Volume 34

Published on November 2023Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

In the 2022 Winter Olympic Games, Anta sports was seen everywhere. The shiny “Chinese Red” along with Anta’s logo on every single Chinese uniform, foreshadows Chinese players’ success and strengthens Anta’s brand identity as the Chinese national sports brand. This article focuses on Anta’s marketing strategies through a literature analysis of the 2022 Winter Olympics, which is the main factor in its success. This article analyzes Anta’s marketing strategies, including digitalization, brand identity, and technology. This article is formatted in the way of marketing strategies analysis along with their problems and suggestions. Anta successfully expanded its business in the 2022 Winter Olympics but still has areas of improvement in its marketing strategies. Anta Sports needs to improve its self-innovation by developing new technologies that improve production efficiency and product quality. Anta can also use AI technology and social media to optimize user profiles and recommendation algorithms in order to improve user stickiness.

View pdf

View pdf

These years, with the development of the internet, online bookshops have reached a growing audience. As online bookstores have gradually expanded their dominance, the size of the physical bookstore retail market has continued to shrink, making it increasingly difficult for physical bookstores to make a profit and leading to a wave of "closures". This paper focuses on the community-based marketing communication of physical bookstores as a mechanism and conducts research from the perspective of service marketing to inspire physical bookstores to better exploit the advantages of the service experience of physical channels and provide ideas for physical bookstores to tailor their service marketing models to create more economic value and thus achieve sustainable development. The study found that for physical bookstores to survive and thrive in a fiercely competitive market, they must build experiential platforms, realize scene operations, develop cultural activities, create a bookish atmosphere, establish emotional links, and realize commercial value. At the same time, brick-and-mortar bookstores should also adopt innovative marketing tools to expand their outreach and explore a unique path of quality development.

View pdf

View pdf

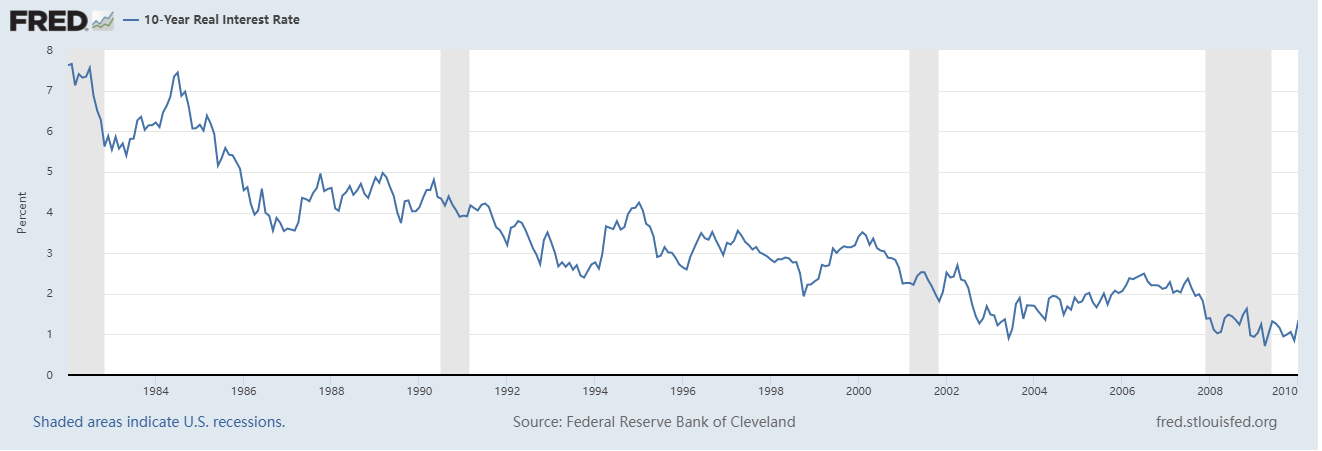

This essay examines how government interventions affect the firms in China, where political connections are valued as one of the essential factors in this fast-growing economy. This research aims to show that the Chinese government treats SOEs and non-SOEs differently by offering different interest rates. This paper contributes to allowing the policymakers to notice the difference in the responsiveness of SOE and non-SOEs investment. The government can plan its expansionary policy schemes by setting the interest rates according to the relative sensitivities of firms to overcome economic fluctuations. The primary methodology is an extension of the IS-LM model, which studies how the exogenous change in policies affects the equilibrium level of income. According to the correlation analysis, SOE investment has an intense negative relationship with interest rates. Still, the non-SOE investment is less responsive than the SOE investment, although it also has an opposite trend with the interest rates. This study modifies the IS-LM curve based on Chinese government intervention behavior and contributes to the further exploration of the investment behavior of firms under policy changes. The Chinese economy is currently rebounding from the aftermath of the pandemic, as the government abandoned its Zero-COVID regime. China’s policy-induced recovery will generate a considerable contribution to global growth according to the IMF’s forecasts, released on January 30th, 2023. This research topic is necessary to be developed as it studies the reaction of firms when the government applied its policy tools to spur the economy.

