Volume 40

Published on November 2023Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

This paper focuses on 2011-2022 A-share real estate listed enterprises and digital financial data as objects, and empirically studies the relationship between the development of digital finance and the financial risks of real estate enterprises. Studies show: (1) the reasonable application of digital finance can effectively suppress the financial risks of real estate enterprises; (2) digital finance reduces the financial risks of real estate enterprises by easing the financing constraints. Based on this, the paper proposes policy suggestions for improving the use of digital finance and the digital financial supervision system.

View pdf

View pdf

The Federal Reserve's tenth interest rate hike has further impacted the U.S. economy and society. Therefore, this paper analyses the current economic environment in the United States and the implications of high interest rates, as well as the link between high interest rates and US Treasuries against the background of the tenth interest rate hike by the Federal Reserve. The research uses information and data from the Federal Reserve, current news, and data from the US stock market as the basis for the analysis. This study concludes that high interest rates are unfavourable for the US economy in the short term, but have helped employment, mortgage repayment costs, and growth in some sectors.

View pdf

View pdf

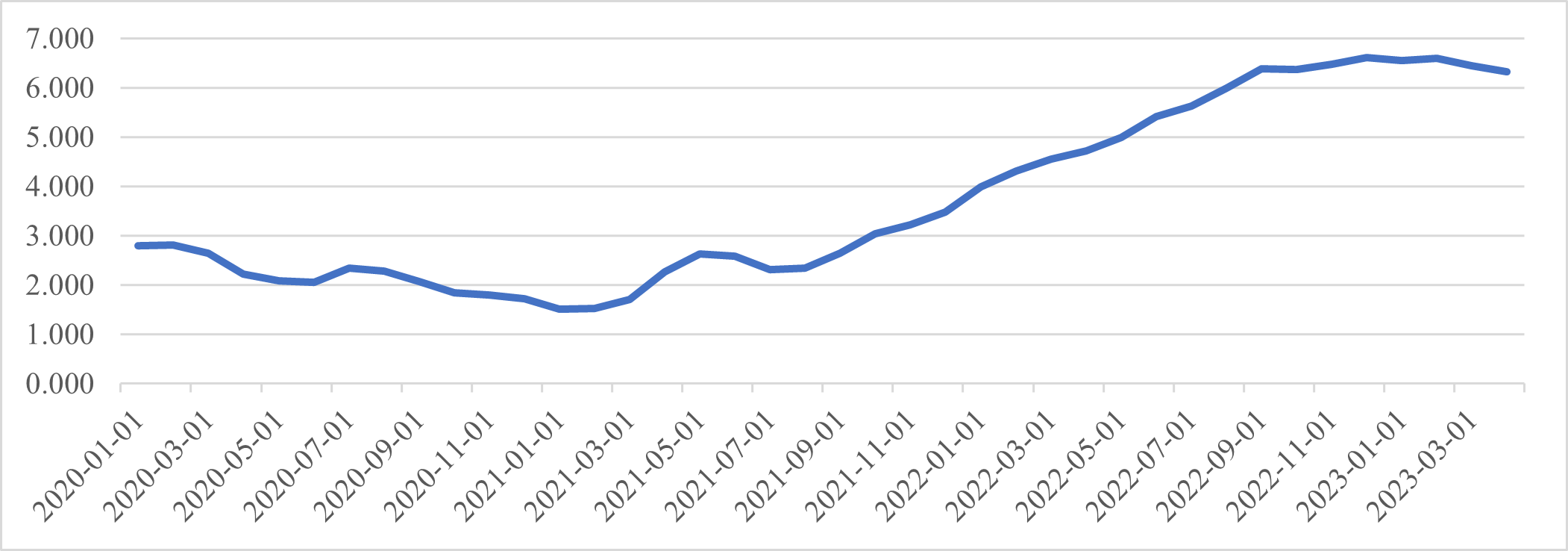

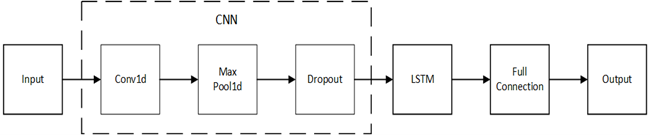

Fluctuations in the stock market represent the changes in the national economy objectively, stock price prediction predicts the future trend of stocks using the past data, which has been widely focused on. Some machine learning algorithms, such as linear fitting and sequence mining, are used to predict the stock market. However, linear fitting faces the problem of overfitting and black relationships with historical data, while sequence mining is short in efficiency and lacks dynamic adaptations. State-of-the-art methods using attention mechanism in neural networks have shown exceptional performance targeting sequential prediction and classification. In this paper, we propose a combined LSTM-CNN attention model to explore the role of attention mechanism in Long Short-Term Memory (LSTM) network-based stock price movement prediction. Experimental results show that our LSTM-CNN-attention model can provide an accurate prediction and reliable trial on the stock price prediction, and the attention mechanism significantly improves the model performance in the stock market.

View pdf

View pdf

