Volume 167

Published on February 2025Volume title: Proceedings of the 4th International Conference on Business and Policy Studies

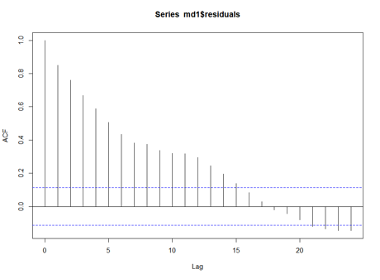

This study investigates the dynamic relationships between Gold and several key financial and economic variables, including Crude Oil, Natural Gas, the NASDAQ 100 Index, U.S. Treasury Bonds, the U.S. Dollar Index, and the Housing Price Index. The research uses advanced statistical techniques such as Vector Auto Regression (VAR) to capture the complexities of these interactions and assess how fluctuations in Gold price can influence other variables and overall economic performance. Significant findings indicate that Gold prices are primarily affected by their lagged values and the U.S. Dollar Index, with strong relationships confirmed by high statistical significance. Notably, a rise in the dollar's value correlates with a decrease in Gold prices, while past Gold prices substantially influence current values. The study highlights the interdependencies among these financial indicators, providing valuable insights for investors and policymakers. By understanding these relationships, stakeholders can make more informed decisions in an increasingly interconnected economic landscape. This research contributes to the existing literature on asset correlations and enhances the comprehension of the factors driving Gold prices within the broader context of financial market dynamics.

View pdf

View pdf

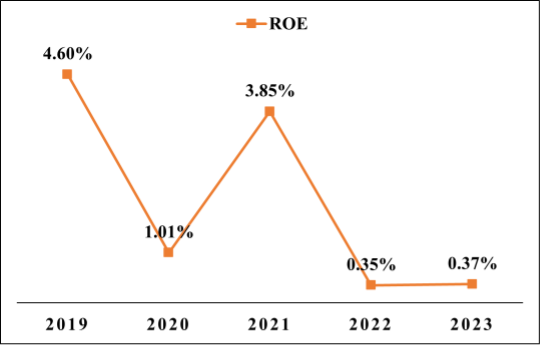

The Dupont financial analysis is a comprehensive financial analysis method. When analyzing the profitability of an enterprise, it can combine the operating results with the financial status, so it can not only analyze the historical situation and current situation of the enterprise, but also predict the future development status of the enterprise according to the analysis results, which can more accurately evaluate the profitability of the company. Based on the Dupont analysis framework system, this paper takes ESH Company as the main case object, analyzes and studies the company's profitability data by using the company's published financial reports from 2019 to 2023, and finds out the problems in the business activities or the deviations in the development decisions of the enterprise. And put forward corresponding improvement measures for the company to improve profitability. The analysis finds that enterprises can maintain profits and stable operating income while increasing financial leverage. But at the same time, ESH company also has some problems in profit, mainly due to the increase in operating costs caused by the sharp compression of corporate profits. In this regard, the author believes that enterprise managers should take a more prudent attitude to make strategic decisions, so as to avoid the compression of profit margins and the situation of the enterprise into the loss.

View pdf

View pdf

Behavioral finance theory emerged as a response to concerns and shortcomings in existing financial theories, such as the Efficient Market Hypothesis (EMH) and the Capital Allocation Pricing Model (CAPM), by incorporating elements of human psychology and behavior into the framework of finance research. The major difference between behavioral finance and classical financial theory (such as CAPM and EMH) lie in their assumptions and interpretations of investor behavior, particularly on whether investors are indeed rational or not. To deal with these crucial issues that behavioral finance raises, investors must first acknowledge the presence of these issue, understand the notion of them and how they influence decision-making, and be aware that their decisions may alter depending on the source and use of money. This paper aims at understanding the key crucial concepts of behavioral finance and presenting several ways to deal with the behavioral finance related issues. Loss aversion, overconfidence and mental accounting will be examined in detail in this paper to explore the reason behind these phenomenon and present ways to deal with these issues.

View pdf

View pdf

With the rapid development of artificial intelligence technology and increasing attention to corporate environmental, social, and governance performance, this study investigates the impact of AI adoption on firms' ESG performance in the Chinese context. Based on the sample of Chinese A-share listed companies from 2009 to 2020, this paper uses the method of textual analysis based on annual reports to examine how AI implementation affects corporate ESG ratings. The results indicate that the extent of AI-related information disclosed in corporate annual reports is significantly and positively related to their ESG ratings. Further analysis shows that this positive relationship holds after controlling for firm characteristics and conducting various robustness tests using alternative measures of AI adoption. The research enriches the literature on the determinants of ESG performance by providing new evidence on the role played by AI technology in enhancing corporate sustainability, and offers practical implications for corporate managers and policymakers on how to use AI technology in improving ESG performance and achieving the goals of sustainable development.

