Volume 108

Published on October 2024Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

In response to increasing global trade, IKEA implemented a more efficient supply chain strategy and introduced a new policy in 2011 to localize its supply chain. The objective of this inquiry was to examine the alterations in supply chain management. Following the transition from centralized to regionalized supply chains, corporations faced adverse consequences such as decreased operational efficiency, increased operating expenses, and reduced adaptability in meeting market needs. These implications include increased complexity in supply chain management, decentralized operating models that result in repeated investments in fixed assets, and trade restrictions that create challenges in integrating information. The article proposes implementing efficient management systems, enhancing collaboration with local suppliers, and utilizing artificial intelligence to optimize the structure of the supply chain based on the observed impacts and outcomes. The objective is to offer risk management guidance for firms that have reached maximum production capacity and require a shift in their supply chain management methods.

View pdf

View pdf

The third wave of global economic integration is advancing at an unprecedented speed. At the same time, there is intense debate among people about the impact of globalization on the economy, society, environment, and other aspects. One of the core issues of debate is the impact of globalization on income disparities between countries. Many people believe that the rules of globalization are beneficial to rich countries by sacrificing the interests of the third world, exacerbating inequality between countries and exacerbating poverty. This article uses literature review and case analysis methods, and panel data to study the impact of globalization on income inequality between countries through a regression based inequality decomposition framework. This paper will start with theoretical analysis and then test these theories with empirical data. Our goal is to provide a comprehensive perspective to understand the interaction between these two important economic variables and to look for possible equilibrium strategies.