This paper provides an overview of the rapidly expanding fintech sector and its impact on traditional financial services. Fintech has emerged as a customer-centric business model in response to the shortcomings of conventional financial services during the financial crisis and COVID-19. The fintech industry has created prospects in a variety of areas, including blockchain (specifically cryptocurrencies), robo-advisors, online payment services, and peer-to-peer lending platforms. However, the quick expansion of fintech also comes with risks, and investment decisions must be made carefully, considering project duration and volatility. Risk management is crucial to preserving financial stability, and legal oversight is necessary. Machine learning and deep learning techniques can be employed to recognize and mitigate these risks. Banking institutions must take precautions to protect customer data and manage unforeseen operations. The fintech sector has the potential to transform the financial industry while maintaining long-term financial health through a balance of innovation, regulatory monitoring, and financial stability.

View pdf

View pdf

Currency policy plays a crucial role in macroeconomic management and is of significant importance for the economic stability and development of countries and regions. Understanding and evaluating the choices and consequences of different countries' currency policy practices are essential. This paper aims to compare and analyze the currency policy practices of China and the United States, two important economic entities, and explore their core elements, policy objectives, and impact on economic stability and growth. China, as the world's second-largest economy, has implemented a series of unique monetary policy measures to address domestic and external challenges. The United States, as the largest economy in the world, has a long-standing tradition of stable monetary policy and faces challenges and responsibilities consistent with its economic status.

View pdf

View pdf

The paper practically investigates relationships among digital finance, financial risks, and high-quality development of real estate companies using data from listed real estate companies and digital finance from 2011 to 2020. The research findings are as follows: (1) Digital finance significantly foster the high-quality development of real estate companies; (2) Mechanism analysis indicates that digital finance can advocate the high-quality development of real estate companies by alleviating financial risks. Therefore, this paper suggests policy recommendations such as the government issuing policies to drive the development of digital finance, companies establishing sound internal control and risk management mechanisms, and companies undergoing digital transformation to promote the high-quality development of real estate companies.

