Volume 24

Published on September 2023Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

While the bond market is continuously developing and growing, the risks behind them are becoming more and more prominent. Since the bond market broke the rigid payment in 2014, the amount and quantity of bond defaults have been increasing. The decline is to show the characteristics of high credit rating, state -owned background enterprise, and multi-industry diffusion. The occurrence of bond defaults has brought different degrees of damage to related entities. This has a great risk for the bond market. Therefore, in this context, how to effectively deal with the impact of bond default risks on enterprises and conducts empirical analysis on the basis of this is a major problem. This article analyzes the causes of bond default from the perspective of breach of contract, and according to the reasons, the solution to risk management is proposed, including macroeconomic regulation and specific measures.

View pdf

View pdf

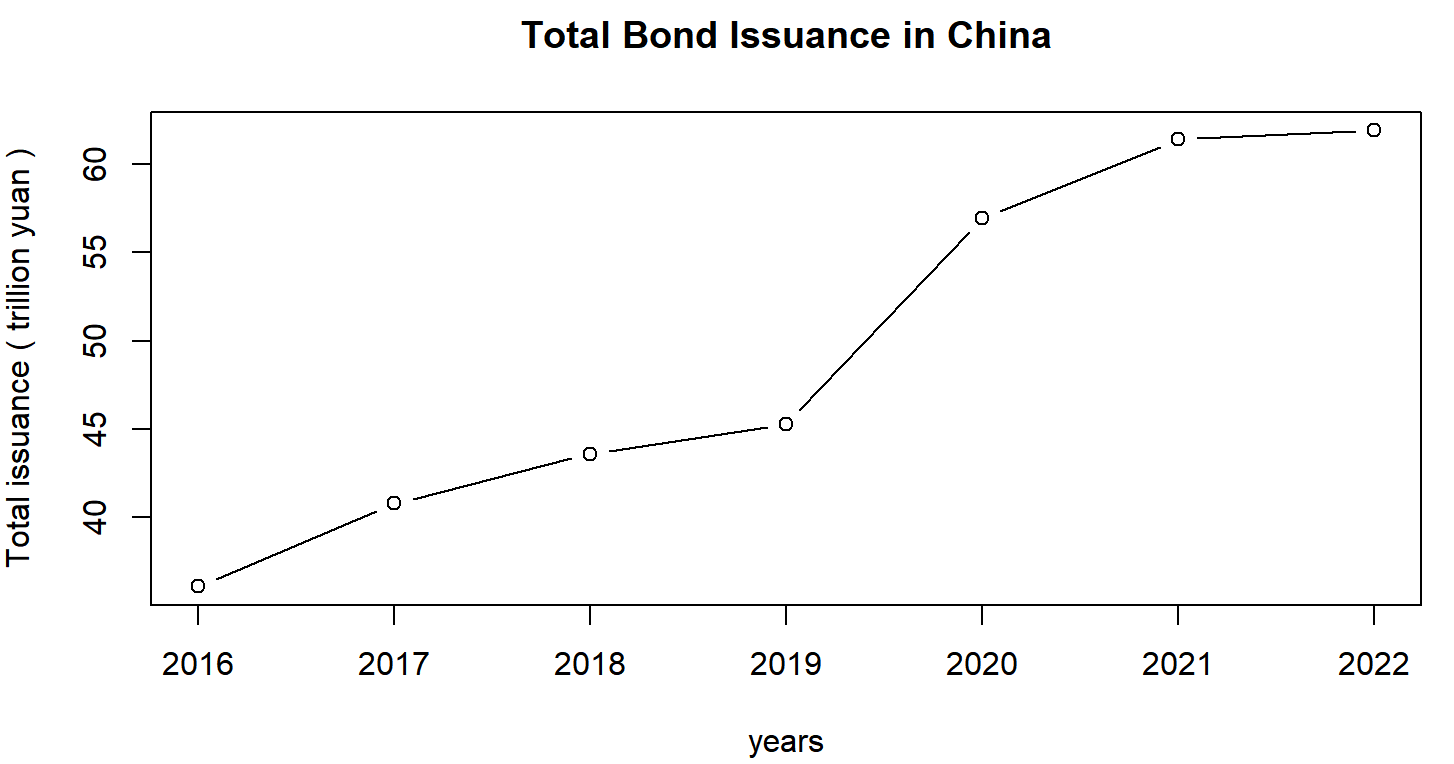

Bond market is an important part of financial market. A fully developed bond market can provide protection against financial risks and maintain the stability of financial markets. Compared with capitalist countries, the development process of Chinese bond market has its particularity. Since 1981, after more than 40 years of development, Chinese bond market has now run smoothly, with a high-level opening up and orderly. Moreover, the investor structure has been diversified, and the trading volume of the money market continues to increase. However, there are still problems, such as insufficient liquidity, lack of diversity, and the bond market 's inability to fully play its basic role in resource allocation and regulatory holes. For these problems, this paper puts forward some suggestions from the aspects of market participation, product type, market supervision and policy implementation, in order to help the development of Chinese bond market.

