Volume 70

Published on January 2024Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

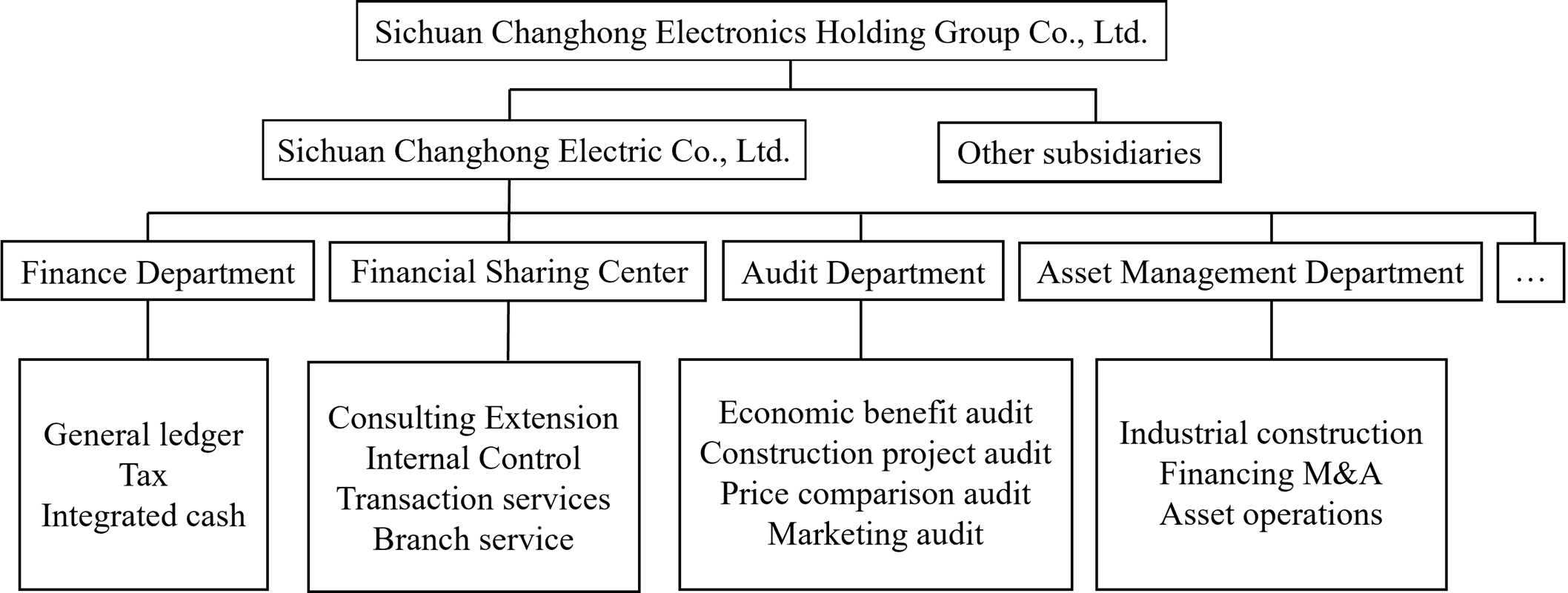

Due to the information technology industry's rapid development, digital transformation has become the key to enterprise development. This essay is based on the historical context of the "great wisdom moves to the cloud" era, taking Sichuan Changhong as an example to conduct research, and discovers the lack of value in the traditional financial sharing center in the process of digital transformation. In order to address this issue, this paper comprehensively uses methods such as literature research, case analysis and data statistics to study and analyze the operation model and effect of the financial sharing center, and reveal its advantages and potential. Research has found that digital financial sharing centers can increase the speed and precision of financial business procedures, reduce costs, and provide more timely financial data and analysis results, thereby improving organizational decision-making capabilities. This research has important reference value for how enterprises deal with decision-making implementation issues arising from digital transformation. It provides useful experience and inspiration for other enterprises in the construction of financial sharing centers, and promotes the development of enterprises in digital transformation.