View pdf

View pdf

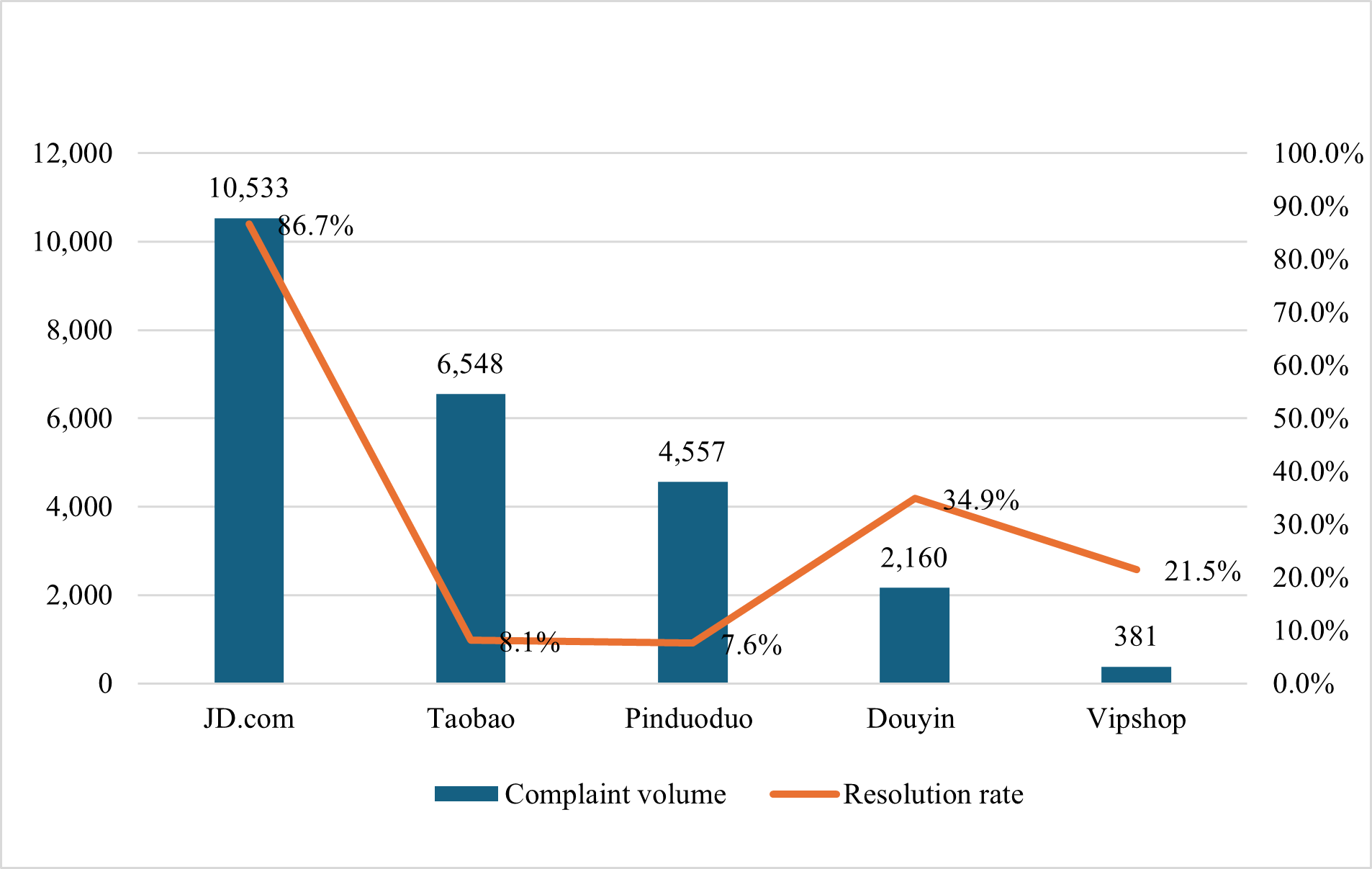

With the rapid development of technology and the widespread adoption of the Internet, e-commerce has become an integral part of people's daily lives. In e-commerce scenarios, consumers can browse and purchase goods anytime and anywhere, enjoying unprecedented convenience. However, at the same time, the issue of post-purchase dissonance has gradually become prominent. This paper aims to explore the influencing factors and management measures of consumer post-purchase dissonance psychology in e-commerce scenarios. The article first reviews the theory of post-purchase dissonance and the theory of perceived psychological contract violation-, providing a theoretical foundation for subsequent research. Then, through a literature review, it identifies multiple factors affecting consumer post-purchase dissonance, including customer service quality, costs incurred from returns, and uncertainties in online shopping. To effectively manage post-purchase dissonance, enterprise managers should focus on improving service quality, optimizing the return process, and reducing shopping uncertainties. Additionally, strengthening consumer education and enhancing their cognitive ability regarding product information and decision-making skills in shopping are also important ways to reduce post-purchase dissonance.

View pdf

View pdf

With the rapid development of the digital economy and the rise of the industrial Internet, China has made significant progress in terms of industrial competitiveness and industrial innovation and development. However, China's capacity for independent technology innovation must be improved. Firstly, China's independent innovation capacity in key core technology areas could be more robust. This mainly manifests in China's reliance on imported technologies and equipment in high-end manufacturing and emerging industries. Although China has made certain technological breakthroughs in specific fields, there is a particular gap between China and the international advanced level. Secondly, the investment in technological research and development of Chinese enterprises must be increased. Although the R&D investment of Chinese enterprises is gradually growing as more attention is paid to scientific and technological innovation, there still needs to be a significant gap compared with developed countries. In particular, the R&D investment of small and medium-sized enterprises is relatively low, resulting in the overall level of independent technological innovation not being high. Again, China needs to strengthen the protection of intellectual property rights. For a long time, the construction of China's intellectual property protection system has been lagging, and the problem of intellectual property infringement is relatively prominent, which has formed a particular obstacle to independent technological innovation. Therefore, studying economic digital development restrictions and development strategies has profound theoretical and practical significance in the new development pattern.

