Volume 82

Published on June 2024Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

Video games have become an indispensable part of some young people's lives over the years. This article will focus on the analysis of a game that is very popular all over the world: CS: GO. One of the main features of this game is the traceability of skins. One of the main features of this game is the traceability of the game skins, and because of this feature, the CS: GO Skin Market has been created. The market has many features similar to those of the financial market. The most important one is the volatility of the skin prices. Based on this, this article presents and analyzes the factors influencing the price of CS: GO skins.

View pdf

View pdf

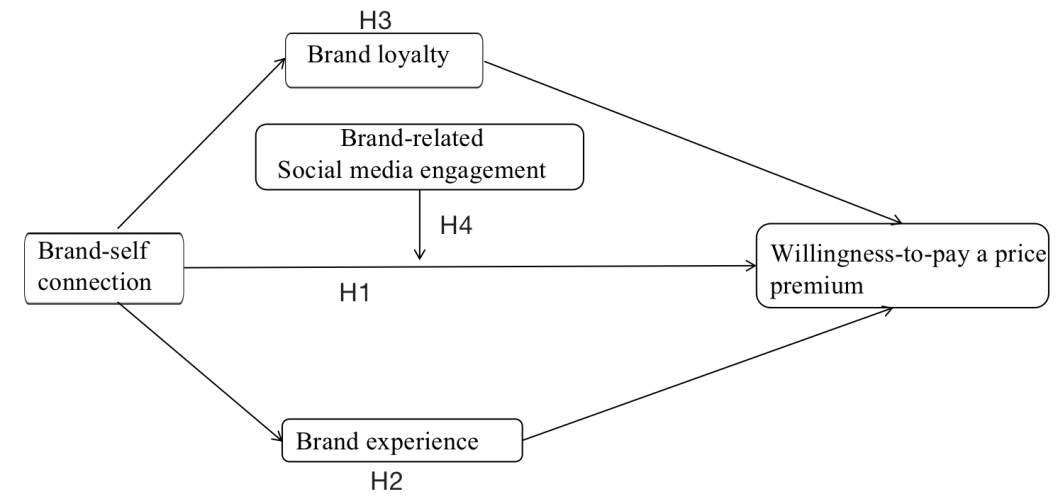

Exploring brand-self connection as a tool for driving profitability is gaining traction among scholars and industry professionals. This study introduces and validates a conceptual model aimed at discerning the influence of brand-self connection on luxury consumers’ willingness to pay (WTP) a price premium. Based on survey data from 270 Chinese luxury consumers and analysis via SPSS 27.0, the results reveal that brand-self connection not only directly augments consumers’ WTP a price premium but also exerts an indirect influence through the mediating roles of brand experience and brand loyalty. Interestingly, though brand-related social media engagement emerges as a moderating factor in this relationship, its impact remains marginal within the luxury market context. Together, these findings illuminate the complex nuances of luxury consumer behavior, enriching brand management, consumer-brand relationships, and pricing strategy. Practitioners can harness these insights for strategic decision-making in the luxury market arena.

View pdf

View pdf

This essay aims to investigate the primary beneficiaries within the fashion industry concerning NFTs, elucidate how luxury goods can derive benefits from NFTs, and discern potential future applications of luxury brand- related NFTs. Employing methods such as textual analysis and case studies, this research selects prominent luxury cases, exemplified by the likes of Burberry, Balmain, Givenchy, Louis Vuitton, to analyze luxury brands' current utilization of NFTs. Moreover, the study identifies drawbacks and outlines the future research direction. Additionally, through semi-structured interviews, the paper engages with three relevant industry practitioners to acquire supplementary data. From the investigation above, one of the utmost features of NFTs is that it can guarantee the property rights of virtual assets, thus ensuring the viability of virtual product transactions. A reverse analysis concludes that products with value and scarcity are transformed into NFTs to maximise their advantages. The rise of the NFT art market is a substantial evidence of this argument. As a result, luxury brand are best suited to launching NFTs and are more likely to attract buyers to consume and collect them than other categories in the fashion industry.