View pdf

View pdf

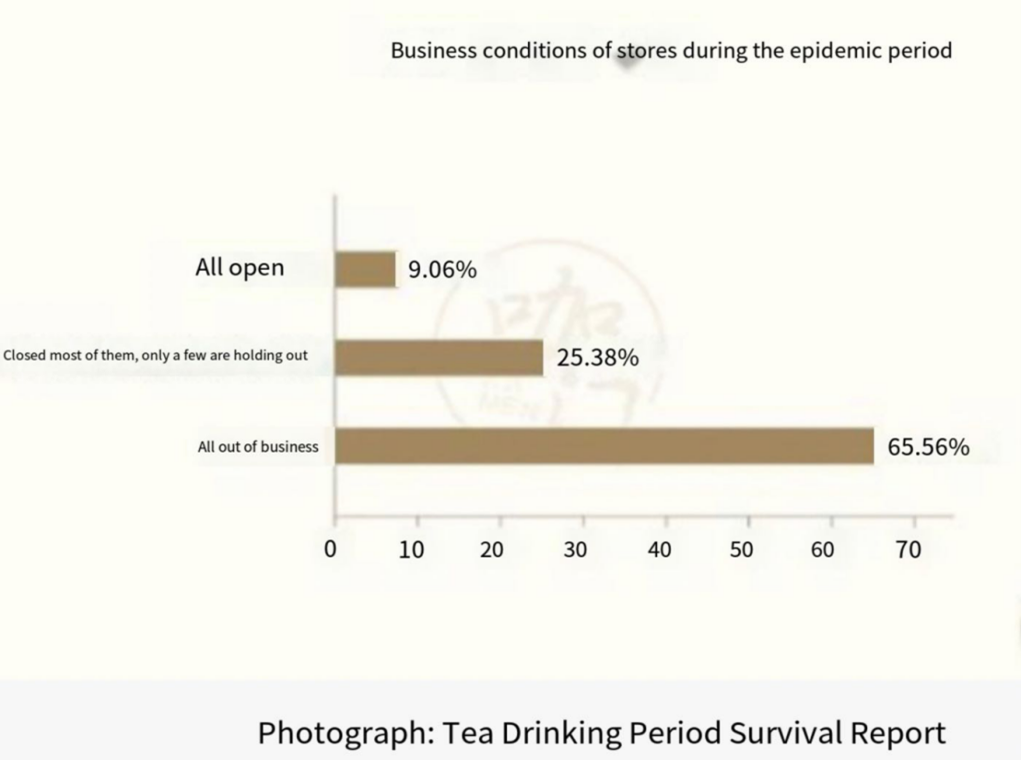

This case study mainly expounds the advertising and marketing strategy of Hey Tea through co-branding and building high-end Internet celebrity stores and the idea of mainly building well-known Internet celebrity stores before the epidemic to form an online and offline closed loop with the control and sale of small programs during the epidemic, and compare the marketing strategies of digital new media.

View pdf

View pdf

The objective of this research paper is to thoroughly examine the risks and investment opportunities that exist within the aviation industry for publicly listed companies. The aviation industry encompasses a wide range of sectors, including airlines, aviation manufacturers, and aviation service providers, all of which play a vital role in the overall economy. Many airlines operating within this industry have shares listed on public stock exchanges, providing investors with the opportunity to engage in buying and selling activities. As a result, it is of utmost importance for investors to develop a comprehensive understanding of the associated risks and investment potential associated with publicly listed companies operating within the aviation sector. However, researchers conducting such an analysis must possess a certain level of knowledge and comprehension regarding the intricacies of the aviation industry and its interconnected markets. Acquiring in-depth knowledge about the industry and related market dynamics is crucial for accurately assessing the risk factors and determining the investment value of these listed aviation companies.

