Volume 156

Published on February 2025Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

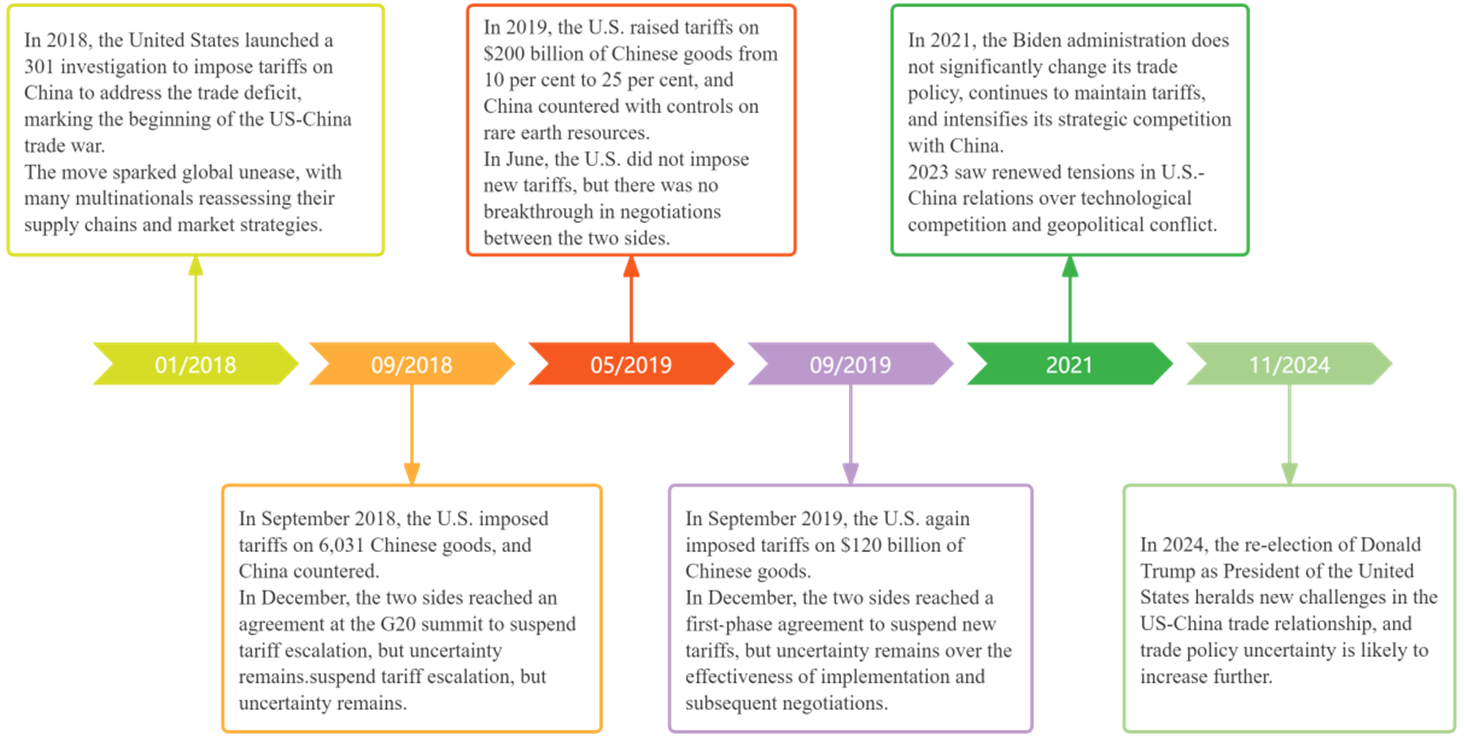

Against the backdrop of global economic uncertainty and escalating trade protectionism, this paper reviews existing research and the timeline of the China-US trade war, while systematically organizing relevant data from Beifa Group. A combined theoretical and case study approach is adopted to explore the impact of trade policy uncertainty on entrepreneurial confidence and its subsequent effect on corporate innovation, as well as feasible methods to maintain entrepreneurial confidence in the face of fluctuating trade policies. The study shows that under policy uncertainty, entrepreneurial confidence has a significant positive impact on corporate innovation. Case analysis reveals that Beifa Group, in a high trade uncertainty environment, adopted a niche strategy to achieve differentiation, interacted with new markets to drive market-adaptive innovation, and built a digital platform to cluster industry chain enterprises, thereby maintaining entrepreneurial confidence and innovation capabilities. This research provides practical strategies for companies facing trade policy uncertainty, offering insights on how to promote corporate innovation through enhancing entrepreneurial confidence.