View pdf

View pdf

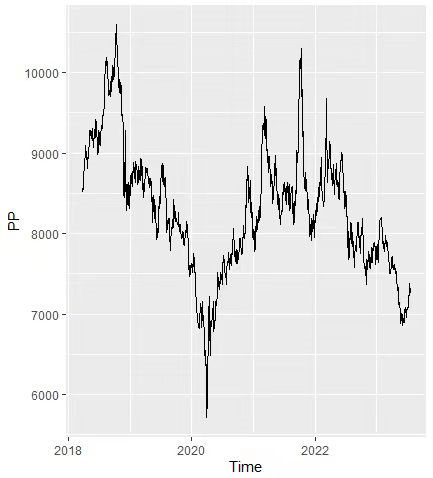

Since the polypropylene (PP) is one of the most widely used plastics, the futures prices of polypropylene are of great significance for studying the Chinese plastic market and related investors. This paper analyzes the factors that influence the changes in PP futures prices during and before the pandemic period by examining the correlation between upstream raw materials, downstream product markets, and PP futures prices. The results show that the futures prices of the raw materials are positively correlated with PP futures prices. Additionally, during the COVID-19 pandemic, due to the reduction in domestic PP demand in China, blocked crude oil imports, and refinery closures caused by control measures, the impact of crude oil futures prices on PP futures prices is relatively diminished. Furthermore, the increased demand for plastic packaging during the pandemic led to abnormal fluctuations in the packaging stock index, making it less valuable for analyzing PP futures prices. Finally, a regression analysis is conducted to establish a generalized predictive model for PP futures prices during non-pandemic periods, which is 9.91469 * crude oil futures prices + (-1.22343) * packaging stock index + 3.96203 * textile stock index + (-0.26201) * medical devices stock index. Its reliability is tested using data tests, residual vs. fitted analysis, and K-fold cross-validation, among other methods.

View pdf

View pdf

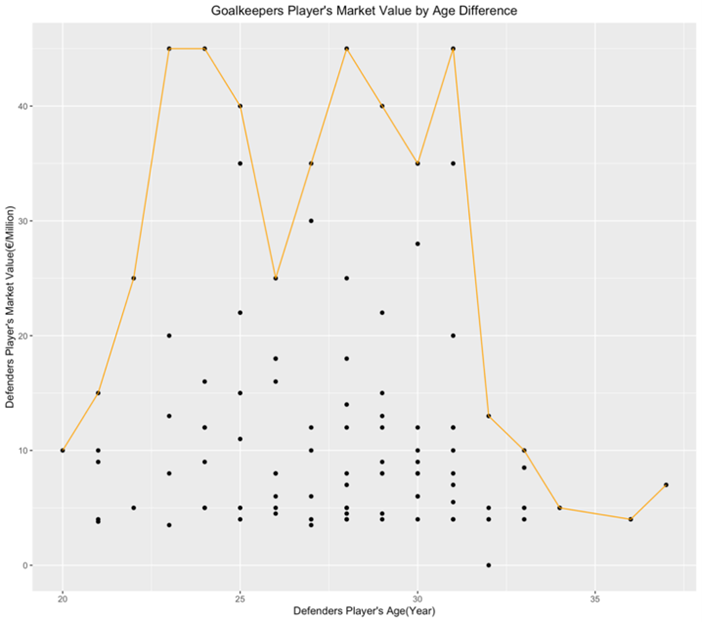

This research study delves into the intricate dynamics that influence player market values in various positions within European soccer leagues. Through the development and advancement of the soccer market industry and player health keeping. This study considered that soccer player's market value could be influenced by different factors or by different numbers of range nowadays compared with previous studies. By analyzing the newest version of player market value, influence factors of elite soccer players in season 2022/23 UEFA leagues. The analysis model analyzed a few key factors that influence the player's market value, such as age, goals, assists, and league. Simple/ Multiple regression models, T-tests, and ANOVA analysis are used in the examination. The research demonstrates that age plays a pivotal role, with players experiencing value growth during specific age ranges. League affiliation and performance metrics, particularly goals and assists, also emerge as significant drivers of market value. The study provides valuable insights for decision-makers within the soccer ecosystem, aiding in player management strategies and market navigation.

View pdf

View pdf

The capital asset pricing model (CAPM) is a highly useful and relatively simple equation used in this study for calculating the volatilities, also known as beta, of different stocks in four different industries in the S&P 500 Index and a 1-year T-Bill. The beta values of the stocks in each industry were added together to find the total beta for each industry. An overall decreasing trend in industry beta values near the end of the 2022 can be seen for banking and media & entertainment, while transportation increased a little and retail remained relatively constant, with transportation having beta values closest to one. Changes in industries with beta values near one will better reflect the overall market, as the market’s beta is assumed to be one. The purpose of this research is to compare the risks and sensitivities of these four industries after the COVID pandemic, and the results show that as the pandemic subsides, beta values have begun to shift closer towards one.

