adjust feedback within milliseconds. Leveraging these advances, the present study engineers and validates a learner-adaptive system that fuses wav2vec-based speech recognition, a vision transformer for non-verbal cues, and a diffusion-avatar prompt engine trained through reinforcement learning with human fluency rubrics as reward. One hundred twenty intermediate English learners (B1–B2) practised with the agent or a teacher-led communicative syllabus for twelve weeks. Fine-grained telemetry captured 63 948 utterances, 5.7 million prosodic frames, and 173 hours of video frames. Mixed-effects growth modelling shows the AI group improved words-per-minute by 48.6 wpm (95 % CI = 42.4–54.8), mean-length-of-run by 3.91 syllables (CI = 3.34–4.48), and reduced filled-pause density by 6.3 pauses per 100 words (CI = 5.1–7.5), outperforming controls on all endpoints (p < 0.001). Learner diaries corroborate quantitative gains, citing lower anxiety and heightened prosodic experimentation. Findings evidence that synchronising cross-modal analytics with real-time generative feedback yields substantial fluency dividends and offer design principles for scalable AI-assisted speaking tutors.

View pdf

View pdf

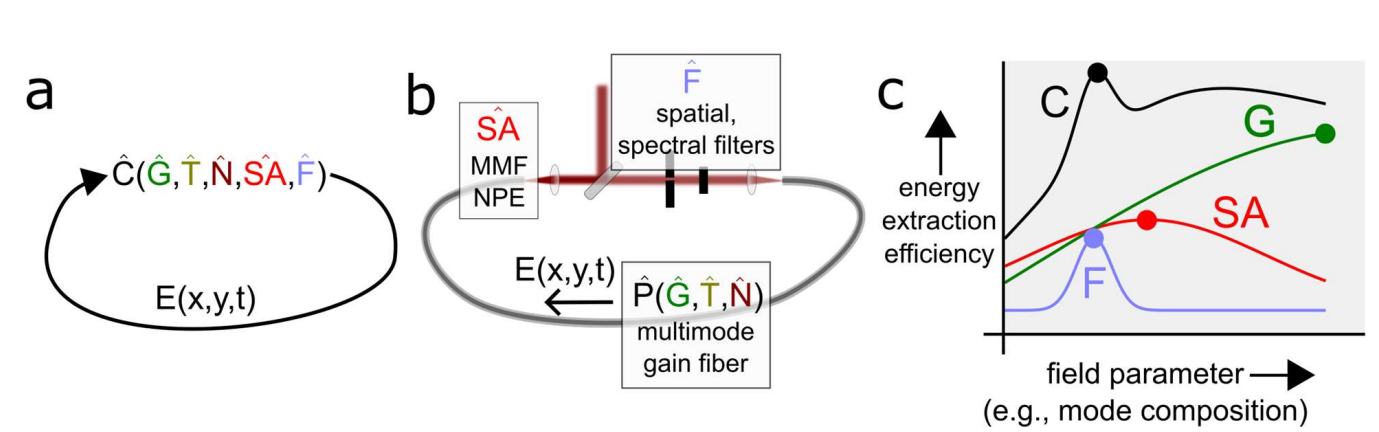

Spatiotemporal mode locking (STML) enables femtosecond emission that exploits coupled spatial and temporal dynamics, but achieving targeted transverse modes with predictable limits remains difficult due to high-dimensional, nonlinear cavity parameter spaces. We present a data-driven framework that combines a fast digital twin of the cavity with experiment-in-the-loop learning to synthesize and switch among variable transverse modes while quantifying performance limits. A reduced-order propagation model provides millisecond evaluations for control, while Bayesian optimization and reinforcement learning map actuator settings to modal content, pulse energy, and jitter. Closed-loop experiments on a reconfigurable cavity validate inverse designs for TEM00{00}–TEM10{10}–multimode operation, revealing trade-offs among dispersion, Kerr nonlinearity, saturable absorption, and spatial filtering. We measure timing jitter, relative intensity noise, and spectral-temporal quality to bound achievable performance across modes and identify mode-dependent ceilings governed by gain bandwidth and B-integral. Results establish a general route to agile, specification-driven STML sources and provide actionable guidance on performance limits for variable-mode femtosecond lasers.

View pdf

View pdf

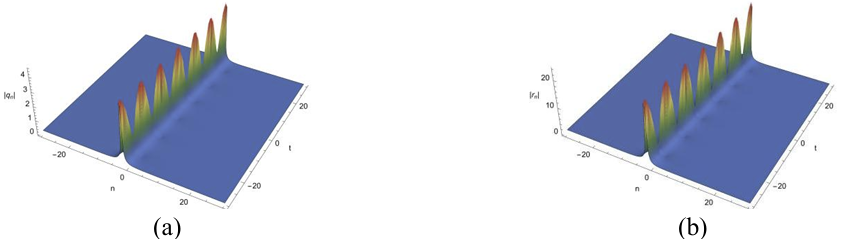

In recent years, significant progress has been made in the study of nonlinear Schrödinger equations within the fields of mathematical physics and nonlinear wave dynamics. However, investigations on the semi-discrete form of coupled local nonlinear Schrödinger equations remain relatively limited. In this work, within the framework of semi-discrete systems, we impose local reduction conditions on the coupled nonlinear Schrödinger equation and propose a new integrable semi-discrete two-component coupled local nonlinear Schrödinger equation. Starting from a semi-discrete4×4matrix Lax pair, and with the aid of a gauge transformation, explicit formulas for the Darboux transformation of the system are derived. By selecting appropriate seed solutions, exact solutions of the system on the zero background are obtained through the constructed Darboux transformation. Furthermore, the dynamical properties of these solutions are visualized using mathematical software. The results reveal that the system admits typical breather-type soliton solutions, which exhibit periodic oscillations in the temporal direction and localization in the spatial direction. This study not only deepens the understanding of soliton dynamics in semi-discrete local nonlinear systems but also provides an effective approach and theoretical reference for analyzing similar nonlinear wave equations.

View pdf

View pdf