View pdf

View pdf

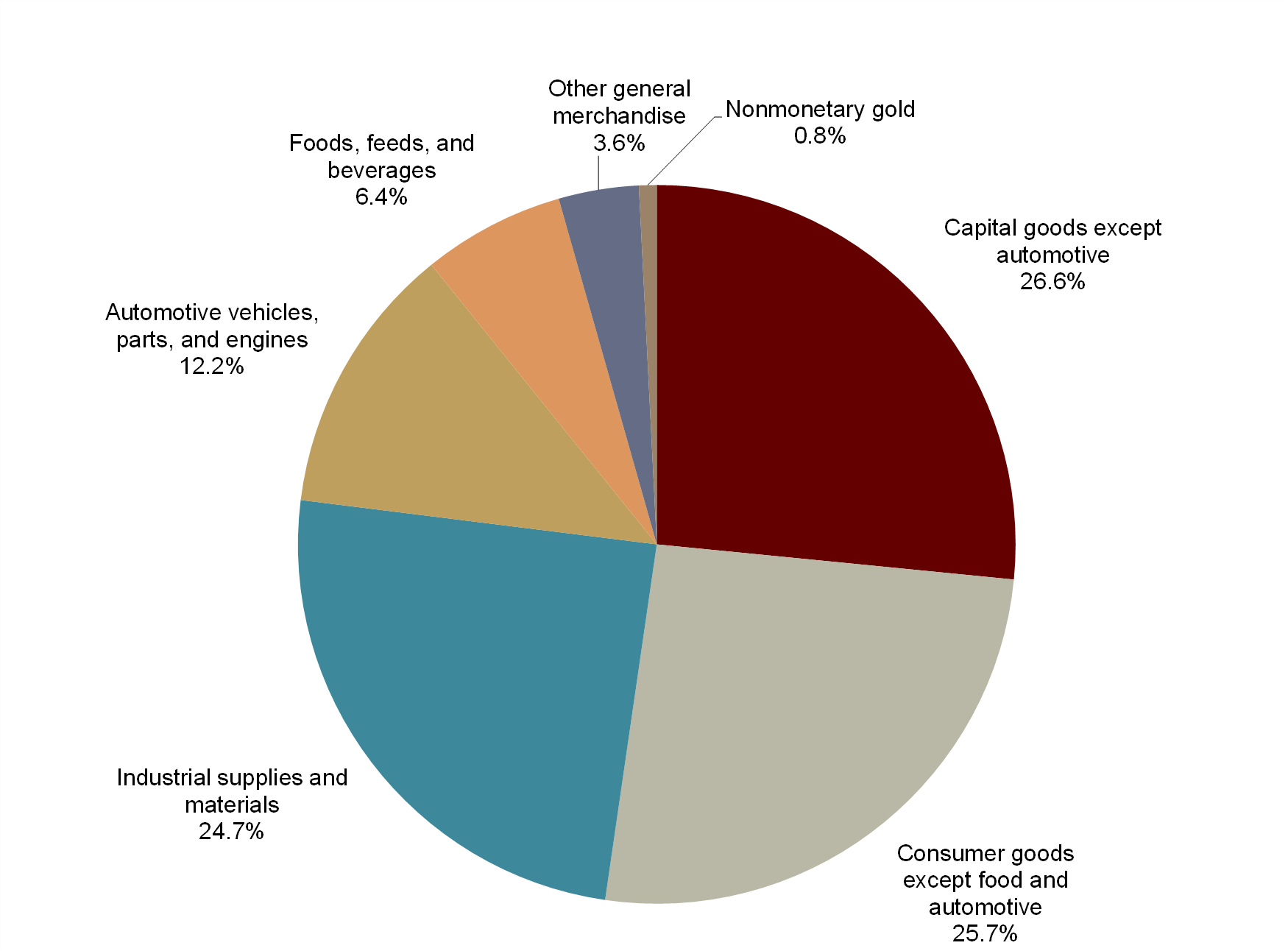

Due to the continuous development of global trade globalization and the weakening of monopolistic policies by major powers, the current international trade pattern has undergone tremendous changes, which has also led to significant changes in the GDP development of various countries. So the impact of import and export trade on international economic growth is enormous. This paper takes the United States as a typical developed country and China as a typical developing country, and the economic growth changes of both countries are most representative of the changes in import and export trade. Therefore, it focuses on the impact of import and export trade on the Sino-US economy to explore the specific changes in recent years. This article mainly focuses on the impact that has changed the import and export trade between China and the United States, resulting in how their economy has changed.

View pdf

View pdf

This research views data science as the basis of the decision-making process at SCM. Tough international trade environment characterized by complex supply chain and inventory issues as well as unpredictable demand for goods necessitates powerful analytics tools. Using the latest technologies - machine learning, predictive analytics, and big data - data science generates data-driven decisions for more accurate, efficient, and prompt SCM decision-making. The study intends to study the current trends and evaluate the influence of data science in SCM decision-making processes. It also delves into the difficulties and advantages with the utilization of data science during these procedures. This study uses a synthesis approach by systematically going through a literature review to gather data from different academic journals and industry publications. According to the results of the thematic analysis, the themes will emerge, so the whole complexity and depth of data science applications in SCM will be properly revealed. Data science changes the business decision-making in a way that was impossible before with the advent of new information from the huge and complex data sources. Data analytics not only smoothens but also upgrades long-term trend forecasting and market readiness in SCM. Furthermore, the paper emphasizes the influence of the Internet of Things (IoT) and industry 4.0 technologies of SCM with an accent on how they are associated to increase efficiency and sustainability in the operations.