View pdf

View pdf

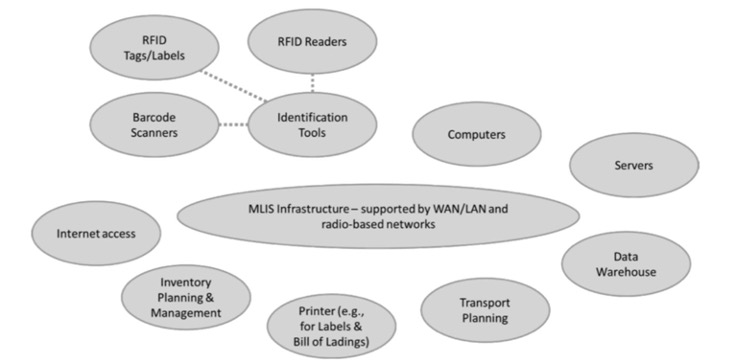

Traditional enterprises generally lack systematic support services, affecting product traceability and data storage, and reducing the logistics industry's efficiency. Logistics information systems (LIS) are very important for the future development of the logistics industry, especially in distribution, tracking, and supply chain optimization. Applying the LIS system has greatly improved the distribution performance and customer satisfaction of the logistics industry. Furthermore, LIS plays an important role in improving customer satisfaction, internal communication efficiency, and synchronization processes. However, the adoption of LIS faces significant challenges, including data security and change management. Investing in robust network security measures, such as cryptography and multi-signature protocols, can address data security concerns. At the same time, organizations also need top-down effective communication and synchronized LIS. Reasonable application of LIS is the key to improving the efficiency of modern logistics. LIS developers should stay attuned to market trends and technological advancements, ensuring systems are prepared for future innovations.

View pdf

View pdf

In an era where digital entertainment dominates, understanding how traditional toy companies maintain market competitiveness is essential. LEGO, as the world’s leading toy manufacturer, serves as a compelling case study. This paper examines LEGO’s market leadership through a financial valuation using the Discounted Cash Flow (DCF) model and a strategic evaluation of its business practices. Using data from LEGO’s annual reports, the DCF model estimates LEGO’s enterprise value at DKK 392,139 million as of 2023. The strategic evaluation highlights LEGO’s unique “System of Play”, innovative product design, IP collaborations with major franchises, fan engagement and ventures into movies, video games, and theme parks as key drivers of its market dominance. With an estimated value of the LEGO company, the study underscores LEGO’s innovation and diversification in achieving success, offering relevant lessons for peer companies.

View pdf

View pdf

With the rapid development of big data technology, supply chain risk management is facing unprecedented opportunities and challenges. Big data can not only provide accurate risk prediction and real-time monitoring but also reveal potential supply chain risks through data mining and analysis, so as to help enterprises deal with and avoid risks in advance. This study aims to explore the strategy of supply chain risk management under the power of big data and analyze how big data can effectively identify external and internal risks in the supply chain, especially in the uncertain economic environment and global market, how to improve the transparency, adaptability and risk prevention and control level of the supply chain through big data technology. This study also reveals some problems existing in the process of big data enabled supply chain risk management, such as data leakage, lack of technical capacity, information asymmetry, etc., and puts forward corresponding solutions. Finally, the research shows that supply chain risk management enabled by big data can not only enhance supply chain stability but also provide enterprises with effective risk response solutions and promote the intelligent development of supply chain management.

View pdf

View pdf

With the continuous development of artificial intelligence technology, generative artificial intelligence copyright infringement occurs from time to time. Generative artificial intelligence may infringe on the personality rights and copyright of others. Clarifying the subject of generative AI infringement and the applicable principles of attribution is the basis for handling such cases. Users, research and development, and platforms of generative artificial intelligence may constitute the subject of generative artificial intelligence infringement. Generative AI generated content infringement attribution should be analyzed according to the specifics of the facts. The first thing to consider is the nature of the generated content and the use scenario, the autonomy of the AI, the user's intent, and the developer's design intent. Secondly, relevant laws and regulations should be improved to ensure that technological development is synchronized with legal protection, and a perfect regulatory mechanism should be established to monitor and copyright audit AI generators in real time to reduce the occurrence of infringement incidents. This paper will discuss the attribution of generative AI content infringement through specific case studies and put forward corresponding legal recommendations.

View pdf

View pdf

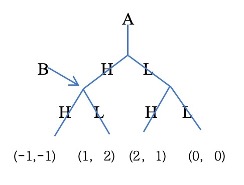

This study uses the game theory framework to deeply explore the interaction of all parties in auto insurance product pricing, aiming to reveal its complex game relationship and propose effective optimization strategies. Researchers have found that competition and information asymmetry among insurance companies have a significant impact on pricing, but there is still a research gap in the formation mechanism and long-term effect evaluation behind it. Therefore, this study uses the game theory framework, including models such as the prisoner's dilemma, coordination game and signaling game, to deeply explore the interaction of all parties in auto insurance product pricing, aiming to reveal its complex game relationship and propose effective optimization strategies. The results show that through indirect cooperation (such as setting industry standards and sharing non-sensitive data), insurance companies can avoid vicious price wars and improve market transparency; standardized services and simplified terms simplify consumer decisions and enhance market trust; introducing third-party verification and adjusting premiums based on driving records ensure that pricing more accurately reflects the level of risk. The research conclusion points out that this study provides valuable theoretical and practical guidance for game strategies in auto insurance pricing, but there are still limitations in data acquisition, model assumptions, regional differences and long-term effect evaluation. Further exploration and improvement are needed in the future to meet complex market challenges.

View pdf

View pdf

Under the new normal of economic development, China's emphasis on corporate social responsibility continues to increase. Institutional investors are often seen as an important force that can improve corporate governance. Examining the influence of shareholding on the sustainable growth of firms aids in comprehending how to enhance corporate governance structures to foster sustainable development. This article focuses on Chinese A-share listed firms from 2010 to 2021 as the subjects of study. The two-way fixed effects method is employed to examine the impact of institutional investors' ownership on corporate social responsibility scores in China. The results show that institutional investors hold shares can enhance corporate social responsibility. By improving corporate governance, institutional investors help companies manage and respond more effectively to risks and opportunities associated with social responsibility. In this paper, the heterogeneity analysis is further carried out, and it is found that the shareholding of institutional investors shows a more distinct facilitative impact on state-owned enterprises’ social responsibility performance. This study has a guiding role in optimizing corporate governance structure and enhancing the level of CSR fulfillment.

View pdf

View pdf