Volume 16

Published on September 2023Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

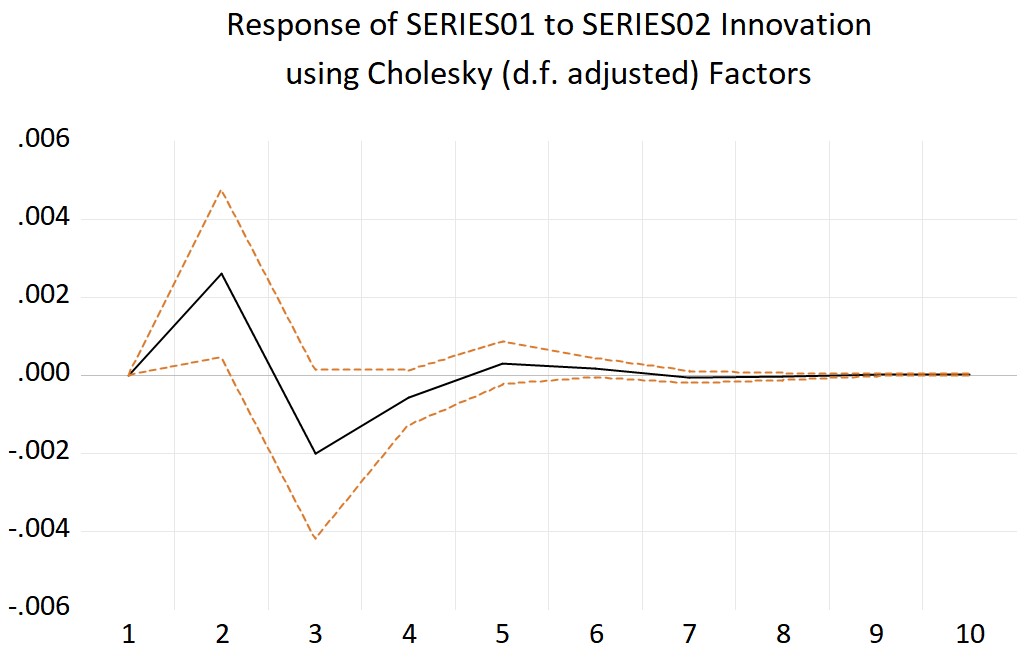

Today's world is a changing world and Economic globalization will be an irresistible trend. There are so many uncertain event factors like the global covid-19 epidemic, global China–United States trade war and Brexit etc. Those events are all affecting the global economic growth. However, will the affection be one-way or two-way? This paper focus on investigating the interaction between China and American’s Stock Index. In this study, the stock index Standard and Poor's 500 (S&P 500) in America and China Securities Index 300 (CSI 300) in China from 01/09/2021 to 01/09/2022 are selected as data, and the VAR model is established to capture the relationship between China’s and America’s stock variation. The following conclusions can be drawn from a study of the results: first, VAR model is convergent as the period of the time increases. Second, the impact of the Impulse response will last for about 10-14 periods. Third, from the variance decomposition, the affection from CSI 300 to S&P 500 will stabilised at around 10.993% and from S&P 500 to CSI 300 will stabilised at around 2.77%. The results in this paper benefit the related investors in financial markets.