View pdf

View pdf

Nowadays blind box became a hot topic; people in different ages buy blind boxes and blind box as. a marketing strategy also been used in different area. Also, blind boxes often connected with the pop culture which is a fantastic culture worth our research for many Z generation are crazy int it. POP MART is company which sell the products: blind box which inside a small doll with random cute images. It is now the leading enterprise of China blind Box market and have many strong sticky customers. However, it is hard for a bind box company to attract long term customers for its products is full of uncontrollable. Indeed, pop mart did well in terms of attracting new customers and turn them into long term loyal customers. This passage will analyze the problem of why POP MART could attract so many customers and why most of their customers are strongly loyal to the company’s products.

View pdf

View pdf

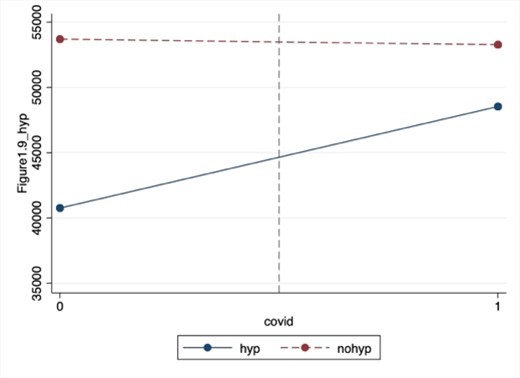

There is a lack of evidence on whether a pandemic exacerbates economic inequalities among disadvantaged groups. This study examined whether the income of single households was affected by sample adults who were infected with COVID-19. I used NHIS data, compared the average income between infected sample adults and uninfected for each of the sub-groups, and constructed the difference in the difference graph based on the mean value. Also, using a difference-in-difference model to confirm statistically significant differences in mean income between the different groups. The results show that full-time sample adults infected with COVID-19 have significantly lower incomes than those uninfected; the sample adults with hypertension, low education, or non-metropolitan residents’ groups, who were not infected with COVID-19 were the most disadvantaged financially. The main reason for these unexpected results may be that the unemployment of infected persons instead qualifies them for high benefits.

View pdf

View pdf

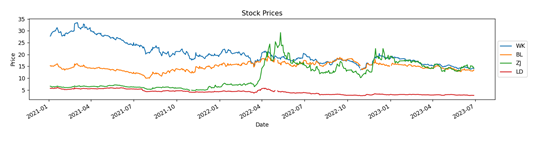

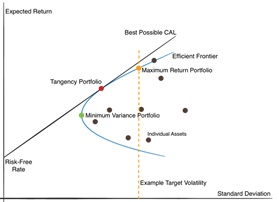

This paper introduces an innovative approach by incorporating quadratic programming (QP) into the Markowitz portfolio optimization framework. The central objective of our study is to explore the integration of QP as a solution scheme for portfolio optimization problems with constraints, particularly in the context of the dynamic and complex Chinese real estate market.By meticulously formulating rigorous mathematical models and implementing systematic procedures, we empirically assess the effectiveness and applicability of QP within the Markowitz portfolio model. Our research contributes to a deeper understanding of portfolio optimization by shedding light on how QP can aid investors in optimizing their portfolios in the intricacies of the Chinese real estate market. We provide valuable advice for investors, enabling them to make more informed and efficient investment decisions, thereby reducing risk and maximizing returns. This study serves as a valuable reference for academics, practitioners, and policymakers seeking to navigate the challenging landscape of the Chinese real estate market.

View pdf

View pdf

This study conducts a comprehensive analysis of the factors influencing technology stock performance, a sector that captivates investors due to its rapid growth and innovation potential. By examining macroeconomic factors, industry-specific dynamics, and company-level management and governance, the research aims to elucidate their impacts on stock prices and returns. Macroeconomic indicators such as interest rates and economic growth cycles are assessed alongside industry trends like R&D intensity and competitive dynamics. Additionally, the study evaluates the role of corporate governance in shaping investor perceptions and stock performance. The findings offer investors deeper insights for informed decision-making and identify directions for future research, providing actionable recommendations for navigating the technology investment landscape.