View pdf

View pdf

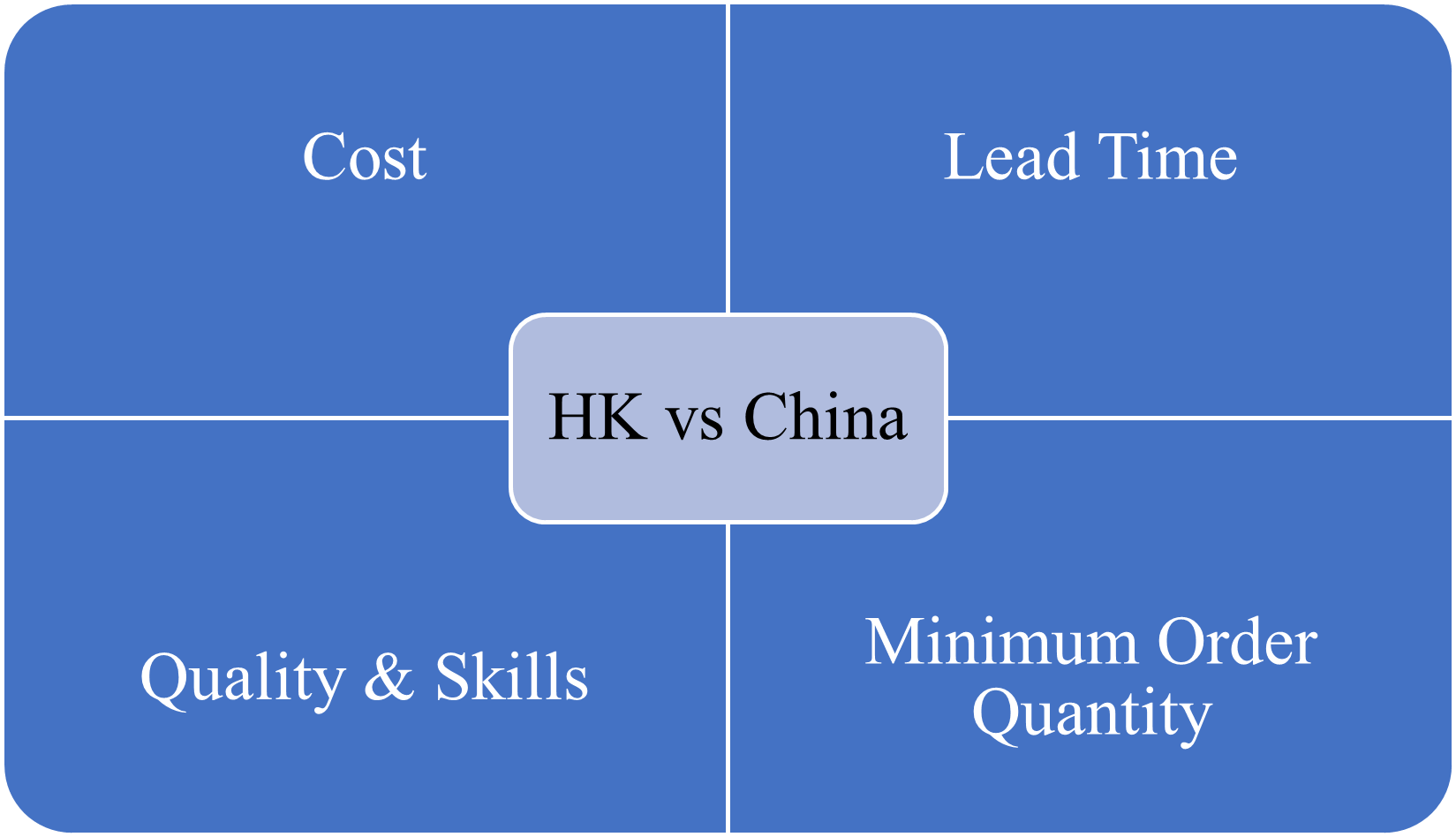

This paper revolved around two core research issues: production location selection and subsequent production decisions. The aim of the study was to provide a detailed analysis of Sport Obermeyer's data from 1992 to 1995 in a new way, hoping to assist companies facing similar challenges. The paper took Cost, Quality, Lead time and Minimum order quantity as bridges to the four main factors affecting the choice of production location. It detailed the advantages and disadvantages of the two production locations: Hong Kong and China. Then, with the aid of the Newsvendor model, the mismatch cost ratio for the 10 styles was determined. Ultimately, using the coefficient of variance for comparison and confirmation of the mismatch cost ratio results, the paper helped Sport Obermeyer analyze which styles of parkas had low-risk and low-uncertainty demand, and which had high-risk and high-uncertainty. The paper then combined the characteristics of the two production locations and assisted Sport Obermeyer in making subsequent production decisions. Five styles of parkas suitable for production in China and five styles suitable for production in Hong Kong were identified, ensuring stable profits and deliveries for Sport Obermeyer.

View pdf

View pdf

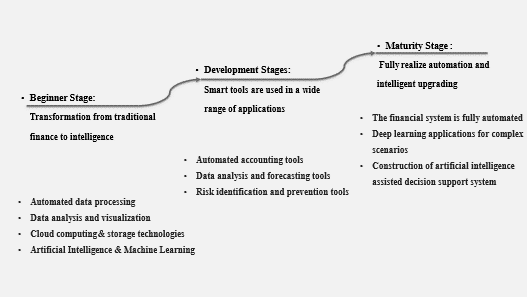

Recently, intelligent financial applications have been regarded as an important pillar of enterprise development and will play a significant contribution to the progress of future enterprises. Enterprises need to make continuous progress and adapt to the rapidly changing social environment with high competitiveness, and finance, as an indispensable part of enterprise development, needs to make great progress. With the continuous development of digital transformation, intelligent finance has become an important driving force for enterprise development, and is widely used in information processing, personnel management, market analysis, business management, etc. The purpose of this paper is to explore the sustainable impact of intelligent finance on enterprise development, including the application of financial intelligence, financial shared development, data analysis and management, etc., and comprehensively sort, analyze and summarize the relevant research through the method of literature review. In addition, it provides reasonable suggestions for the future development direction of enterprise finance, so that enterprises can gain competitive advantages from intelligent financial applications, improve company efficiency, and achieve good and long-term development.

View pdf

View pdf