View pdf

View pdf

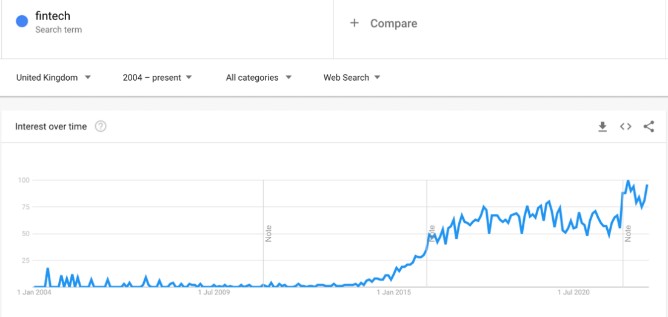

The rapid development and large-scale application of artificial intelligence, data mining, big data, and cloud computing have already led to dramatic changes in the ecological conditions of social and economic agents. Under the rapid technological development, traditional commercial banks are facing problems such as insufficient development momentum. Therefore, to accelerate its digital transformation, financial technology (fintech) has prompted the banking industry, so as to keep up with the development trend of the times and empower the innovation of commercial banks. Specifically, by analysing the current situation and the impact of the relevant major fintech on the development of the banking industry, this paper aims to gain insight into the advantages and directions of the transformation. The final conclusion of this paper is that, currently, all regions are spending more money on investing in the fintech industry. However, the underlying technological strengths are unevenly developed, with Europe and the US being the most prominent and the Asia-Pacific region catching behind. Fintech represented by artificial intelligence, big data, and cloud computing, can reduce banks' operating costs, helping them accurately profile their customers and intelligently do marketing.

View pdf

View pdf

The number of applicants for civil service posts has increased year by year, and the phenomenon of "Civil Servant Craze" has heated up again. Some scholars have made a quantitative analysis of the causes and effects of this phenomenon from the perspective of sociology and economics, but there are still few literatures using case studies. Therefore, this study will take Zhanjiang as an example to conduct case analysis, collect the employment information of civil servants in Zhanjiang in recent years, and understand the current academic background of the employed civil servants in the city and its changes. The "Civil Servant Craze" may be related to traditional concepts, civil servants' income, and its job stability. In addition, most of the people employed in Zhanjiang are graduates of non-key undergraduate colleges, which may be related to the city preference of high-level (Overseas, Project 985, Project 211, Key undergraduate) universities students for employment and the different employment pressures of graduates of different levels during the epidemic.

View pdf

View pdf

In the context of the increasing awareness of sovereignty in the world and the changing relationship between China and the United States, the employment situation of Chinese students after studying in the United States is one of the hot issues of concern in today's society. For international students, the employment situation at home and abroad is changing and has changed dramatically, and the phenomenon of devaluation of "returnees" is becoming more and more common compared to the early days of reform and opening up. The research method of this paper is SWOT analysis, and the specific research methods are as follows: collecting the employment-related data of Chinese international students in the US in recent years, comparing the employment situation of international students at home and abroad by using SWOT analysis, and making a comprehensive analysis and evaluation of the employment situation of Chinese international students returning to China and staying in the US. To sum up, in the age of information technology, a large amount of information can be collected beyond geographical and spatial restrictions, and international students can even obtain information on time abroad. From the above, if the barriers to learning are removed, international students can overcome the obstacles and make up for the shortcomings with their own efforts.