View pdf

View pdf

During the post-pandemic era, whether Covid-19 will cause a financial crisis is one of the key issues. Some research are done about the relationships between the Covid-19 crisis and the 2008 financial crisis, but there still exists much blank about mechanics and explanations in this field. This paper first focuses on the 2008 financial crisis, analyzing key factors attributing to such a serious financial crisis, giving suggestions in response to factors found, and then comparing the 2008 financial crisis to the Covid-19 crisis to give some warnings. In the course of analyzing key factors, this paper concludes with previous research and uses the game theory model to show why the policy of the government is indispensable. As to give responses, this paper takes the Dodd-Frank Act and Basel III for example to show how people deal with key factors found before and then gives some supplementary suggestions. The conclusion of this paper is that the 2008 financial crisis was the result of constantly aggressive monetary policy and people’s lack of awareness of risks and proper regulation. The by comparing the Covid-19 crisis and the 2008 financial crisis, this paper thinks the Covid-19 crisis won’t be serious if the Fed is careful about constantly aggressive monetary policy and the government strictly implement policies like the Dodd-Frank Act and Basel III.

View pdf

View pdf

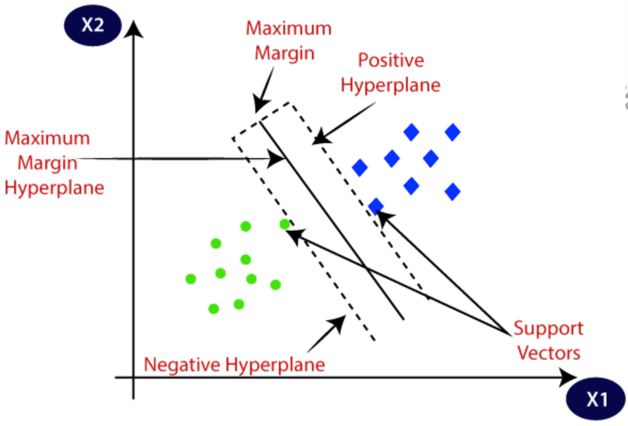

By reviewing the relevant literature on machine learning in the field of asset pricing, this paper summarizes the application status, development trend, and existing problems of machine learning asset pricing methods, including commonly used algorithms, commonly used frameworks, and the advantages and disadvantages of different algorithms, comprehensively understanding the development status and trend of this field, and looking forward to the future possible research directions. In general, the machine learning asset pricing method has gradually shifted from manual feature extraction at the very beginning, relying on assumed models to build and solve model parameters, to end-to-end processing, increasing the diversity of data sources, especially with the development of deep reinforcement learning in recent years. This paper will focus on the methods and research progress of machine learning in the field of asset pricing and compares the applicability and limitations of the machine learning method according to the principle of a machine learning algorithm in different application scenarios.

View pdf

View pdf

This paper shows that increased bank asset liquidity does not necessarily reduce risk-taking. The help provided by the government in the epidemic crisis has also been provided after the damage occurred. On the other hand, the merger of banks is not a good thing for low-risk banks. Regulators should conduct frequent financial reports on banks to ensure that the risk of sudden default due to weak supervision is reduced. Foreign exchange risk management is especially important for banks involved in cross-border transactions and foreign exchange business. Reasonable control of the market exchange rate prohibits the impact of the foreign exchange black market on the market. The COVID-19 epidemic has led to fluctuations and instability in global exchange rates and the banking industry. For the foreign exchange transaction risks caused by exchange rate fluctuations, banks usually need various foreign exchange derivatives instruments to ensure that foreign exchange risks are effectively managed.

