Volume 110

Published on August 2024Volume title: Proceedings of ICEMGD 2024 Workshop: Decoupling Corporate Finance Implications of Firm Climate Action

In recent years, with people's increasing emphasis on health, the demand for China's sports rehabilitation training industry has been continuously increasing. In this context, it can provide more development momentum for the sports rehabilitation training industry, which is conducive to the continuous improvement of related medical technology, promote the continuous development of sports medicine integration, and better serve the general public. But in the continuous development of the sports rehabilitation training industry, many difficulties have also been encountered. This study mainly used literature research and logical analysis methods, combined with the current development trend and professional development of the sports rehabilitation training industry, to analyze market demand, professional talent cultivation, and the development of laws and regulations, and propose a series of improvement measures, which can be more accurate for the future development direction of the sports rehabilitation training industry. From a social point of view, it is necessary to strengthen the health awareness of some people and improve the training and professionalism of professional talents. For the government, it is to strengthen support for the sports rehabilitation training industry and strive to cultivate more compound sports rehabilitation talents, which can lay a solid foundation for the better development of the sports rehabilitation training industry.

View pdf

View pdf

Cross-border e-commerce is a rapidly growing market segment that means high-quality logistic support for long-term growth. This paper investigates the peculiarities of present cross-border e-commerce logistics conditions, defines existing challenges, and suggests improvement ideas. In this case, the study reviews literature and case studies to examine the issues affecting cross-border logistics, including long transit times, high freight costs, and bureaucratic formalities in accessing various customs. This research is designed to help readers understand the specific forces that affect logistics configuration and suggest methods to improve the performance and quality of the logistics services being delivered to customers. Through the realization of these optimization measures, the study will aim to play a significant role in enhancing the sustainable growth of the cross-border e-commerce sector and preventing it from being out-competed in the world market. The findings of this research highlight the critical strategies and technological innovations necessary to address these challenges and demonstrate their potential to improve logistics efficiency and reduce costs significantly.

View pdf

View pdf

This study delves into Hermes’ strategic operations in the luxury goods market, focusing on its brand management, brand marketing, and their profound impact on corporate sustainability. Anchored in its rich history and exceptional craftsmanship, Hermes has strategically positioned itself as a leader in the global luxury market through market segmentation and innovative marketing strategies. Particularly amidst ethical controversies and increasing consumer concerns about ecological issues, Hermes has enhanced its market competitiveness through initiatives such as ethical sourcing and environmental advocacy, establishing itself as a benchmark in corporate social responsibility (CSR). Additionally, starting from the definition of luxury goods, the study analyzes Hermes’ current brand development status, emphasizing brand management and marketing. Sustainable development as a core value continues to influence luxury brands’ marketing strategies, targeting specific middle and upper social classes to ensure brand image alignment with the identity and status of target consumers. Through an analysis of Hermes’ marketing strategies, this study provides insights into luxury consumers’ psychological needs and behavioral habits.

View pdf

View pdf

Short video platforms, with their ease of content production, wide dissemination, and large user base, have become important mediums in the internet, providing new opportunities for film marketing and promotion. This study explores the use and effects of short video platforms (Douyin) in film marketing. Through case analysis and in-depth interviews, short video marketing has significant advantages in disseminating film information, attracting audiences with diverse content forms, and increasing exposure and appeal. However, issues like excessive plot leakage and content homogenization may affect audience expectations and viewing experience. The study also reveals that short video marketing excels in emotional resonance and guiding social topics but should avoid over-reliance on star power and misleading promotions. Based on these findings, the study recommends optimizing short video film marketing strategies, including maintaining content novelty, enhancing emotional marketing, effectively using audiovisual language, and accurately targeting audiences to improve marketing effectiveness and audience engagement.

View pdf

View pdf

Numerous reasons contribute to the liabilities of a firm in the aviation industry. As a capital-intensive industry, the aviation industry has long faced high liabilities caused by the cost of purchasing necessary means of production. Also, the industrial feature that the aviation business has in its off-season and peak season has brought uncertainty to the industry. In addition, it has also experienced increasing pressure due to the decreasing travel and transport demands during and after the COVID-19 pandemic. Considering the reasons above, the debt management ability of an airline has become more essential than before to investors. This research will compare and analyze the debt level of sample firms in the aviation industry, and provide a basic overview of the sample firms’ business situation through utilizing a quantitative method and several indicators. The conclusion is that the differentiation in debt levels results from the differences in industrial features, firm situations, and operating and investment activities.

View pdf

View pdf

As social media platforms have matured, influencer marketing has increasingly gained favor among advertisers. This study explores the optimization strategies for influencer marketing in the beauty industry. Through case analysis and previous research experiences, it is recommended that suitable influencers for different brands and products be selected. The findings indicate that influencer marketing significantly enhances brand awareness and consumer trust. However, brands need to make precise selections based on target customer groups, brand image and story, and influencer types. The three key factors proposed in this study—target customer groups, brand value and story, and creator types—offer specific brand guidance when choosing influencers. By optimizing influencer selection strategies, beauty brands can build their brand image more effectively and improve market competitiveness. The conclusions emphasize that influencer marketing should become a necessary promotional tool for beauty products. The study also highlights future research directions, including applying these strategies in other industries and more systematic data research.