View pdf

View pdf

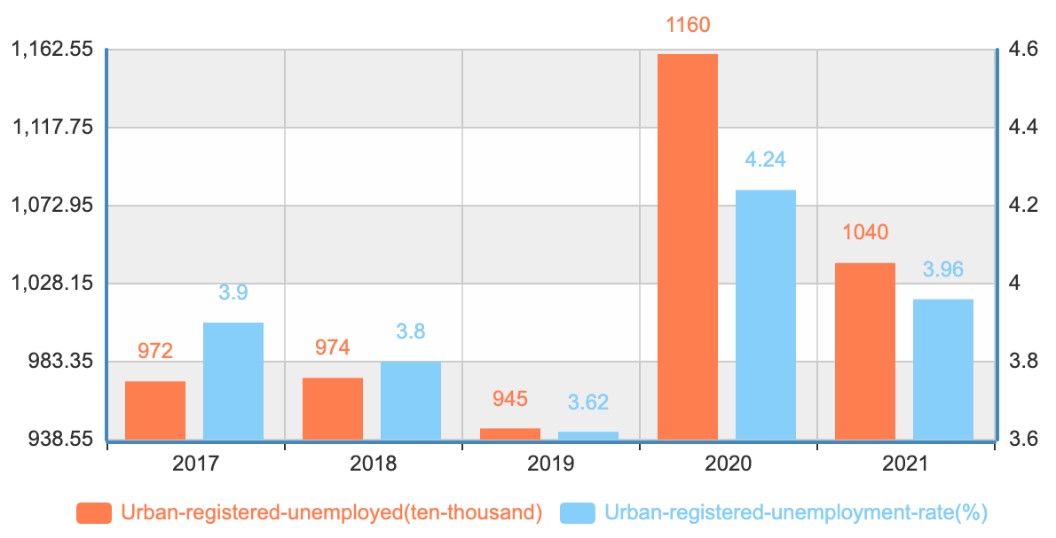

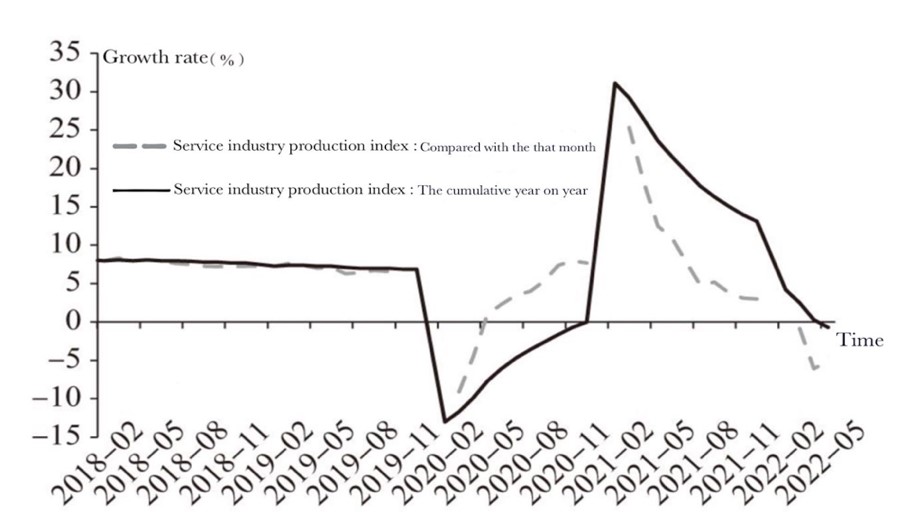

As the world's second-largest economy with a population of 1.4 billion people, China has the world's most sophisticated industrial chain and occupies a critical position in the glob-alized world economic market with a strong manufacturing sector and a promising service sector. With a market mechanism that is very different from the free-market economy popular in the Western world, such as a completely different proportion of taxation, usual-ly the influence of the political system, the Chinese market often operates with huge po-tential profit margins and potential crises. It is often greatly influenced by policies, espe-cially under the epidemic in 2020. The purpose of this paper is to analyze the general fu-ture directly, exploring current trends from the domestic and international aspects and making a rational economy on a macro level by looking at market operations over the past few years, taking into account current trends, and making recommendations accordingly.

View pdf

View pdf

Product differentiation is a key component of market structure, according to the theory of industrial organization, and the degree to which enterprises control the market depends on how well they differentiate their products. In addition, the company generates enough uniqueness in the components making up the product entity or in the delivery of the prod-uct to distinguish it from competing goods of a similar nature and draw in customers, earning their preference and loyalty. This paper introduces the causes of product differen-tiation, analyzes its application in the market and the implementable strategies for enter-prises to achieve product differentiation, and uses some examples to illustrate that product differentiation is a highly visible marketing strategy, which should be widely promoted. At the same time, it also has certain limitations and instability. Products need to establish a variety of different advantages and long-term supply chain between enterprises, cannot blindly exaggerate the role of product differentiation. In the current market environment, the same product categories emerge in endlessly. Therefore, businesses must properly cre-ate differentiation in order to make their products stand out.

View pdf

View pdf

The stock index is very important to study the overall trend of the development of financial markets and the development of the stock industry. This paper mainly studies the interaction between stock indexes and the influence of the main fields included in the stock index on the index and related indexes. In this paper, Hong Kong Hang Seng Index and FTSE CHI index were selected for research, and impulse response analysis and variance decomposition analysis were carried out on the data through VAR model. By analyzing the results, the following conclusions can be drawn: First, the model is convergent. Second, the influence from one market to another market persist for several periods. Third, with the increase of lag period, FTSE CHI HK Index was influenced by HK Hang Seng Index and finally stabilized at about 96.1906% and HK Hang Seng Index was influenced by FTSE CHI HK Index and finally stabilized at about 93.995%.

