Volume 127

Published on December 2024Volume title: Proceedings of ICFTBA 2024 Workshop: Finance in the Age of Environmental Risks and Sustainability

With the rise of the "She -economy," female consumers' attention to and willingness to purchase national products are increasing. This paper focuses on the female consumer group, exploring their user experience and emotional responses during the process of purchasing national products, and how these factors affect their willingness to buy national products. The paper collects relevant data through a questionnaire survey and uses SPSS 27.0 for statistical analysis of the data. The results show that female user experience and female emotional response have a significant positive effect on purchase intention, with female emotional responses playing an important mediating role. This paper enriches the research content of the "She-economy" theory and provides new insights for understanding female consumer behavior. At the same time, the research results have practical significance for both enterprises and female consumers.

View pdf

View pdf

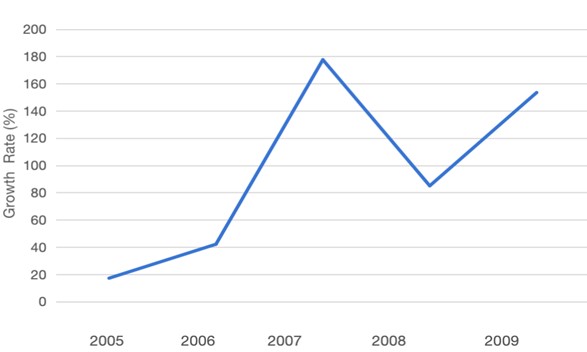

The Global Financial Crisis (GFC) and the COVID-19 pandemic shock have similarities and differences. They both cause major economic downturn, affecting the normal functioning of the society. The cause and impact of them are different since the GFC is an internal shock whereas the economic downturn brought by the COVID-19 pandemic is an external shock that cannot be predicted. The corresponding expansionary fiscal and monetary policies are also slightly divergent. This research compares the economic impact of the GFC and the COVID-19 shock, specifically in China, focusing on the policy responses in different situations. Based on the analysis of the impact of the policies implemented in the GFC, the four-trillion investment proposed in 2008 was not a sustainable fiscal policy since it had made the government highly in debt. In 2020, the government also employed expansionary fiscal policies, but instead of spending on basic infrastructure, it concentrated on the advanced technology and service industry. Further, this paper suggests that the government could spend more on new investment plan like 5G technology to revive the economy during the aftermath of the pandemic.