View pdf

View pdf

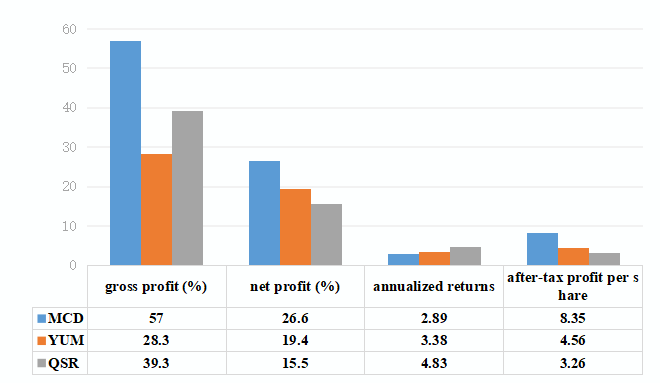

Life has gotten faster for the majority of people in tandem with society's rapid development. For the rise in time expenses and many other variables, the catering industry has ushered in an era of diversity, with countless types of business and deeper product segmentation. Due to its quickness and convenience, fast food has steadily developed into one of the catering service types with the quickest growth rates in the catering industry in an effort to keep up with changing dietary ideals and consumer preferences as well as the quickening pace of life. This situation begs the question: Who controls the fast food sector in reality? What kind of trend is the fast food sector creating in our nation considering how late it was introduced in China? This article will start from company introduction (products provided, development history, market size), company strategy (business model, operating indicators), recent financial situation (operation capacity, financial structure, solvency and other financial ratios), and future prospects (valuation, price/earnings ratio, stock trend).

View pdf

View pdf

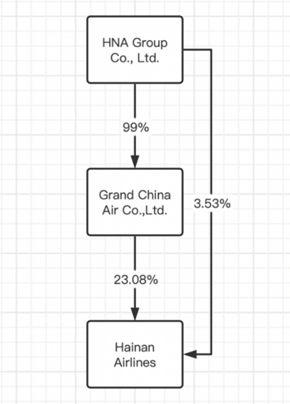

At the beginning of 2020, the sudden new crown epidemic spread rapidly around the world, which had a huge impact on various industries. Especially in the air transport industry, the profit margins of various companies are gradually declining. The problems of Hainan Airlines have also gradually emerged. Due to the company's bond default and lack of internal control, it declared bankruptcy and reorganization. In this context, through research on Hainan Airlines' operating conditions and management strategies, it is proposed that the new crown epidemic is not the main factor affecting its bankruptcy reorganization. It is due to the continuous accumulation of various hidden dangers of the enterprise. And found that the main problems of Hainan Airlines are: (1) Insufficient profitability leads to the potential crisis of insufficient liquidity, and the company's assets cannot be effectively used, which drags down cash flow; (2) The transportation industry is under heavy competition pressure and there are diversions; (3) There are problems in internal management, and the excessive expansion in the early stage has led to the dislocation of Hainan Airlines' asset structure and the occurrence of insolvency. After a comprehensive analysis of the reasons for the bankruptcy and reorganization of Hainan Airlines, it is proposed to enhance the company's operational capabilities and conduct business in multiple ways to increase profits; to diversify financing and optimize the bond structure of Hainan Airlines; to further improve the internal control of the company to avoid further dictatorship. appear once.

View pdf

View pdf

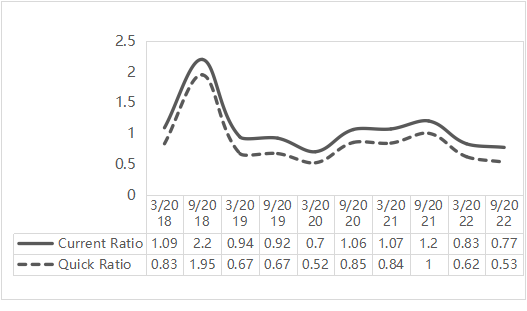

The food service industry has grown rapidly as immigration and urbanization have exposed people to more food and beverages and interest in them. Coupled with increasing proportion of working women, rising trend of dining out and rising disposable income of the people are supporting the growth of the global market. As of 2018, the global food service market has grown to $3.4 trillion. Amidst this, there is also a growing demand for coffee as people work longer hours. Young people are also more willing to choose cafes as a place to socialize and relax. However, the 2019 Covid-19 sweep has had a significant impact on the world economy, especially the food service industry. This article takes Starbucks, an excellent enterprise in the food service industry, as the research object. From the perspective of business model and ratio, analyze Starbucks' business performance in the past five years, and compare Starbucks' performance changes before, during and after the outbreak.

View pdf

View pdf

This project report aims to explore the use of minority quotas or minority reserves as a means of increasing diversity in university admissions and widening access. The report provides a critical review of the literature on this topic, outlines the benefits and drawbacks of using quotas and reserves, and presents a mathematical model which introduces a fairness constraint to the Men-proposing Deferred Acceptance (DA) Algorithm to address the issues of underrepresented minority groups and promote diversity in the college admissions process. The model is used to match students and schools in a way that maximizes diversity while maintaining fairness and efficiency. This report provides proof and computational results to demonstrate the effectiveness of our approach. The report draws on Alvin E. Roth's “The Art of Designing Markets” to underscore the importance of designing effective market mechanisms that address the challenges of diversity and equity in university admissions. The report concludes that minority quotas and reserves can be effective tools for promoting diversity and social justice in higher education, but that they must be implemented carefully and in conjunction with other policies aimed at addressing structural inequalities.

View pdf

View pdf