View pdf

View pdf

In recent years, the international situation has been unpredictable, changes in the economic environment have profoundly affected people's psychological expectations, and the securities market has experienced different volatility, which brings challenges to the validity of the Fama-French three-factor model. Based on this model, this paper selects 20 stocks in the Chinese A-share market, divides them into six portfolios according to their size and book-to-market ratio, conducts a regression analysis of monthly returns from August 2017 to July 2022, and then verifies the explanatory power of the market factor, size factor, and book-to-market ratio factor on the excess returns of the stocks. The results demonstrated that the three factors can partially account for the variation in returns, with SMB having a more significant impact on small-cap companies and HML on firms with a high book-to-market ratio.

View pdf

View pdf

Agriculture, forestry, animal husbandry and fishery enterprises have performed steadily and well during the epidemic period from late 2019 to the end of February 2020. But there is still a gap in empirical analysis, which deserves further research. This study examines the Fama-French three-factor model's application to China's agricultural, forestry, animal husbandry, and fisheries sectors, and analyzing and interpreting the related results. In this study, the daily return data of 27 Chinese agriculture, forestry and fishery listed companies in the past two years were obtained through the RESSET, and divided into six groups of stock portfolios according to size and book-to-market ratio size, and the relevant empirical and regression analyses were conducted for each portfolio using Python and Eviews. The findings demonstrate that the size impact and book-to-market ratio effect are two parameters in the model that have a high explanatory power on the return of the agriculture, forestry, and fishery stock portfolio in the sample period.

View pdf

View pdf

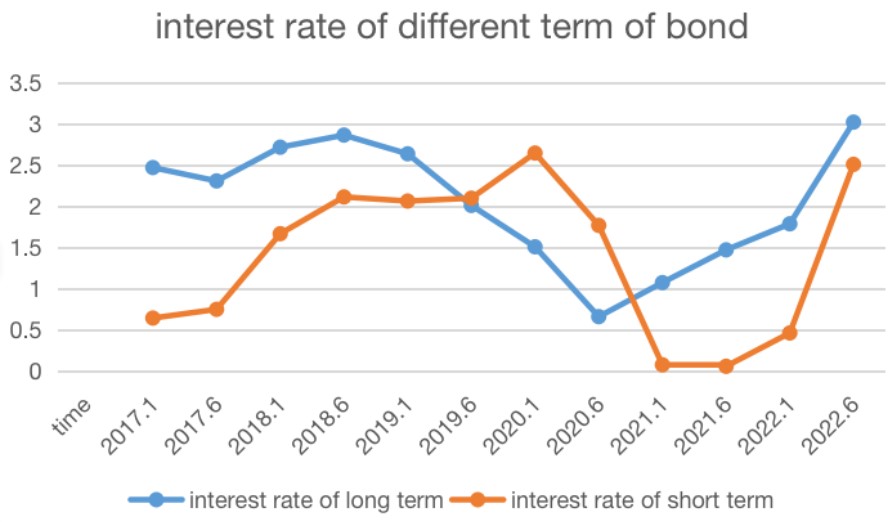

Compared with stocks, bond investment can not only reduce relatively large risk losses, but also ensure that the investment status is healthy and stable. However, whether the product trend in the bond market can be used as a tool for monitoring economic conditions is a question worth pondering. This article’s main function is discussing why the bond market is useful and the influence and difference of bond’s maturity and interest rate for the economy and investor. Through the research and discussion of the article, the paper focused on the conclusion that the comparison of the interest rates of long-term bonds and short-term bonds in the bond market in the same period can reflect the overall economic situation of the market to a certain extent, and the significance of this conclusion is that, It can not only enable investors to observe the market trend through the interest rates of bonds of different maturities, and make choices for their next investment decisions, but also enhance the functionality of the financial market and strengthen the connection with the economic market.

View pdf

View pdf