View pdf

View pdf

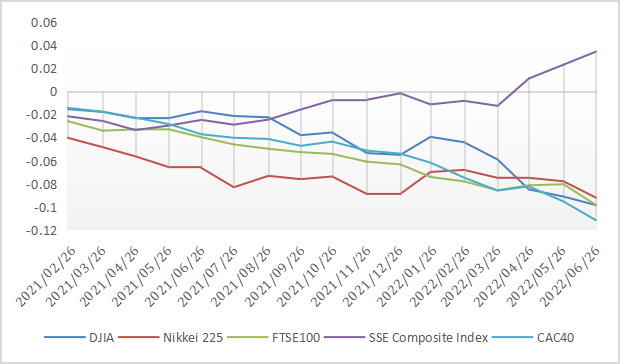

Equity market declines fiercely caused by the current liquidity crisis. Investors pay more attention to optimized portfolio in order to reduce losses. 5 representative indexes were chosen from capital market to construct financial portfolios. The sketch of the efficient frontier was plotted, and portfolios with the 1/N, the maximum sharpe ratio and the minimum volatility were acquired based on 10000 scipy optimization calculations, the FTSE100 accounts for the largest section of the portfolio with the maximum sharpe ratio while the SSE Composite Index possesses the biggest shares in the portfolio with minimum volatility. Comparing three portfolio returns of accumulations, it could be observed that the maximum sharpe ratio portfolio’s performance surpassed the 1/N and the minimum variance portfolio, several investors could make reasonable decisions refer to this result in the special tough period.

View pdf

View pdf

Inflation and volatility have reached previously unheard-of heights as a result of the COVID-19 pandemic's significant market disruptions. The purpose of this paper is to examine the pandemic's short- and long-term effects on financial markets while taking into account how these effects vary across nations and geographical areas. Investors, businesses, and governments around the world have faced enormous challenges as a result of the initial stock market decline in February and March 2020 as well as the ongoing economic volatility and unpredictability.

View pdf

View pdf

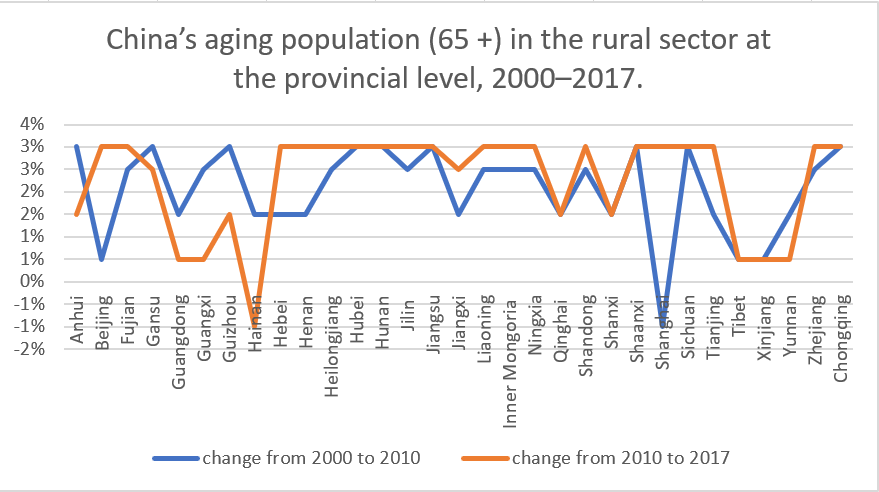

With the improvement of China's economic level of aging, China has also encountered the problem that most developed countries will encounter - aging. However, since China is still a developing country and it is per capita economic level is relatively low compared with developed countries, China's aging degree is relatively low. Therefore, this paper mainly studies whether China's aging level has had an impact on market employment in the past few years. This paper uses regression analysis to analyze whether aging has affected the employment of Chinese enterprises. The dependent variable is the employment level of enterprises, and the independent variable is the aging population.; Use multiple analysis methods to judge the possible consequences of aging on Chinese enterprises. The research result is that China's aging has had an impact on the employment of Chinese enterprises and will have a relatively bad impact on the employment situation in China in the future.