View pdf

View pdf

This paper explores in depth the impact of big data and machine learning on asset pricing. By addressing the limitations of traditional asset pricing models, it analyzes the challenges and opportunities brought by big data to the financial markets. Traditional models, due to their linear assumptions, struggle to handle the complexity of high-dimensional data. However, machine learning techniques, particularly deep learning, overcome this issue with their powerful data processing capabilities, thereby enhancing the model’s external validation capacity. This paper summarizes various methods of applying modern machine learning in asset pricing, including feature engineering and end-to-end deep learning, and discusses the adaptive mechanisms of AI technologies to the complexity of asset pricing. Through case analysis, the article also emphasizes the significant effects of AI in improving predictive accuracy and market efficiency. This paper provides a new perspective for asset pricing research and offers practical pathways for the intelligence and dynamic adaptability of financial markets.

View pdf

View pdf

Internal risk governance is a critical determinant of bank performance, influencing stability and profitability within a complex and dynamic financial environment. This study examines the mechanisms by which internal risk governance affects the performance of Chinese city commercial banks (CCBs) through the lenses of Principal-Agent Theory and Risk Management Theory. Specifically, the research explores the interplay among internal governance, capital regulation pressures, ownership concentration, income diversification, and risk-taking behavior. The findings reveal that enhanced internal risk governance mitigates risk-taking behaviors, thereby improving bank performance. Conversely, increased capital regulation pressures and higher ownership concentration are linked to elevated risk-taking and reduced performance. Additionally, income diversification is shown to decrease risk-taking while positively impacting bank performance. This study provides new insights into the theoretical and practical dimensions of risk management, offering implications for strategic decision-making, regulatory oversight, and policy formulation aimed at strengthening the resilience of city commercial banks.

View pdf

View pdf

With the global emphasis on environmental protection and sustainable development, new energy vehicles have become crucial in addressing issues such as the over-exploitation of non-renewable resources, climate change, and reducing dependence on traditional fossil fuels. Currently, new energy vehicle technologies are being innovated and the market scale is expanding. However, there are also problems such as limited driving range, insufficient charging facilities, and the lack of unified standards for vehicle performance and safety. This paper focuses on the current situation of the development of new energy vehicles and puts forward suggestions for future development. This research is structured around three key areas: new energy technologies, infrastructure, and market promotion. Using a combination of qualitative analysis, case analysis, and comparative analysis, this paper explores technological breakthroughs, with a focus on improving battery performance and developing new battery technologies; infrastructure development, emphasizing the layout and expansion of charging facilities; and market promotion, which addresses consumer demands and marketing strategies.

View pdf

View pdf

In the past, people's management of employee performance was mainly in the company's management structure. At the same time, in this process, in order to achieve the overall efficiency and income of the enterprise, and promote better economic development, people pursue more freedom in life and efficiency in work. The relationship between employee performance and differentiated management is analyzed in this paper. This research also explores Maslow's hierarchy of needs theory and employee differentiated management mode. This paper discovers the relationship between employee performance and differentiated management through research. The study found that the two exhibit an inverted U-shaped correlation, that is, the degree of differentiated management is taken as the independent variable, and employee performance is taken as the dependent variable, and the level of employee performance is affected by the degree of employee differentiated management, which provides new ideas and research directions for further research on employee performance and differentiated management.

View pdf

View pdf

In recent years, green bonds, as a new type of financial instrument, have gradually become an important tool for promoting corporate green transformation and improving environmental, social, and governance (ESG) performance. Based on data from A-share listed companies from 2010 to 2020, this paper empirically analyzes the impact of the 2015 green bond policy guidelines on corporate ESG ratings and its mechanisms using the difference-in-differences (DID) method. The study finds that the implementation of the green bond policy significantly improves corporate ESG ratings and indirectly promotes improvements in environmental protection, social responsibility, and governance structure by reducing financing costs. In addition, this paper reveals the heterogeneous effects of the green bond policy across different regions, types of enterprises, and industries. It finds that the policy has a more significant effect in economically developed regions and non-state-owned enterprises, while its impact is relatively weaker in the central and northeastern regions. Mechanism analysis shows that the reduction in financing costs plays an important mediating role in enhancing corporate ESG performance through the green bond policy. This paper provides empirical support for policymakers to optimize green finance policies and offers new perspectives for companies to use green bonds to improve their sustainable development capabilities.

View pdf

View pdf

With the promotion of the Belt and Road Initiative, the global investment and construction activities of Chinese infrastructure enterprises such as China Construction and China Railway have significantly improved the national image and brand awareness. However, in this process, these enterprises face challenges such as cultural differences, information gaps, and local people's doubts about foreign investment. This study explores how Chinese infrastructure companies shape the country's image through effective business communication strategies in the context of the Belt and Road Initiative. Through literature review and case study, this study will focus on the communication strategies adopted by Chinese infrastructure enterprises in countries along the Belt and Road, and how these strategies affect local consumers' perception and trust in Chinese brands. The study reveals that successful communication cases not only enhance brand recognition, but also increase consumer trust in the quality and efficacy of the program. In addition, cultural communication strategies are essential in different markets, helping enterprises integrate into the local society and improve their brand image. This study provides a new perspective and ideas for the brand communication of Chinese infrastructure enterprises in the international market. I contribute theoretical support for future academic research in related fields.