View pdf

View pdf

As global climate change keeps deteriorating, adverse effects have emerged, including global warming, rising sea levels, and extreme weather. From diverse literature, we summarized that these effects have triggered irretrievable damage to coral reefs worldwide and indirectly influenced tourism in small island developing states (SIDS). Since the economy depends drastically on tourism, we propose the study to quantify the effect caused by coral bleaching, a by-product of global warming, on tourism in SIDS. We schedule to find the relationship between coral bleaching rate and tourism development in targeted areas via a panel data model and a regression model. We expect our result can contribute to part of the ministries' legislation in SIDS

View pdf

View pdf

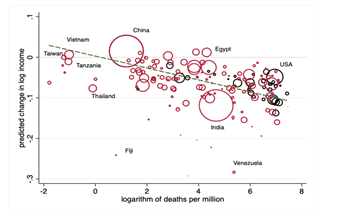

The contemporary world is characterized by its diversity and globalization, and how to allocate limited resources has emerged as a complex issue. The widening gap between rich and poor has led to growing concerns regarding the inherent inequity and potential instability that arise from these disparities. Global threats, the challenge has emerged in front of people, which significantly impact people’s daily life. For instance, from the pandemic, the drastic influence on the economy to environmental crises that upend livelihoods has been presented. Moreover, environmental crises, such as extreme weather events, deforestation, and the depletion of natural resources, pose significant threats to both developed and developing nations. Lastly, political conflict could also dramatically impact citizens' lives and the state of economic growth. This essay delves into the intricate relationship between global threats and global income inequality, seeking to dissect the multifaceted dynamics that bind these two seemingly disparate phenomena, by illustrating different perspectives from the academic world and presenting the author’s personal view.

View pdf

View pdf

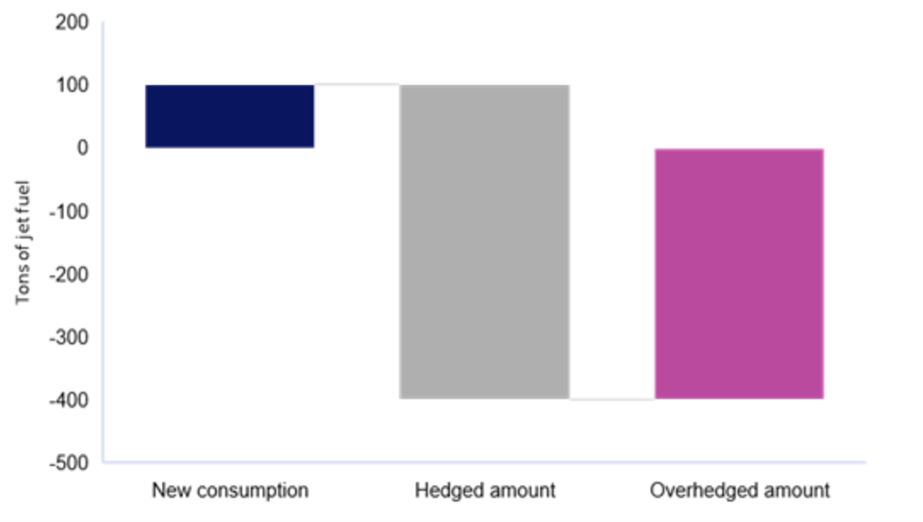

This paper introduces how companies use crude oil futures to hedge their risk and analysis the advantages and drawbacks of using crude oil futures. In the first section, we briefly introduce the crude oil market and crude oil futures. Besides, we explain some basic definitions of hedging like short and long position and basic risk. Then we introduce how companies use crude oil futures to hedge. In the second section, we analyze several cases and summarize the features of crude oil futures. First, we focus on three cases: Jet fuel cross-hedging, Metallgesellschaft AG, and Sinopec and introduce their backgrounds and how these companies operated and the functions of crude oil futures in details. Then we analyze the changes of crude oil futures market at that time and figure out why these companies had have used the crude oil futures that eventually have failed to hedge and then summarize the features of crude oil and crude oil futures. In the third section, we conclude that the crude oil futures provide advantages, such as active market and the potential to protect profit margins. However, they also face some problems like a high leverage ratio, price fluctuation, Etcetera.

View pdf

View pdf

Mongolia's challenging geography and historical development obstacles position it on the fringes of economic advancement. This paper presents a thorough analysis of its unique social, cultural, and economic hurdles, proposing visionary strategies for poverty alleviation and sustainable growth. The first section advocates a shift towards value-added industrialization, addressing the sparse population by exploring rural-to-urban migration and urging the dismantling of gender-based divisions while fostering rural entrepreneurship. The second part highlights leveraging indigenous cultural attributes and uplifting rural assembly industries to achieve balanced regional development. However, it cautions against unintended consequences like protectionism and urban-rural disparities. The third segment uncovers fundamental impediments rooted in Mongolia's self-sufficient, myopic nomadic culture, underscoring the need for education to reshape outdated mindsets. Moreover, the abrupt transition from nomadism to socialism and Western ideals has left a fragmented cultural identity, posing an identity challenge. This paper emphasizes the enduring influence of culture on socio-economic progress and underscores the significance of cultural preservation to steer Mongolia towards prosperity and global equity.

View pdf

View pdf