View pdf

View pdf

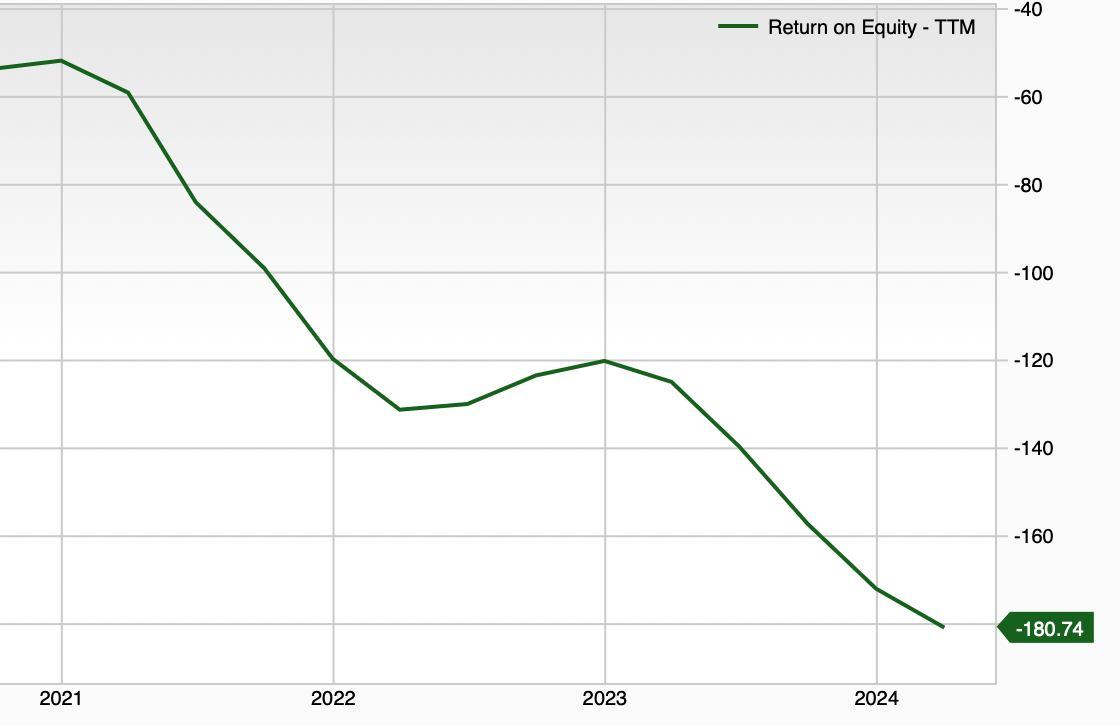

Although the pandemic's impact gradually faded after 2020, McDonald's has experienced a falling return on equity, along with a rising beta. The purpose of this paper is to take McDonald's as an example, investigate the relationship between return on equity and beta, and investigate how beta is affecting the return on equity. This paper has discovered a negative correlation between the two variables and has assigned three possible reasons for this relationship. The first is that, under the situation of a negative return on equity and high beta, companies may seek more risky strategies, which may reduce the return on equity and increase beta if the strategies eventually fall. Using more conservative tactics can be an effective suggestion. Secondly, the use of diversified strategies may also contribute to this negative relationship, as firms may choose to concentrate their operations in areas where they have the greatest competitive advantage rather than spreading their influence across multiple areas. A third possible reason could be investors' reluctance to further invest in a company experiencing rising beta, a sign of high associated risks. This reluctance could lead to an increase in the company's cost of capital, thereby reducing the return on equity, unless accompanied by a significant increase in profit. To mitigate the severity of this issue, it is recommended that firms lower their level of sentiment, thereby reducing the level of panic among investors.

View pdf

View pdf

The logistics business, like others, is undergoing dramatic transformations as a result of the worldwide digitization movement. The logistics industry in China, as a critical pillar of economic development, faces enormous potential for growth. Digital transformation has emerged as a fundamental driver for the logistics industry, with the potential to significantly improve logistics efficiency, cost, and user experience through technological and model changes. This article examines the digital transformation of the Chinese logistics business, using Jingdong Logistics as a sample case study. It investigates how Jingdong Logistics has significantly improved logistics efficiency through digital transformation, as well as an in-depth investigation of how it serves as an industry leader in this regard. The purpose of this study is to highlight Jingdong Logistics' digital transformation success stories, as well as provide useful references and inspiration for the digital transformation of the logistics industry and other industries. The number of firms participating in digital logistics has increased significantly across the country, and the market size has continued to grow, indicating the powerful significance of digital transformation in driving the logistics industry's expansion. Jingdong has significantly improved logistical efficiency by leveraging elements such as data-driven decision-making, process automation, and precision marketing, resulting in a more convenient and personalized shopping experience for customers. Jingdong not only focuses on improving its own operating efficiency, but it also actively provides digital procurement services to the real economy, supporting inclusive and shared growth in the logistics industry.

View pdf

View pdf

The United States, as the world's largest economy, also stands out as one of the Western nations with the most pronounced wealth gap, long trapped in a vicious cycle where the rich continue to grow richer while the poor become poorer. This predicament profoundly impacts social equity and justice, simultaneously hindering the comprehensive and healthy development of the economy. Since the outbreak of the COVID-19 pandemic, despite the massive fiscal and monetary stimulus measures undertaken by the US government, these initiatives have failed to effectively benefit the underprivileged, instead offering billionaires opportunities to expand their wealth portfolios, thereby widening the chasm of the wealth gap even further. Unlike previous studies that focused solely on individual or specific categories of countries, this paper endeavors to comprehensively and deeply analyze the current state, underlying root causes, and widespread consequences of the wealth gap in the US. In addition, this paper puts forward targeted policy suggestions based on the unique national conditions of the US, including strengthening the implementation of anti-monopoly law, promoting the reform of electoral system, optimizing tax policy and so on. These policy recommendations aim to provide both theoretical foundations and practical guidance for alleviating the wealth gap, thereby promoting social equity and ensuring sustainable economic growth.