View pdf

View pdf

Digital finance and financial inclusion have already become significant components of many countries’ financial system. Starting from the early 21th century, the researchers focus on building the developed digital finance and financial inclusion system. This paper concludes the development of digital finance and financial inclusion and then summarizes the three significant effects on small, micro enterprises and common residents according to the existing study, emphasizing the importance of the digital finance and financial inclusion to economic growth. The impacts include that digital finance can increase the efficiency of financial market by improving the success rate of two-way selection of both parties in the financial market, in addition to increasing the consumption quality of residents. This paper also points out that digital finance and financial inclusion will bring new risks to the financial market, and subsequent researchers still need to study how to make digital finance more stable and less risky.

View pdf

View pdf

As the sports industry continues to grow, there is an increasing demand for the brokerage industry in the sports sector. Klutch Sports, an American professional sports agency, has grown rapidly since its creation in 2012, and boasts a number of big-name players, including Rich Pual, the company's founder. Rich Pual is the founder of Klutch Sports, which has negotiated more than $1 billion in contracts by signing more and more players to high-dollar deals. In July 2019, Unite Talent Agency (UTA) announced the acquisition of part of Klutch Sports and the appointment of Rich Paul is responsible for running the sports division. Through the outstanding ability of the leader and absorbing business talent to form an experienced team to provide players with the company's characteristics of the full range of services, so Klutch Sports has maintained a good momentum of development, from a small company gradually become a strong sports brokerage company. Its operation and development of the company is worth studying and learning from. Klutch Sports agency is used as an example for this study to provide professional sports brokerage firms with favourable information so that they can better and more characteristically combine sports and business, as well as provide greater economic value to the sports industry. This study argues that agencies need to improve to adapt to this era of "player empowerment" and reap the benefits of having the players' interests as their primary goal.

View pdf

View pdf

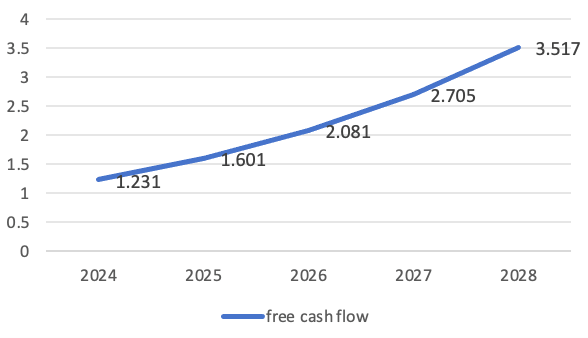

The purpose of this article is to analyze the market environment and financial position of Agnico Eagle Mining Company in order to provide investment advice. AEM occupies an important position in the global mining industry. Despite the apparent cyclical nature of the mining industry, AEM has also benefited from the recovery in commodity prices and the recovery in mining company profits since 2015. This article analyzes and evaluates the financial performance and market value of Agnico Eagle (AEM) from various aspects, such as financial ratio analysis, discounted cash flow (DCF) model, relative valuation method, industry trend analysis, and risk assessment. This paper evaluates AEM's liquidity, solvency and profitability by comparing key metrics such as quick ratio, current ratio, long-term debt ratio, cash ratio, total debt ratio and interest coverage ratio. It also analyzes global gold demand, mining market recovery, and critical metals market dynamics, providing context for AEM's future revenue forecasts and strategic decisions. After a comprehensive analysis, AEM is considered to have good growth potential and competitive advantages, making it suitable for investors looking for stable returns.

View pdf

View pdf

The Walt Disney Company (DIS) is a giant in the entertainment industry with a diversified investment portfolio, including theme parks and streaming services such as Disney+. This article provides an in-depth analysis of DIS's liquidity, solvency, profitability, and valuation, and compares it with major competitors such as Sony, Comcast, and Netflix. DIS has demonstrated good liquidity and debt paying ability, thanks to diversified sources of income and prudent financial management. Compared to competitors such as Netflix, although its profitability indicators are robust, there is room for improvement. Valuation indicators indicate that, the pricing of DIS's stock price is relatively reasonable, but investors should be aware of the risk of overvaluation. DIS's strategies include expanding streaming services, maximizing theme park revenue, and embracing digital transformation. Although DIS offers the potential for stable growth, investors must be wary of industry disruption and constantly changing consumer preferences. In this rapidly developing entertainment industry, the position of DIS cannot be ignored, and investors also need to carefully weigh risk and return. This paper adopts fundamental analysis to inform investors insights of the risks and opportunities of DIS.

View pdf

View pdf