View pdf

View pdf

In the research of customer behaviour, customer stickiness has always been one of the hottest topics. Relevant research of customer behavior is based on the obtained data, and proposes advice of the corresponding industry. This paper aims at a special purchasing group among customers. Through the PCA of the order content of this special part of customers, it can be concluded that the factors affecting the customer's purchasing behaviour mainly include the quantity and unit price. Through the analysis of the results, reasonable and feasible suggestions can be put forward for the transformation of one-time customers into long-term and stable customers, thus the customer's adhesion can be improved.

View pdf

View pdf

Pension investment portfolios play a pivotal role in ensuring financial security for retirees. With an aging global population, the importance of optimizing these portfolios to withstand market fluctuations and ensure steady returns becomes paramount. This study delves into the complexities of pension investment portfolios using the time-tested mean-variance model, aiming to strike a balance between risk and expected returns. Focusing on key industries like technology, entertainment, automotive, resources, and air travel, the research critically analyzes a diverse set of stocks. Methods employed include a deep analysis of expected returns, variances, covariances, and the overarching risk-return trade-off. Preliminary results underscore the nuanced nature of portfolio management and the indispensability of incorporating modern portfolio theory in pension fund management. The outcomes of this study not only aid in making informed investment decisions but also shed light on the broader social implications of robust pension fund management, emphasizing its significance in securing retirees' financial futures.

View pdf

View pdf

Zhejiang Heping Automobile Sales and Service Co., Ltd., established in 2000, is a leading automotive sales enterprise integrating car sales and repair services. Undergoing three stages of development, namely, expanding and strengthening car sales, venturing into financing leasing, and consistently enhancing efficiency, the company has successfully achieved a clever integration of "financing leasing + car sales." This integration ensures a steady and ample supply of funds for the enterprise while simultaneously increasing profits. Seizing the opportunities of era development and conducting a rational analysis of the industry's strengths and weaknesses, Zhejiang Heping has innovatively adopted a new approach, combining "car sales + tunnel boring machine financing leasing," thereby ensuring a robust cash flow for the enterprise, continuously expanding business operations, reducing operational risks, and increasing overall company returns.

View pdf

View pdf

This study focuses on fund portfolio investments in the Chinese market. The application of classic portfolio optimization methods encounters several issues when applied to fund portfolios. For example, issues such as the non-normal distribution of returns on funds or fund portfolios, turnover rate limitations in fund investments, and liquidity constraints of fund assets, which can lead to transaction costs and opportunity costs, are prevalent challenges. The existence of these issues can compromise the effectiveness of classic portfolio optimization methods like Mean-Variance Optimization. This may result in a reduction of accuracy in determining the portfolio’s optimal weights, a deviation of actual trading results from the model’s optimal expectation, and may even render the optimal weights impractical in real-world scenarios. To address these challenges, this paper integrates the 2-Step covariance matrix method (2-Step method) and the measurement of fund transaction costs into the portfolio optimization process. The paper finds that the 2-Step method, compared to the baseline, can indeed improve the risk-return indicators of the potimal fund portfolio. The inclusion of the transaction cost can effectively control the turnover frequency of the portfolio. Even after accounting for these costs, the 2-Step method continues to exhibit a significant improvement effect compared to the baseline.

View pdf

View pdf

With China's economy entering the stage of rapid development, the competition of listed companies in the electric power industry belonging to the national economy is also very fierce, and it is easy to appear many problems related to financial risks. Through the research on the current situation of financial risk of listed companies in the power industry, this paper has an in-depth understanding of the types of corporate financial risk and the ways of evaluation, and discusses the ways of preventing financial risk combined with the concrete practice, so as to provide some feasible suggestions for promoting the further development of listed companies in the power industry. The types of financial risks are very complex, and enterprise managers need to make accurate decisions on the long-term development of the company according to the actual situation, so as to help the normal operation of the financial market and promote the progress of society.

View pdf

View pdf