View pdf

View pdf

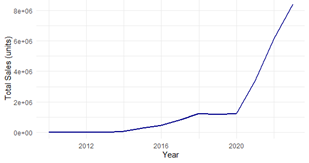

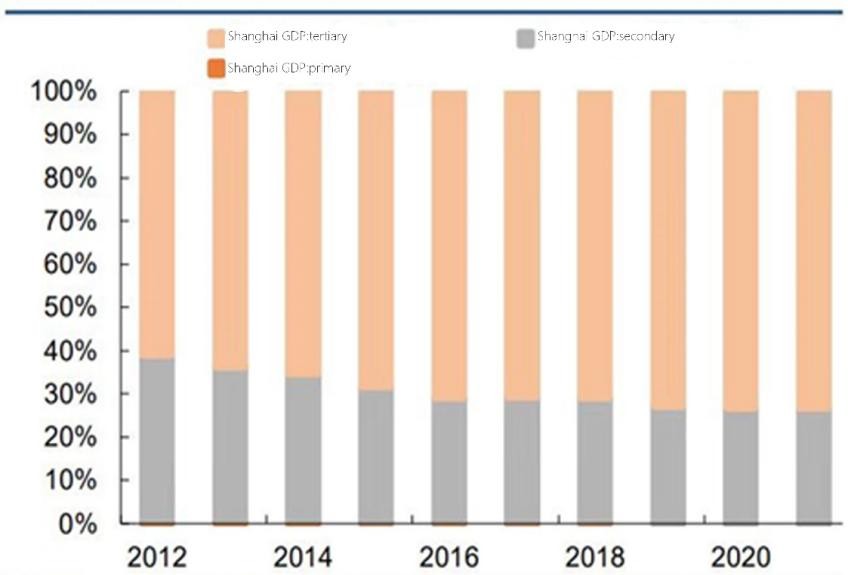

Under China’s climate plan to achieve carbon neutrality by 2060, where it wants to peak its emissions by 2030, the electric vehicle (EV) market is set to play a pivotal role. Using sales data and policy analysis, this paper investigates the effects of carbon neutrality policies on China’s EV market. Global and local policies, such as subsidies, tax credits, and procurement requirements, have provided essential support for the EV industry and its market. Using sales and policy analysis, the research investigates how policy initiatives have impacted consumers, shifted automaker strategies and influenced the advancement of battery technology. The analysis revealed that since 2018, Chinese electric vehicle sales have skyrocketed due to policy pushes, with BEVs leading the charge. The results highlight that further policy and infrastructural development and technological advancement are crucial to maintaining market growth for the long-term target of environmental sustainability. Hence, the paper provides guidelines for policymakers and industry players in China to improve strategies that complement the country’s carbon reduction goals while acting as a reference for nations with similar climate goals.

View pdf

View pdf

At the beginning of 2019, China faced significant challenges due to the outbreak of COVID-19. During the epidemic, the people and the government experienced many difficulties, such as communication difficulties and insufficient supplies. Simultaneously, the global economy entered the attenuation phase, and the epidemic dealt a major blow to the world. In response, China carried out many strategies to prevent and control the spread of the epidemic, such as citywide lockdowns and nucleic acid. During these processes, these moves had a mixed impact on China's economy. This paper examines the effects of the epidemic on China's economy by analyzing news articles, official reports, and statistical data, including changes in imports and exports, trade balances, population trends, and unemployment rates before and after the outbreak. The findings reveal that while the epidemic introduced numerous challenges, it also prompted structural changes, leaving a nuanced and multifaceted impact on the Chinese economy.By searching for news reports, official reports, and comparing China's total imports and exports, trade deficit, resident population, and unemployment rate before and after the epidemic, the paper able to get a sense of how the epidemic affected China and how it impacted the Chinese economy as a whole. By analyzing the impact of the epidemic, this paper finds that the epidemic has had both positive and negative impacts on the Chinese economy.

View pdf

View pdf

The stock market is an indispensable part of the financial market, and the fluctuation of interest rate in the stock market is also a common and important phenomenon in the financial market, which is unpredictable, complex and elusive. This paper examines the impact of interest rate fluctuations on the stock market and its influencing factors. The research results are as follows: The impact of such interest rate fluctuations on the stock market can be reflected in indirect influencing factors such as corporate financing costs and investors' investment preferences. Changes in intermediate factors caused by interest rate fluctuations largely determine the rise and fall of stock prices, thus forming a closed loop and once again having the same or different impacts on stock market investors and all walks of life. As an important factor in the financial market, the change of interest rate is also affected by various indicators, such as interest rate policy and inflation.

View pdf

View pdf