This article provides a comprehensive analysis of the key factors shaping real estate markets, focusing on urbanization trends, technological advancements, and global economic shifts. Urban migration is fueling demand in metropolitan areas, leading to significant infrastructural developments and a reevaluation of property values. Concurrently, technological innovations like artificial intelligence, virtual reality, and blockchain are transforming real estate transactions and management, enhancing market efficiency and transparency. Additionally, the paper examines the impact of global economic conditions, including trade wars and policy changes, on real estate investment and market stability. By integrating these elements, the article forecasts potential market trends and offers strategic insights for navigating the complexities of the real estate sector. This synthesis not only highlights current influences but also projects future changes in the landscape of real estate, suggesting adaptive strategies for industry stakeholders.

View pdf

View pdf

At the dawn of the 21st century, the ascending comprehensive national strength of China has significantly bolstered the role of the RMB in global economic transactions, thereby expediting its international settlement globalization. This development, unfolding within the framework of an increasingly interconnected global economy, profoundly impacts Singapore. Positioned as a crucial trading partner and geographical neighbor to China, while simultaneously serving as a vital security ally of the United States in Asia, Singapore's political and economic landscapes are witnessing transformative shifts. This paper endeavors to meticulously examine and elucidate the specific impacts of RMB settlement globalization on Singapore's political and economic dimensions. Moreover, it aims to explore the potential challenges and opportunities that these impacts may engender for Singapore in the near future, particularly against the backdrop of the US-China competition. The analysis of how the global proliferation of RMB settlement is reshaping Singapore, alongside the nature and direction of this influence amid the strategic rivalry between the US and China, is of paramount importance. It provides deep insights into the evolution of the global political-economic order and assists in formulating strategies for middle-tier nations like Singapore within the changing regional dynamics. By offering a detailed understanding of these developments, this study acts as an essential guide for navigating crises, capitalizing on developmental opportunities, and actively participating in regional affairs.

View pdf

View pdf