View pdf

View pdf

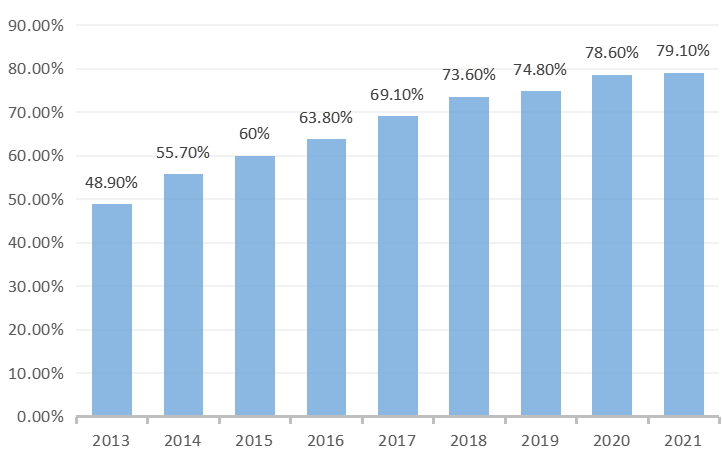

The rise of mobile payments and online shopping in an era based on advanced internet technology has provided a lot of convenience to the public, however how the relationship between the two develops determines the socio-economic and development level. This article will focus on the interplay between mobile payments and online shopping, analysing and defining each of them. In examining the relationship and impact of the two, this article uses a qualitative research method using questionnaires to investigate payment penetration, user size, purchase patterns, and reasons for mobile payments and online shopping. The study provides insight into the pros and cons of the two, and the corresponding relationship between the outputs. The result is that mobile payments and online shopping in China are interactive and complementary. This paper obtains empirical results from the study that mobile payments should be combined with online shopping, and that in the future, both will work together to overcome online challenges to better develop.

View pdf

View pdf

In the modern era, finance is a tool that anyone is able to use to manage their wealth. People are eager to invest their extra money, and this piece is written with individual investors in mind who can utilize it as a resource when building a portfolio. In this study, the CAPM model and Markowitz model are used to determine the efficient frontier, capital allocation line, minimum risk portfolio, and optimal portfolio using three stocks chosen from various exchange markets and the SPX index. The data was analyzed to demonstrate that higher risk carries a higher expected return, and that the stock price also adheres to the normal distribution theory. Additionally, it covers the pertinent risk factors and how to diversify the risks. This paper offers guidance regarding the management of wealth for individual investors.

View pdf

View pdf

Canada is not only a geographic neighbor of the United States, but also one of its most important trading partners. The Fed's interest rate hike has had many effects on Canada, not only in terms of its impact on financial markets, but also in terms of its impact on international trade. This paper will discuss the perspective of financial markets, the impacts of the Fed's interest rate hike on the exchange rate market, the stock market and the bond market. In terms of international trade, Cenovus Energy Inc. will be taken as an example to study the impacts on international trade between the two countries based on the existing background from 2020 to 2022 because during the past three years, there were the period that the Fed did not adjust interest rates and the period that the Fed raised interest rates suddenly. Finally, conclusions will be drawn from the above analysis, and some recommendations for Canadian monetary authority, multinational corporations, and investors will be given.

View pdf

View pdf

In recent years, with the rapid development of the Internet, the financial market pattern is also changing. And the way of consumption through the Internet is gradually becoming mainstream. In order to meet the needs of the majority of consumers, online credit products have emerged. The emergence of this new financial service is not only a change in the quality of life of the masses of society, but also a new challenge for the financial market. Therefore, this paper investigates its impact on consumers' over-consumption decisions. Through regression analysis, we conclude that there is a positive relationship between the online credit lending model and the public's overspending decision. And the higher the loan amount, the longer the repayment period, the lower the loan interest rate, and the more accessible the loan qualification, the higher the public's willingness to overspend. On the other hand, the degree of loan facilitation has no statistically significant effect on the degree of overspending. By establishing a model to analyze the degree of overspending, this study is conducive to the establishment of reasonable consumption habits by consumers. It can help the financial service industry understand customers' consumption tendencies, rationalize their programs and provide a reference for government agencies to formulate economic policies. And it can promote the successful development of the financial market.

View pdf

View pdf

With the development of the Internet, online shopping has become increasingly important and widespread in people's daily lives. The marketing methods used by merchants in online shopping have gradually attracted the attention of scholars and research. However, consumers know little about the marketing strategies and merchants are not sure which of these marketing strategies they prefer. This paper is based on the background of the times, firstly, the research and summary of the relevant literature to understand the types and outlines of marketing strategies, based on this research method of interview collection, the collection of interview texts and analysis of the texts, the study of the impact of different marketing strategies on consumer preferences, with the intention of research to test the hypothesis proposed in the text. After analyzing the interview texts, the following conclusions were drawn: 1. Product marketing strategy positively impacts consumer choice preferences; 2. Price marketing strategy has a positive impact on consumer choice preferences; 3. Channel marketing strategy has a positive impact on consumer choice preferences; 4. Promotional marketing strategy has a positive impact on consumer choice preferences; 5. Consumers tend to prefer promotional marketing strategies. Based on this, this paper gives suggestions that merchants should choose promotional marketing strategies first and mix other marketing strategies to achieve better results in online marketing.

View pdf

View pdf