View pdf

View pdf

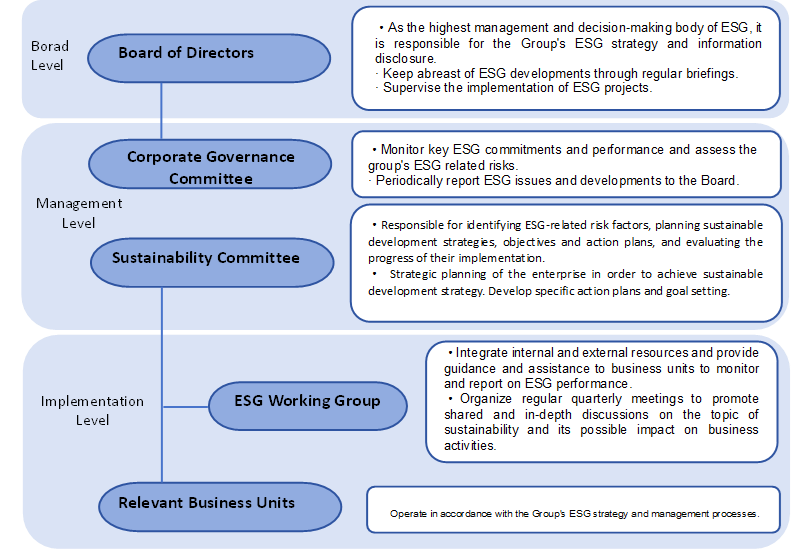

With the accelerated adoption of ESG principles, ESG risk management is facing severe challenges and unprecedented opportunities, and many companies have initiated the disclosure of ESG information, the development of ESG governance frameworks, and other activities to provide a solid foundation for advancing ESG. Fundamentally, ESG focuses on managing a company's non-monetary risks. Over time, multiple strategies will be integrated into risk management to achieve sustainable growth of the company's operations through ESG risk management. This paper will study the framework and standards of ESG risk management through theoretical research, analyze the opportunities and challenges of ESG risk management in combination with the case of Xiaomi, and provide good experience and reference for more excellent enterprises.