View pdf

View pdf

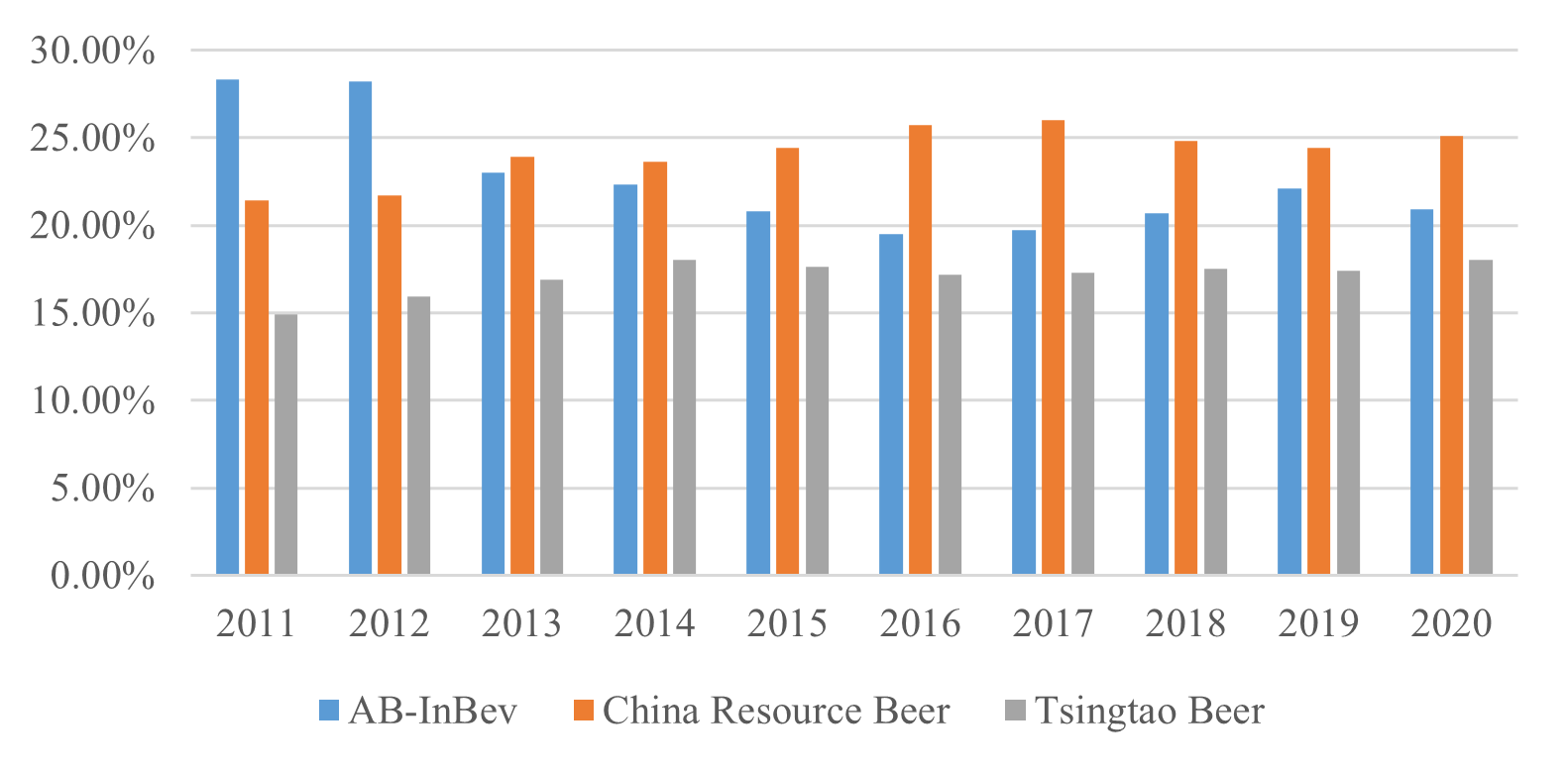

In recent years, due to the accelerated pace of life, to relieve pressure, most people tend to drink to relax. For the type of wine, the most popular choice is beer. Thus, it may be a good choice to invest in the beer industry for investors. The main purpose of this article is to ana-lyze AB-InBev, which is the leading enterprise in the beer industry, and then get the in-vestment value of this company while providing references for other companies. To achieve this goal, the capital structure of AB-InBev is analyzed by calculating many indicators such as the Weight Average Cost of Capital, and the company's business risks are analyzed in de-tail from three aspects including financial data, costs, and competitors. The result of the analysis is that although the company's profitability is strong, the risk to the company is still high. This leads to the conclusion that risk-neutral or risk-loving people are better suited to invest in AB-InBev.

View pdf

View pdf

The objective of this paper is to explore the correlation between the capital structure and op-erating performance of selected leading pharmaceutical companies listed on the stock ex-change during the COVID-19 pandemic. To investigate how diverse capital structures influ-ence corporate performance, this study collects, calculates, and compares pertinent financial data, including leverage ratios, performance indicators, and cash flow, for these firms over three years. The findings show that companies with lower debt ratios are more likely to achieve stable earnings and cash flows, as well as to achieve higher performance indicators to some extent, compared to companies with higher debt ratios. Thus, capital structure has an impact on a company's operating performance. At the same time, a reasonable capital structure optimization can enhance a company's operating performance and mitigate opera-tional risks. It is recommended that listed companies in the pharmaceutical industry should focus on optimizing their capital structure to reduce financial risks and financing costs and to improve cash flow levels in order to achieve stable improvements in operating perfor-mance while ensuring sound operations and management. Investors should also focus on the capital structure of companies when making investment decisions and select those compa-nies with a sound capital structure for investment. These findings and recommendations provide suggestions and directions for the pharmaceutical industry to optimize its capital structure and improve its operating performance.

View pdf

View pdf