View pdf

View pdf

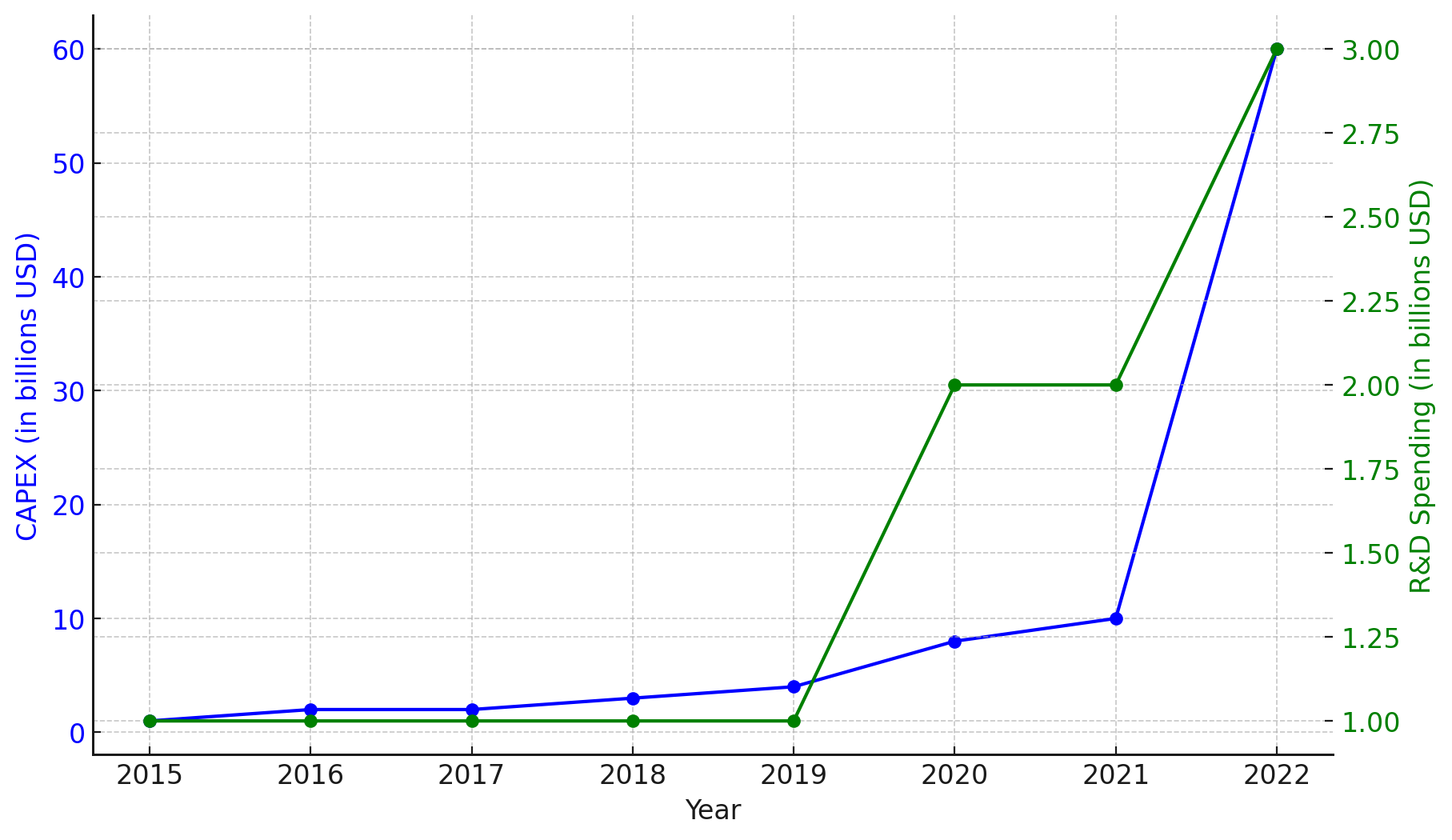

By conducting a detailed case study of Tesla, a leader in the electric vehicle industry, this paper delves into how companies can strategically align their investments with government environmental goals amid economic uncertainty. Specifically, the analysis explores how Tesla has navigated challenges such as geopolitical tensions and supply chain disruptions while continuing to invest in technological innovation and research and development. The study underscores how Tesla has effectively utilized government incentives to cushion the impact of economic volatility. Through this in-depth examination of Tesla's investment decisions in uncertain economic environment, the paper concludes that companies can achieve both short-term profitability and long-term sustainability by adopting flexible investment strategies. Tesla's success not only underscores the importance of such strategies, but also solidifies its leadership position in the global transition to sustainable energy. Based on Tesla's approach, this research recommends that other firms could adopt similar flexible investment strategies to enhance their resilience and maintain a competitive edge in the global transition to sustainable energy.

View pdf

View pdf

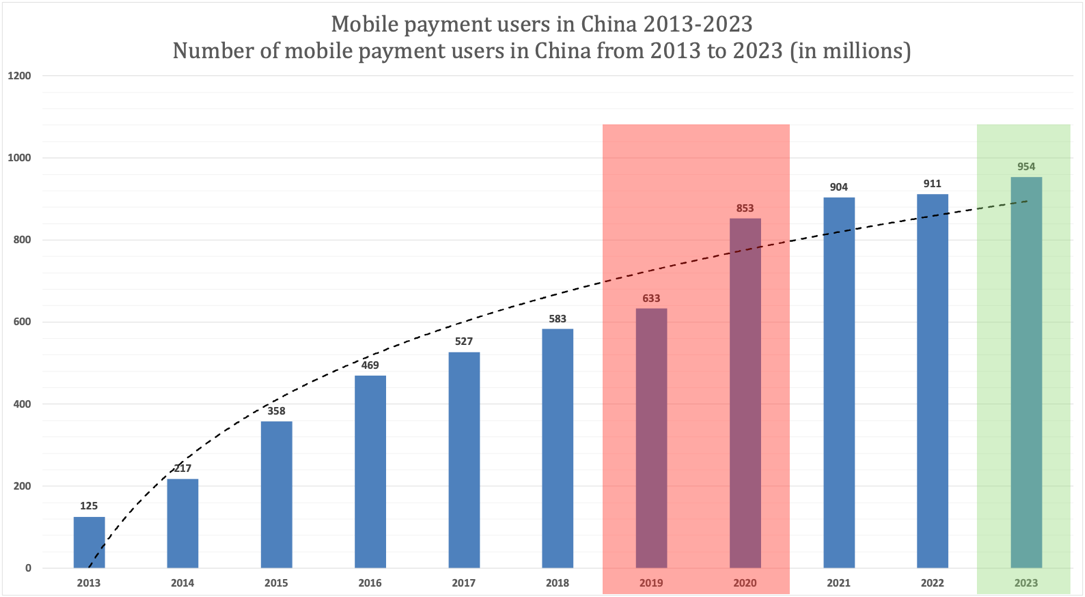

The global COVID-19 outbreak, which began in late 2019 and concluded in early 2023, significantly impacted the world economy. However, China's economy, bolstered by the influence of mobile payments, has shown remarkable resilience. This study examines the impact of the post-epidemic mobile payment era in China, including consumption, Tourism, and user perceptions sectors. This is based on the data analysis of the payment system reports from the People's Bank of China, Alipay’s and WeChat’s payment system reports, Chinese Demographics, the study of User perceptions of Chinese Mobile payment, Mobile payments Online Consumption Share, Chinese Household Consumption via mobile payments. The results are that the users’ number and the total transaction number of mobile payments increased significantly compared with pre-epidemic; mobile payments transformed offline needs into online consumption and helped rural areas and older people eliminate liquidity restrictions; travel expenses paid through mobile payment platforms doubled growth compared with the same period in 2019; the epidemic has necessitated people to use mobile payments. This study concludes that mobile payment stimulated and increased the Chinese Household Consumption Level, and it can enhance users' satisfaction and happiness; mobile payment is a crucial factor in improving tourism recovery and development. The research summarized the effects of mobile payment on Consumption, Tourism and Chinese User Perceptions in the post-epidemic era. Mobile payment will still play a positive driving role in the Chinese economy's growth. The research also provides suggestions and estimates for the future of the Chinese mobile payment market.

View pdf

View pdf

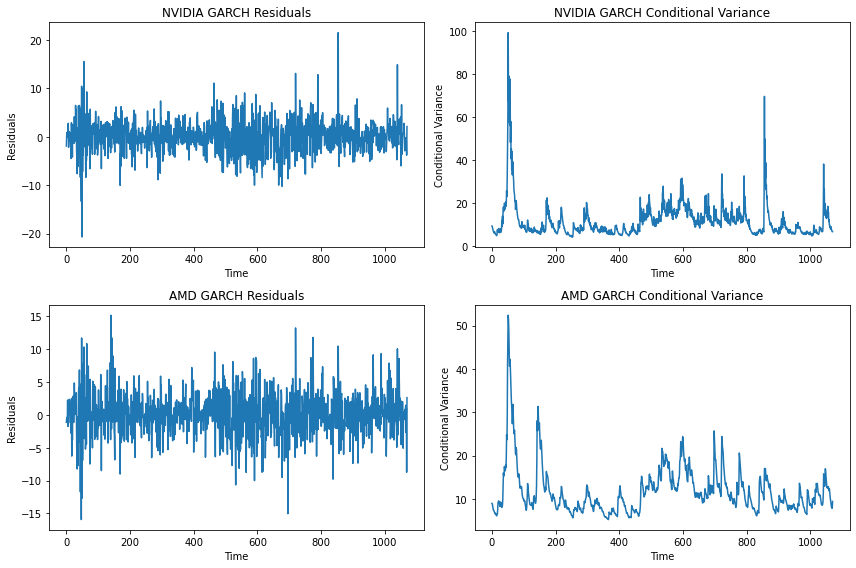

In an era of rapid technological advancement and market volatility, understanding the financial determinants of stock performance is crucial for investors and stakeholders. We explore the influence of Net Earnings per Share (EPS) and financial leverage, as measured by the Debt-to-Equity (D/E) ratio, on the stock prices of NVIDIA and AMD, leading companies in the GPU market. Utilizing data spanning 2020 to 2024, EGARCH models are employed to examine stock price volatility and the effects of financial leverage. Multiple regression analysis is also conducted to establish quantitative links between stock prices, EPS, and D/E ratios. The predictive model, basing on the fitted data, is compared against actual stock prices, validating its accuracy. The findings reveal a robust positive association between EPS and stock prices, while the impact of the D/E ratio is more nuanced, pointing to divergent risk management approaches between NVIDIA and AMD. This research enhances the understanding of how financial indicators can shape stock performance, particularly within the technology sector. The results indicate that NVIDIA's stock price is more sensitive to EPS fluctuations, whereas AMD's stock performance is influenced by both EPS and moderate levels of financial leverage. These insights provide valuable guidance for investors seeking to optimize their portfolios in the tech industry.

View pdf

View pdf

China implemented the one-child policy in 1979 to control population growth by limiting most couples to one child. This policy has been strictly implemented for over thirty years. However, it is one of the most controversial and radical social policies in modern history. Through an analysis of existing literature, this paper shows that the implementation of the one-child policy was historically necessary because it could better stabilize the economic and human social development at the time, but it also had significant social impacts on Chinese society. These impacts include changes in family structure, gender norms, and social and economic inequality between urban and rural areas. At the same time, the policy also had a significant impact on the well-being of individuals. Because the one-child policy has complex and far-reaching social impacts on Chinese society, understanding these impacts is crucial to developing policies that promote the well-being and sustainability of individuals, families, and communities.

View pdf

View pdf